Do you know what’s the meaning of a financial ratio? In general, financial ratios have an understanding as a quantitative analysis of information contained in a company’s financial statements to evaluate aspects of operations and the performance of the company’s finances. A financial ratio is an appropriate action to know and assess how the level of health of the company before later looking at the company’s financial statements. Now, you can use the help of Financial ERP Software to make your company’s economic activities have more accurate results. The article will be a comprehensive discussion of financial ratios and their types. Check out to find out more!

Table of Content:

Table of Content

Functions of Financial Ratio

There are several functions of financial ratios. The financial ratio can quickly detect a company’s potential situation, whether related to improvement or vice versa. Also, a company can analyze the strength of its finances using financial ratios. The level of a company’s assets used can be seen from this. In addition, financial ratios can also help analyze the company’s growth and development in the future.

Types of Financial Ratio and Formula

Speaking about the financial ratio types, Darmawan (2020), in his book entitled ‘Dasar-Dasar Memahami Rasio dan Laporan Keuangan’ or ‘Basics of Understanding Financial Ratios and Statements’ explained that there are several types of financial ratios. Here is an explanation of the types of financial ratio and their formulas:

Profitability ratio

Understanding the profitability ratio is a way to figure out how well a company can make money in a certain amount of time by looking at things like sales transactions, cash, and capital as well as how many people work for the company. You can use the Sales Software if you want to make sales smarter, faster, and better. Sales software can help your sales team be more productive in many different ways when it comes to making sales.

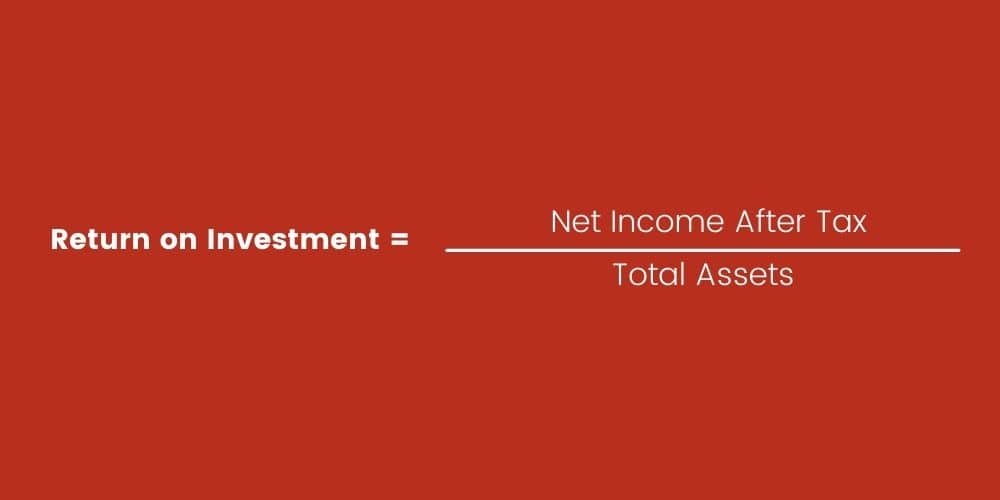

There are several types of profitability ratios. To begin with, there is Return on Investment (ROI). This ratio provides information about a company’s ability to generate profits based on the company’s asset amount. Here is the formula for calculating Return on Investment (ROI):

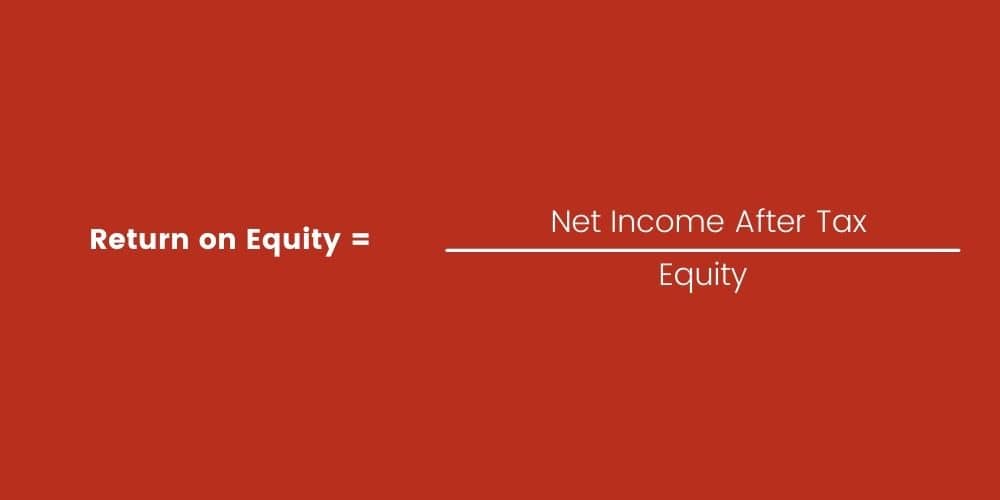

Furthermore, there is a return on equity. The ratio can calculate the company’s net income after tax by using the company’s capital. Here is the formula to calculate return on equity:

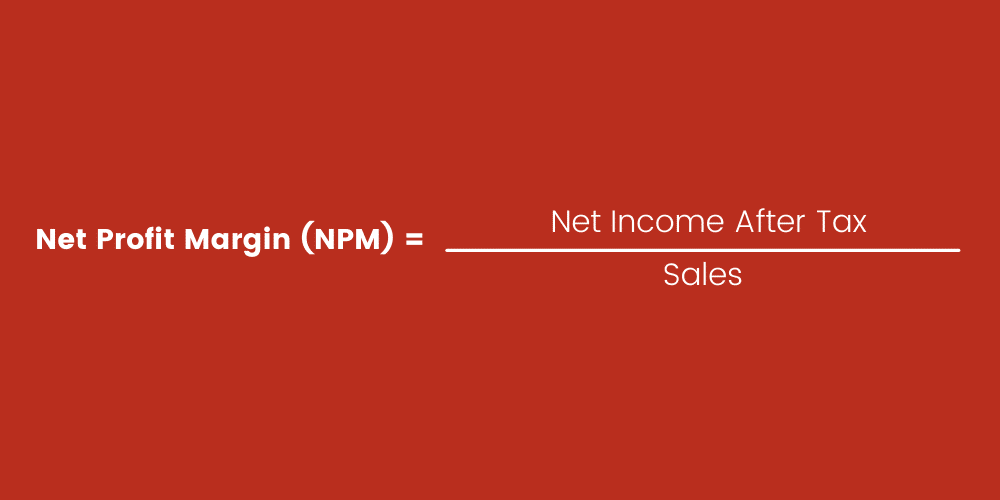

Another one, there is Net Profit Margin (NPM). The ratio is able to calculate the net income that the company earns compared to its sales. Net Profit Margin (NPM) can explain the company’s efficiency level. Here is the formula to calculate Net Profit Margin (NPM):

Then, the last type of profitability ratio is the gross profit margin. The ratio can calculate the efficiency of a company’s production cost control. It also indicates the ability of a company to produce efficiency. In other words, the gross profit margin is a percentage of the company’s gross profit by the sales in a period. Here is the formula to calculate the gross profit margin:

Liquidity ratio

This ratio can be defined as a parameter that describes a company’s ability to pay all the short-term financial obligations by the due date using the available assets. Thus, a company can be said to be liquid if it can pay its obligations. In contrast, a company can be said to be illiquid if it can’t pay its obligations.

Also read: Financial Statements: Definition, Functions, and Examples

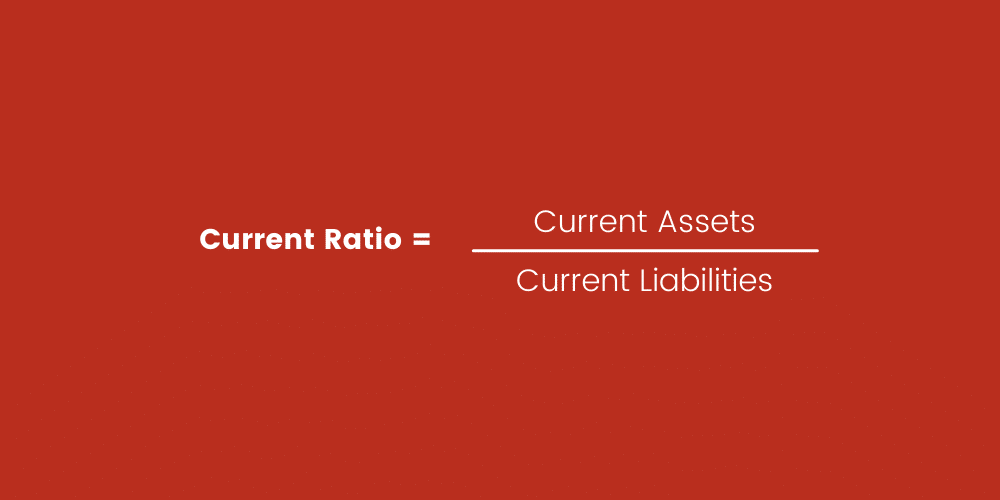

There are several types of liquidity ratios. To begin with, there is the current ratio. This ratio is a comparison between current assets and current liabilities, which is the most common measure to know the company’s ability to fulfill its short-term obligations. In other words, this ratio can provide information about how current assets can cover a company’s current liabilities. Here is the formula for calculating the current ratio.

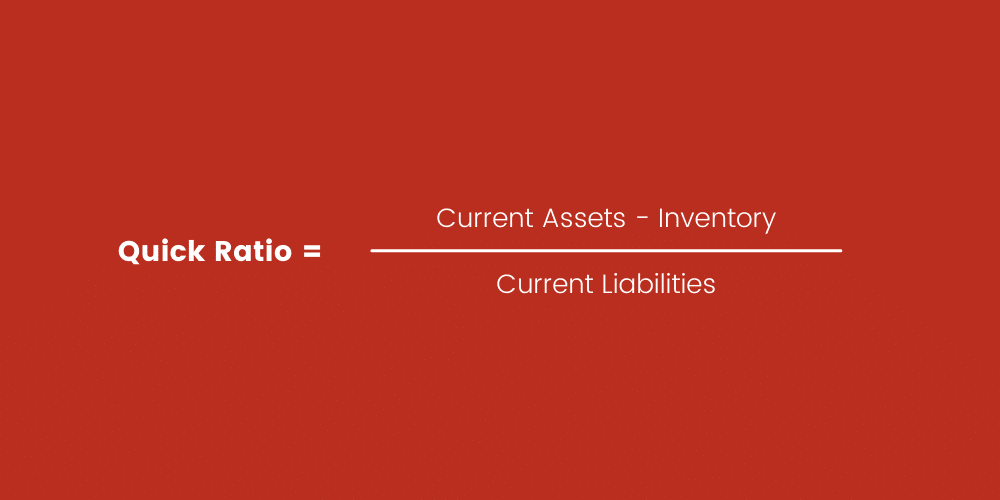

Furthermore, there is a quick ratio, often called the acid test ratio. One of the experts in Indonesia, Raharjaputra, expressed his opinion about the definition of a quick ratio. According to him, a quick ratio is a ratio used to measure the company’s ability to pay its obligations using current assets that are reduced by inventory. Also, Raharjaputra considers this as less liquid. Here is the formula for calculating the quick ratio:

Another one, there is the cash ratio. This ratio shows the company’s cash position, which can cover the current debt. Here is the formula to calculate the cash ratio:

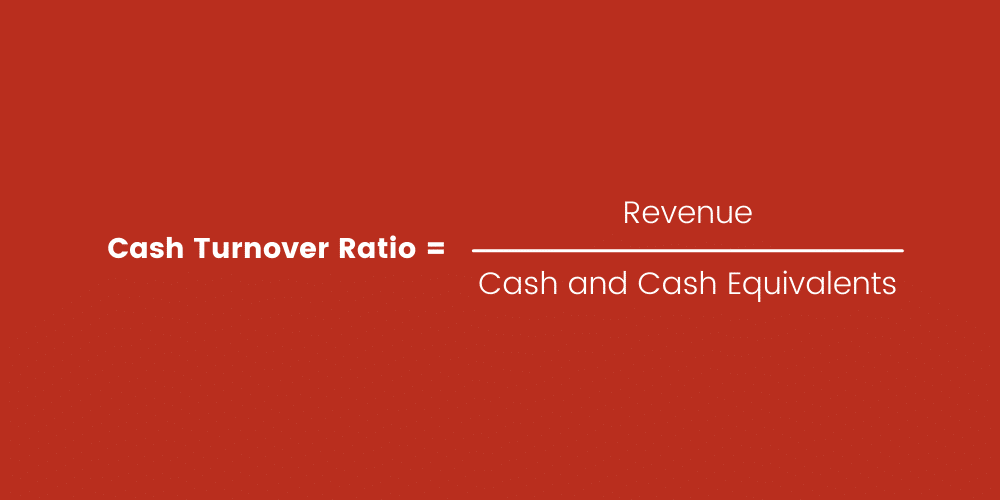

The last type of liquidity ratio is the cash turnover ratio. This ratio can indicate the relative value of net sales on the net working capital. Here is the formula to calculate the cash turnover ratio:

Solvability ratio

The solvability ratio provides information about how the company can settle its obligations if the company is liquidated. This ratio relates to the funding decisions that the company will choose to finance in debt rather than personal capital. In other words, the solvability ratio is a ratio that is used to measure how much company assets are funded through debt.

There are several types of solvability ratios. To begin with, there is Debt to Asset Ratio (DAR). This ratio is the total liability to the asset. The ratio is able to inform the number of comparisons of total assets and total liabilities. Here is the formula to calculate Debt to Asset Ratio (DAR):

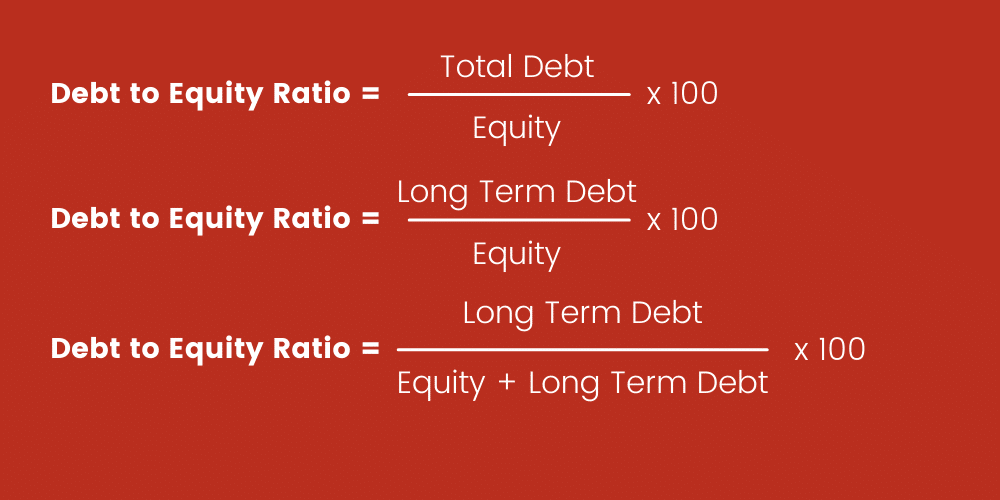

Furthermore, there is Debt to Equity Ratio (DER). This ratio is the proportion of a company’s debt financing relative to its equity. Here is the formula to calculate the Debt to Equity Ratio (DER):

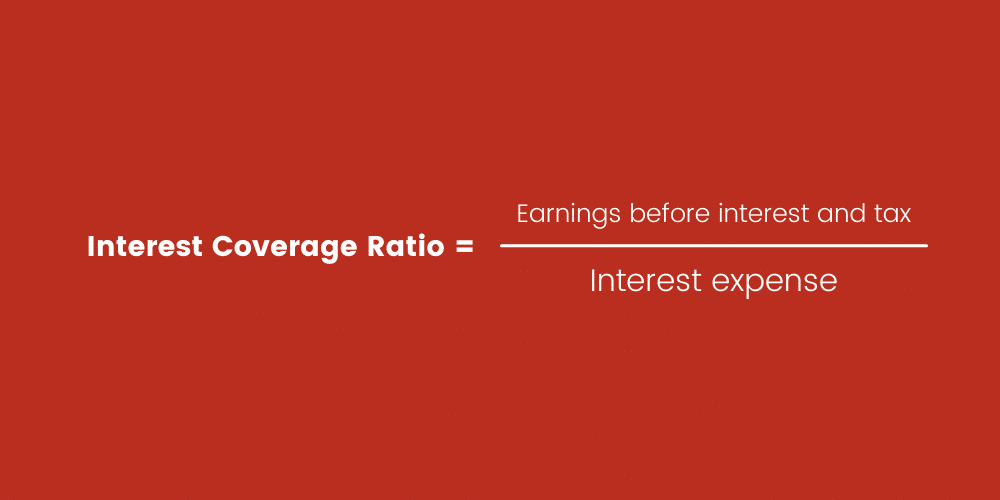

Last but not least, there is an Interest Coverage Ratio (IC). This ratio can provide information about how well the company can pay the interest on its outstanding debts. Here is the formula to calculate the Interest Coverage Ratio (IC):

Activity ratio

This ratio can evaluate a company’s ability to use its assets and liability to generate sales and increase profits. In addition, this ratio can provide the basics of comparison in a certain reporting period to analyze the changes that occur during the time.

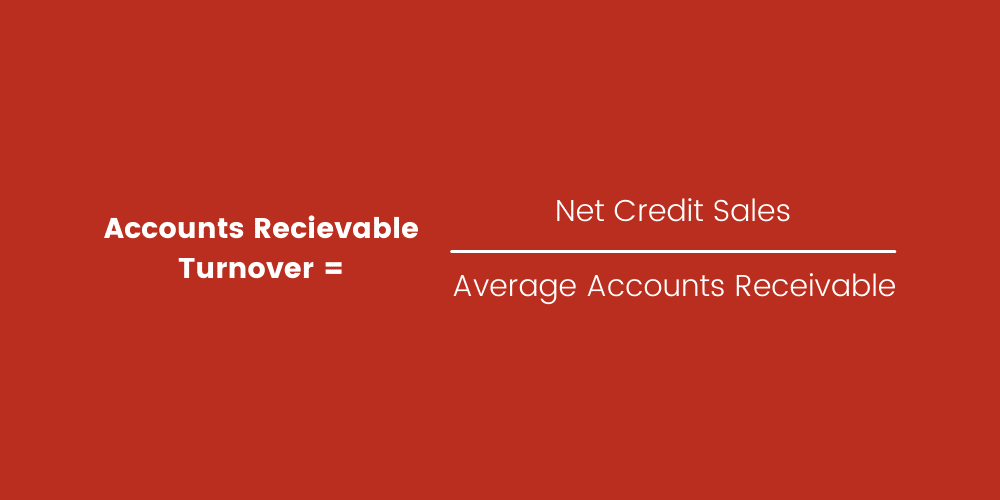

There are several types of activity ratios. To begin with, there is accounts receivable turnover ratio. The function of this ratio is to determine the entity’s ability to collect a certain amount of money from the customer. Here is the formula for calculating the accounts receivable turnover ratio:

Furthermore, there is a merchandise inventory turnover ratio. This ratio can show the intensity of a company in selling and replacing its inventory in a certain period. Here is the formula to calculate the merchandise inventory turnover ratio:

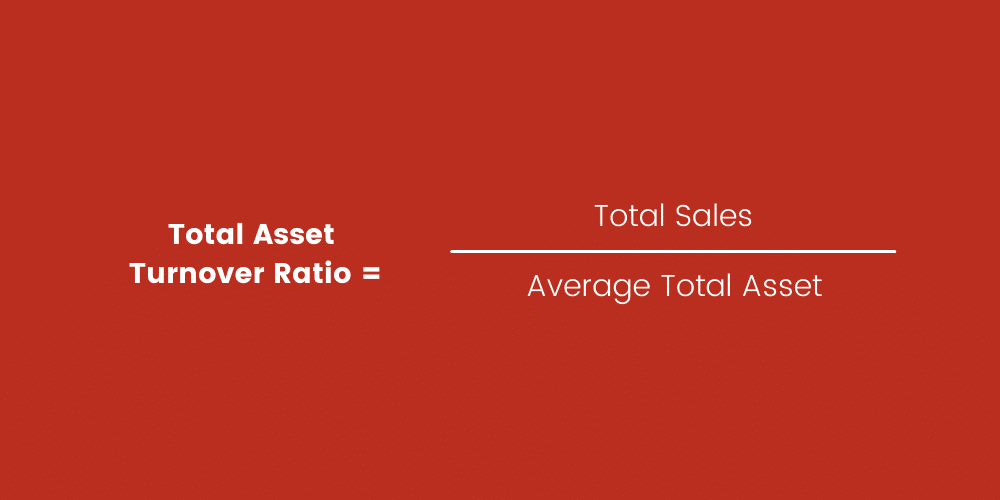

Last, there is the total assets turnover ratio. This ratio is used as a parameter of efficiency level used by a company to maximize revenue by using owned assets. Here is the formula for calculating the total assets turnover ratio:

Also read: Debit and Credit: Explanation and Use in Accounting

Why HashMicro’s Accounting Software is the Best Tool for Financial Ratio Analysis

If you’re looking for the best accounting software that simplifies financial analysis, HashMicro’s Accounting Software is the perfect solution. Equipped with advanced financial reporting features, it helps businesses calculate and analyze key financial ratios such as profitability, liquidity, and efficiency in real time. By integrating seamlessly with other business modules, HashMicro’s ERP-powered accounting system ensures accurate financial data, automates calculations, and minimizes human errors. With real-time insights, businesses can make informed decisions to improve financial health and long-term growth. Learn more about how HashMicro can help you analyze financial ratios effectively.

Conclusion

Financial ratios play an essential role in a company. Therefore, in making a decision or policy, a company will consider carefully looking at the financial ratio. A company can find out how the company’s future growth and development using financial ratios.

HashMicro as a leading ERP Software vendor in Singapore provides solutions for your company to operate business automatically, such as Accounting Software to Competency Management System. Feel free to contact us to get the best offer and free demos.