Looking for how to comply with tax obligations for your corporate company? Corporate tax planning helps you structure income, expenses, and timing so taxes are handled properly without disrupting daily operations.

For many businesses, especially in Singapore, tax planning is not about aggressive savings but about clarity and control. When done early, it supports better forecasting, cleaner reporting, and fewer surprises at year’s end.

A clear corporate tax planning approach aligns financial data, internal processes, and decision-making in a single direction. This is how your corporate business should stay aligned and compliant in its tax obligations.

Key Takeaways

|

The Term Corporate Tax Planning Explained

Corporate tax planning is a systematic, legal process for analyzing a company’s financial situation to optimize its tax obligations. The primary objective is to achieve the highest possible tax efficiency without violating applicable regulations, thereby maximizing after-tax profits and improving cash flow.

This process involves a thorough evaluation of various transaction options, investments, and business structures to identify the most tax-advantageous scenarios. It involves planning income timing, allowable deductions, and internal documentation so tax outcomes align with business decisions throughout the year.

Singapore’s Tax Regulations for Corporations

Singapore’s corporate tax framework is designed to be transparent, predictable, and business-friendly, with the Inland Revenue Authority of Singapore (IRAS) acting as the central authority for tax administration, enforcement, and guidance. Understanding the core rules set by IRAS helps companies stay compliant while planning taxes more effectively throughout the year.

Key corporate tax regulations in Singapore include:

- Flat corporate income tax rate

Companies in Singapore are taxed at a flat 17% corporate income tax rate on chargeable income, regardless of whether they are locally or foreign-owned. - Estimated Chargeable Income (ECI) filing

Most companies must file their Estimated Chargeable Income within three months after the end of their financial year. This early declaration allows IRAS to assess the tax payable before final filing. - Annual corporate tax return submission

Companies are required to submit Form C-S, Form C-S (Lite), or Form C annually, depending on eligibility. The standard filing deadline is 30 November of the Year of Assessment. - Partial tax exemptions and start-up schemes

Singapore provides partial tax exemptions and start-up tax exemption schemes that can significantly reduce taxable income during the early years, subject to qualifying conditions. - Territorial basis of taxation

Corporate tax generally applies to income earned in Singapore or received in Singapore from overseas, making income classification and proper documentation essential.

Why is Enterprise Tax Planning Important for Your Company?

Ignoring corporate tax planning is equivalent to leaving one of the largest business expenses unmanaged. Here are several fundamental reasons why every company, regardless of its size or industry, should prioritize corporate tax planning as an integral part of its business strategy.

- Optimizing cash flow efficiency

Corporate tax planning helps you keep more working capital inside the business by reducing avoidable tax leakage. That extra cash can fund growth priorities or act as a buffer during slow periods. - Legally minimizing tax liabilities

The goal is to lower tax payable using legitimate deductions, incentives, and smart timing, not to hide income. Done properly, it improves retained earnings while staying within the rules. - Enhancing compliance and reducing audit risk

A structured plan keeps filings accurate, consistent, and on time, which reduces penalties and rework. It also strengthens documentation, so you’re better prepared if questions or audits happen. - Supporting strategic decision-making

Tax impacts are tied to big decisions like expansion, asset purchases, and restructures, so planning helps you see the real net cost early. That clarity improves forecasting and prevents “tax surprises” after the deal is done. - Strengthening reputation and investor confidence

Strong tax planning signals disciplined governance and lower risk, which stakeholders care about. It supports cleaner financial statements and builds credibility with investors, lenders, and partners.

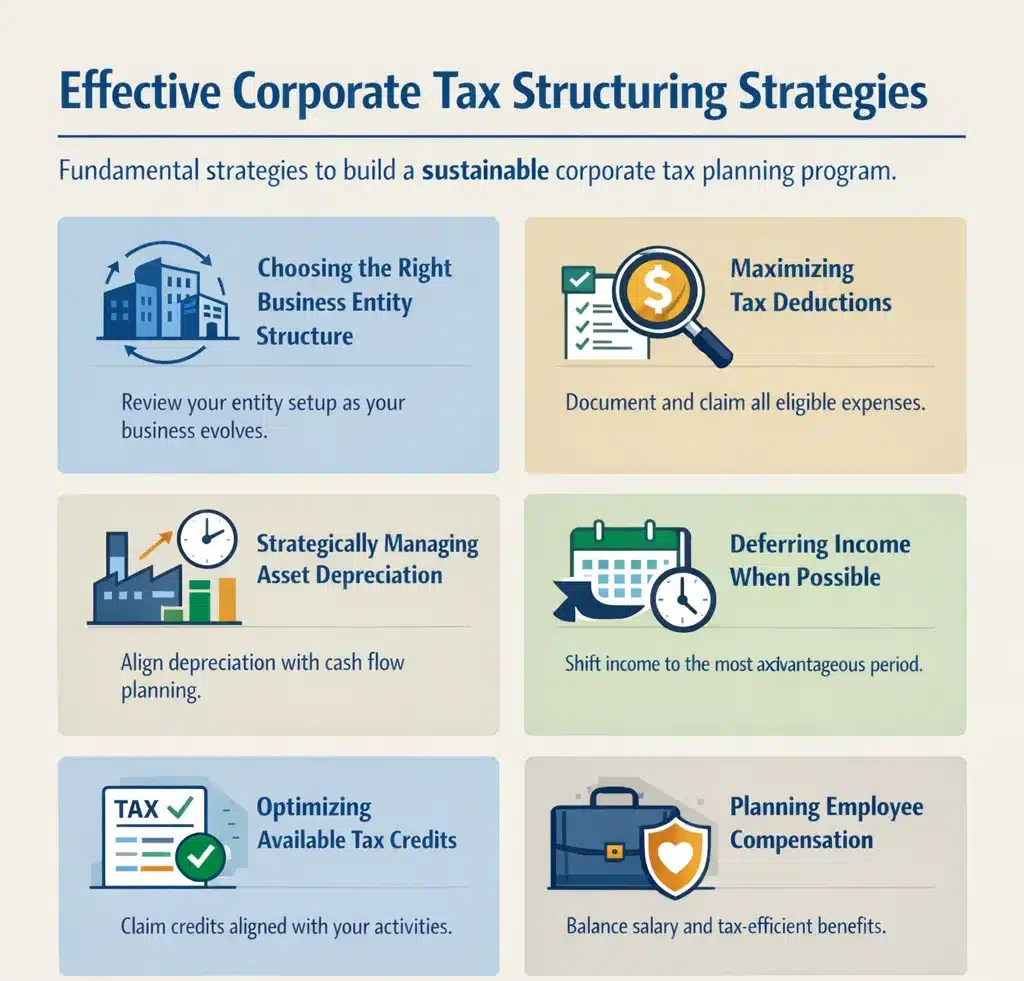

Effective Corporate Tax Structuring Strategies

After understanding the importance of tax planning, the next step is to implement concrete and actionable strategies. The following are fundamental strategies companies can implement to build an effective, sustainable corporate tax planning program.

- Choosing the right business entity structure

Start by confirming whether your current entity structure still matches how you earn revenue and distribute profits. Review it as the business grows because the “right” setup can change once you add investors, new business lines, or overseas income. - Maximizing tax deductions

List all operational expenses that are legitimately claimable and standardize how teams submit supporting documents. Strong documentation is the difference between a deduction you planned for and one you lose during review. - Strategically managing asset depreciation

Map your major assets and select depreciation methods that align with cash flow and profit planning across the year. Track additions, disposals, and usage changes so depreciation stays accurate and defensible. - Deferring income when possible

Plan revenue recognition and billing milestones so income lands in the most appropriate period, especially for project or subscription models. This creates a smoother taxable profit without distorting the actual business performance. - Optimizing available tax credits

Identify credits that match your activities, then build the evidence trail before you claim them. Credits can deliver direct tax savings, but only when eligibility and documentation are clean. - Planning employee compensation and benefits

Structure compensation with a clear split between salary and benefits, then confirm how each component is treated for tax purposes. This improves employee value while keeping payroll costs and tax exposure more predictable.

To better understand, take a look at this infographic.

The Role of Technology in Optimizing Corporate Tax

As corporate tax optimization in Singapore becomes more data-driven, manual tracking is no longer enough to keep pace with reporting and analysis needs. Technology helps centralize financial data, improve accuracy, and support tax decisions with real-time visibility.

- Automation of tax calculation and reporting

Technology automates tax calculations and report prep from your transaction data, so you don’t rely on manual formulas. This reduces errors and keeps tax numbers consistent with your latest books. - Integration of financial data for in-depth analysis

An ERP connects sales, purchases, inventory, and assets in one dataset, making tax analysis faster and more complete. You can spot deductible costs, track depreciation, and validate expense classifications without chasing files across teams. - Simulation and forecasting of tax scenarios

Modern tools let you model “what if” scenarios like asset purchases, restructuring, or cost changes, and see the projected tax impact. This helps finance teams choose the most tax-efficient option before decisions are locked in. - Ensuring compliance with the latest regulations

Systems that receive regular updates help you stay aligned when tax rules, rates, or reporting formats change. That lowers the risk of unintentional non-compliance and reduces last-minute rework before filing.

Business Tax Planning Roadblocks and How to Solve Them

Although corporate tax planning offers many strategic benefits, its implementation process is not always smooth. Understanding and addressing these common obstacles will help companies build a more resilient and sustainable tax planning foundation.

- Complex and frequently changing tax regulations

Tax rules shift, and interpretations evolve, so internal teams can fall behind fast. Stay current with regular updates from trusted tax sources, and switch to cloud accounting tools that are up to date with the latest rule changes. - Lack of accurate financial records

Tax planning breaks down when data is incomplete, inconsistent, or scattered across spreadsheets and teams. Fix it by centralizing transactions in a single accounting system and making routine reconciliation a non-negotiable habit. - Difficulty in separating business and personal expenses

Mixed spending creates messy classifications and weakens your deductions, potentially raising red flags. Separate accounts and cards, then set clear internal rules so every payment has a business purpose and proof. - Procrastination in planning

Leaving tax planning until year-end turns it into damage control and limits your options. Run quarterly check-ins to forecast tax exposure early and adjust decisions while you still have room to act.

How Tate & Lyle Complies with Tax Regulations Using Integrated Accounting Technology

As a multinational manufacturer, Tate & Lyle faces complex tax obligations across multiple jurisdictions and business units. Integrated accounting technology helps align data, controls, and reporting so tax compliance remains consistent and manageable across the group.

- Centralizing multi-entity financial data

Integrated accounting software consolidates data across global entities, providing Tate & Lyle with clear, group-wide visibility for corporate tax planning and reporting. - Managing transfer pricing documentation and controls

The system supports consistent intercompany pricing, transaction tracking, and documentation, all of which are critical for defending transfer pricing positions. - Tracking deductible costs and eligible incentives

Manufacturing, R&D, and sustainability expenses are accurately classified, helping identify deductions and incentive claims tied to innovation and ESG initiatives. - Improving audit readiness and compliance reporting

Detailed audit trails and standardized tax reports reduce compliance risk and support faster responses to regulatory reviews.

Conclusion

Corporate tax planning is a vital component that cannot be separated from a company’s strategic management. More than just an administrative obligation to meet reporting deadlines, effective tax planning is a powerful tool for enhancing financial health, managing risks, and supporting sustainable business growth.

These strategies rely on three pillars: regulatory knowledge, accurate records, and the right technology. Interested in taking your corporate tax planning to the next level? Consult with our expert regarding your concerns and enhance your business’s tax to achieve superior automation.

FAQ About Corporate Tax Planning

-

What is the main goal of corporate tax planning?

The main goal is to legally minimize a company’s tax liabilities while remaining fully compliant with all regulations. This helps improve cash flow, maximize after-tax profits, and support the company’s overall financial health and strategic growth.

-

How often should a company conduct tax planning?

Corporate tax planning should be a continuous, year-round process, not just an end-of-year activity. Regular reviews, such as quarterly, are recommended to assess financial performance, project tax liabilities, and adjust strategies as needed.

-

Can small businesses benefit from corporate tax planning?

Absolutely. While the strategies may differ in scale, small businesses can greatly benefit by maximizing deductions, managing expenses properly, and choosing the right business structure. Effective tax planning helps preserve crucial capital for growth and stability.