Imagine an accounting department within a bustling enterprise struggling to keep pace with the sheer volume of financial transactions pouring in daily. Without the aid of account reconciliation software, reconciling bank statements, invoices, and ledger entries becomes a challenging task, fraught with the potential for human error and oversight. However, have you chosen the right account reconciliation software for your Singaporean company?

The right account reconciliation software can make accounting professionals who usually grapple with the complexity of different data sources and formats more efficient. Where financial data resides in different branches of the system is on a centralized platform. Without a centralized platform to seamlessly merge and reconcile data, accounting staff must manually compile fragmented information, which often leads to discrepancies, misinterpretations, and ultimately, unreliable financial reporting.

Selecting the ideal software tailored to the requirements of Singaporean businesses entails careful consideration and a substantial investment. Therefore, this article will discuss various reconciliation accounting software in detail that can be your consideration in choosing a system that suits your business needs.

Table of Content:

Table of Content

What is Account Reconciliation Software and its Importance to Your Business

Account reconciliation software is a pivotal tool designed to streamline the process of comparing and aligning financial records, such as bank statements, invoices, and ledger entries, ensuring accuracy and coherence within financial data. It acts as a central hub where disparate financial data sources converge, facilitating seamless reconciliation and providing businesses with a clear, real-time view of their financial health.

Account reconciliation software plays a vital role in modern financial management, providing businesses with the tools they need to ensure accuracy, compliance and efficiency in their financial processes. In today’s fast-paced business environment, where transactions happen quickly and data volumes increase, the need for a robust reconciliation solution has never been greater.

The following are some of the importance of reconciliation account software that can be your consideration to use software instead of a manual system.

1. Accuracy and precision: The software can automate the process of comparing financial records, such as bank statements, invoices, and ledger entries, ensuring the accuracy and precision of financial data. Your business can rely on the software to maintain consistent and reliable financial records.

2. Compliance with regulations: You can ensure compliance with various accounting standards and regulations by providing thorough documentation and audit trails of financial transactions, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

3. Efficiency and time savings: Account reconciliation software can also automate repetitive tasks, streamline workflows, and reduce time spent on reconciliation, allowing accounting professionals to focus on more strategic activities.

4. Visibility and insight: The software provides businesses with real-time visibility into their financial health through detailed reports and analyses. Businesses can gain valuable insights into their performance, identify trends, and make informed decisions to drive growth and profitability.

5. Risk management: Using account reconciliation software can help identify discrepancies and anomalies in financial data. This allows businesses to detect potential fraud or errors early and take corrective action to minimize risks.

6. Enhanced decision-making: Implementing account reconciliation software can ensure that businesses have access to up-to-date financial data, allowing them to make strategic decisions in line with company goals and priorities.

7. Improved cash flow management: Account reconciliation software generates detailed cash flow statements, giving businesses visibility into cash inflows and outflows, enabling them to optimize cash flow management and make informed financial decisions.

Top 7 Best Account Reconciliation Software in 2025

Selecting the right software is crucial for Singaporean companies navigating today’s global market. It streamlines operations, ensures compliance, and facilitates informed decision-making. Thus, meticulous evaluation is essential to find software that aligns with a company’s needs. Here are some reconciliation account software recommendations to consider:

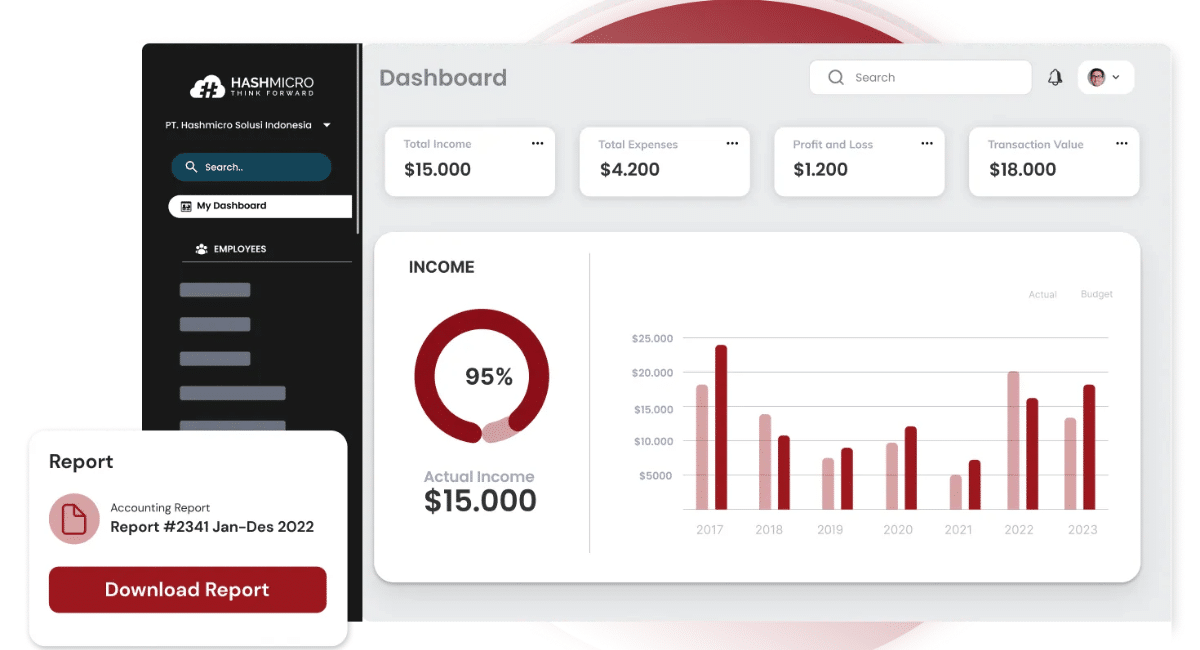

1. Account Reconciliation Software from HashMicro

HashMicro account reconciliation software is a solution for accounting processes that is often used in companies. HashMicro is an ERP provider that was originally established in Singapore, but now HashMicro has expanded to SEA countries to help enterprise companies.

In addition to accounting software, HashMicro also provides various other end-to-end solutions such as CRM, HRM, inventory, and procurement for more than 25 industries. HashMicro is one of the best accounting software vendors that has successfully become one of the leading ERP software in Southeast Asia.

Using the best accounting software in Singapore, businesses can improve operational efficiency, data accuracy, and overall financial management in the business. HashMicro accounting software offers outstanding features such as:

- Bank integrations & auto reconciliations: The software allows integration with banks, facilitating an automatic reconciliation process to ensure the accuracy of financial transactions.

- Asset database & depreciation: With this feature, your company can track assets, calculate depreciation automatically, assist in efficient and accurate asset management.

- Financial budgeting & realization: With HashMicro software, your company can create and track financial budgets and monitor budget realization to optimize spending.

- Cash flow statements: You can easily get a detailed cash flow statement, this feature provides visibility over cash inflows and outflows, which is essential for informed financial decision making.

- Financial ratios: HashMicro enables companies to generate and analyze various financial ratios, and provides deep insights into the company’s financial health.

- Multi-level analytics: Your company can compare financial performance at various levels and also provide a comprehensive understanding of overall business performance with this outstanding feature.

Pros:

- User-friendly web interface and dashboard.

- Ease of customisation to suit the company’s needs.

- Easily integrated with other systems without 3rd party assistance.

- ISO certified data security.

Cons:

- Variable implementation time as features are customized to business needs.

- Difficult to schedule a free demo due to high enquiry

After knowing in detail the recommendations for bank reconciliation software, you may consider HashMicro by clicking the image below to find out more about the price calculation.

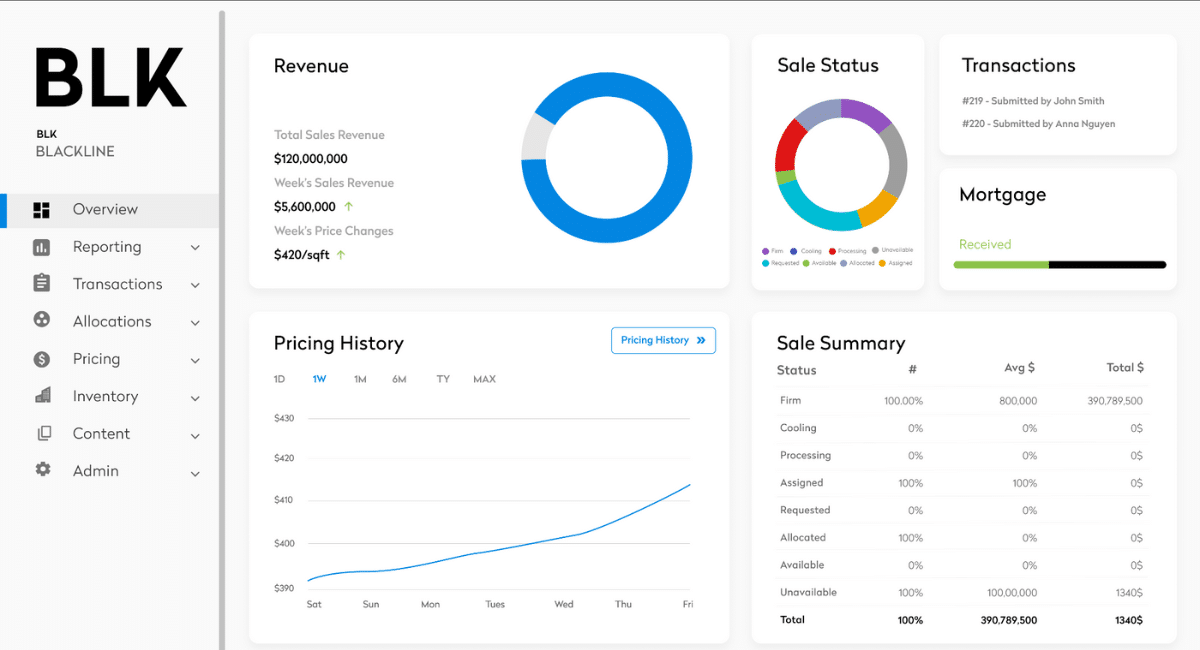

2. BlackLine

BlackLine provides a financial closing solution incorporating features for account reconciliation. Tailored for large-scale enterprises, BlackLine simplifies reconciliation procedures while improving transparency and oversight of financial information. BlackLine has outstanding features such as:

- Match transactions and journal entries

- Assign deadlines and measure the progress of employees

- Cloud-based technology allows for real-time updates

- Custom report generation

Pros:

- Reconciliations can be set up in many different ways.

- Automation tools help reduce manual effort and errors in reconciliation.

- Easy to use interface

- Responsive customer support

Cons:

- Higher cost may be prohibitive for smaller businesses.

- Implementation complexity may require significant resources.

- Implementation was a little longer than expected

- Lack of integration with other modules and systems

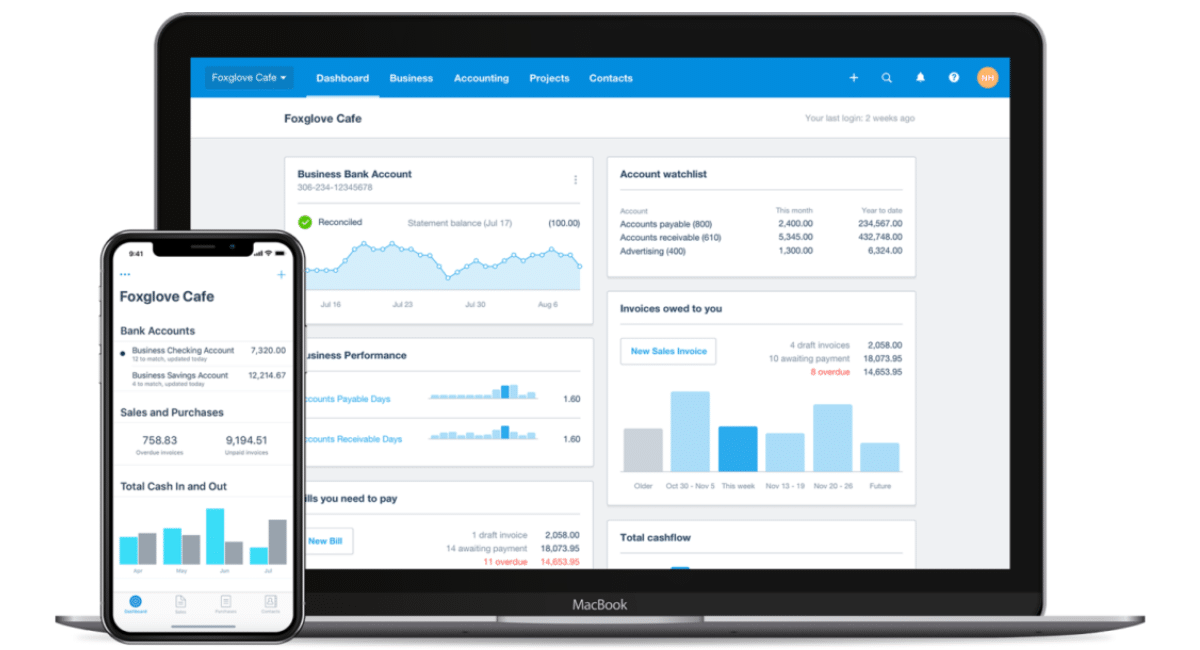

3. Account Reconciliation Software from Xero

Xero is an accounting application that can automate transaction matching and expense categorisation, simplify reconciliation tasks and suggest solutions when discrepancies occur. Xero offers many features and a user-friendly interface for effective financial management, such as:

Key Features of Xero:

- Seamless integration with accounting and banking platforms

- Advanced automation capabilities for streamlined reconciliation

- Customizable reports and real-time dashboards

- Strong security measures to protect your financial data

- Automatic bank feeds

- Bank rules

- Split transactions

Pros:

- Uses a side-by-side layout for easy matching of transactions.

- Invoice management and bank reconciliation

- Integration with mobile apps

Cons:

- Lack of customer support

- Having a steep learning curve

- Features that don’t fit the needs and support the business

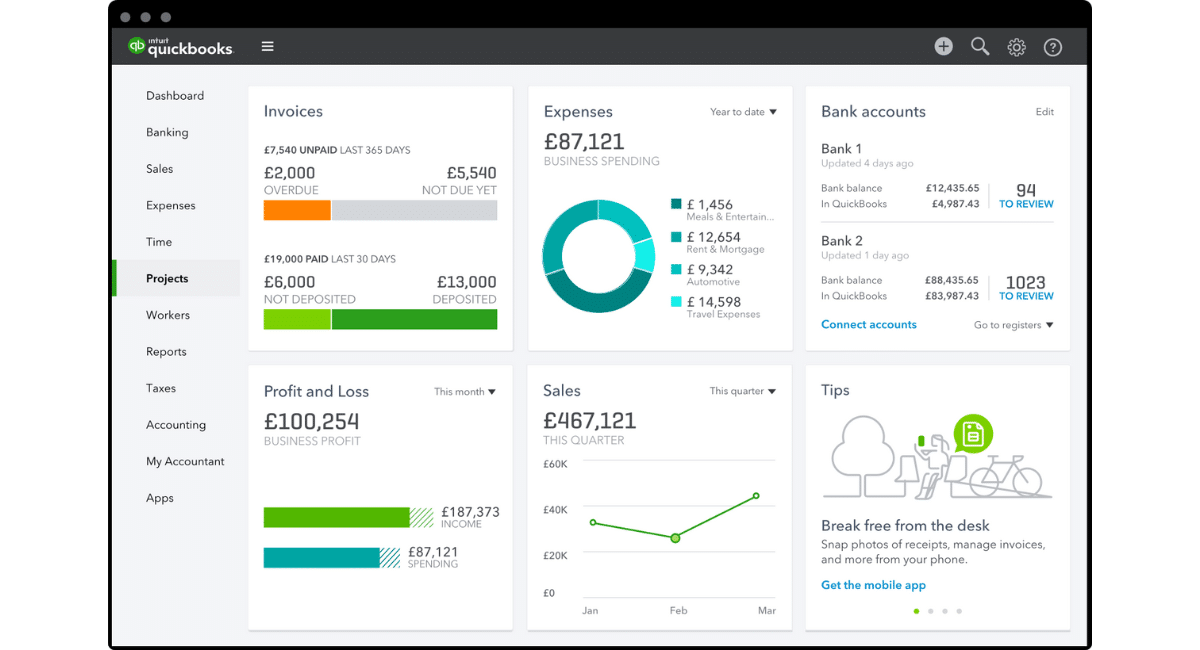

4. QuickBooks

Intuit QuickBooks is a versatile financial accounting software that offers bookkeeping, invoicing, and payment functions. QuickBooks can simplify the bank account reconciliation process in the software. With its ability to quickly detect and resolve discrepancies between recorded transactions and bank statements, QuickBooks ensures efficient and accurate account reconciliation, and provides recommendations to resolve identified issues.

Key Features of QuickBooks:

- Automated account reconciliation

- Real-time financial insights

- Integration with banking platforms and third-party applications

- Financial reporting

Pros:

- Onboarding and migration of existing financial data is quick

- Excellent customer support

- Automated matching makes account reconciliation much faster

Cons:

- QuickBooks is not as customizable as other platforms on this list

- Complicated and hard to understand software features

- User interface is not intuitive

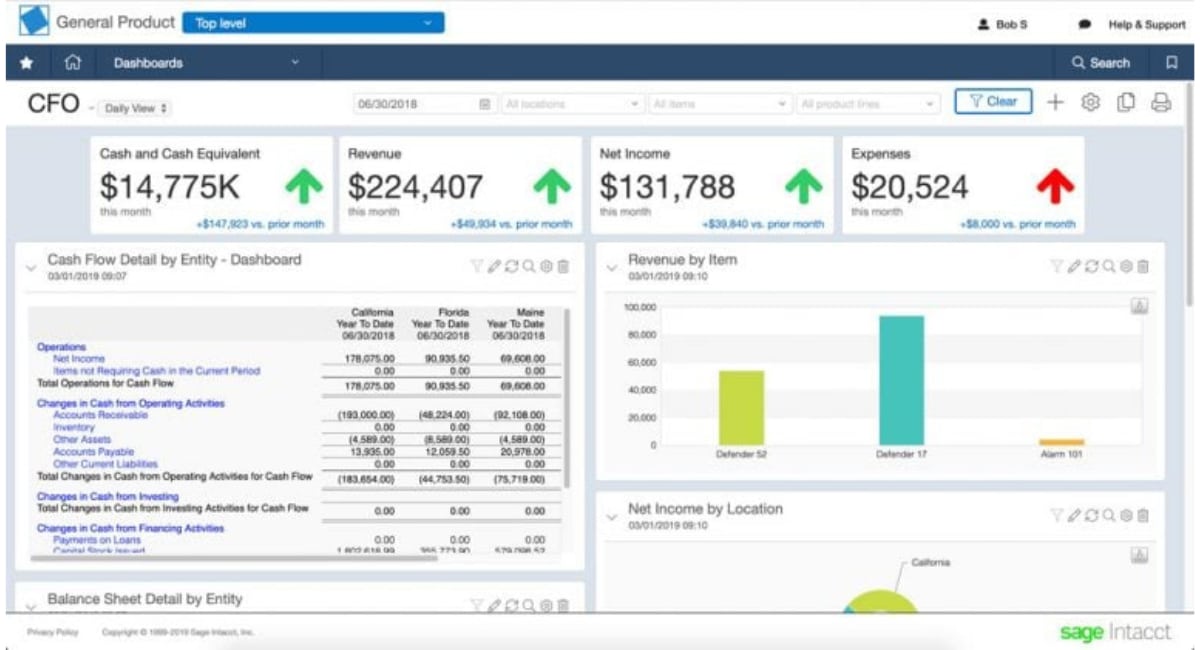

5. Bank Reconciliation Software from Sage Intacct

Sage Intacct, a cloud-based financial management software, automates accounting and financial processes, and its ability to reconcile accounts Sage Intacct allows users to compare bank statements, track general ledger balances, and manage financial data efficiently. Sage Intacct has various features that can help businesses excel such as:

- Automated account reconciliations

- Customizable workflows

- Robust reporting capabilities

- Customer support

- Security features

Pros:

- Sage Intacct automatically matches incoming transactions, streamlining the reconciliation process

- Integrations with other software

Cons:

- UX is sort of outdated

- Not mobile friendly site

- Lack of customization options for certain features

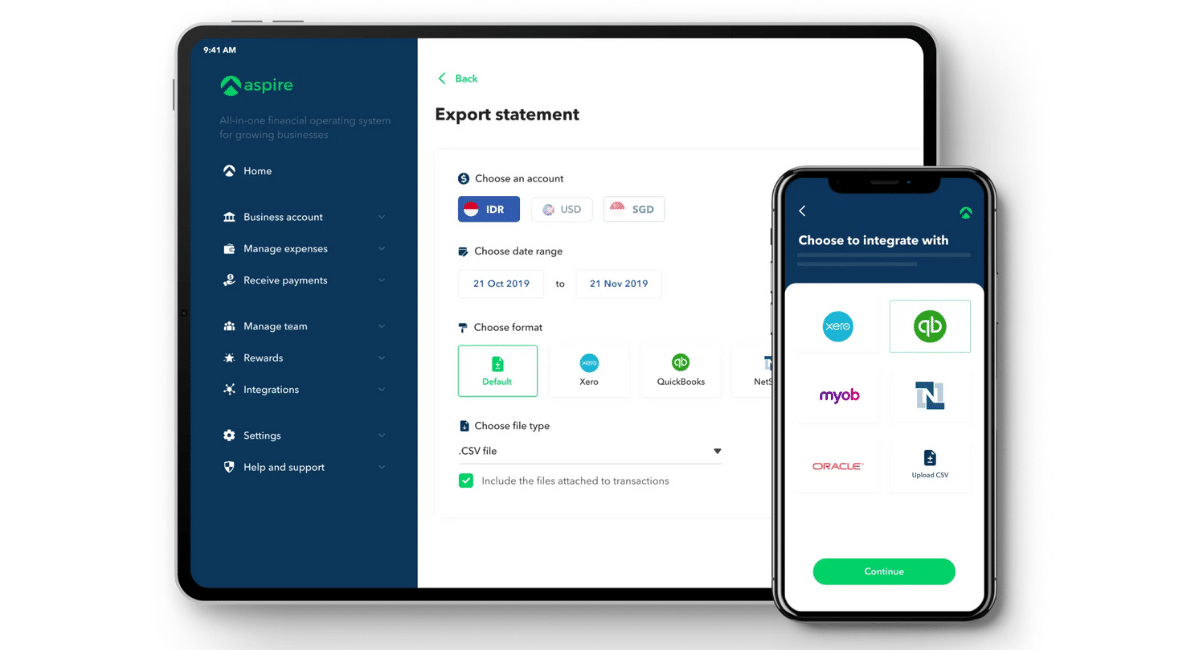

6. Aspire

This accounting software has been recognised as one of the solutions in Singapore with a number of features and advantages that accelerate modern business processes and optimize company efficiency and expenses. Aspire provides various features that help businesses manage their finances more effectively such as:

- Advanced expense and receipt pass throughs

- Integrated invoicing and reconciliation

- Intelligent categorisation and automated general ledger mapping

Pros:

- Integration with mobile app

- Supports 19 currencies for local payments.

- Accounting software integration

Cons:

- Features in the app are very limited

- High cost and there are some limitations

- Lack of customer service when issues arise

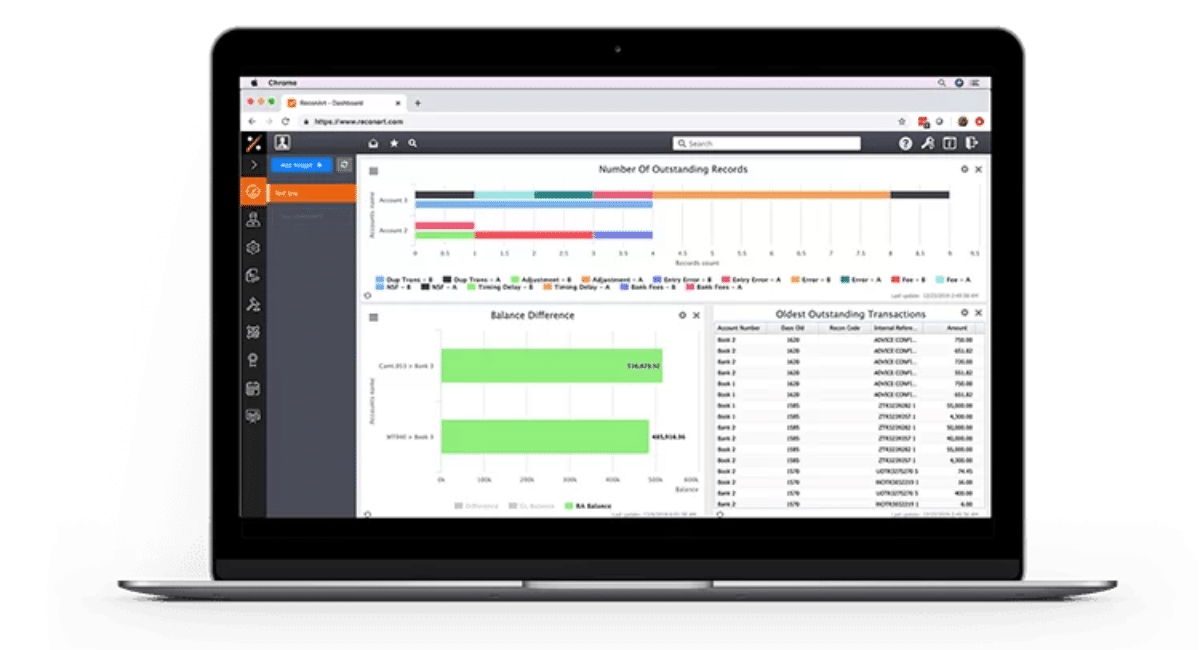

7. ReconArt

ReconArt is a powerful cash reconciliation software that automates and manages all data reconciliation processes from start to finish. It is a web-based solution that businesses of all sizes can use. Here are some of the key features of ReconArt:

- Powerful matching engine

- Scheduler

- Period-based closing and reporting

- User-friendly interface

Pros

- Lets you create approval workflows.

- Offers high-volume transaction matching.

- Integrates with enterprise resource planning (ERP) tools like NetSuite.

Cons

- Is a bit expensive, especially for small businesses.

- Requires a steep learning curve due to its advanced feature set.

- Includes a variance analysis feature to help you resolve discrepancies easily.

How to Choose the Best Account Reconciliation Software

Choosing the best account reconciliation software involves considering several factors. Here are some key points to consider:

-

Scalability

Look for account reconciliation software that can scale with your business as it grows, accommodating increasing transaction volumes and complexity. HashMicro’s is known as the best accounting software offers scalability to support businesses of all sizes, from startups to large enterprises, ensuring flexibility and adaptability over time.

-

Customization

Seek account reconciliation software that can be customized to meet your specific business needs and industry requirements. HashMicro’s accounting software allows for extensive customization, enabling businesses to tailor the software to their unique processes, workflows, and reporting preferences.

-

Ease of use

Prioritize account reconciliation software with an intuitive and user-friendly interface to minimize training time and ensure widespread adoption among your team. HashMicro’s accounting software is renowned for its user-friendly design, making it easy for users at all levels of proficiency to navigate the software and perform reconciliation tasks efficiently.

-

Integration

Choose account reconciliation software that seamlessly integrates with your existing systems and applications, such as ERP, CRM, and banking platforms, to facilitate data exchange and streamline workflows. HashMicro’s accounting software offers robust integration capabilities, allowing for seamless connectivity with a wide range of third-party systems and applications.

-

Advanced features

Consider account reconciliation software that offers advanced features beyond basic reconciliation functionality, such as automated matching, exception handling, and real-time reporting. HashMicro’s accounting software includes advanced features designed to enhance accuracy, efficiency, and visibility in the reconciliation process, empowering businesses to make informed decisions based on up-to-date financial data.

By considering these key factors and leveraging the benefits offered by HashMicro’s accounting software, businesses can choose the best account reconciliation solution to meet their unique needs and drive financial success.

Conclusion

Choosing the right account reconciliation software is paramount for businesses to maintain financial accuracy, compliance and efficiency. With the increasing complexity of financial transactions and regulatory requirements, choosing the best software becomes critical to maintaining business operations and ensuring long-term success. Investing in the most suitable software, businesses can reduce risk, improve decision-making, and drive growth.

Among the various options available, HashMicro’s Account Reconciliation Software emerges as a top choice for businesses looking for a comprehensive and customized solution. With its scalability, customization options, and user-friendly interface, HashMicro software can easily adapt to the unique needs and workflows of different industries and company sizes.

Schedule a free demo today to explore how HashMicro’s software solutions can transform your accounting process.