Adjusting a journal is something you need to do for your business. This aspect of adjusting entries is part of the field of accounting, that is, in the change of balances on the account that you need to adjust into the company ledger at the end of the accounting cycle. However, The purpose is to record income or expenses that they did not acknowledge during the period. You have to do it carefully so that there is no minute recording. If there are mistakes at the beginning, it will be more difficult at the end.

However, to make it easier for you to manage your books and all journals in your business, you can use accounting software that has the best features, is easy to use, and can minimize bookkeeping errors and fraudulent actions that your employees can do.

Strong financial control starts with great software. Explore Singapore’s best accounting software options or try our free demo.

Adjusting journal entries is what you need to do in the accounting cycle. Accounting is a process of recording business transactions and financial reporting. The process reflects a continuous and uninterrupted cycle. Therefore, accounting has a cycle related to the activities of recording business transactions and financial reporting. To manage the recording of transactions in your business, you can use the right accounting software.

Definition of Adjusting Journal Entries

Of course, for those of you who enter the world of Accounting, getting to know adjusting journals is nothing new. Before moving to the examples section, it might be helpful to know what an adjustment log is.

Adjusting journals record changes in balances in a particular account that can ultimately show the actual balance.

Adjusting Journal Entries Function

Discussing the meaning alone is not enough. You should also understand some of the features of the adjustment entries to better understand this material, such as the calculation of actual nominal estimates (revenues and expenses) for the corresponding period and how they are recorded in a special journal for adjusting entries.

Purpose of Adjusting Journal Entries

As a business owner, adjusting the journal is something you need to do. The purpose of the adjustment of entries relates to the accounting aspect, that is, to convert cash transactions into accrual accounting methods.

Type of Transaction Adjusting Journal Entries

After knowing the definition, function, and purpose of adjusting journal entries, the next explanation is regarding the types of adjusting journal transactions. However, In this case, there are 7 types you need to know. What are those? Here’s the explanation:

Equipment

Equipment in the adjusting journal is goods owned by the company, which are consumable or can be used repeatedly and are relatively small in shape which generally aims to complement the company’s business needs.

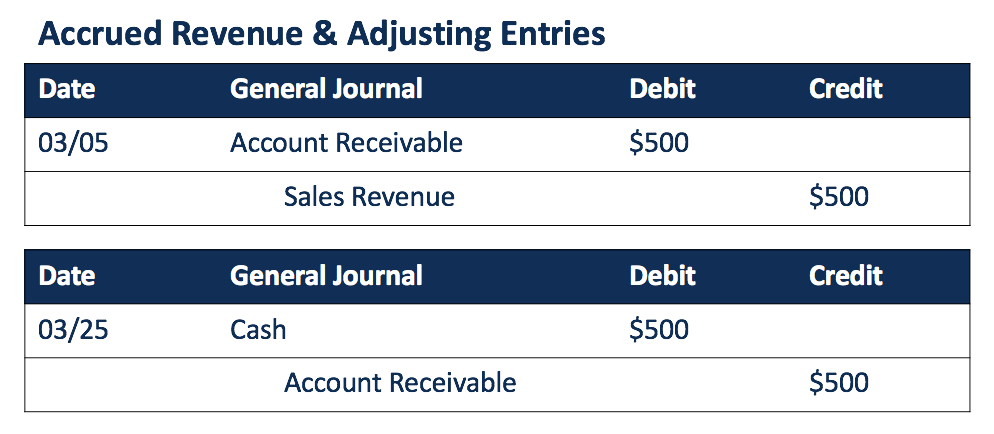

Revenue receivables

Receivables allow buyers to obtain the company’s products by way of debt.

Expense debt

Accrued expenses or you can also refer to expenses payable are expenses that have been incurred but have not been paid until the end of the period and have not been recorded in the relevant account.

Prepaid income

Unearned Income is income that has been received in the State Treasury but has not become the government’s right. The reason is that there is still an obligation for the government to provide goods/services in the future as a consequence of receiving income from the State Treasury.

Expenses paid in advance

Prepaid expenses are costs that are not yet an obligation of the company to pay for the period concerned, but have been paid in advance, and services for these expenses are not received immediately.

Loss of accounts receivable

Loss of receivables is a form of loss that occurs because of the principle that the receivables recorded in the balance sheet financial statements only have the nominal receivables that the company is expected to take.

Shrinkage

Depreciation or depreciation is something that can change the original cost of fixed assets.

Steps to Make Adjusting Journal Entries

Complete the trial balance

Before you make adjusting entries, you prepare a trial balance first. A trial balance is an accounting report that includes each transaction in the general ledger. However, The trial balance functions as a tool for recording, analyzing, monitoring, and checking all financial transactions. To make financial transactions easier, you need a financial management system.

Prepare to adjust journal

In the second stage of adjusting the journal, you just compiled adjusting the journal. In making adjustments there are accounts that you must adjust such as income, expenses, and equipment.

Creating a trial balance followed by adjustments

Next, the process of preparing a balance sheet after adjusting entries, usually includes an income statement, cash flow statement, balance sheet, and others.

Example of Adjusting Journal Entries

Conclusion

Adjusting a journal is something you need to do for your business. This aspect of adjusting entries is part of the field of accounting, that is, in the change of balances on the account that you need to adjust into the company ledger at the end of the accounting cycle. However, The purpose is to record income or expenses that they did not acknowledge during the period. You have to do it carefully so that there is no minute recording. If there are mistakes at the beginning, it will be more difficult at the end.

However, to make it easier for you to manage your books and all journals in your business, you can use accounting software that has the best features, is easy to use, and can minimize bookkeeping errors and fraudulent actions that your employees can do.

Strong financial control starts with great software. Explore Singapore’s best accounting software options or try our free demo.