In economics, the Break-Even Point (BEP) is a critical component of a company’s sustainability. One of BEP is a function of forecast the impact of cost and efficiency changes on profitability.

Business owners must undoubtedly calculate the revenue generated by their business activities over a specified period. Entrepreneurs frequently employ break-even point (BEP) calculations.

For business owners and investors, data from the BEP of the business in operation is critical. This is because investors want to know whether the company is profitable, as this will affect their results. One way of calculating BEP is a function of the help of accounting software. If you still do this manually, you will have difficulties and BEP can affect your company in the future.

Table of Content:

Table of Content

Understanding how to calculate and analyze break-even points enables you, as a business owner, to maintain control over your company’s financial operations. When integrated with the best ERP software, BEP analysis becomes more accurate and efficient, helping you make data-driven decisions for future planning and profitability.

What is a Break Even Point (BEP)?

BEP, or break-even point, is a business calculation used to determine the number of sales required to break even or return capital, at which point the business begins to expect profit. In addition, BEP also acts as a benchmark for someone to start a business or invest. Advantages of BEP is very important for the sustainability of the company. Therefore, it certainly takes a long time to determine the break-even point, especially if you handle a complex business. Use the Purchasing System to control procurement costs.

For any entrepreneur, understanding the break-even point is critical. Without calculating BEP, business owners will encounter numerous difficulties, ranging from determining profit margins to forecasting when their company will return capital.

In the BEP position, there are no losses or profits, i.e., zero. Thus, the BEP reference becomes critical for business owners to configure several items to increase sales and generate profits.

Break Even Point Concept

It is critical to understand a product’s BEP value. By determining the BEP, a business can forecast its financial performance in subsequent periods.

According to Susan Irawati, the fundamental assumptions of BEP are as follows:

- The classification of costs incurred in a company must be in fixed costs and variable costs;

- Variable costs change in total according to changes in volume, while fixed costs do not change in total;

- The amount of the cost remains unchanged despite the change in activity, while the fixed cost of the company will change;

- While analyzing the period, the selling price per unit is constant;

- The concept of assuming the product is always sold out of every production;

- The company sells and makes one type of product. If the company makes or sells more than one type of product, then each product’s balance of sales results remains.

This fundamental assumption will assist you in modifying the formula for calculating the Break-Even Point. In general, these fundamentals constitute a fixed rule for calculating the correct BEP. If you ignore this, the BEP value calculation is very likely to fail.

Also read: Marketing Mix: 4P and 7P Concept

Purpose and Function of Break Even Point Analysis (BEP)

After comprehending the fundamentals of this break-even point analysis, it is necessary to understand its purpose. BEP is responsible for some different functions within the organization. The following are four advantages of BEP being familiar with BEP analysis:

- Knowing the value of BEP allows employers to estimate the volume of production capacity that will remain once the BEP is reached. By determining the value of the BEP, you can select the maximum profit projection that may occur.

- The BEP value makes it possible to determine the efficiency measures that the company can take. When manufacturing runs automatically, fixed and variable costs change. This is because the variable costs associated with labor are replaced by fixed costs related to machines.

- The BEP value helps entrepreneurs know the change in profit value in case of changes in product prices. The relationship between BEP value, product cost, and profit is parallel, so if one element’s value increases, the other element will also increase, and vice versa.

- Because BEP serves to determine the change in profit, BEP can also determine losses. For entrepreneurs, by knowing the value of BEP, entrepreneurs can anticipate the value of losses when there is a decrease in sales.

Benefits of Break Even Point

Meanwhile, three benefits serve as the basis for break-even analysis, namely:

- As a guideline for business owners to provide appropriate investment value to offset initial production costs;

- Utilize the results of these calculations to analyze the company’s purchase and sale of shares, budget planning, and financial projections;

- BEP is a benchmark for determining margins so that the business gains profit, not loss.

Break Even Point Forming Components

Four components contribute to the value of BEP. Fixed costs, variable costs, selling prices, and profits are the four forming elements. Here is an explanation of each of the aspects that contributed to the formation of BEP:

Fixed cost

Fixed cost is a cost that remains constant regardless of changes in the production process. The change in question is the company’s ability to produce goods over time. Examples of fixed costs are depreciation, labor, building, or warehouse leases.

Variable cost

Variable costs are costs whose value varies per unit—cost changes due to the volume of production capacity that can change in response to market demand.

Production volume with cost variables is related because if one increases, the other will follow. Examples of variable costs include electricity, raw materials, and transportation.

Selling price

The selling price is the sum of all costs associated with producing the item plus the value of the profit or margin that the company will earn. Usually, the determination of the selling price per unit occurs after production.

Revenue

In business, revenue comes from the sale of products. To calculate the profit, multiply the selling price by the number of products sold. The company requires revenue value to estimate future period revenue based on margin and variation in margin and units and prices.

Methods and How to Calculate Break Even Points

There are three methods that business owners commonly use in calculating BEP. Each method has its function. For you to better understand each method, pay attention to the description of the following methods, among others:

BEP per unit

BEP unit = FC ÷ (P – VC)

FC : Fixed Cost

P: Price per unit

VC: Variable Cost

Divide the fixed cost by the contribution margin per unit to arrive at the break-even points. The contribution margin per unit is calculated by subtracting the selling price per unit from variable costs per unit. Additionally, deducting total overall sales from variable costs can determine the contribution margin.

BEP sales value

BEP = FC ÷ Margin of contribution per unit

Calculating BEP does not have to be in unit terms; if you know how many units a business must sell to cover production costs, you can multiply that figure by the cost per unit.

BEP in currency terms

Currency BEP =

FC ÷ (Margin Contribution per unit / Price per Unit)

Calculating BEP is as simple as multiplying the selling price per unit by the BEP per unit. The BEP’s value in the unit of currency used will be determined as a result of multiplication.

If you want to know the rupiah equivalent of the break-even point, you can calculate it by multiplying the break-even point formula in units by the price (P).

When calculating BEP in currency units, you must first decide which currency to use; if a currency difference exists, one of the value currencies must be drained first.

Examples of Break Even Point Analysis

Ghofar is the managerial accountant for XZ Company, a perfume manufacturer. He had previously stipulated that Company XZ’s flat costs would consist of property taxes, rent, and salaries, which amounted to $100,000.

The variable cost of producing a bottle of perfume is $2 per unit. This perfume is priced at $12. To establish a break-even point or profit margin for Company XZ perfumes is:

BEP = 100,000 / (12 – 2) = 10,000 (units)

As a result of fixed costs, variable costs, and perfume selling prices, the XZ Company had to sell 10,000 units to break even.

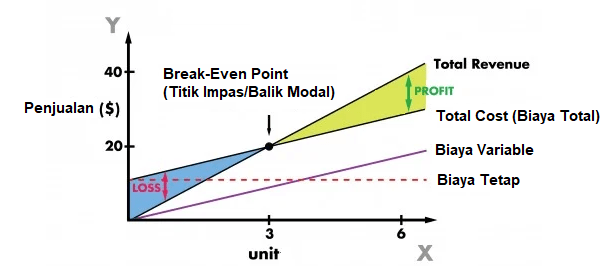

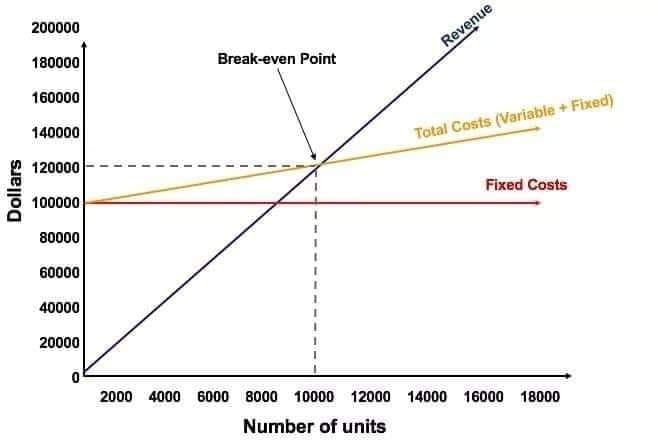

Break even point graphic

From the example of the analysis above, it is time to implement it into the graph. To achieve Cost Volume Profit, it needs a graphical representation that you can see below:

Explanation

- The unit of volume is on the X-axis (horizontal), and the dollar amount is on the Y (vertical) axis.

- The red line shows a total fixed cost of $100,000.

- The blue line shows revenue per unit sold. For example, when you sell 10,000 units it will generate revenue of 10,000 x $12 = $120,000.

- The yellow line indicates the total cost (fixed and variable costs). For example, if a company sells 0 units, then the company will spend $0 on variable costs, but $100,000 for fixed costs, bringing the total cost to $100,000. If the XZ company is able to sell 10,000 units, the company will need 10,000 x 2 = $20,000 for variable costs and $100,000 for fixed costs at a total cost of $120,000.

- The break-even point is 10,000 units. At this point, the income will be 10,000 x 12 = $120,000 and the cost will be 10,000 x 2 = $20,000 in variable costs and $100,000 in fixed costs.

- If the number of units exceeds 10,000, the company will profit from the units sold. Try to note that the revenue line is larger than the yellow total cost line after 10,000 units. Likewise, if the number of units is below 10,000, the company will lose money. From 0 to 9,999 units, the total cost line is above the revenue line.

Factors That Increase a Company’s Break Even Point

It is critical to establish the company’s break-even point to establish its minimum target for covering production costs. BEP, on the other hand, may increase or decrease in response to certain factors. Several factors can contribute to an increase in BEP.

Increased revenue from customers

Increased customer sales imply increased demand. The company’s product production was then increased to meet the increased demand, resulting in an increase in BEP to cover the additional costs.

Costs of production are increasing

The most difficult aspect of the business is maintaining the same level of customer sales or demand for a product while variable cost prices, such as raw material prices, increase.

When this occurs, the BEP increases to account for the increased costs. Along with production costs, additional potential increases include warehouse rents, employee compensation increases, and higher utility rates.

Equipment repairment

When a production line becomes disjointed, or a section of the assembly line is damaged, the BEP increases because the production company cannot meet the target number of units within a specified time frame. Additionally, equipment failure resulted in increased operating costs and, as a result, increased break-even points.

How to Minimize Break Even Point?

Of course, as a business owner, you want to minimize your break-even point. Once you’ve identified the causes of rising BEP, the best ways to reduce it are:

Raising the price of the product

All businesses do not want to raise the price of a product without careful consideration because the increase in the price of a product can decrease the customer base.

Even so, rising product prices can help reduce BEP levels. If you look at the graphical analysis above, what changes is that the blue line (revenue) becomes steeper as it rises. As a result, the meeting point of BEP becomes lower.

Outsourcing

Businesses can increase profitability by outsourcing, which assists in lowering production costs as volume increases because outsourced employees do not receive the same benefits and protections as employees hired directly by the company.

Businesses that utilize outsourced work systems have the option of hiring them temporarily. Thus, there is no need to spend money on salaries when production volume is stable, as employee payroll continues to apply even when production is suspended.

Conclusion

Understanding how to calculate break-even points is critical if you want to maximize your profits. Additionally, you can manage your business’s finances and set certain profit margins. BEP plays a critical role in ensuring the company’s survival. Even so, determining the break-even threshold might take a long time, especially if your firm is sophisticated.

The digital world is bringing about corporate transformation to provide more precise information and cost calculations with automated systems. Use the best Accounting Software from HashMicro. Get free demo now!