Companies typically require expenses to benefit their operations or to reap immense benefits from fixed assets. Capital expenditure is an expenditure to increase efficiency and company capacity in the next few years.

Because of their ever-increasing income and needs, large corporations are more likely to be familiar with this term. Capital expenditure differs from other types of spending in that it is CapEx or Capital Expenditure because it is profitable in the long run.

Physical and intangible assets are fixed assets that fall under the CapEx category. We usually spend money once every few years. Check out the article below to learn more about the definition of capital expenditure, examples, formulas, and more!

Table of Content:

Table of Content

Understanding Capital Expenditure

Capital expenditure (CapEx) refers to the funds a company uses to acquire, maintain, or upgrade its fixed assets. This includes investments in buildings, equipment, software, and other assets that support long-term growth and operational efficiency. CapEx investments typically cover large projects or significant asset purchases.

Unlike operating expenses (OpEx), which cover day-to-day operational costs, CapEx involves a one-time cash outflow with long-term benefits. Careful planning is essential due to the size of the CapEx budget. Companies must ensure that CapEx investments align with strategic goals and deliver value over time.

Spend under management plays a crucial role in CapEx planning and execution. By having CapEx spend under management, businesses can better track and monitor these significant expenditures, ensuring transparency and control.

Also read: How to Reduce Operating Costs in Your Retail Business

Example of Capital Expenditure

Capital expenditures do not include all company expenses. Expenditures meaning for capital expenditure should include maintaining, buying, increasing fixed assets. Fixed assets are defined as physical assets that cannot be consumed and have a useful life of one year or more. So that the costs incurred are beyond operational costs.

- In today’s digital age, the main asset used is software. The purchase or improvement of software is CapEx on non-realized assets with a useful life of more than one year. The software used is usually ERP software that can help a company’s business operations. Companies that already have operational activities with high complexity usually need ERP software. Thus software is one of the hidden assets that might indirectly boost a company’s productivity.

- The use of the software is closely related to the use of hardware such as computers, servers, LAN networks, internet networks, and others. Hence it supports the employment of software as an assistant to the company’s commercial activities. This equipment upgrade can be in the form of new purchases, maintenance, upgrades, or other means.

- In addition, buildings and properties are essential assets for the company because we can use them for many years. Renewal of buildings and property can be in the form of purchases, maintenance, or upgrades related to buildings and property. The useful period owned by buildings and property is long enough that the design of funds issued on buildings and properties must be mature enough.

- The company also requires distribution vehicles. Vehicle costs are quite high, especially for companies with high mobility, especially in remote rural areas. Companies can renew their vehicles in a variety of ways, including acquiring a fleet, purchasing new, or simply renting.

Income Expenditure vs. Capital Expenditure

In business, spending is critical. We can use this for both long-term and short-term benefits. Typically, these expenditures aim to increase the company’s efficiency and profits. There are two general types: capital and income. Even though the two expenditures are the same, their purposes are not.

As previously explained, capital expenditure aims to provide benefits in the long term. The costs incurred are usually very high due to the depreciation of assets in the long run. On the balance sheet, capital expenditures are typically classified as fixed assets. For example, building assets or property, furniture, vehicles, and equipment.

Income expenses are made for daily business activities, so you can only feel after the activity. These expenses are not fixed assets but rather current period expenses. The costs incurred are also not as significant as capital expenditures.

Because income expenditure does not add to the value of a fixed asset, it is only profitable in the short term. Administrative costs, employee wages, supplies, rental costs, electricity, insurance, taxes, shipping costs, and other expenses are examples of income expenditures.

Also read: What is Revenue? Definition, Type, and How to Calculate It

How Do You Determine Capital Expenditure?

If you have access to the company’s cash flow statement, you can see the capital expenditures in the investment cash flow section right away. If not, you can calculate it manually using a formula. Here’s how to figure out CapEx:

- First, calculate the first net increase in PPE (property, plant, and equipment), by subtracting PPE at the end of the year from PPE at the beginning of the year. Calculation of PPE value is located in the assets section of the balance sheet.

- Then, on the balance sheet, compute the depreciation. Calculate the depreciation expense by dividing the accumulated depreciation at the end of the year by the accumulated depreciation at the beginning of the year. In addition to this method, depreciation expense can be seen on the income statement.

- The last step is to plug these figures into the capital expenditure formula.

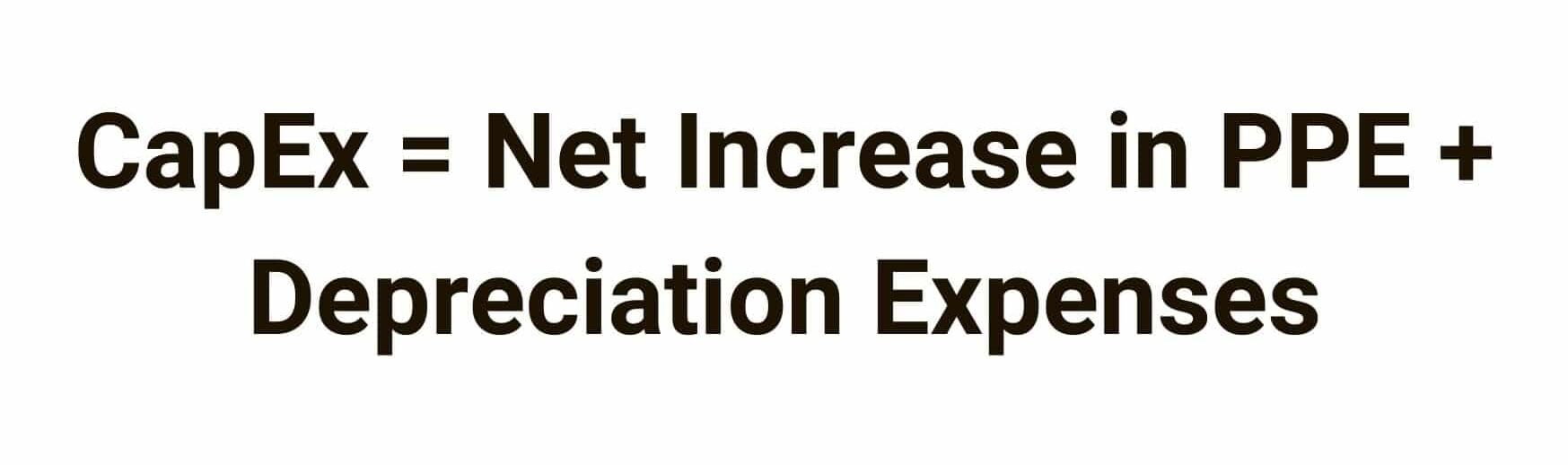

CapEx formula

The capital expenditure formula is as follows:

Notes:

CapEx: Capital Expenditure.

PPE: Property, plant and equipment

Depreciation: Current depreciation

The logic behind the formula is that the current period’s PPE on the balance sheet equals the previous period’s APD plus capital expenditures minus depreciation. The income statement and balance sheet derivatives are also used in this formula.

Conclusion

Capital expenditure is one of the expenditures made to increase a company’s efficiency and profits. This expenditure is for the purchase, leasing, maintenance, and expansion of both physical and intangible fixed assets. CapEx is a one-time cash outlay that is not recurring because it occurs only once every few years, but the profits earned are long-term.

Software is one of the unrealized assets included in the CapEx classification. Companies use software to make work easier so you don’t have to spend as much time and effort. HashMicro ERP software is important software that businesses, particularly large businesses, use to make operational activities more efficient and effective.