Effective financial management is essential for the success of any Small and Medium-sized Enterprises (SMEs). As a small business, keeping track of finances, managing invoices, reconciling accounts, and generating accurate financial reports can be overwhelming and time-consuming.

This is where SME accounting software plays an important impact on SMEs’ financial processes, especially in providing the right and affordable solution.

Since there are many accounting software options available, the best accounting software for small businesses in Singapore stands out by offering unique features and benefits tailored to local needs. It is important to understand the detailed information about some of the best accounting software first before implementing the right software.

Therefore, this article will provide the information you need to know about accounting software for small businesses, including the best software recommendations you can consider for your small business.

Key Takeaways

|

Table of Content:

Table of Content

What is SME Accounting Software?

Small and Medium-sized Enterprises (SMEs) are defined by their size and operational characteristics, occupying a middle ground between large corporations and micro-enterprises.

The criteria for categorizing an enterprise as an SME may vary across different countries and industries. In general, SMEs are characterized by factors such as their revenue, number of employees, and asset value. These factors can vary based on the specific industry and country context.

SME accounting software is a specialized software solution designed to meet the unique financial management needs of small and medium-sized businesses. SMEs often face resource constraints and limited budgets, making it essential to have efficient and cost-effective accounting tools.

So, SME accounting software offers a comprehensive set of features that streamline financial processes and help businesses stay organized. These SME accounting software solutions typically include modules for general ledger management, accounts payable and receivable, invoicing, inventory management, payroll, and financial reporting.

The software also automates processes such as data entry, bank reconciliations, and invoicing, reducing the risk of errors and saving valuable time. By automating these repetitive tasks, SMEs can allocate their resources to more strategic activities that drive business growth.

The Benefits of SME Accounting Software

Small and medium-sized enterprises (SMEs) sometimes face unique challenges when it comes to managing their financial records and accounting processes.

With SME accounting software, SMEs can receive a range of benefits that can help optimize their financial management, improve decision-making, and ensure compliance with regulatory requirements. Then, here are several key benefits of SME accounting software.

1. Cost-friendly

To thrive in a competitive market with comprehensive software usually takes a lot of cost during accounting software implementation. Then, SMEs need an efficient and cost-effective solution for managing their financial records and accounting processes.

This is where SME accounting software comes into play, offering numerous benefits tailored specifically for the needs of small and medium-sized businesses. One of the key advantages of SME accounting software is its cost-friendly nature.

Traditional accounting methods often require significant investments in terms of hiring specialized accountants or outsourcing accounting services. These expenses can be burdensome for SMEs, especially those with limited financial resources.

By implementing SME accounting software, businesses can significantly reduce their accounting costs. The software automates repetitive and time-consuming tasks, such as data entry, calculations, and report generation.

This automation eliminates the need for manual labor, saving both time and money. Moreover, SME accounting software eliminates the need for extensive paperwork and physical storage, further reducing administrative costs.

2. Reduce risk

Effective risk management is a crucial aspect of running a successful business, especially for SMEs. Inadequate financial controls and poor record-keeping can expose SMEs to various risks, such as fraud, errors, non-compliance with regulations, and financial mismanagement.

Then, small business accounting software can help reduce these risks and protect the business’s financial integrity. SME accounting software can enhance financial transparency and accuracy.

By automating accounting processes, such as transaction recording, invoicing, and reconciliation, the software minimizes the chances of human errors and eliminates the need for manual data entry. This reduces the risk of miscalculations, misplacements, or loss of critical financial information.

Furthermore, SME accounting software often incorporates robust internal control features. These features include user access controls, audit trails, and approval workflows, which help prevent unauthorized access to financial data and ensure proper segregation of duties.

By enforcing these controls, SMEs can mitigate the risk of internal fraud and unauthorized transactions, promoting financial accountability and integrity within the organization.

3. Real-time collaboration

Effective collaboration is essential for the smooth operation of any business, including SMEs. In the context of accounting and financial management, SMEs often face challenges when it comes to coordinating tasks, sharing information, and maintaining clear communication among team members.

With SME accounting software, there is real-time collaboration, fostering teamwork and efficiency within the organization. SME accounting software can facilitate simultaneous access and real-time updates to financial data.

SMEs can leverage the software’s cloud-based or networked infrastructure to centralize their financial information. This allows authorized users to access the system from different locations, enabling remote collaboration and eliminating the barriers of time and physical presence.

The Features of SME Accounting Software

From tracking expenses and generating invoices to managing cash flow and ensuring regulatory compliance, the complexities of accounting can be overwhelming for SMEs. Fortunately, there are some features designed to simplify these tasks.

In this section, we will explore the key features of SME accounting software that can empower businesses to effectively manage their finances, make informed decisions, and propel their growth.

1. Send invoice

Effective and timely invoicing is crucial for SMEs to maintain healthy cash flow and ensure smooth financial operations. Manual invoicing processes can be time-consuming, prone to errors, and challenging to manage as the business grows.

SME accounting software provides a comprehensive invoicing process, enabling SMEs to send professional and accurate invoices efficiently. The software typically offers intuitive and user-friendly interfaces that allow businesses to generate professional-looking invoices with ease.

SMEs can add their company logo, personalize the invoice layout, and include essential details such as customer information, payment terms, and itemized descriptions of products or services rendered.

Moreover, SME accounting software often includes automation capabilities, simplifying the invoicing process. The software can automatically populate invoice fields with customer data, transaction details, and pricing information, reducing the need for manual data entry. This saves time and minimizes the risk, ensuring accuracy in the invoicing process.

2. Bank integration

Seamless integration with banking systems is a valuable feature offered by SME accounting software. It provides banking integration features that simplify and automate the process of importing, reconciling, and tracking bank transactions with real-time access.

By establishing this feature, SMEs can effortlessly import their bank statements and other transaction details directly into the accounting software. Furthermore, SME accounting software often offers bank reconciliation capabilities.

The software can automatically compare imported bank transactions with those recorded in the accounting system, highlighting discrepancies or missing entries. This greatly simplifies and accelerates the bank reconciliation process, reducing the likelihood of errors and ensuring accurate financial records.

3. GST returns

Goods and Services Tax (GST) compliance is an important aspect of financial management for SMEs. Filing accurate and timely GST returns can be complex, especially as businesses navigate changing tax regulations and deal with large volumes of transactions.

SME accounting software can simplify the process of GST return filing, ensuring compliance and reducing the administrative burden for SMEs. The SME accounting software is typically equipped with built-in GST tax rules and rates, which can be applied to each transaction automatically.

This automation saves SMEs time and effort by eliminating the need for manual calculations and reducing the risk of errors in GST calculations. Moreover, this software provides a centralized platform for tracking and recording GST-related information.

The software allows SMEs to accurately capture and categorize GST input and output taxes associated with each transaction. This ensures that the business maintains detailed and organized records, facilitating seamless reconciliation and verification of GST-related data.

5 Best SME Accounting Software Recommendations

SMEs are constantly seeking ways to optimize their financial management processes through SME accounting software. With the ever-increasing complexity of accounting tasks, leveraging the right software becomes essential for SMEs to stay organized, efficient, and compliant.

You can explore the best accounting software for small business recommendations that can empower your businesses to take control of finances and pave the way for long-term success.

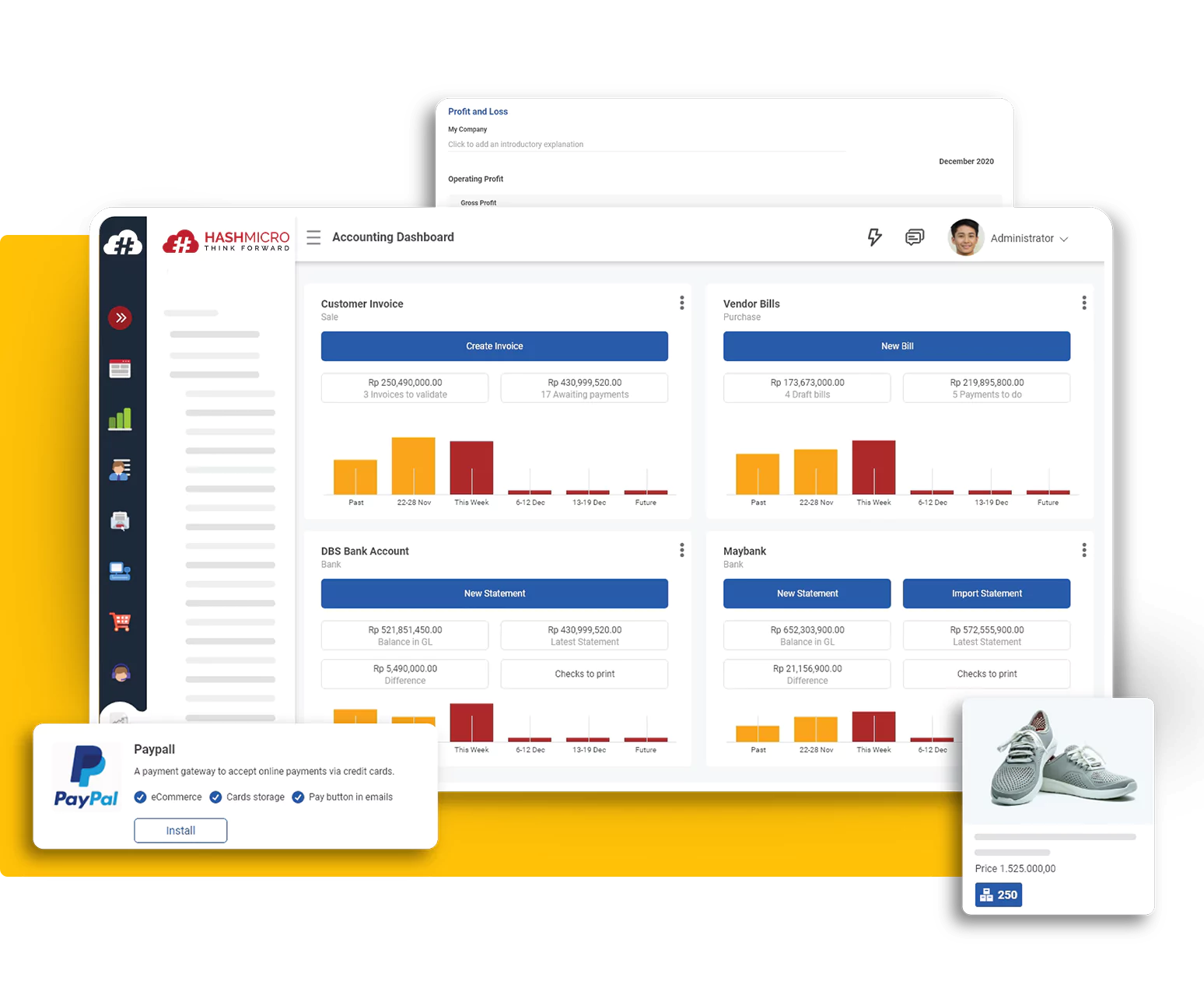

1. HashMicro

When it comes to choosing the right accounting software for SMEs, HashMicro stands out as a top recommendation. HashMicro offers a comprehensive suite of accounting software solutions tailored to meet the specific needs of SMEs.

One of the key advantages of HashMicro is its affordability, making it accessible to businesses with varying budget constraints.

Moreover, SMEs can take advantage of the Productivity Solutions Grant (PSG) with up to 50% discount to offset the cost of implementing HashMicro’s accounting software. Additionally, HashMicro goes beyond providing software by offering professional assistance throughout the implementation and adoption process.

Their team of experts ensures a seamless transition and provides ongoing support to address any queries or issues that may arise.

With its user-friendly interface and robust features, HashMicro provides SMEs with an efficient and streamlined accounting solution. HashMicro offers a comprehensive suite of tools for managing financial tasks such as invoicing, bank reconciliation, expense tracking, and reporting.

Its cloud-based platform allows for easy accessibility and collaboration, empowering SMEs to work anytime, anywhere. HashMicro also integrates seamlessly with other business applications, providing a connected ecosystem for managing various aspects of the business.

With its intuitive interface, powerful features, and scalability, HashMicro is an ideal choice for SMEs looking to simplify their accounting processes and gain better control over their financial management.

2. Xero

Xero harnesses advanced technology to deliver innovative features and functionalities. The accounting software automates repetitive tasks, streamlines processes, and provides real-time insights into financial data, empowering SMEs to make informed decisions and optimize their financial management.

With Xero’s accounting software, SMEs can upgrade their operational efficiency, improve accuracy, and focus on driving their business growth.

3. QuickBooks

Another recommendation is QuickBooks accounting software. QuickBooks offers a range of customizable templates and reports that provide valuable insights into the financial health of the business.

SMEs can generate detailed reports, such as profit and loss statements, cash flow analysis, and balance sheets, enabling them to make informed decisions and monitor their financial performance.

4. Wave

Wave is also a good recommendation when it comes to the best small business software. As SMEs grow and evolve, Wave can easily accommodate the changing needs of the business.

The software allows for the addition of new users, integration with other business tools, and expansion of functionality, ensuring that QuickBooks remains a reliable and effective accounting solution as the business expands.

5. FreshBooks

FreshBooks is one of the highly recommended accounting software. It offers a user-friendly and intuitive platform that simplifies financial management tasks for SMEs at a reasonable price. With its comprehensive set of features, businesses can efficiently track income and expenses, manage payroll, and create detailed financial reports.

Conclusion

In conclusion, effective financial management is crucial for SMEs, and accounting software plays a vital role in streamlining their financial processes. SME accounting software offers a range of benefits tailored to the needs of SMEs, including cost-effectiveness, reduced risk of errors, and real-time collaboration.

Among the top recommendations for SME accounting software, HashMicro stands out for its affordability and comprehensive suite of accounting tools. Before implementing the software, it gives you a chance to try the free demo with professional assistance. It can help you consider the most suitable software for your business.