From an accounting, cash is the most liquid asset a company can own. Balance funds mean that a company has money on hand and can use that money as it wishes or needs. You can manage your liquid assets and other assets efficiently by using Asset Management Software.

According to the Financial Services Authority, funds are currency available for a business consisting of bank notes and coins, which are legal tender; in non-bank companies, checks, money orders, and other securities that can be immediately converted into real money.

Table of Content:

Table of Content

According to Experts, What Is Cash?

Thomas Sumarsan

According to Thomas Sumarsan, funds are a liquid current asset that money can use directly for business continuity.

Rudianto

Cash, according to Rudianto, is a method of payment or exchange that is owned by the business and can be used for corporate transaction operations as necessary.

C. Rollin Niswonger, Carl S. Warren, and Philip E. Fess

Cash, as defined by C. Rollin Niswonger, Carl S. Warren, and Philip E. Fess, is the increase or decrease in an owner’s capital as a result of the sale of goods, the providing of services to clients, the renting of property, the borrowing of money, and any other revenue-generating activities.

Standards of Financial Accounting

Cash is a means of payment that is ready and freely used to finance the general activities of the company.

Characteristics of Cash

Cash has specific characteristics that can distinguish it from other assets in the company.

Here are the characteristics of funds that you need to know:

- Highly liquid corporate assets;

- The most common standards of exchange;

- It can be the basis of calculations as well as the measurement of values.

Source Cash

So how can you get money? Here are the sources of money receipts in a business/company:

- Obtain funds through the sale of investments;

- The existence of shares issue or capital additions by the owner of the company in money;

- There is a decrease in current assets other than money that receives funds offset by the receipt of receivables, the sale in money, and else.;

- There is the issuance of debt securities, both short-term (money orders) and long-term debt (bonds, mortgages, and else.), and increased debt with the receipt of offset funds;

- Fund receipts due to interest, rent, or dividends from investments, donations, or gifts or the receipt of tax payments in the prior period.

What Includes Cash and What Doesn’t?

Recognize the groups that do and do not fall into the money category, namely:

Including cash

- Cash. These are paper and metal real money that applies to payments.

- Travel cheque. It is a cheque that commercial banks issue; its use can serve customers who want to travel or travel in a particular time with a long distance.

- Teller cheque. Similar to travel cheques that are both commercial banks as makers, there are only different purposes: serving other parties.

- Postal money order. It is a document that can be used as money.

- Cheque. It is a document that the company can receive as payment from another party.

- Company money. That is the company’s money stored in the bank that the company can take at any time.

Excluding cash

- Term deposit (time deposit) is a deposit in a bank that can only be liquid within a certain period;

- Stamps;

- Money that has been available for a particular purpose leads to its use being bound. An example is a pension fund;

- Cheque back (post-date cheque) is a category of funds that you can not consider money before the time comes.

Types of Cash

Cash is divided into sections. Each part of the treasury aims as supervision and examination related to the distribution of money flows.

You can find fund sharing in accounting ledgers.

While the funds on the financial statements have become one, the use of financial statements can be easily understood by others, even if they are novices.

The types of money are divided into, among others, small money, money in banks, money reporting, money equivalents, restricted money, and bank overdrafts. Check out each of his explanations, namely:

Petty funds (Small funds)

Petty funds are money that the company prepares to pay various expenses with a relatively small value and is uneconomic when making payments by check.

Also Read: Avoid The Following 4 Common Mistakes in Cash Flow Management

Cash in the bank

Cash in a bank is a form of corporate money deposited in a particular bank account. The amount of money in the bank tends to be significant. It requires higher security, so it is not possible to make transactions directly because the amount is large and vulnerable in terms of security.

As a form of security and transparency, funds in the bank will always be related to the company’s bank account.

Cash reporting

Companies can do cash reporting directly. However, often the implementation can cause some problems, including:

Cash Equivalents

Cash equivalents are a combination of company assets that have a maturity of fewer than three months. This money is beneficial for their use when the company’s financial condition is complex or unstable.

The simplest examples are the Sovereign Debt Securities and treasury bills.

Restricted Cash

Understanding of restricted cash is money that companies deliberately separate to pay off significant future obligations.

As an illustration, the HashMicro company must pay technical handling of 250 million rupiahs for the next six years. By this condition, the company must set aside 250 million rupiahs on a restricted money account.

Bank Overdrafts

Bank overdrafts mean the company is issuing checks that are worth more than the balance in the bank.

For example, the HashMicro company issued checks of as much as 700 million, even though the company’s account balance only had 450 million. With the difference in credit and cheques made, the remaining 250 million will go into short-term debt.

Cash Control

Cash control is divided into two, cash receipts and cash expenditures. See further explanation.

Cash receipts

- Record all money receipts immediately;

- Deposit to the bank all money receipts on the same day;

- Performs separation of functions on officers who handle money receipts with money register machines.

Cash expenses

- Perform all money expenditure activities using checks, except expenses with small amounts that should use small money funds;

- A minimum of two officials must sign each check;

- Neatly shade against checks that are not used or miswritten;

- Give a paid stamp for the proof and cheque that has come out.

Also Read: 7 Tips for Managing and Improving Cash Flow Efficiently

Internal Cash Control

Because the nature of highly liquid money causes susceptibility to fraud, it requires internal control mechanisms to maintain some money and ensure the accuracy of money recording accounting.

The purpose of internal control is to ensure that assets are protected and valuable for the achievement of business objectives, accurate business information, and employees have complied with regulations and regulations.

Additionally, internal cash control can safeguard the company’s assets against theft, embezzlement, or the placement of support in inappropriate locations.

According to Dyckman et al. (1999), the internal control system for funds must include the following:

- Separating storage and accounting for money

- Record all money transactions

- Maintain only the minimum money balance required

- Perform periodic calculations of balances

- Reconciliation of ledger fund account balances and bank balances

- Get a decent return on an idle balance.

One other way to smooth funds is to use E-invoice Software from HashMicro. flow cash by monitoring all invoice statuses in one view. That way, the funds become smooth and accurate.

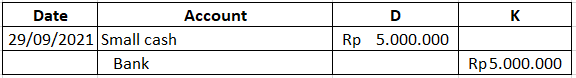

Cash Control Examples Using Imprest Methods

The amount of funds is set, and the number of checks that tellers receive to pay minor expenses to the bank is always the same. It records payments when it replenishes its inventory.

Example:

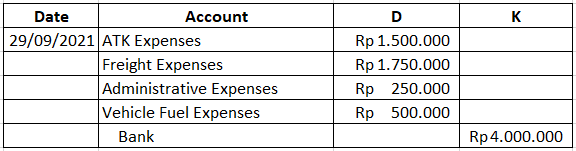

HashMicro formed a small fund of Rp5,000,000 on September 29, 2021; the expenditure of small funds until September 29, 2021, was Rp4,000,000 with the following details:

| ATK Expenses | Rp 1.500.000,00 |

| Freight Expenses | Rp 1.750.000,00 |

| Administrative Expenses | Rp 250.000,00 |

| Vehicle Fuel Expenses | Rp 500.000,00 |

| TOTAL | Rp 4.000.000,00 |

On September 29, 2021, the company recharged. So the journal paragraph compiled on the above transaction is as follows:

- SMALL FUNDS FILLING

- WHEN FUNDS EXPENDITURES ARE SMALL (NO JOURNAL NEED)

- WHEN RECHARGING

So that small funds remain Rp5,000,000

Summary

You have understood what money is, its characteristics, sources, types, controls, and internal controls. We also give examples so that you can better understand them. By reading this article, you can find out the importance of money in accounting for your business. If you are struggling to record your business funds, use the best Accounting Software from HashMicro.

Try the free demo now for an instant experience.