Understanding cost structure plays a pivotal role in ensuring profitability and operational efficiency. Cost structure refers to the framework of costs incurred in producing goods or delivering services, which can significantly impact a company’s pricing strategy. A well-organized cost structure helps identify areas for cost optimization and ensures a better allocation of resources to achieve strategic goals.

But how can businesses optimize their cost structure for growth? By implementing some of the best accounting software, integrated with advanced ERP systems, provide many features that help manage and analyze costs efficiently. You can experience its benefits firsthand by accessing our free demo.

From automated expense tracking to insightful cost analysis, HashMicro provides the tools to optimize your financial operations and ensure long-term success. Its ability to automate cost management processes is an essential solution for businesses.

Key Takeaways

|

Table of Content:

Table of Content

What is Cost Structure?

Cost structure refers to the composition of a business’s expenses, outlining how costs are distributed between fixed costs and variable costs. Understanding this structure allows businesses to analyze their spending patterns, set strategic pricing, and improve profitability. On top of that, it makes budgeting and forecasting way more accurate, so teams can plan smarter, avoid surprises, and focus their resources where they matter most.

In addition, a well-defined product cost structure allows businesses to identify cost-saving opportunities and enhance operational efficiency. By regularly reviewing and optimizing their cost components, companies can reduce waste, improve production processes, and maintain a competitive edge in the market. This proactive approach ensures long-term sustainability and adaptability in an ever-changing business environment.

Hashy AI Fact

Need to Know

Hashy AI instantly accesses accurate financial reports and business insights, helping to make more precise decisions. Hashy AI Finance helps you figure out an accurate forecast of your income and expenditure over a specified future period of time.

Request a free demo today!

Types of Cost Structures

Businesses generally adopt two primary cost structures: cost-driven and value-driven, each with its own approach to managing pricing and value.

1. Cost-Driven

Cost-driven businesses focus on providing low-cost products and services, prioritizing affordability for customers. To achieve this, they implement various cost-cutting strategies and optimize processes to maintain the lowest possible costs.

Their goal is to offer competitive pricing while still making a profit, often by finding savings that competitors may overlook. Examples of cost-driven companies include budget airlines, discount retailers, and service providers that offer lower prices than their competitors.

2. Value-Driven

Value-driven businesses, on the other hand, aim to deliver exceptional value to their customers. While their products or services may not always be the cheapest, they focus on providing the best possible experience or quality for the price.

Pricing is competitive, but the core value proposition is centered around superior quality or service. Examples include premium airlines, luxury retailers, and highly skilled service providers who focus on delivering greater value rather than the lowest price.

Key Components of Cost Structure

Understanding a company’s cost structure is crucial for managing expenses and maximizing profitability. It involves categorizing costs into fixed, variable, and semi-variable components, each playing a role in overall business efficiency.

1. Fixed Costs

Fixed costs remain constant regardless of production levels. Common examples include rent, employee salaries, and insurance premiums—expenses that are incurred even if the business produces nothing.

2. Variable Costs

Variable costs fluctuate in direct proportion to production or sales. These include costs like raw materials, production labor, and shipping fees, which change based on business activity.

3. Semi-Variable Costs

Semi-variable costs combine elements of both fixed and variable costs. For instance, utility bills may have a fixed base rate, but the total increases with higher usage, depending on production levels.

4. Direct Costs

Direct costs are directly attributable to the production process, such as raw materials and labor. These costs are essential to the creation of a product or service.

5. Indirect Costs

Indirect costs, while necessary for operations, do not directly tie to production. Examples include administrative expenses, marketing, and utilities that support the broader business.

6. Marginal Costs

Marginal costs refer to the additional costs incurred when producing one more unit of a product. Understanding marginal costs helps businesses assess pricing and production decisions.

7. Contribution Margin

The contribution margin represents the revenue remaining after variable costs are deducted. This figure is essential for covering fixed costs and achieving profitability, providing insight into financial sustainability

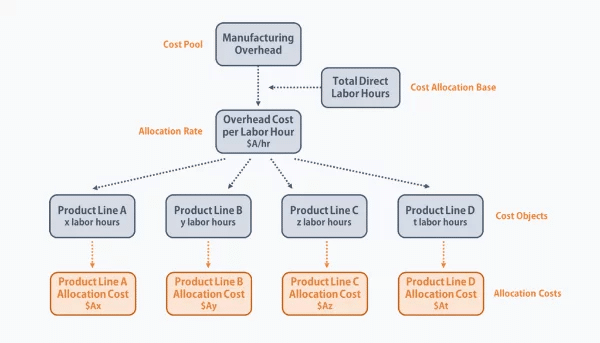

8. Allocating costs

Cost allocation is analyzing and collecting costs that arise to perform cost objects more precisely. Examples include well-structured products, projects, departments, business units, and consumers.

9. Cost Pool

A Cost pool is a collection of similar indirect costs that are grouped together for easier allocation. Examples include overhead costs like rent, utilities, or salaries that are not directly tied to specific products or services.

Elements of Cost Structure

The following are some examples of production expenditure structure elements:

Customer Cost Structure

- A flat fee is an additional administrative fee for customer service and warranty claims.

- Variable costs are the cost of the goods and services you sell to customers, the return on sales, and the credit notes you receive.

Product Cost Structure

- Fixed costs are divided into direct labor costs and factory overhead costs.

- Variable costs are divided into direct materials, production equipment, costs, and cutwork.

Service Cost Structure

- Fixed costs, including additional management fees.

- Variable costs include employee salaries, bonuses, tax credits withholding taxes, travel, and entertainment.

The Cost Structure of the Product Line

- Fixed costs have administrative costs, production costs, and direct labor.

- Variable costs include direct materials, manufacturing equipment, and commissions. You may need to map these costs from various activities to the cost structure of a specific object.

Cost Structure-function for the Company

The business’s product cost structure is fundamental, especially for the finance division. Generally, It helps define how expenses are distributed across different types of costs—primarily fixed costs and variable costs—which are essential for pricing, profitability, and financial planning.

Given that this is related to the business’s financial health, then it should be that every company can make a cost structure. Because, by utilizing an expenditure structure, the company will be able to control various divisions and make efficient spending efforts in the future.

After discussing the product cost structure of a business, you now have a basic understanding of financing and its various forms. Arrange and choose the rules for multiple activities intelligently and carefully. Budget management can help your business become more efficient and reduce the risk of loss.

Cost Structure Formula

The basic formula for a company’s cost structure can be expressed as:

Total Costs = Fixed Costs + Variable Costs

Where:

- Fixed Costs: Costs that remain constant regardless of production volume.

- Variable Costs: Costs that change in proportion to the volume of goods or services produced.

For more detailed analysis, businesses often break down costs further:

Total Costs = Fixed Costs + (Variable Cost per Unit × Quantity Produced)

This formula helps businesses understand how total costs increase with production and sales, guiding decisions on pricing, profitability, and resource allocation.

Examples of Cost Structure

With the collection of costs, the production overhead cost uses direct working hours to calculate cost allocation.

At first, the business will undoubtedly accumulate the company’s overhead costs over time.

For cost structure example, in one year, the total overhead costs are divided by the total hours worked to determine overhead costs, i.e., cost per hour or allocation rate.

Thus, the business will double the hourly cost by the number of hours worked in producing the product to arrive at a specific overhead cost.

The Importance of Cost Structures and Cost Allocation

To maximize profits, businesses must explore every opportunity to reduce costs. While certain fixed costs are necessary for operations, financial analysts should regularly review financial statements to pinpoint any excessive expenses that do not contribute to core business functions.

By understanding a company’s overall cost structure, analysts can identify cost-cutting opportunities that don’t compromise product quality or customer service. They must also monitor cost trends to ensure consistent cash flows and prevent sudden cost increases.

Cost allocation also plays a crucial role in decision-making. If costs are not allocated correctly, businesses may make poor decisions, such as mispricing products or investing in non-profitable areas.

This process enables analysts to determine the per-unit costs for various product lines, departments, or business units. With this data, financial analysts can provide recommendations for improving product profitability and eliminating low-margin products.

Streamline Your Cost Structure with HashMicro’s Accounting Software

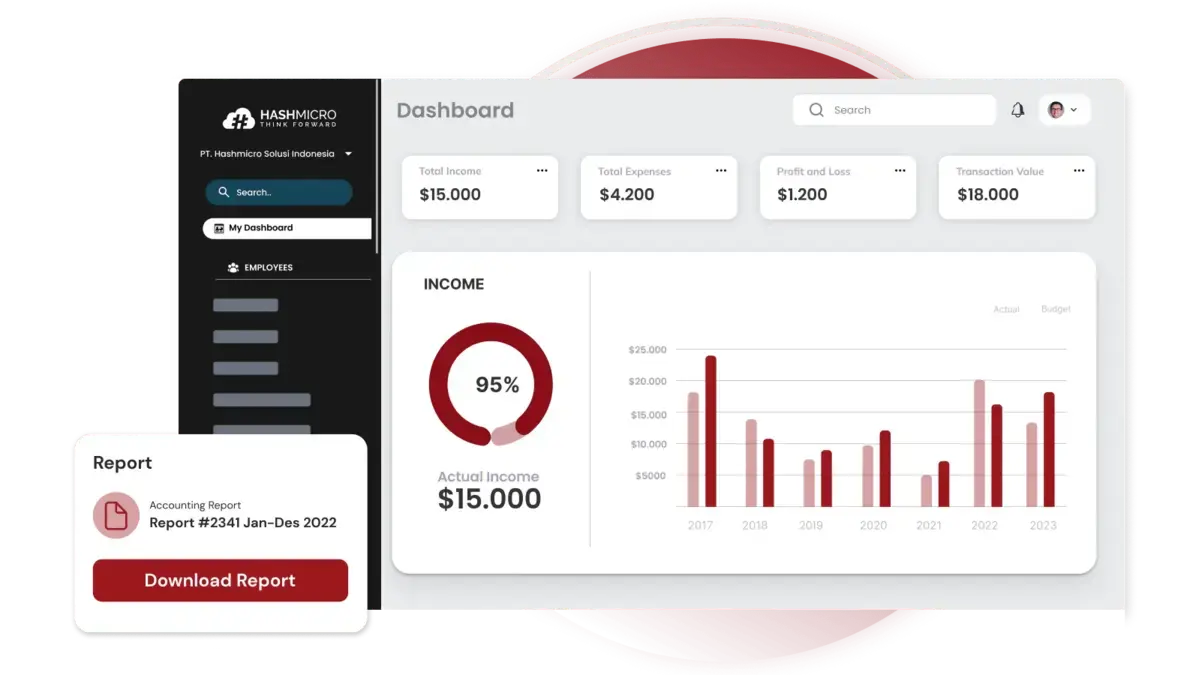

HashMicro’s online accounting software provides a robust solution for streamlining cost structure, crucial for any business in Singapore looking to optimize its financial performance.

By integrating advanced features such as real-time reporting and automated expense tracking, this system ensures that businesses can maintain accurate and up-to-date records of all financial transactions. This visibility allows for immediate identification of financial trends and cost-saving opportunities.

Moreover, HashMicro’s system simplifies the complex processes involved in financial management. It automates the categorization of fixed and variable costs, making it easier to track expenses against budgets. This precision not only aids in better resource allocation but also enhances the accuracy of financial forecasting.

The software’s capacity to integrate with other business systems, like CRM and ERP, further streamlines operations by providing a unified view of the company’s finances and operations. Additionally, the system supports detailed cost analysis and allocation, crucial for businesses with multiple departments or product lines.

By accurately assigning costs to specific projects or departments, HashMicro’s accounting software enables businesses to pinpoint exactly where efficiencies or adjustments are needed. This targeted approach helps in effectively managing and reducing unnecessary expenditures, leading to a more streamlined cost structure and improved overall financial health.

Conclusion

To optimize the company’s revenue, you should look for as many steps as possible to minimize cost structure. In addition, since fixed costs are essential for a company’s operations, a person with financial analytical skills should monitor financial statements.

The financial statements should show whether there is a possibility of high costs and whether an economic activity is making a profit or not. Meanwhile, a financial analyst familiar with the structure of production costs must find a way to reduce costs without implying product quality.

Thus, businesses can use this analysis to monitor cost trends to ensure that stable cash flow and unexpected cost increases do not occur or are minimal. The cost allocation function can help an analyst to be able to calculate the cost per unit based on some product, business unit, or department, until knowing the profit per unit.

Automate cash flow management, financial statement generation, bank reconciliation, adjustment journals, invoice creation, and more with our accounting software. If you’re a large enterprise, HashMicro’s accounting software is tailored to scale alongside your business. Our budget management feature efficiently handles budget management tasks and establishes approval matrices based on available budgets. Click here to explore our free demo and 70% funding from CTC grant today!