Do your financial statements often show lower profits even when revenue looks stable? Or maybe your asset values seem to decline too quickly, creating confusion during audits. These issues are usually caused by mismanaging depreciation expense, a silent cost that gradually eats into your profit margins.

According to IRAS, one of the most common issues found during corporate tax audits in Singapore is the incorrect claiming of capital allowances on assets that don’t qualify. This mistake often stems from poorly managed asset tracking. Over time, such errors may affect financial accuracy and reduce eligible tax deductions.

To avoid these pitfalls, many businesses are upgrading how they manage asset depreciation. Instead of relying on spreadsheets or manual entries, they use systems that can calculate, monitor, and report depreciation with consistency. This approach allows for cleaner financial records and better long-term planning.

Companies that streamline depreciation processes are finding it easier to stay compliant, make accurate forecasts, and maintain investor trust. If you’re aiming for better financial clarity, this guide will walk you through everything from how depreciation expense works to choosing the right method for your business.

Key Takeaways

|

What is a Depreciation Expense?

Many business owners often ask, what is depreciation expense, and why does it matter for long-term assets? In simple terms, it’s the process of spreading the cost of a fixed asset across the years it brings value to your business. Rather than deducting the full cost at once, the expense is recorded gradually.

When a business acquires long-term assets such as machinery, equipment, or vehicles, these assets are capitalized. If the full cost were expensed immediately, it would exaggerate expenses during that period and understate profitability in future periods. Depreciation helps avoid this imbalance.

This expense plays a vital role in aligning the cost of using an asset with the revenue it generates through a depreciation schedule in financial accounting. It also ensures that financial statements present a more accurate and consistent view of a company’s profitability over time.

Depreciation Expenses versus Accumulated Depreciation

Depreciation appears frequently on income statements as a normal business expense, but it’s often confused with accumulated depreciation. While both are related to the reduction in asset value over time, they serve very different purposes and are reported in different places within financial documents.

| Component | Depreciation Expense | Accumulated Depreciation |

| Definition | The portion of an asset’s cost allocated during a specific period | The total depreciation recorded over an asset’s lifetime |

| Financial Statement | Appears on the income statement | Appears on the balance sheet under long-term assets |

| Type of Entry | Operating expense | Contra-asset account |

| Purpose | Matches asset cost to the period of benefit | Tracks total reduction in asset value |

| Frequency | Recorded periodically (monthly, quarterly, or annually) | Cumulative; increases with each recorded depreciation expense |

| Cash Impact | Non-cash, affects net income | Non-cash, affects net book value of assets |

To clarify the difference, depreciation expense is recorded as a cost on the income statement for one specific period. Accumulated depreciation, on the other hand, reflects the total amount deducted from the asset’s value since its acquisition. So, is depreciation an expense? Only within the current reporting cycle.

On the other hand, accumulated depreciation does not represent an expense like typical operating expenses examples. Instead, it reduces an asset’s carrying value on the balance sheet, showing how much of the asset’s value has been used over time.

How to Calculate Depreciation Expense

Depreciation expense is calculated to spread the cost of an asset over the period it provides value. While each method varies in complexity and purpose, they all aim to reflect asset usage as accurately as possible on financial reports.

1. Straight-line depreciation method

The straight-line method is the most straightforward approach. It assumes that an asset loses value evenly over time. This method is often applied to fixed assets like buildings or furniture that depreciate at a consistent rate.

Formula:

Depreciation Expense = (Purchase Price – Salvage Value) ÷ Useful Life

- Purchase price is the amount paid to acquire the asset.

- Salvage value is the estimated resale or scrap value at the end of the asset’s useful life.

- Useful life refers to how long the asset is expected to be productive or generate value for the business.

This formula takes the depreciable amount (purchase price minus salvage value) and spreads it equally across the total number of years the asset is expected to be used. The result is a fixed annual depreciation cost.

2. Double declining balance method

The double declining balance method is a type of accelerated depreciation. It allows businesses to write off a larger portion of an asset’s cost earlier, which is useful for items that lose value quickly or generate most of their return early on.

Formula:

Depreciation Expense = Beginning Book Value × (2 ÷ Useful Life)

- Beginning book value is the asset’s value at the start of the year, after accounting for previous depreciation.

- The factor “2” doubles the rate used in straight-line depreciation, making the write-off faster.

- Useful life is the total number of years the asset is expected to be used.

This method doesn’t use the salvage value in the formula directly, but the depreciation stops once the asset’s book value reaches its salvage value. The amount depreciated decreases each year as the book value shrinks.

3. Units of production method

The units-of-production method ties depreciation to actual usage rather than time. It’s useful when asset wear depends more on output than age, such as in machinery, factory equipment, or vehicles.

Formula:

Depreciation Expense = [(Cost – Salvage Value) ÷ Total Estimated Units] × Units Produced

- Cost is the initial purchase price of the asset.

- Salvage value is the expected value at the end of its life.

- Total estimated units refers to the expected production capacity over the asset’s life.

- Units produced is how much output the asset generated during the current period.

This method calculates a per-unit depreciation rate and multiplies it by actual usage. The more an asset is used in a given year, the higher the expense recorded for that period.

How to Choose the Right Depreciation Expense Method

Selecting the right depreciation method starts with understanding how the asset provides value. Some assets wear out consistently, others lose value more rapidly, and some depend on actual usage. Using a method that matches the asset’s nature ensures accurate financial reporting.

Here’s a simplified comparison to help guide your decision:

| Method | Best For | Expense Pattern |

| Straight-line | Steady-use assets | Same amount each year |

| Double declining balance | Fast-depreciating assets | Higher early, lower later |

| Units of production | Usage-based depreciation | Varies with output |

The straight-line method works best when an asset provides consistent benefits year after year. Office furniture, buildings, or leasehold improvements are often depreciated this way because their value declines evenly throughout their useful life. This method is ideal if your goal is simplicity and predictability in expense reporting.

However, if your workspace requirements change frequently, renting furnishings can sidestep capital purchases and the related depreciation entries. Adopting flexible office furniture solutions helps reduce upfront spend, ease logistics, and keep teams agile as headcount or layout shifts occur.

In contrast, the double declining balance method is a better fit for assets that lose value quickly or become less efficient early on. Vehicles, electronics, and software licenses are common examples. If your business needs to recover costs faster or expects higher returns in early years, this method helps reflect that financial reality.

The units-of-production method is most suitable for equipment that wears out based on output, not time. Manufacturing tools, printing machines, or heavy-duty machinery used in mining or logistics fall under this category. When usage varies from period to period, this method ensures your expense recognition stays accurate and fair.

Choosing the right method improves reporting accuracy, supports better budgeting and compliance. If managing multiple asset types and aiming to automate depreciation in Singapore, consider HashMicro’s Accounting Software. Eligible companies can claim up to 70% funding via the CTC grant.

Examples of Depreciation Expenses

Understanding how depreciation works becomes easier with real-world examples. Below are simplified scenarios for each calculation method, helping you see how the formulas apply across different types of business assets.

Straight-line depreciation example

A design agency buys new office equipment for $36,000. The equipment is expected to be useful for six years, with no salvage value. Using the straight-line method, the company records $6,000 in depreciation annually.

Formula:

Depreciation expense = (Purchase Price – Salvage Value) ÷ Useful Life

= ($36,000 – $0) ÷ 6 = $6,000 per year

Double declining balance example

A logistics company purchases a delivery van worth $60,000 with a five-year useful life. In the first year, it applies the double declining balance method and records $24,000 in depreciation.

Formula (Year 1):

Depreciation expense = Beginning Book Value × (2 ÷ Useful Life)

= $60,000 × (2 ÷ 5) = $24,000

In the second year, the book value drops to $36,000. The new depreciation expense becomes:

Formula (Year 2):

= ($60,000 – $24,000) × (2 ÷ 5) = $14,400

Units of production example

A manufacturing firm buys a printing machine for $85,000, with no residual value, and expects it to produce 80,000 units. If the machine produces 9,000 units this year, the depreciation expense is $9,540.

Formula (per unit):

Depreciation Expense = (Cost – Salvage Value) ÷ Estimated Total Units

= ($85,000 – $0) ÷ 80,000 = $1.06 per unit

Annual depreciation:

= $1.06 × 9,000 = $9,540

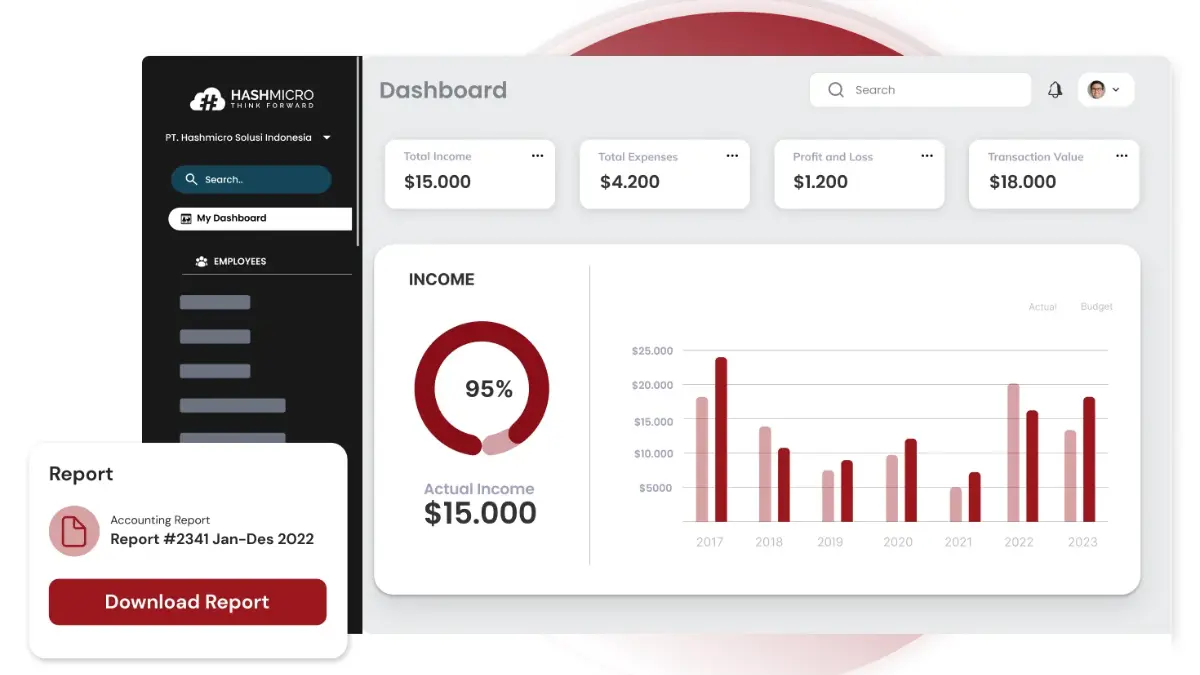

How HashMicro Helps Accounts for Depreciation Expense

Managing depreciation expense across various assets can be overwhelming, especially when each item comes with its own useful life and financial impact. Without automation, it’s easy to make mistakes that affect reporting, compliance, and long-term planning.

HashMicro’s Accounting Software makes this process easier by automating calculations, maintaining accuracy, and keeping financial records updated in real time. Businesses can reduce manual input, improve visibility, and ensure every expense is tracked properly.

More than 2,000 companies across Southeast Asia rely on HashMicro to simplify how they manage financial data. With localised features and integration across procurement, inventory, and CRM, the system supports Singapore’s fast-moving business needs.

Key features of HashMicro’s Accounting Software for depreciation management:

- Financial statement with budget comparison

Track whether actual depreciation expense aligns with budget forecasts. This helps finance teams catch overspending early and maintain better cost control. - Multi-level analytical reporting

Segment depreciation expense by project, department, or location. This provides sharper insights and supports more accurate financial analysis. - Cashflow reports

Monitor how depreciation affects cash flow across reporting periods. This allows for smarter allocation of funds and better long-term planning. - Forecast budget

Project future depreciation expenses based on current asset value. This feature supports more accurate budgeting and resource planning. - Custom printout for invoices

Create detailed invoices and reports linked to specific asset depreciation. This improves internal documentation and communication with stakeholders. - Complete financial statements with period comparison

Compare depreciation data across different periods to spot performance trends. This supports decision-making at both operational and strategic levels. - Chart of accounts hierarchy

Organise depreciation entries within a structured chart of accounts. This makes financial reporting more transparent and easier to manage. - Multi-company with intercompany transaction and consolidation

Manage depreciation for multiple entities within a single system. This helps ensure consistent reporting across all branches and business units. - Treasury & forecast cash management

Integrate depreciation with broader cash forecasts. This helps maintain liquidity and supports ongoing financial stability.

With Hashy, the built-in AI assistant, your finance team can automate time-consuming tasks like depreciation updates, asset valuation, and expense reporting. This frees up time for strategic work and ensures greater consistency across reports.

Conclusion

Depreciation expense plays a critical role in representing the true value of assets over time. By understanding how it differs from accumulated depreciation, learning how to calculate it correctly, and choosing the right method based on asset behavior, businesses can maintain accurate, reliable financial reports.

HashMicro’s Accounting Software transforms this complex process into a streamlined, automated workflow. From real-time reporting and multi-level analysis to forecasting and intercompany consolidation, the system equips finance teams with the tools they need to manage depreciation with precision and confidence.

Explore how your business can improve expense tracking and reporting accuracy. Book a free demo today to see how HashMicro can simplify depreciation management and support smarter financial planning.

FAQ about Depreciation Expense

-

Is depreciation expense a cash flow?

No, it’s a non-cash expense. While it doesn’t involve actual money leaving the business, it reduces taxable income and may improve cash flow indirectly.

-

What category is depreciation expense?

Depreciation is classified as an operating expense. It’s shown on the income statement and adjusted under operating activities in the cash flow statement.

-

Can I depreciate a used asset?

Yes. As long as it’s used for business and has a useful life, a used asset can be depreciated based on its purchase price and remaining value.

-

Is it better to depreciate or expense?

Depreciation suits long-term assets. Expensing is usually for low-cost or short-lived items. The right approach depends on the asset’s value and usage.

-

Can depreciation methods be changed?

Yes, but only with valid reasons and proper documentation. Any change must follow accounting standards and be disclosed in financial reports.