A profit and loss statement or an income statement shows a company’s revenue and expenses over a certain period of time. It is usually issued quarterly and at the end of the accounting year. The numbers in it indicate whether your business is operating at a profit or a loss during that time period.

If you use business Accounting Software, it is certainly easy for you to make financial statements. However, it is still essential to learn the terminology used in a profit and loss statement. That way, you can take advantage of the information in it to improve your business efficiency.

Use this guide to analyze your profit and loss statements and as a reference whenever you need help preparing one.

Table of Content:

Table of Content

The Purpose of a Profit and Loss Statement

Before learning the basic components of an income statement, let’s find out what it’s made for.

For Demonstrating Your Company’s Financial Health

You can use an income statement to measure your business income and expenses. Since it records your business finances over a period of time, it will be easier for you to track your business progress from time to time.

A profit and loss statement can be seen as a map because it helps businesses stay on track. This document can also be used as a tool to control expenses and allocate budgets better.

Attracting Investors to Your Business

Any company that really wants to grow and expand its reach will eventually need the help of an investor whom they can share profits with.

However, most investors only want to work with companies that have sufficient income, manageable expenses, and healthy profit margins. Your income statement can be used as a tool to motivate them to invest in your business.

For Figuring Out Fundamental Financial Concepts

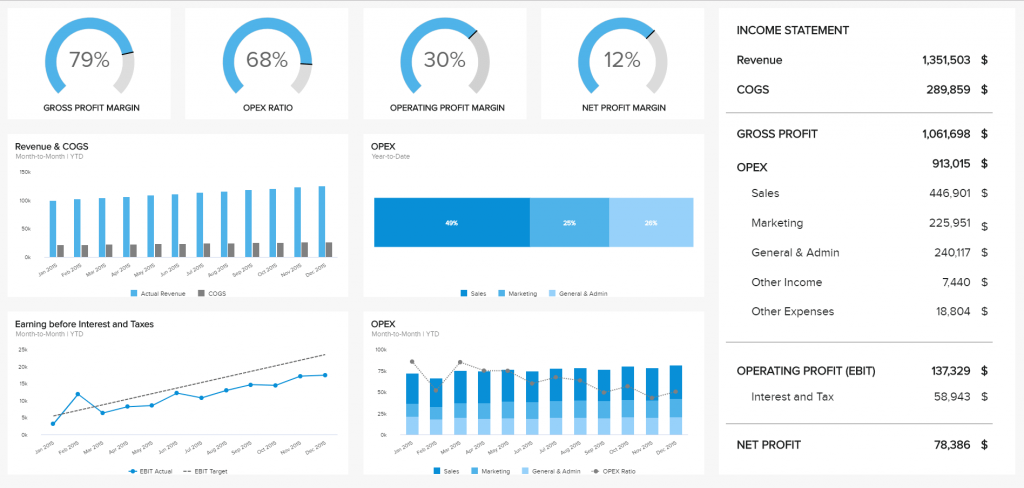

Many business owners get easily excited by large amount of revenue and profits, yet they can’t differentiate between gross profit and net profit. This is crucial because net profit includes interest payments, taxes, depreciation, and amortization. The formula for net profit margin is net profit divided by revenue multiplied by 100.

Components of an Income Statement

The first time you see an income statement, you might find it hard to understand all the elements. There is a lot of unfamiliar information to take in if you are not an accountant. Let’s explore each component of a profit and loss (P&L) statement. Here are the most common terms and their definitions:

Revenue

Not only does revenue cover the total sales you make, but it also includes money you receive from things like selling property and equipment or receiving tax refunds.

Net Profit

Net profit is the positive difference in total income (operating and non-operating) with total cost (operating and non-operating) in a certain period after deducting the estimated income tax.

Earnings Before Tax (EBT)

EBT is the total income that has not been reduced by taxes. So, to calculate this pre-tax profit, you must reduce operating income with interest expense.

Earnings Before Interest & Tax (EBIT)

EBIT shows how much profit the company generates from its operational activities without including elements of interest or tax expenses.

Loss

Losses are a one-time removal or decrease in a business resource or asset. Most losses refer to the amount that an asset decreases in value over the course of its useful life for your business.

Expenditures

Expenditures or expenses are payments made for current and future obligations in order to obtain profits. You can optimize company expenses with the help of a procurement system.

Cost of Goods Sold (COGS)

COGS is the expenses imposed both directly and indirectly to produce goods or services in the conditions and places where the goods can be sold or used.

Gross Profit

Gross profit reflects total revenue minus the COGS. Basically, it is a company’s profit that excludes operating expenses, interest payments, and taxes.

Operating Expenses

Operating expenses include all costs associated with running your business that is not included in the COGS, such as payroll, travel, training manual, leases, utilities, equipment purchases, hardware and software, advertising, cell phones, and internet services. To automate the calculation of employee payroll, you can use HashMicro’s HRIS system.

Depreciation

Depreciation is a procedure in allocating the cost of a tangible asset over its useful life and is used to account for declines in value. Find out how to calculate depreciation on fixed assets in this article:

Fixed Assets & Depreciation | Accounting Principles

How to Prepare a Profit and Loss Statement

Now that you know the basics of an income statement, you will find it easier to create one.

We strongly recommend that you use EQUIP accounting system to manage your books. This software automates any financial statement generation including P&L statements. Complete and accurate reports can be made within a few seconds. You can also generate reports based on area or branch if you manage multiple branches in different locations.

However, if you are not ready to use an automated accounting system, here are the steps that you must follow to prepare a P&L statement:

- Prepare your business income for each quarter of the year. Where has it been allocated to?

- List your business expenses for each of those quarters. What did you spend your business expenses on? Do those expenses count as the cost of goods sold or operating expenses?

- Deduct your total cost from gross profit to get the EBIT per quarter and for the year

- Then, calculate any interest and taxes and subtract them from the EBIT

- Now you can find out whether your company has been making a profit or loss

To learn more about the format and appearance of a profit and loss statement, visit our page on profit and loss statement templates.

Conclusion

An income statement helps you understand your business finances better, manage expenses more wisely, and even predict how long your business will last. Therefore, the company needs to make its income statement. Accounting software from HashMicro can make creating your company’s income statement easier. In addition to maximizing performance, companies can also use an ERP system from HashMicro that can serve all aspects of business management, such as inventory, HRM, POS, to CRM.

As you can see, P&L statements are basically the answer to the question: Is my business making a profit or loss over a certain period of time? These documents help you understand your business finances better, manage expenses wisely, and even predict how long your business will last. Get a free demo now!