Millions of homeowners pay taxes on their homes every year. Cities, counties, and school districts charge property taxes on the land they use to run their businesses. These taxes are taxes that people or other legal entities, like corporations, have to pay on the property they own. Most of the time, the tax is based on the value of the land or other property owned. Calculating taxes is hard, so you should use a tool or Accounting System to help you.

Even though it is just a tax that property owners have to pay. Most property owners need to learn how to calculate this tax, but then again, the amount of property tax they pay changes every year. It is especially so for people who own property in Singapore. They need to know about any new rules or requirements so that they can avoid being fined. So, business owners use Accounting Software to help make the process easier. Read this article to learn everything you need to know about property tax.

Table of Content:

Table of Content

If you own a property in Singapore, you automatically have to pay property tax. This tax differs from income, rent, and stamp duty. In that case, how high are Singapore’s taxes? Since the taxes assessed each year are different, a concise explanation would be futile. The tax for most HDB apartment owners will increase in 2022. In addition, the tax rates for residences in Singapore would increase for both owner-occupied and non-owner-occupied properties beginning in 2023 as a result of the Budget 2022 announcement.

How to Calculate Property Tax

The tax is calculated using the value of the property. This includes the land and the buildings on it. In most cases, a tax assessor will conduct a property valuation once every one to five years and then bill the owner of the property the appropriate amount of money according to the taxing authority’s standards.

Keeping track of these assessments is crucial for property owners, but that’s where a portfolio tracker can be a valuable tool. However, you can calculate them manually too. Here is the formula to calculate it; for example, if the AV of your property is $50,000 and your tax rate is 10%, you would pay $50,000 x 10% = $5,000.

Annual Value (AV) x Property Tax Rate = Property Tax Payable

How to Calculate the Annual Value (AV)

Calculating the Annual Value is done by taking the Rental Value and deducting the Reasonable Rental Cost of Furnishings and Maintenance from that Amount. Tenants will receive an alert from IRAS whenever there is an adjustment to their AV rate. This serves to streamline the process and make it more convenient for tenants. However, property owners can also check the current AV rates from the Inland Revenue Authority of Singapore (IRAS) at any time by logging into their website. IRAS can provide this information around the clock.

What is IRAS Property Tax?

All property owners must pay property tax for as long as they own the property. Whether or not a property is occupied by its owner determines how much of a percentage increase or decrease there is in the tax rate. Not only that but there is also a 5% penalty for late payment. The IRAS rate and the property’s Annual Value (AV) both determine the IRAS tax.

Also read: Best Automated Financial System to Improve Your Business Account

Owner-occupied Property Tax Rates

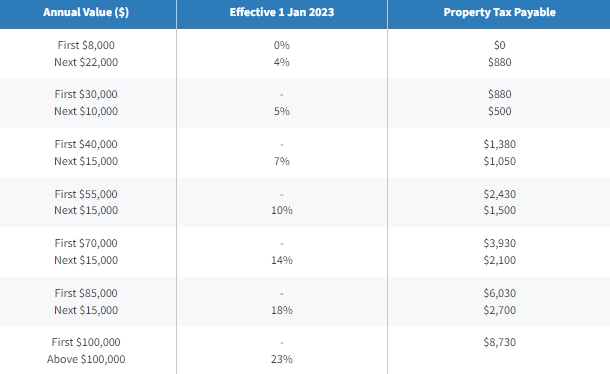

In budget 2022, it was said that Singapore’s tax rates for homes would go up starting in 2023. To be clear, whether you pay owner-occupied or non-owner-occupied taxes, there is no change to the IRAS tax rates (for example, if you rent out an apartment). However, the tax rates for owner-occupied homes will change in 2023 and again in 2024. Based on the IRAS website, here are the tax rates for people who live in their own homes:

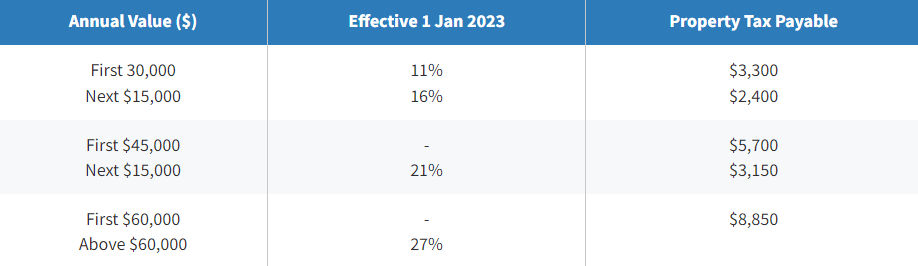

Non-owner-occupied Property Tax Rates

There are different tax rates for homes that are owned and not owned. As was already said, the change in the rule affects how property owners pay taxes. This increase will affect all properties that don’t belong to the owner, with an annual value of more than $30,000. Here are the pay rates from the IRAS website. You can go to the IRAS website to learn more.

How to Check Your IRAS

We are aware that the earlier explanation of taxes made you feel dizzy. However, please don’t get too worked up about it because checking taxes in today’s technologically advanced society is a breeze thanks to the internet. All that is required of you is to go to the website. The website’s decision to provide open access to all Singaporeans was a wise choice on the part of the government.

How to Pay Property Tax

Similar to how you check your taxes, you can now pay your tax online. You can pay at your convenience using GIRO (one-time or 12 installments), PayNow QR, internet banking, the AXS app, internet banking funds transfer, or Telegraphic Transfer (if you do not have a Singapore bank account). It’s clear how convenient it is for you to make payments anywhere and anytime, so there are no tax issues.

Obligation to Update IRAS

Updating IRAS is already an obligation for property owners to avoid penalties. Property owners often make changes to their properties, making it mandatory to update IRAS. For the inspector to accurately assess your liability, property owners must update IRAS with their property information. Failure to do so will result in statutory penalties. If you don’t, the law says there will be consequences of up to $5,000. If they don’t tell the tax inspector about the following events. Some things that need to be changed are as follows:

- Sale or change of ownership of a property

- Completion of the demolition of the property

- Rental of property

Is Property Tax Rebates Possible?

Are tax refunds possible? In fact, during the COVID-19 crisis in 2020, the Singaporean government gave tax breaks on property to help the economy. The rebate, on the other hand, is not for homes. In the same way, there is no rebate for homes in 2022. You will still have to pay IRAS on your HDB flat, condo, or landed house. But, as we’ve seen, as long as you live in the property, you will get a lower owner-occupier tax rate, a form of relief that stays in place.

Progressive Property Tax Rates Exclusion List

It is important to note that the tax rate only applies to some properties. Taxes on these types of properties are restricted to 10%. Property owners in this category are exempt from using IRAS, but they must get government planning approval. The property must have obtained planning approval for the above purposes for the present 10% rate to apply. According to IRAS, there are some exceptions, such as child care centers, student care centers, and welfare homes.

Conclusion

Property tax is a tax that every property owner must pay. This tax is interpreted and applied differently in each nation, including Singapore. Property taxes are subject to revision every few years in this country, and any modifications you make to your home will affect the total amount you owe in taxes. However, some websites will help you to take care of tax issues.

From viewing pay rates to the latest government policies, it is all on the website. Remember to keep paying your taxes on time to avoid penalties. However, your financial problems, especially for business owners, are not only property tax but various other things. For that, Accounting Software from HashMicro provides features as a solution to your financial problems. Get the pricing scheme and free demo as soon as possible!