Financial statements are data that indicate an organization’s or business’s activities and financial situation over a specific time period. The importance of information in producing accurate financial accounts cannot be overstated. As a result, many businesses rely on Document Management Software to gather accurate data.

This report’s information will be utilized subsequently by stakeholders and shareholders to analyze the company’s success and identify the activities that must be made to boost business profitability. We explain the various sorts of financial statements in depth in this article, along with examples. However, before we go any further, it’s important to understand the purpose and function of financial statements.

Table of Content:

Table of Content

The Purpose of Financial Statements

Financial statements are created so that stakeholders and shareholders of an organization or company understand their financial position. You can find out whether your business is winning or losing, how much debt you have to pay, as well as how and where to allocate your budget.

The Benefits of Financial Statements

Here are the main benefits of financial statements for your business.

Establish Credibility

Your company’s credibility can be proven through financial statements. Comprehensive, transparent, and clear financial statements show that the company’s operations are running smoothly. So this can help increase investor and client confidence in your business.

Improve Decision Making Process

Proper use of finance data analytics helps you make the right decision for your business.. Where you should invest, how you should utilize your business capital, and what costs need to be reduced, you can make better decisions with your financial statements.

Show Your Company’s Health

With your financial statements the company, you can conduct an evaluation of your company’s health. Through financial statement, you need to pay attention to your business cash flow. If the expenditure is always greater than the income, then we can take the conclusion that your company isn’t profitable.

Types & Samples of Financial Statements

Generally, there are four types of financial statements that every business owner should know. Each report can stand on its own and is used for a different purpose.

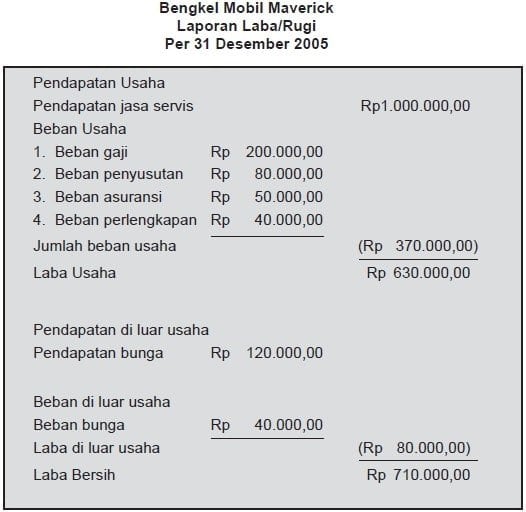

Income Statement

The income statement (also referred to as a profit and loss statement) is a type of financial statement that shows the income and expenses of a company in a certain period of time. If the income is greater than the expenditure then the company is making a profit, but if the expenditure is greater than the income, then the company is operating at a loss. To minimize losses, improve your sales productivity using HashMicro’s Sales Application, which is already integrated with a variety of different systems, including accounting systems.

In general, there are two types of income statements; the single-step income statement and the multiple-step income statement. The single-step format tends to be easier to make since it uses only one subtraction to arrive at net income.

A single-step income statement would look like this:

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

The multiple-step income statement uses multiple subtractions in computing the net income shown on the bottom line, segregating the operating revenues and operating expenses from the non-operating revenues, non-operating expenses, gains, and losses. The multiple-step income statement also shows the gross profit (net sales minus the cost of goods sold).

Here is what a multiple-step income statement looks like:

Cash Flow Statement

A cash flow statement template can show the company’s inflows and outflows for a certain period. So with a cash flow statement, you can estimate your money turnover in the future. This report can also make accountable to the company’s stakeholders.

There are two sources that you can use to figure out your inflows; operations and funding or loans. While outflows can be seen from the large number of costs incurred by the company, both for its operations and investments.

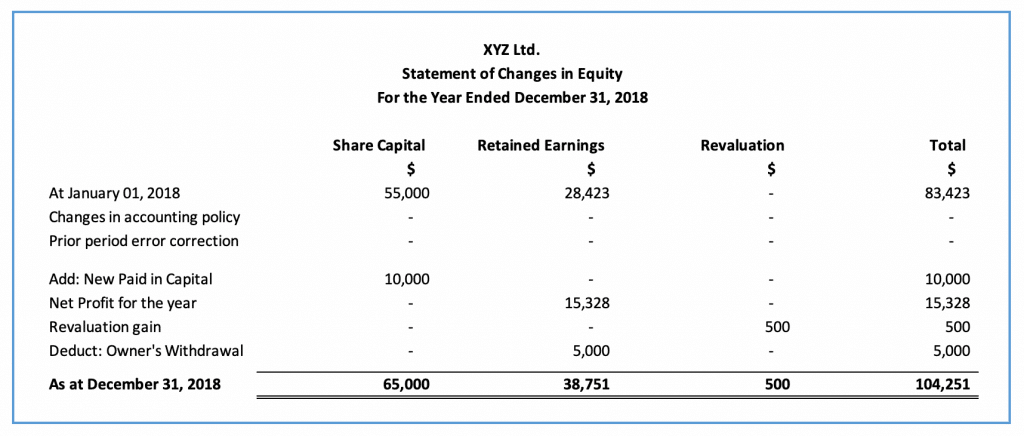

Statement of changes in Equity

Statement of changes in equity provides information about the amount of capital that you have in a certain period of time. With this type of report, you can completely find out about the changes in the capital that occur, how much, and also what causes these changes.

The transactions most likely to appear on this statement are as follows:

- Net profit or loss

- Dividend payments

- Proceeds from the sale of stock

- Treasury stock purchases

- Gains and losses recognized directly in equity

- Effects of changes due to errors in prior periods

- Effects of changes in fair value for certain assets

The most common way to present the statement of changes in equity is as a separate statement or to add it to another financial statement.

Balance Sheet

The balance sheet displays your overall financial condition and position for a certain period. By compiling this type of report, you can find out the number of your business assets, liabilities, and equity.

We can refer to the balance sheet as a statement of net worth, or a statement of financial position. So the balance sheet is based on the fundamental equation: Assets = Liabilities + Equity.

If you’re seeking a deeper understanding of the topic within a specific industry, check out our article on financial statement for manufacturing company.

Conclusion

Financial statements are crucial for the continuity of your business. By generating them, you will understand the current and future financial condition of your business. Generally, the creation of financial statements is at the end of each period, either by the end of the month or by the end of the year.

Generating financial statements manually, using paper or spreadsheets is certainly very time-consuming. Moreover, this is very vulnerable to errors that could have a negative impact on the decisions. In addition, piles of paper records are vulnerable to lose or damage.

Fortunately, you can now automate your financial report generation. You can create any financial statement in seconds with the Accounting System by HashMicro. It can show and easily configure real-time data in various formats.

HashMicro’s Accounting System is integrated with sales, purchases, and inventory so you can have more complete visibility regarding your company’s financial condition. In addition, with an advanced forecasting feature, this system also enables you to forecast your future income more accurately. To experience the benefits of the software yourself, you can request a free demo here.

:max_bytes(150000):strip_icc():format(webp)/InvestoApple2jpeg-da0c6b0acbc7478d9df0caf561ad0afc.jpg)