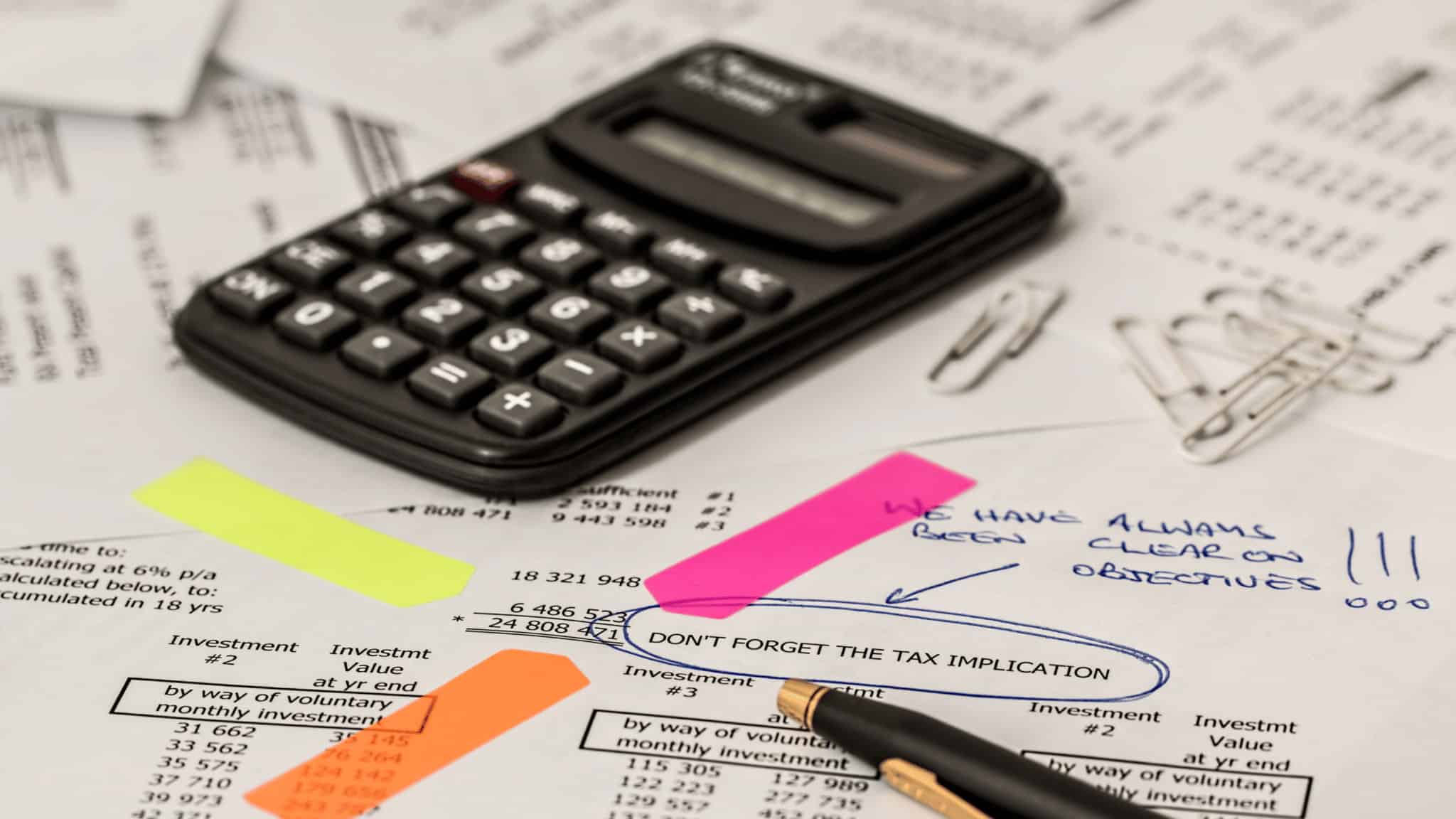

Small companies may have difficulty managing financial flows effectively since they need an expert or specialist to manage them. If they hire accounting or financial systems experts, the company will need to make additional investments in supporting them.

As a result, companies could use accounting services to assist in managing company financial flows to reduce expenses. This service is called an ‘accounting company’ or ‘accounting firm.’ In addition to accounting companies, you can also use accounting software to help manage your business.

Table of Content:

Table of Content

What is an accounting company? An accounting company is a company that helps its clients to make sure the financial transactions in the company are accurate and legal. The accounting company also makes this newly established company’s work easier.

Business owners who use the services of an accounting company become more committed to running their businesses. Organizational bookkeeping, payroll, auditing services, tax planning and preparation, and business consultancy are all things an accounting firm can provide for a company. You can also implement accounting software to make your business finances more efficient.

Related Article: Key Benefits of Using an Accounting App

Business Model of Accounting Company

The business models accounting firms offer are largely unknown to many business owners. This model is unique because accounting firms serve clients in keeping with the business’s goals. Here are the business models of the accounting companies.

The typical accounting model

The typical accounting firm model provides the services that clients require immediately. These include audit services, tax returns, and bookkeeping. The rate offered in this business model is often adjusted on an hourly rate.

The outsourced accounting model

The outsourced accounting model provides the same services as typical accounting companies but differs from them in that it frequently handles a company’s business issues directly. In this case, when the accountants must perform the tasks, the business owners are also aware of what should be done to improve their business so that the accountants can assist in achieving that goal. Big businesses first used the outsourced accounting model, but now smaller businesses or organizations are using it.

Bad Business Model for Accounting Company

The accounting business model is typically flawed, turning the company into a typical or general accounting model. Influencing factors are directly tied to the accountant who works and how the company organizes its core. Here are the bad business models for accounting companies you should know.

Famine or feast-type revenue

The famine or feast is a recurring pattern that service companies fall into when they try hard to acquire new businesses. After doing so, they must stop performing their marketing and sales actions to complete the work they just earned. But as they get close to finishing that work, they become worried. So they rush to launch their business development initiatives to produce more leads and close sales.

Famine or feast can occur when companies are overworked dealing with customers. They then realized that the business had no new customers and marketing. To avoid a famine or feast cycle, accounting firms should provide other services, as they may only be busy during specific periods.

Meaningless work being commoditized

Meaningless work is a job that accomplishes nothing. Typically, meaningless work involves an aspect of deception and fraud. Employees must feel obligated to pretend that their work exists for a reasonable cause, even if they believe such statements absurd. To avoid meaningless work, the first thing to check is to list your most important values and ask yourself if your job is helping you live up to those values. After identifying your dissatisfaction, you can develop a strategy to improve the situation.

Return getting smaller as you grow

With the company’s expansion, it is necessary to take extensive action to identify how the company’s benefits are achieved. Accounting companies may gain new clients annually or monthly. However, because accounting firms need a lot of money to do their jobs and can’t charge enough for their services, their returns will be less or even negative. So, it’s important to ensure that the accounting firm’s profits align with its services. Hence, it will improve the firm’s performance and make customers happier.

Related Article: Recommendations of Best Accounting Software for Business

The Importance of Accounting in Business

Accounting is important in business because it helps the company to run smoothly. Companies that are just starting and want to keep track of their finances must choose an accounting company that guarantees quality. In addition to saving money, using an accounting firm makes it easier for companies to reach their goals because accounting firms handle financial matters and provide consultation services to clients.

However, when choosing the right accounting company for your business, you should look for a company with the same vision and goals as yours and one that understands the business you are establishing. Choosing the right accounting company aims to minimize future losses due to incomplete financial reports and poor financial planning.

Conclusion

After learning about accounting firms that can help your business manage its financial flows, you can use software for accounting to monitor the management. A simple digitalization system that can be used anywhere and at any time can help your business.

HashMicro’s accounting software has features that comply with Singapore’s current accounting regulations. You can also customize the software according to the way your company operates. You can try the free demo and view the pricing scheme calculations for the HashMicro accounting software.