Are your profits not aligning with your growing sales? Or do you notice missing revenue that can’t be traced back to any particular expense? These silent losses often point to a common but underestimated issue: revenue leakage. It’s a subtle but persistent drain that can affect financial health over time.

Approximately 42% of companies experience revenue leakage, with most reporting an average loss of 9% of their annual revenue caused by unnoticed leaks from inefficiencies. These losses are often due to billing errors, inconsistent pricing, or manual mistakes, rather than simple mistakes.

The good news is that there are proven ways to prevent these losses. By improving visibility across sales and finance, automating key billing checkpoints, and enforcing stronger oversight, companies can plug financial gaps and reclaim lost income more reliably.

In this article, you’ll learn what revenue leakage is, what causes it, and how to stop it, along with practical strategies and tools like accounting software that can help you plug the leaks before they impact long-term profitability.

Key Takeaways

|

What is Revenue Leakage?

Revenue leakage refers to income that businesses fail to collect, often without even realizing it. This issue typically stems from errors in financial or administrative processes, and it tends to slip past routine audits or inspections.

In many cases, the problem originates from billing departments, especially where manual data entry, outdated invoicing systems, or spreadsheet dependency are involved. These weak points lead to underbilling, pricing inconsistencies, or untracked services.

Revenue leakage becomes more likely as an organization grows in complexity. For instance, with multiple sales reps or varied pricing strategies, the lack of centralized contract or discount control can result in lost income opportunities.

What Are the Causes of Revenue Leakage?

Revenue leakage is rarely caused by a single issue. Instead, it often results from a mix of inefficient processes, outdated systems, and unchecked pricing policies. To understand how these leaks occur, let’s look at the most common culprits that quietly drain revenue.

1. Inefficient and manual processes

Revenue leakage often starts with manual workflows and outdated systems. For instance, relying on spreadsheets or delayed billing processes can lead to errors that go unnoticed. Moreover, when billing is handled separately from service delivery, important charges may be missed entirely.

2. Pricing and policy gaps

Another common source stems from unmonitored discounts and inconsistent pricing practices. Without proper pricing controls, sales teams might extend expired promotional rates or unauthorized discounts. As a result, profits suffer, even when sales performance appears strong on paper.

3. Data inaccuracy and poor oversight

Lastly, inaccurate or fragmented customer data can create critical blind spots. For example, expired credit cards or undercounted subscriptions often lead to unbilled services. In addition, unclear internal policies may cause teams to skip penalties or forget billable add-ons during invoicing.

Examples of Revenue Leakage

Revenue leakage often stems from overlooked operational gaps that gradually drain profitability. Below are some less obvious, yet impactful examples of how leakage can occur in your business processes.

Delayed or skipped renewals

Subscription-based businesses sometimes lose revenue when automatic renewal systems fail or when no reminders are sent for expiring contracts. This can result in customers lapsing without notice, reducing recurring income.

Sales team over-discounting

In high-pressure sales environments, teams may offer excessive discounts to close deals faster. Without strict approval flows or dynamic pricing tools, these discounts can go unnoticed and erode profit margins over time.

Untracked project scope changes

When clients request additional work mid-project and teams execute without updating contracts or pricing terms, businesses often end up delivering extra value without additional compensation.

Inventory write-offs due to poor reconciliation

In retail or distribution, discrepancies between recorded and actual inventory can cause repeated write-offs. If not traced back to their root cause, these losses accumulate, especially in multi-warehouse setups.

Unused service credits or support hours

Professional services firms often include prepaid support or service hours in client agreements. If these aren’t tracked or redeemed properly, they may expire unnoticed, resulting in value delivered without corresponding revenue.

Take, for example, a consulting firm that offers 20 support hours annually as part of a premium package. If the client uses 30 hours but the overage isn’t monitored or invoiced due to miscommunication between departments, the firm loses revenue it rightfully earned.

How to Find and Stop Revenue Leaks

Tackling revenue leakage requires more than just spot-checking invoices. Often, leaks stem from overlooked workflows, pricing inconsistencies, or outdated systems. With a structured approach, businesses can uncover these gaps and take strategic steps to prevent future loss.

1. Identify and trace revenue leakage points

Start by investigating where the leakage is happening. Complex contracts, missed billing entries, and delayed invoicing are often the culprits. Work with teams closest to revenue flows, like finance and sales, to review workflows and isolate specific breakdowns.

2. Strengthen processes and pricing accuracy

Once the source is identified, it’s crucial to correct any operational weaknesses. Enforce pricing policies more strictly, automate invoice follow-ups, and shift to a consumption-based pricing model when appropriate. These improvements help avoid underbilling or missed payments.

3. Reduce overhead and improve visibility

Cutting excessive customer acquisition costs and validating internal data across systems also plays a major role. Uncoordinated information and manual entry often result in lost income. Using analytics tools or integrated accounting systems ensures a timely detection of these discrepancies.

4. Automate financial controls and compliance

To truly stop leaks, automation must be prioritized. Automated invoice generation, follow-ups, data validation, and usage tracking reduce human errors and ensure consistent billing. Over time, automation builds financial discipline across departments.

To make these improvements scalable and accurate, many companies in Singapore are turning to digital solutions supported by the CTC Grant. If you’re exploring ways to close these financial gaps efficiently, click the banner below to discover the cost of implementing HashMicro’s accounting system in your business.

Reducing Revenue Leakage with HashMicro’s Accounting Software

Revenue leakage often stems from inconsistencies across billing, payment tracking, and reporting. To combat this, businesses need a system that ensures consistency and accuracy at every stage of the revenue process. One effective way to address this challenge is through an integrated and automated accounting solution.

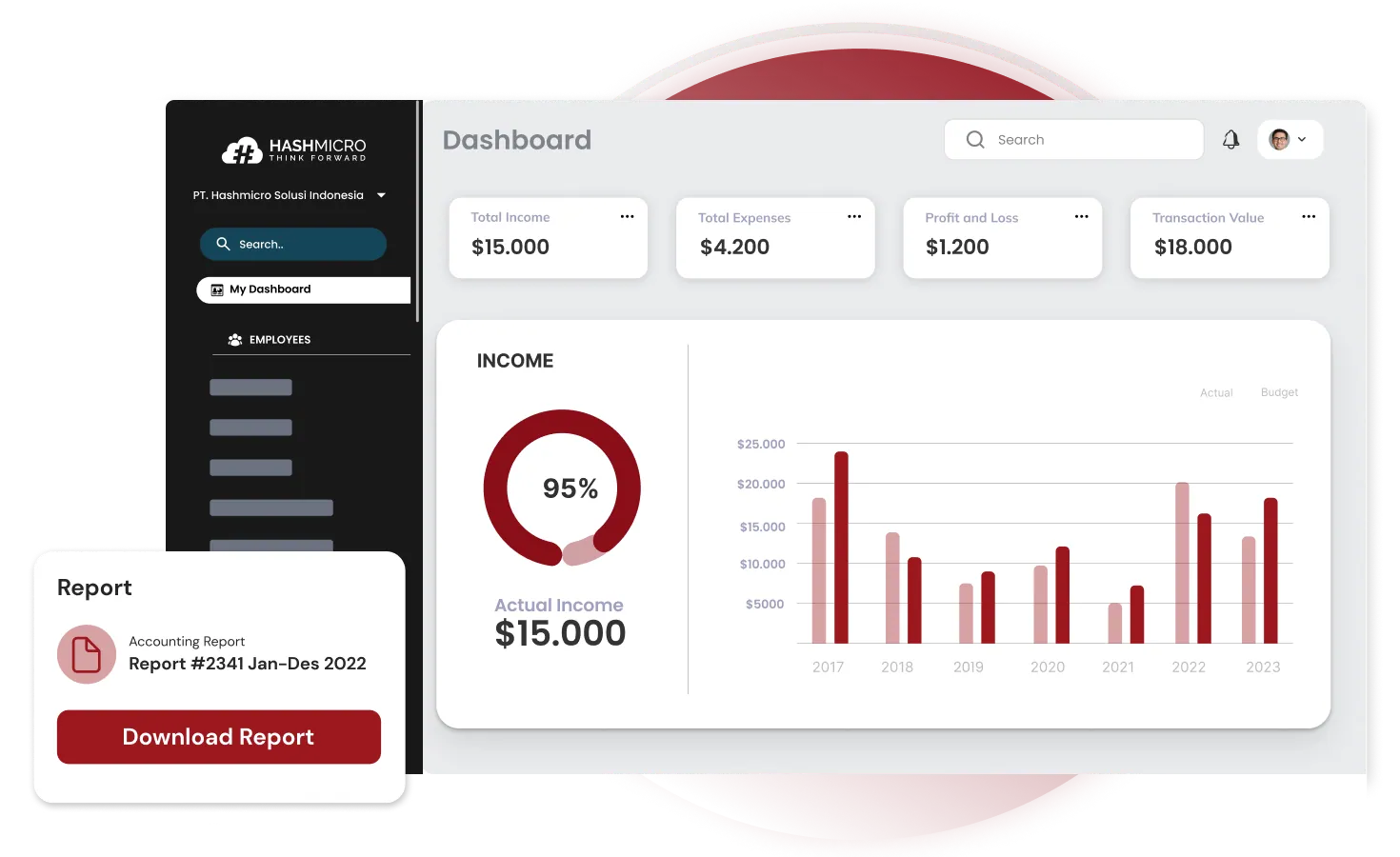

HashMicro’s Accounting Software offers a practical approach to minimizing leakage risks by automating invoicing, synchronizing payment records, and aligning billing with contract terms. By reducing manual errors and improving data accuracy, it helps businesses recover lost revenue and prevent future leak points more reliably.

Some of the software’s most beneficial features include:

- Integrated cash flow reports to track uncollected or delayed revenue.

- Auto bank reconciliation to match payments with billed invoices in real-time.

- Budget vs. realization monitoring to flag inconsistencies between projected and actual earnings.

- Financial statements with comparative analysis, helping you uncover patterns that may indicate hidden leakage.

To improve financial accuracy, HashMicro offers Hashy, an AI assistant that simplifies revenue recognition. It helps automate transaction tracking and financial analysis, ensuring recognition aligns with actual performance and timelines without manual errors.

Additionally, Hashy’s AR Collector automates invoice creation and follow-ups, supporting faster payment cycles and healthier cash flow. With AP Payables automation, businesses can ensure all payments align with service terms, improving the accuracy of revenue recognition.

Conclusion

Revenue leakage remains a serious challenge for many businesses, often caused by billing inaccuracies, weak pricing enforcement, and poor data visibility. Tackling this issue requires tightening operational workflows and adopting proactive financial monitoring strategies.

HashMicro’s Accounting Software offers comprehensive tools to support this need. It automates invoicing, aligns revenue recognition with real-time activity, and improves reporting accuracy. With AI-powered features like Hashy, it simplifies compliance and minimizes lost revenue from manual errors.

Explore how HashMicro can help your team improve financial control and secure sustainable profitability. Book a free demo today to discover the benefits of a smart, integrated accounting solution tailored to your business needs.

FAQ about Revenue Leakage

-

What is another word for revenue leakage?

Another term for revenue leakage is “lost revenue” or “unrealized revenue.” These terms refer to income that a business has earned or is entitled to but fails to collect due to process gaps, billing mistakes, or lack of visibility into financial operations.

-

What is revenue leakage in the banking sector?

In banking, revenue leakage arises from poor fee collection, waived charges, misapplied interest rates, and unenforced contractual terms with clients or partners.

-

How to calculate revenue leakage?

Revenue leakage is the difference between expected and actual collected revenue, caused by issues like underbilling or discounts. Regular audits help track this.

-

What is leakage compensation?

Leakage compensation recovers lost revenue through actions like crediting accounts, re-billing, or adjusting pricing. Contracts may include penalties for detected leakage.