As a businessman, you should certainly have the skill to analyze the company’s performance. The goal is for you to be able to assess how much power and how far the business can improve. One kind of applicable analysis is the DuPont analysis. The use of DuPont analysis can also be enhanced with the help of a Talent Management System that can help manage performance appraisals in the success of a business. Understanding the DuPont component of analysis will help you prepare for a career in accounting or finance.

In conclusion, DuPont analysis is a study tool used to analyze profits from a company or business. In this article, we will discuss what DuPont analysis is, the calculation formula, the difference with ROE analysis, and examples of DuPont analysis. Check out the full review below!

Table of Content:

Table of Content

Definition of DuPont Analysis

In the 1920s Dupont Corporation established the DuPont method of analysis. This model analysis is considered useful to avoid misleading conclusions when it comes to corporate profit analysis. It is a multi-step framework of financial equations that provide insight into a business’s fundamental performance.

The DuPont model outlined a thoroughness of the main matrix that affects the calculation of a company’s return on equity (ROE). Through that, investors will focus on the company’s core performance points. DuPont analysis’s calculations have only one fundamental indicator, a return on equity (ROE).

DuPont Analysis Calculation Formula

The DuPont analysis formula is a development of the formula return on equity (ROE), calculated by multiplying the net profit margin by total asset turnover and doubling equities based on these components. Therefore, it concludes that companies can increase profit on equity by maintaining a high-profit margin, increasing asset turnover, and utilizing its assets more effectively. To achieve this, Your Company needs to use an Asset Management System that can also depreciate assets, ROI, and costs incurred for asset maintenance to be calculated automatically. So the equation for calculating DuPont analysis becomes:

DuPont analysis = net profit margin x asset turnover x equity multiplier

Total asset turnover

Total asset turnover is a ratio that shows how efficiently businesses use their assets to sell and generate revenues. To calculate use the following formula:

Total asset turnover = sales income / average assets

As the business’s total asset turnover increases, so does its equity return. However, this ratio is usually inverse to a net profit margin, meaning the higher the company’s net profit margin, the lower the rate of its assets, and vice versa. Therefore, investors and financial decision-makers can make a comparison to determine which companies are better at encouraging equity returns for shareholders.

Net profit margin

A net profit margin represents a ratio that represents the remaining profit percentage of the business for each dollar in revenues after spending. Here’s the mathematical formula:

Net profit margin= net income / revenue

As the net profit margin ratio increases, its equity return increases. This is because the key concept of the net profit margin is that a business can increase its profit margin by reducing costs, raising prices, or combining both.

Equity doubling

Equity multiplication measures corporate financial leverage and represents part of a return rate for corporate equity that gets away with debt. The formula for calculating is as follows:

Equity Multiplier = average asset / average equity

When the company’s equity multiplication increases, the return rate of its equity will also increase. A business sometimes tries to increase the return rate for equity by taking excess debt. With the formulation of equity multiplication, a DuPont analysis model will show investors an accurate measure of financial leverage to be used in making investment decisions.

Difference Between DuPont Analysis and Simple ROE Analysis

The DuPont analysis formula is more comprehensive than the simple returns on the equity formula, as it provides insight into the individual performance markers that encourage ROE in the company. Meanwhile, a simple ROE formula shows what a company’s ROE ratio is. In contrast with the DuPont analysis formula, which shows how much each individual component impacts the existing ROE ratio in the company.

In addition, this makes it possible for financial decision-makers to identify the strengths and field of corporate opportunities and decide which parts should make adjustments to improve business ROE. The use of the Dupont model for investors is to assist them in making better investment decisions based on detailed comparisons of the power and field of opportunity for a similar company’s ROE ratio. Therefore, It is important to compare the company with its competitors in the same industry, as each industry has varying averages for each component.

Also read: A Simple Guide to Understanding Profit and Loss Statements

Examples of DuPont Analysis in the Company

So that you can understand this analysis easily and better. Here we give an example from the analysis:

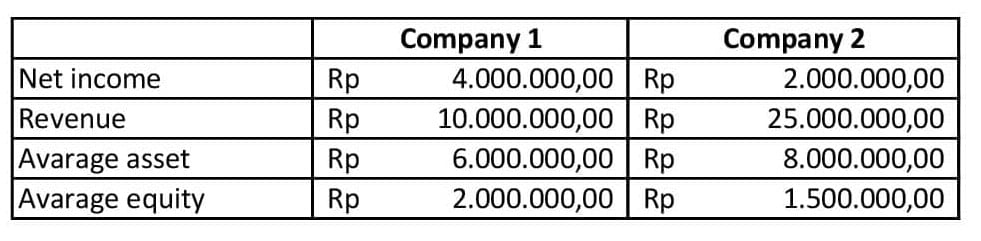

An investor feels attracted to two similar companies in the same industry. Investors use DuPont analysis methods to compare the strengths and opportunities of each company. So it will help them decide which companies are better investment options. They began to gather financial information for each company:

Example of total asset turnover

To calculate the total turnover of brand assets, investors use each company’s average income and assets at the following calculations:

Total turnover of first company assets = 10,000,000/6,000,000 1.6

Total profit of second company assets = 25,000/8,000,000 = 3.1

Example of net profit margin

To calculate their net profit margin, investors use net profit and each company’s income with the following calculations:

First company’s net profit margin = 4,000,000 / 10,000,000 = 0.4

Second company’s net profit margin = 2,000,000 / 25,000,000 = 0.08

Examples of equity doubling

To calculate their duplication of equity, investors use average assets and equal equity each company at the following calculations:

First industrial equity multiplier = 6,000,000/2,000,000 = 3

Second company equity multiplier = 8,000,000/1,500,000 = 5.3

Examples of ROE analysis of DuPont

To calculate profit on each company’s equity, investors use numbers from calculations they already calculated using the DuPont formula for analysis:

First company DuPont ROE analysis = 0.4 x 1.6 x 3 = 1.92

Second company DuPont ROE analysis = 0.08 x 3.1 x 5.3 = 1.31

The DuPont model shows investors that the company of two has a higher equity profit ratio than the one. The majority of this is due to the second company’s double distribution. Based on the information available, a large percentage of the company’s ROE ratio is from a 25% net profit margin. So investors invest in the company one.

Conclusion

In short, DuPont analysis is an analysis model that contains a framework of multi-step financial equations that provide insight into the fundamental performance of the business. This model analysis can be used to calculate the benefits of a company’s equity return or to decide whether to invest in a specific company.

In addition, financial analysis is critical to a business in order to ensure that it starts properly and profits accordingly. However, in doing financial analysis be sure to have good financial data. With good data, it will make it easier for you to make business conclusions. If you are having a hard time managing financial data manually. Use HashMicro Accounting Software to perform an easy and quick process of recording and reporting financial data with accurate and real-time results.

Get started today – Try the free demo for yourself now!