Hay naku! Budgeting can be a real headache for businesses, especially when managing multiple expenses and forecasting future costs manually. Due to its time-consuming and error-prone nature, manual budgeting often leads to errors, inefficiencies, and missed opportunities.

Business budgeting software can transform these challenges into opportunities for growth by streamlining financial planning and enhancing accuracy. These tools simplify tracking, forecasting, and reporting, allowing businesses to focus on their core operations and strategic goals.

The Philippine enterprise software market is expected to grow 9.5% annually between 2024 and 2028. This growth highlights the increasing investment in automation technologies to overcome the challenges in financial management.

However, finding the right fit can be challenging with so many financial budgeting software options. Therefore, this article will provide the 15 Best Business Budgeting Software for all Business 2025, helping you choose the best solution for your needs.

Key Takeaways

|

Table of Contents

What is Business Budgeting Software?

Business budgeting software is a digital tool that helps businesses plan, track, and manage their financial resources, ensuring effective budget allocation. It automates budget creation, monitors expenses, and provides real-time insights to help businesses make informed decisions.

In corporate finance, successfully planning, managing, and optimizing budgets is essential for achieving success. In today’s data-driven world, budgeting software enables organizations to make well-informed decisions, boost financial budgeting, and reach strategic goals with accuracy. It also helps businesses manage variable cost more effectively.

Need to know!

AI-powered budgeting software enhances financial planning by automating calculations, analyzing spending patterns, and providing real-time insights. With Hashy AI from HashMicro, businesses can optimize budgets more efficiently and make accurate financial decisions.

Get a Free Demo Now!

Benefits of Business Budgeting Software

Business budgeting software is essential for streamlining financial planning, optimizing cost management, and supporting informed decision-making. Below are the key benefits of implementing budgeting software in your business operations:

- Improved financial planning through automated budget creation and tracking.

- Real-time monitoring of expenses and cash flow for better cost control.

- Enhanced collaboration by allowing multiple users to access and update budget information.

- Data-driven decision-making supported by detailed reports and analytics.

- Scalability to adapt as the business grows and its needs evolve.

- Risk mitigation by identifying and managing potential financial risks proactively.

- Compliance support with financial regulations and reporting standards.

15 Best Business Budgeting Software for 2025

Below are the 15 best business budgeting software available in the Philippines for 2025. Each has been selected to help businesses streamline financial planning, enhance accuracy, and maintain control over budgets, ensuring they can make data-driven decisions and achieve their goals.

1. HashMicro

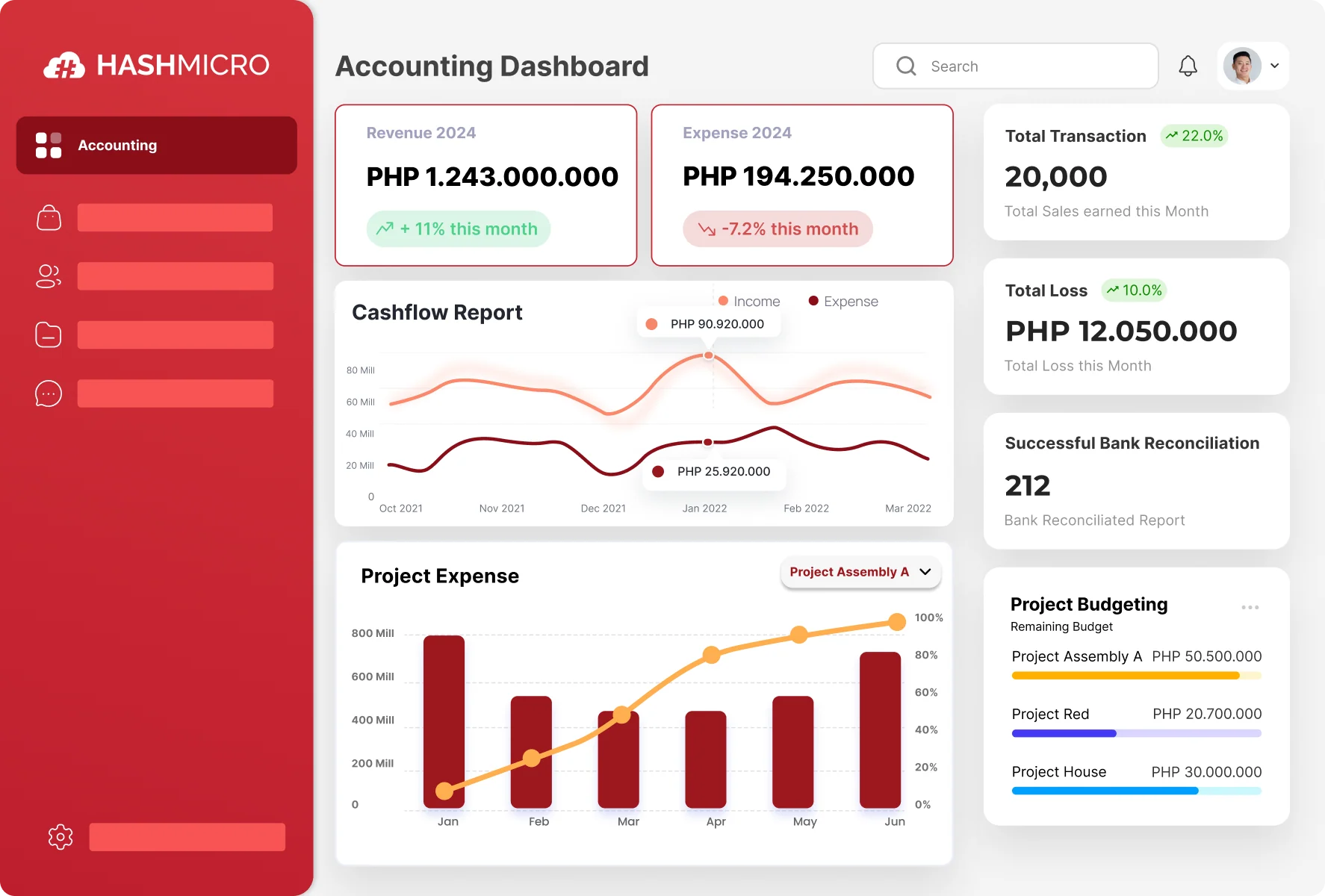

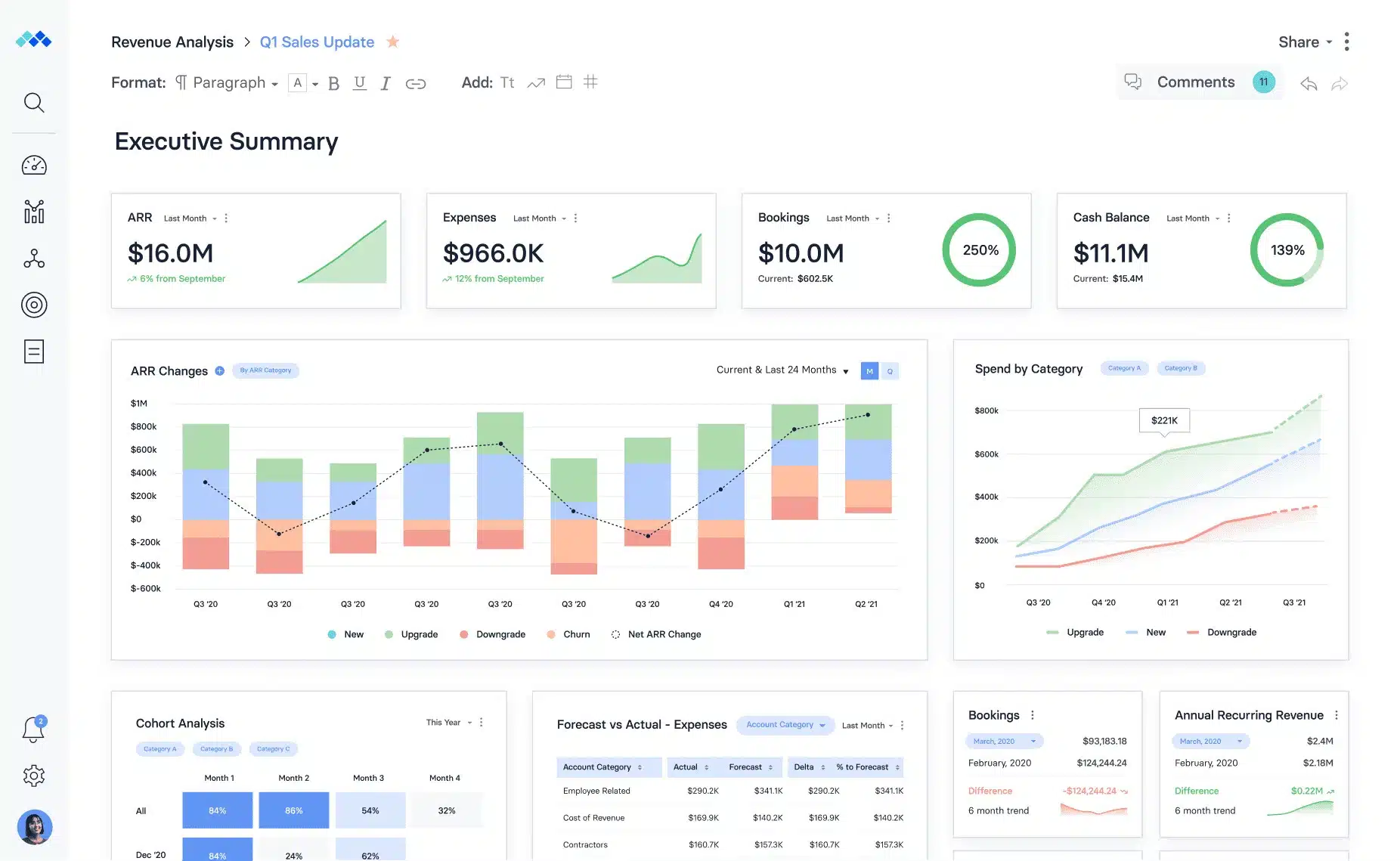

HashMicro Business Budgeting Software is an accounting solution that helps businesses manage financial processes efficiently. The software integrates various financial functions into a single platform, including budgeting, accounting, forecasting, and financial reporting.

Moreover, HashMicro allows businesses to explore the software’s features as a localized solution that complies with The Bureau of Internal Revenue Computerized Accounting System (BIR-CAS) regulations.

Best for:

HashMicro is ideal for all business sizes needing a scalable, all-in-one ERP solution with strong financial management. Trusted by Forbes and Brinks, it suits industries like manufacturing, logistics, and distribution seeking reliable, integrated systems. They also offer a free product tour for ERP integration.

Features:

- Bank Integrations & Auto Reconciliation: This feature seamlessly integrates with multiple banks, ensuring your financial records are always up-to-date. Auto reconciliation reduces errors and saves time.

- Budget Forecast: Budget forecasting tools allow businesses to use historical data and market trends to predict future financial outcomes. This feature helps create accurate budget plans and set realistic financial goals.

- Budget S-Curve: This feature visually represents budget progress over time, helping track financial performance against set budgets. It identifies variances early and allows for timely adjustments to keep financial goals on track.

- Financial Ratio Analysis: HashMicro provides tools for calculating essential financial ratios, offering insights into profitability, liquidity, and solvency. These ratios are vital for analyzing financial stability and making informed business decisions.

- Financial Statement with Budget Comparison: This feature generates financial statements that compare actual performance against the budget, highlighting discrepancies. It enables management to take corrective actions and ensure financial objectives are met.

- Cash Flow Reports: Cash flow reports deliver detailed insights into the cash movement within the business. They are crucial for maintaining liquidity, managing expenses, and planning for future financial needs.

| Pros | Cons |

|

|

Pricing:

To explore how HashMicro’s accounting software can benefit your company, take a closer look at the pricing options. Click the banner below to view the pricing schemes and discover the perfect plan that suits your business’s needs and budget.

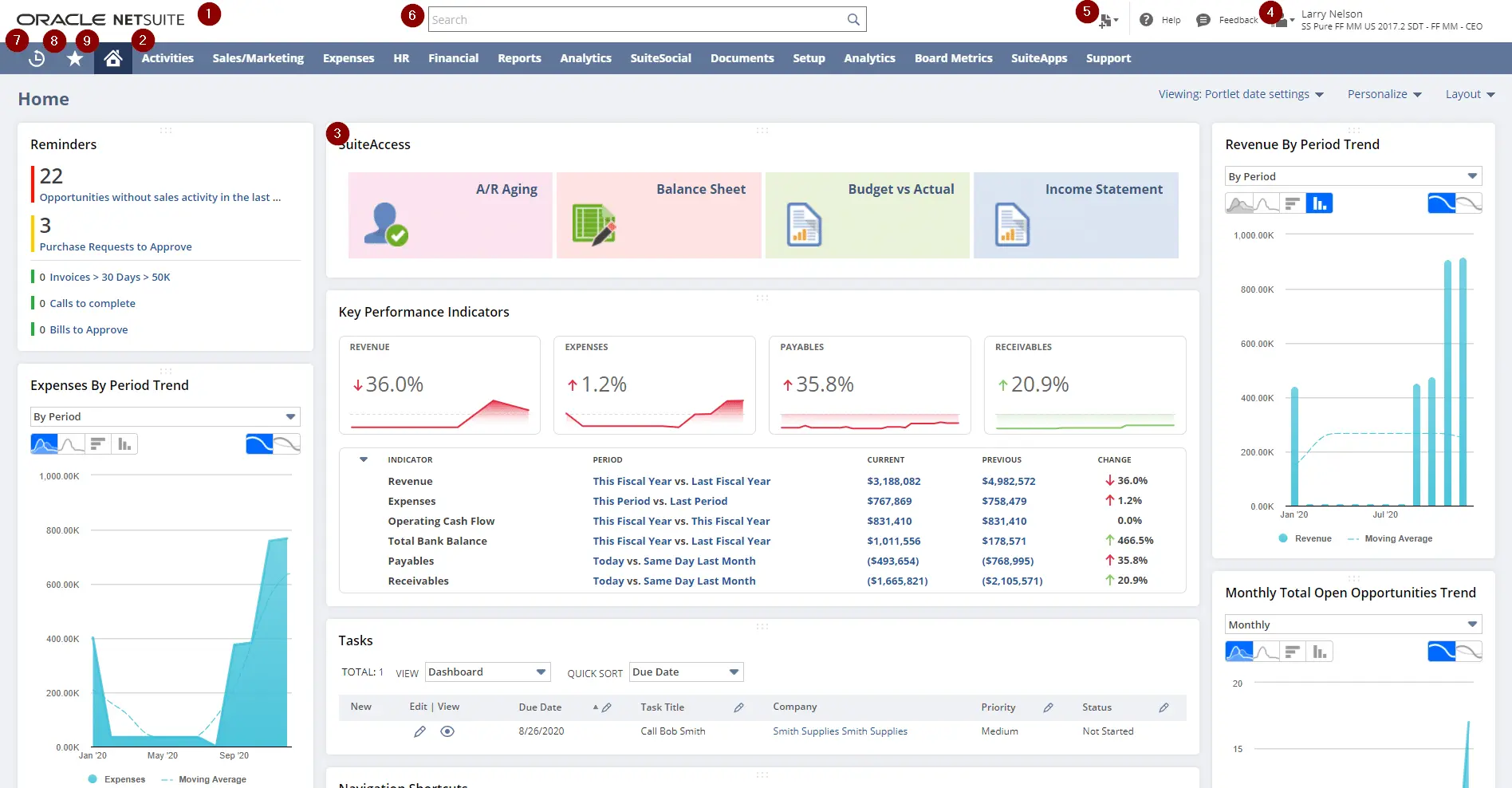

2. NetSuite

NetSuite is a cloud-based business budgeting software designed to streamline financial management and operations for businesses. This production budgeting software offers comprehensive budgeting tools, helping companies manage budgets, forecasts, and financial planning efficiently.

Best for:

NetSuite excels as budgeting software for large companies due to its scalability and powerful integrations.

Features:

- Expense allocation

- Tax and revenue management

- Budgeting and forecasting

- General ledger and accounts receivable/payable

- Financial reporting

| Pros | Cons |

|

|

Pricing:

Implementation price starts at $999 to $2,499 per month or more.

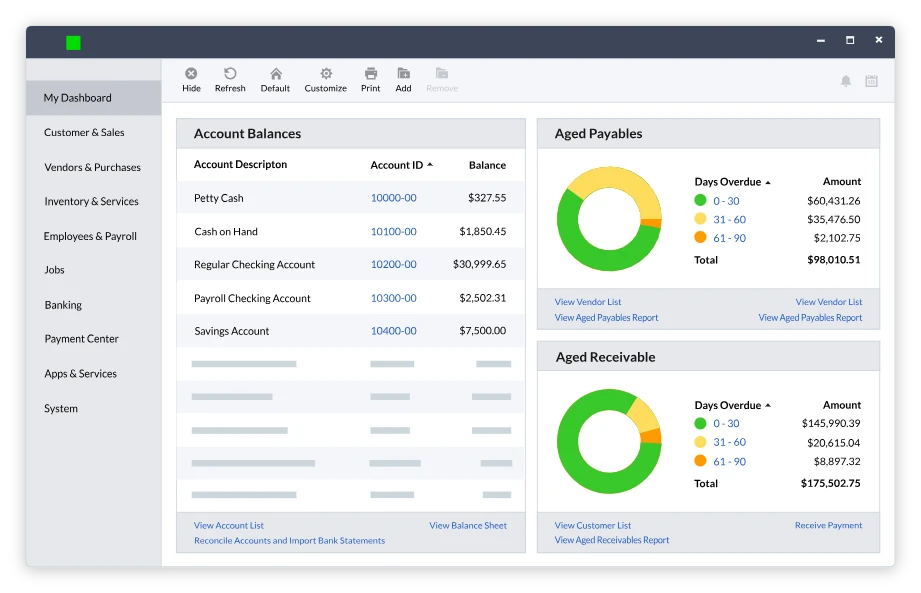

3. Sage

Sage Accounting is business budgeting software that simplifies financial management by automating bookkeeping and budgeting processes. This bookkeeping software offers easy-to-use budgeting tools that help businesses track expenses and forecast future financial performance.

Best for:

Sage Accounting is one of the best business budgeting software options for businesses needing reliable and straightforward budget management tools.

Features:

- Invoicing and billing

- Expense tracking

- Bank reconciliation

- Cash flow and payroll management

- Financial reporting

| Pros | Cons |

|

|

Pricing:

Pro plan at $61.92/month, Premium at $103.92/month, and Quantum at $177.17/month.

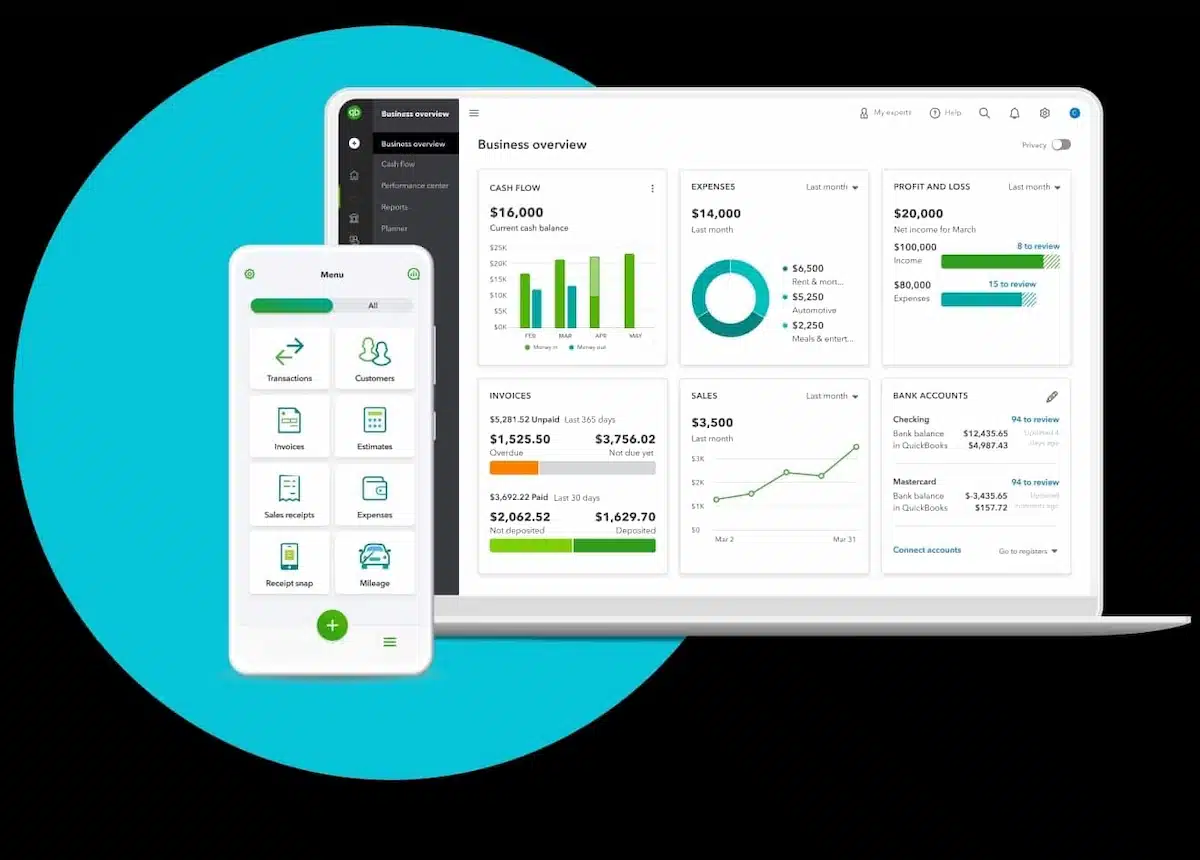

4. QuickBooks

QuickBooks accounting is a popular business budgeting software that allows businesses to manage their finances, including budgeting, invoicing, and expense tracking. The robust QuickBooks accounting platform provides budget apps that simplify financial planning and help ensure accurate budget management.

Best for:

QuickBooks is best for small to medium businesses seeking an easy-to-use accounting solution with reliable customer support. Its simplicity also makes it ideal for non-accountants and startups.

Features:

- Custom invoices and quotes

- Expense tracking

- GST and VAT tracking

- Automatic payment reminders

- Insights and reports

| Pros | Cons |

|

|

Pricing:

Simple Start at $30/month, Essentials at $45/month, Plus at $65/month, and Advanced at $619/month.

5. Centage

Centage is a financial budget software tailored to help businesses create detailed budgets, forecasts, and financial reports. This business budgeting software offers powerful analytics and real-time data insights to support strategic decision-making.

Best for:

Centage is best for companies that looking for advanced budgeting tools that offer real-time insights and flexibility.

Features:

- Scenario planning and forecasting

- Automated budgeting

- Pre-built reports and consolidation

- Workforce planning

- Training options

| Pros | Cons |

|

|

Pricing:

Implementation costs range from $2.250 to $4.250, depending on needs.

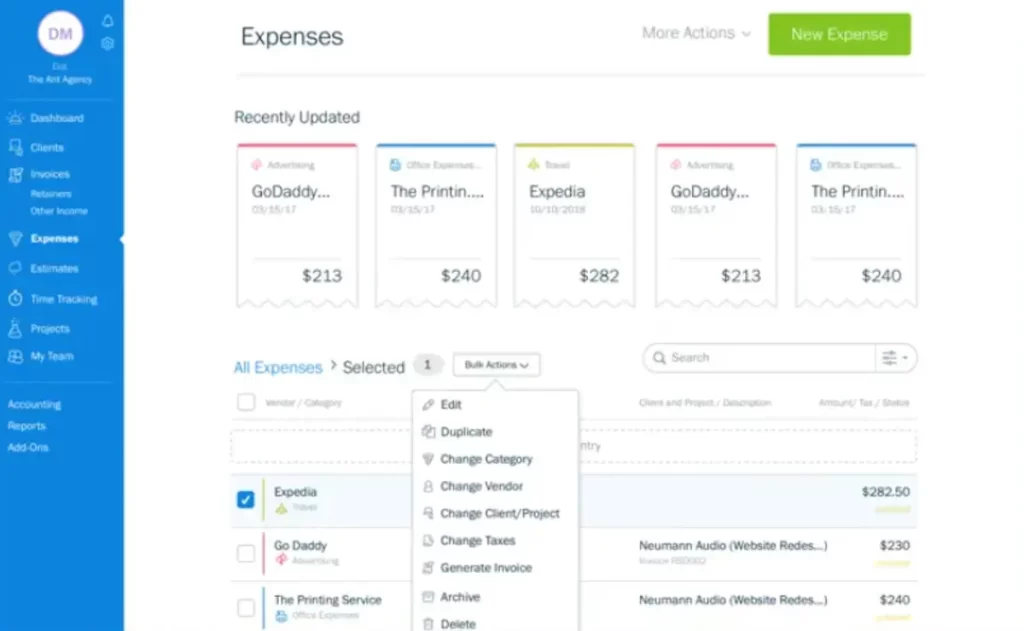

6. FreshBooks

FreshBooks is a cloud-based accounting software that includes features like invoicing software, expense tracking, and business budgeting software. Moreover, it provides budget apps designed to make financial management simple and efficient for businesses with straightforward needs.

Best for:

FreshBooks is best for freelancers and small businesses with straightforward accounting needs, valuing ease of use and responsive customer support.

Features:

- Payment reminders

- Vendor management

- Bank reconciliation

- Time tracking

- Financial reporting

| Pros | Cons |

|

|

Pricing:

Starts at $10.50/month for Lite plan. Higher tiers offer more features.

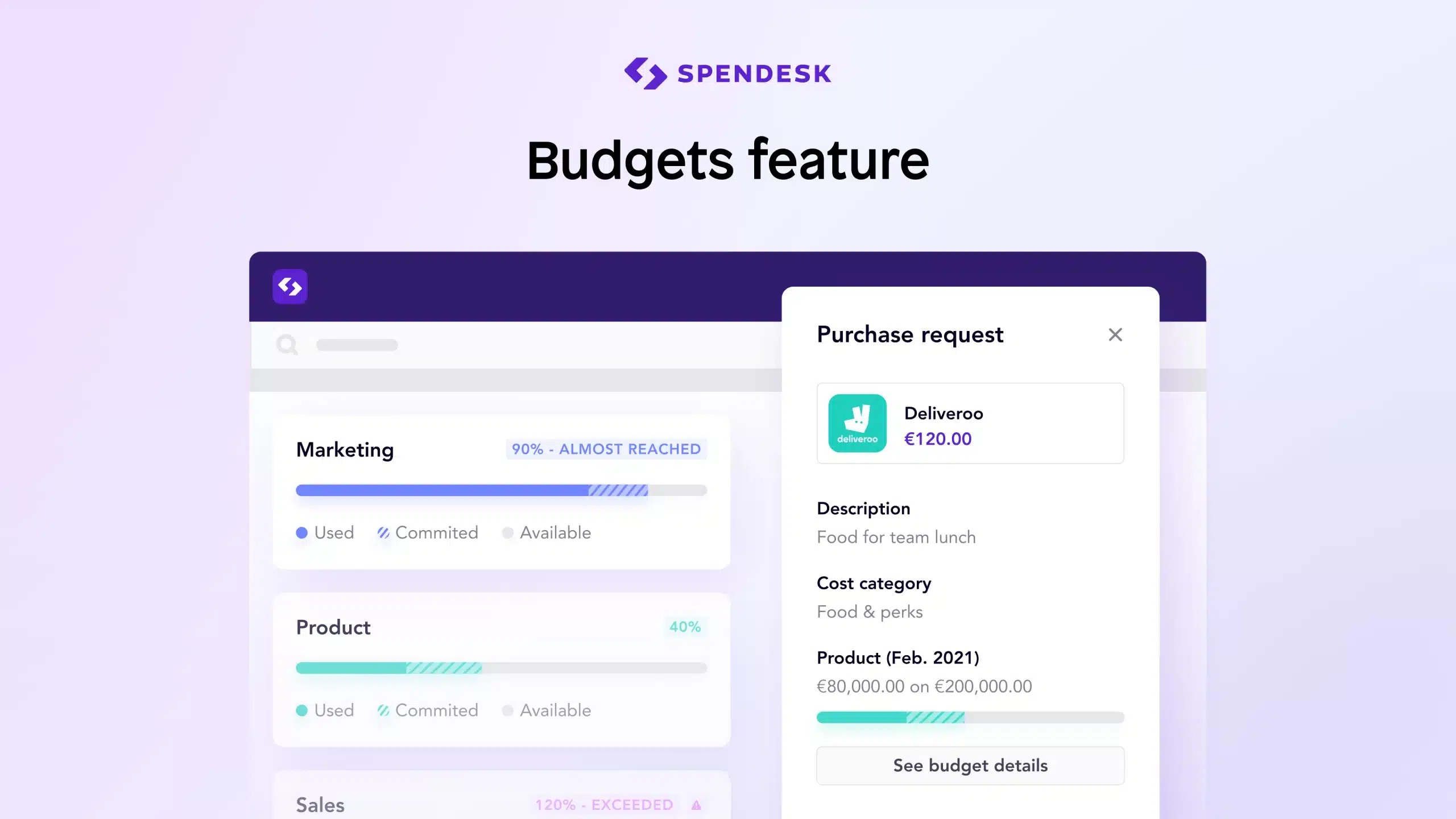

7. Spendesk

Spendesk is a budget management tool that combines expense tracking, approval workflows, and business budgeting software to manage company spending. Consequently, it helps businesses keep budgets under control and provides real-time visibility into financial activities.

Best for:

Spendesk is best for companies that need a unified platform to manage expenses and budgeting, offering strong control over financial workflows for growing businesses.

Features:

- Expense tracking and automation

- Mileage and petty cash accounting

- Budgeting and financial control

- Payment management

- End-to-end encryption

| Pros | Cons |

|

|

Pricing:

Pricing available upon request.

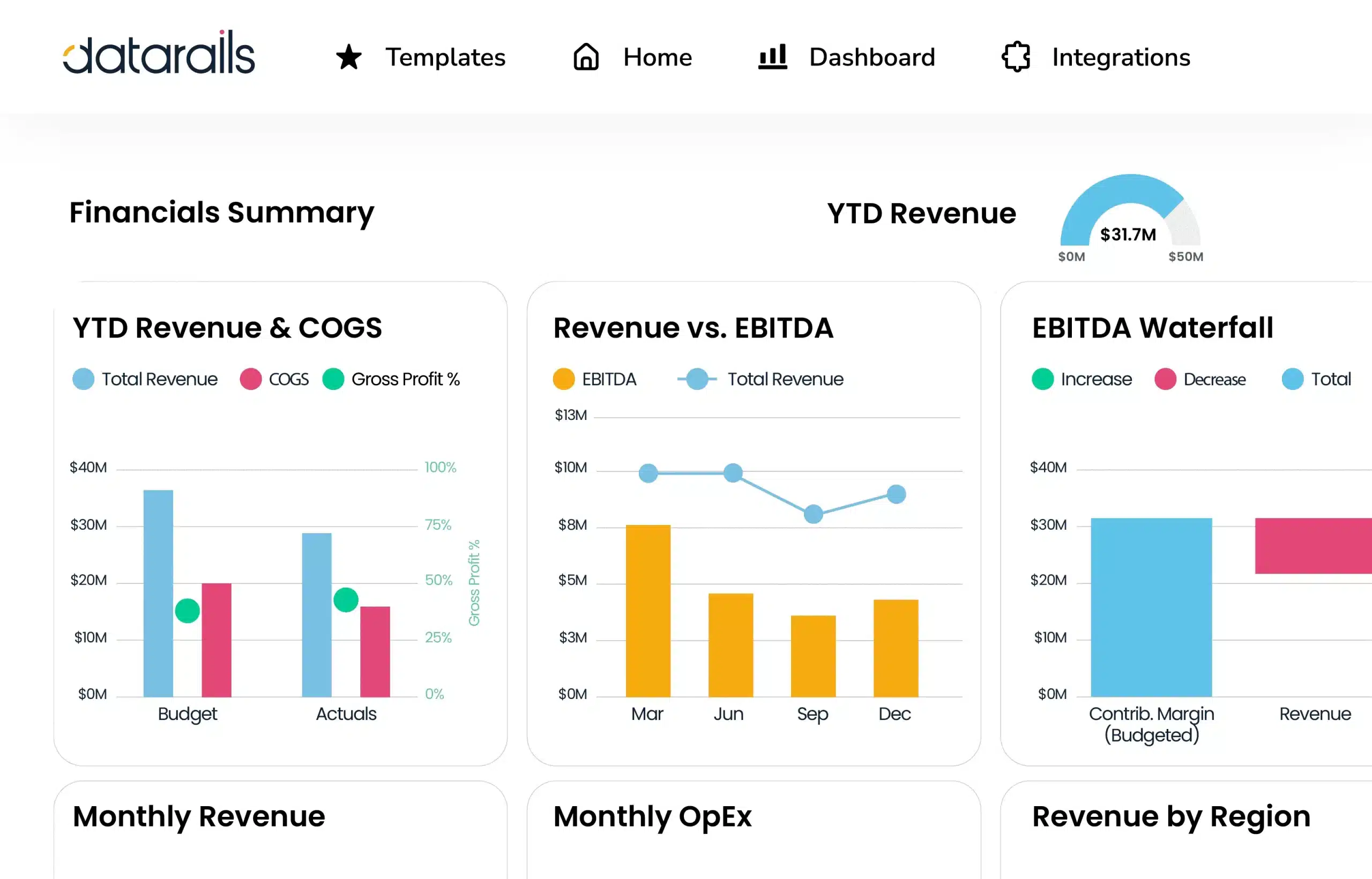

8. Datarails

Datarails is financial budget software that allows businesses to automate their budgeting processes and improve financial planning accuracy. Additionally, this business budgeting software integrates with existing financial systems to enhance data analysis and reporting.

Best for:

Datarails is best for finance teams and businesses that require advanced data integration for in-depth financial analysis and accurate forecasting.

Features:

- Dynamic forecasting

- Custom calculations

- Custom dashboards

- Collaboration tools

- Report customization

| Pros | Cons |

|

|

Pricing:

Available for a custom quote.

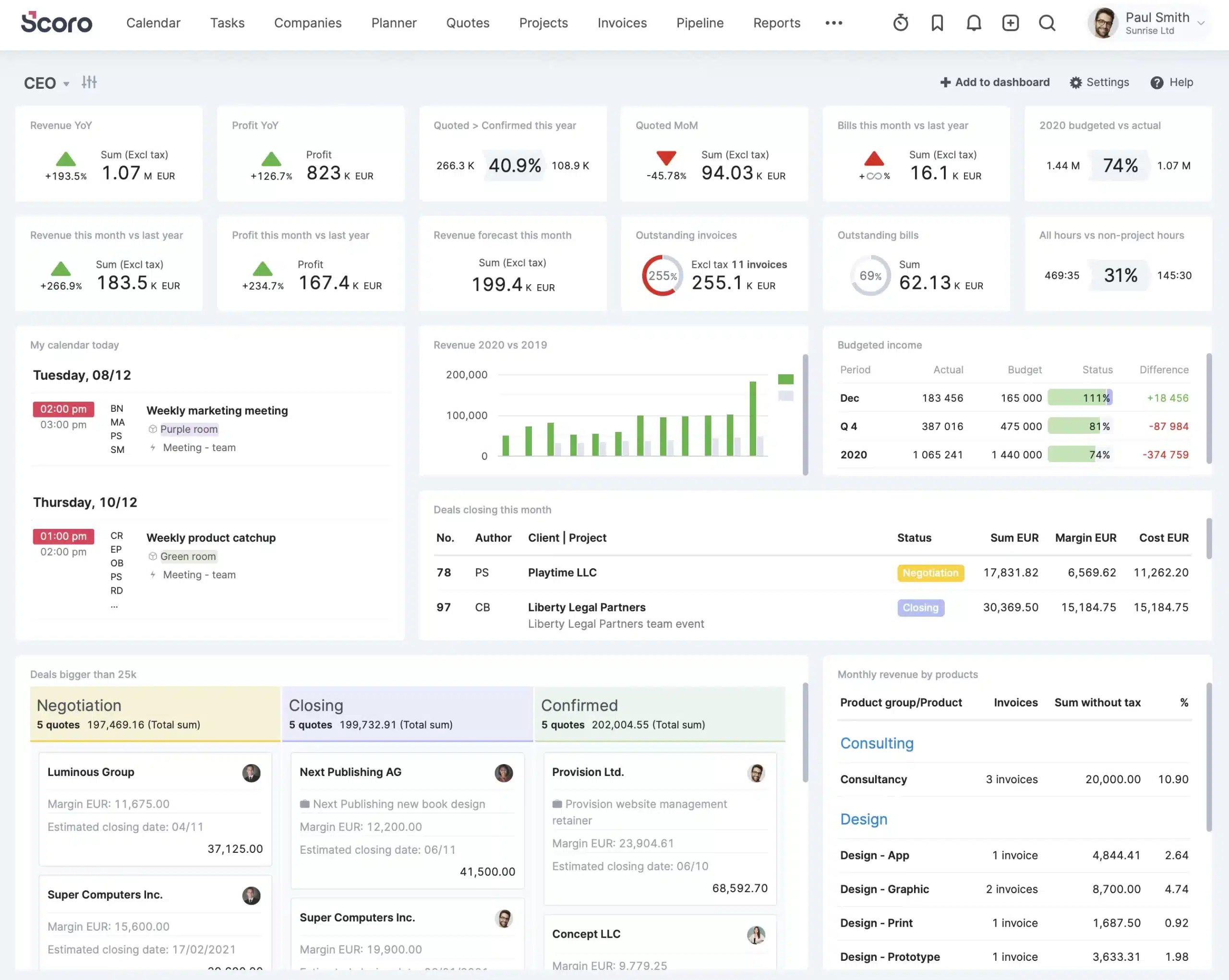

9. Scoro

Scoro is an all-in-one business budgeting software that offers budgeting, project management, and customer relationship management (CRM) features. This accounting software is designed to help businesses streamline their financial and operational processes.

Best for:

Scoro is best for businesses that want to combine financial management with project management in a single versatile platform.

Features:

- Financial tracking

- Budget forecasts

- Expense management

- Invoicing and billing

- Financial reporting

| Pros | Cons |

|

|

Pricing:

Starting from around $20/user/month for the Core plan. Growth plan at $30/user/month, Performance plan at $50/user/month. An Enterprise plan with custom pricing is also available.

10. Mosaic

Mosaic Tech is modern business budgeting software that offers dynamic financial planning tools. This bookkeeping software is designed to help businesses make data-driven decisions based on real-time financial data and insights.

Best for:

Mosaic Tech is great for companies needing cutting-edge budget management tools with real-time analytics.

Features:

- Forecasting and budgeting

- Planning and automation

- Pre-built financial metrics and report templates

- Collaboration tools

- Reporting and analytics

| Pros | Cons |

|

|

Pricing:

Professional plan starts at $9.99/user/month and Business plan starts at $14.99/user/month.

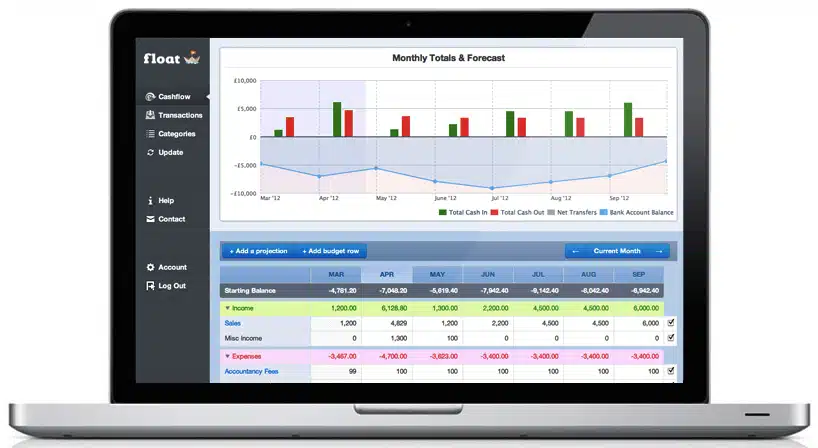

11. Float

Float is business budgeting software that helps businesses manage cash flow and forecast future financial scenarios. It seamlessly integrates with bookkeeping software to provide accurate and up-to-date financial data.

Best for:

Float is best for businesses that prioritize managing and forecasting cash flow to maintain strong liquidity.

Features:

- Recurring and international payments

- Project scenarios and forecasts

- Automated receipt collection

- Physical and virtual corporate cards

- Early warning systems

| Pros | Cons |

|

|

Pricing:

Starter plan at $6 per user/month and Pro plan at $10 per user/month

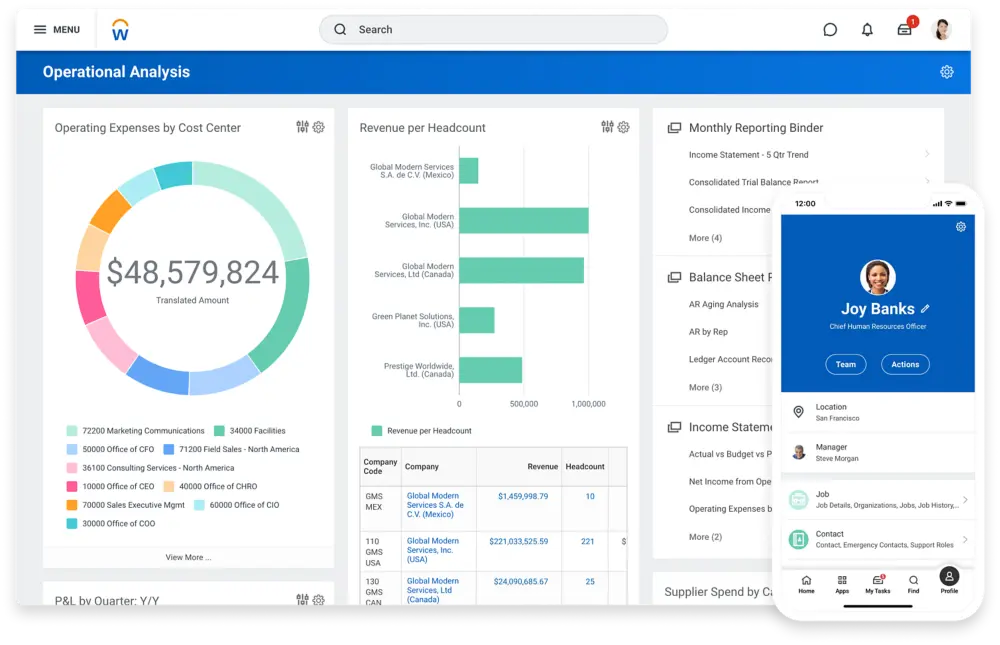

12. Workday

Workday Adaptive Planning is advanced budgeting software for large companies that offers comprehensive budgeting, forecasting, and financial modeling tools. In addition, it provides budget apps that help businesses optimize their financial planning and improve accuracy.

Best for:

Workday Adaptive Planning is best for large enterprises needing a comprehensive, scalable solution for financial planning and analysis.

Features:

- Financial planning

- Project-based planning

- Close and consolidation

- Task assignment and monitoring

- Reporting

| Pros | Cons |

|

|

Pricing:

Implementation costs range from $22,000 – $180,000.

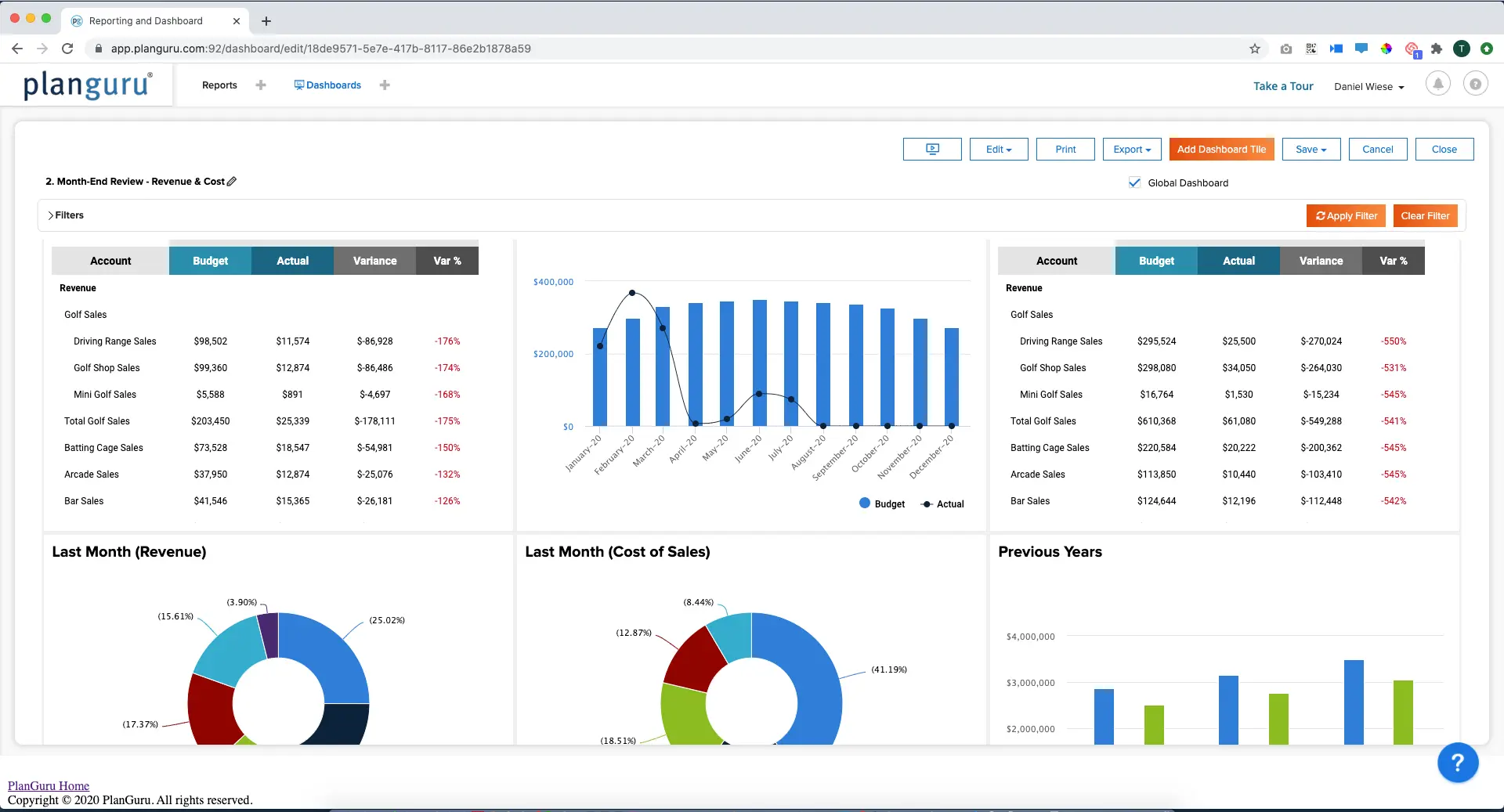

13. PlanGuru

PlanGuru offers financial budget software designed for businesses with less complex needs. It offers budgeting, forecasting, and financial reporting tools. The software is ideal for businesses that need detailed budget management tools without complexity.

Best for:

PlanGuru is best for small to mid-sized businesses seeking an affordable, easy-to-use solution for basic accounting and budgeting needs.

Features:

- Budget creation and management

- 3-way forecasting structures

- Accounts payable and accounts receivable

- Activity dashboard and activity tracking

- Analytics and reporting

| Pros | Cons |

|

|

Pricing:

Single Entity plan at $99/month and Multi-Department Consolidations at $299/month.

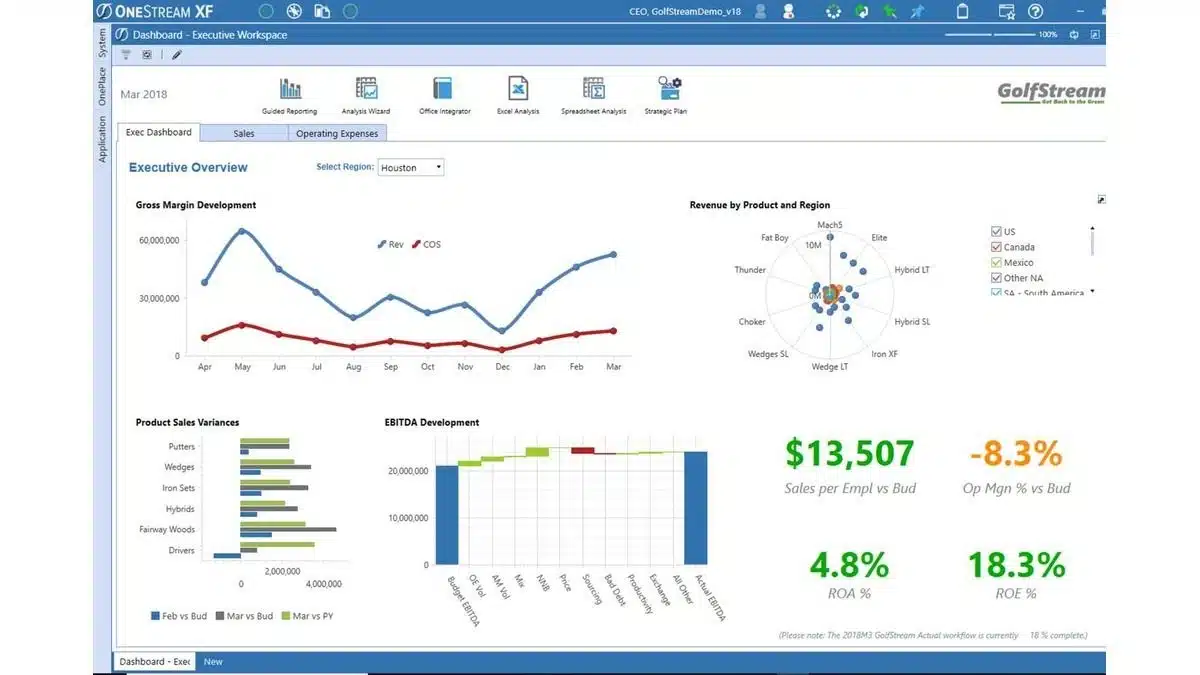

14. OneStream

OneStream is business budgeting software specifically tailored for complex financial planning and budgeting. It offers a powerful tool for large companies needing production budgeting software and detailed financial consolidation.

Best for:

OneStream is best for large, multi-entity organizations that need to manage complex financial environments efficiently.

Features:

- Financial close and consolidation

- Planning, budgeting, and forecasting

- Budget creation and management

- Task management

- Reporting, analytics, and BI

| Pros | Cons |

|

|

Pricing:

Available for a customer quote.

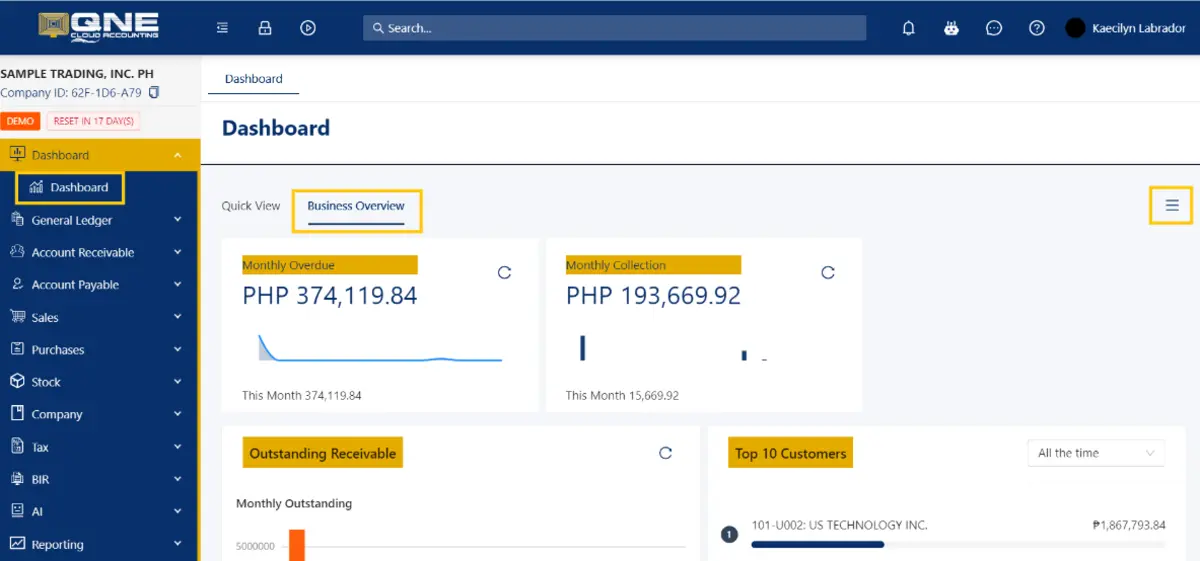

15. QNE

QNE is a popular business budgeting software Philippines that offers accounting and financial management tools tailored to local business needs. The software is designed to streamline budgeting and accounting tasks for growing businesses.

Best For:

QNE is best for businesses in the Philippines looking for budgeting software tailored to local market needs with comprehensive features.

Features:

- General ledger and accounts payable/receivable

- Bank reconciliation

- Budgeting and payroll integration

- Tax management

- Financial reporting

| Pros | Cons |

|

|

Pricing:

Starting at $100, flat rate.

What are the Types of Business Budgeting?

Understanding various business budgeting types is key to creating a financial framework aligned with business goals. Each type suits different business needs and sectors. Here are some main budgeting used by businesses:

- Zero-based budgeting: Zero-based budgeting mandates begin each fiscal year with a clean slate rather than relying on data from the prior year’s budget.

- Activity-based budgeting: Activity-based budgeting uses a top-down approach to allocate funds for achieving strategic goals, aligning the budget with key organizational priorities.

- Incremental budgeting: Incremental budgeting adjusts last year’s budget by a set percentage, strategically adding funds where needed.

- Value-proposition budgeting: Value-proposition budgeting assesses each budgeted expense in relation to the value it brings to the organization. This budgeting approach helps to eliminate non-essential costs, thereby enhancing return on investment.

- Capital budgeting: Capital budgeting assesses large projects by analyzing projected cash flows to ensure they meet organizational goals.

- Top-down budgeting: Top-down budgeting occurs when senior leadership establishes the overall budget for the organization, with departmental leaders subsequently implementing and managing it within their respective areas.

- Bottom-up budgeting: In bottom-up budgeting, departments set goals and costs, which are combined into a budget for senior review.

How to Choose the Best Business Budgeting Software

Choosing the right business budgeting software is crucial for optimizing financial management and supporting business growth. Below are several key factors for businesses to consider when choosing the solution that aligns with your needs.

- Assess your needs: Firstly, identify your company’s specific requirements. Next, determine if you need features like real-time reporting, multi-currency support, or advanced forecasting tools, especially for budgeting software for large companies.

- Evaluate features: Look for capabilities that match your needs, such as automated budget tracking, expense management, and financial analysis tools. Ensure the software supports your budgeting methods and integrates well with other accounting software and bookkeeping software.

- Consider scalability: Choose software that can grow with your business. Ensure it handles increasing data volumes and offers scalable features and pricing plans, making it suitable for production budgeting software and evolving needs.

- Check integration capabilities: Ensure the software integrates smoothly with your existing accounting systems and other business applications. This integration will streamline data transfer and reduce manual entry errors.

- Review user experience: It should be intuitive for your team to adopt and use effectively. Look for options offering good customer support and training resources, which are crucial for effectively implementing budget management tools and budget apps.

- Read reviews and testimonials: Look for feedback from other users to gauge the software’s performance and reliability. This can provide insights into how well the software meets users’ needs, helping you choose the right financial budget software and budgeting tools.

Conclusion

Selecting the right business budgeting software is crucial for effective financial management and achieving your company’s growth objectives. The right choice ensures accurate budgeting, efficient resource allocation, and better financial decision-making.

HashMicro’s Accounting Software stands out for its comprehensive features and seamless ERP integration, making it a top choice for businesses. It offers robust budgeting tools, real-time reporting, and scalability to meet diverse financial needs.

To optimize your financial management and experience the benefits firsthand, consider HashMicro’s software for your business. Sign up for a free demo today to see how it can transform your budgeting process and support your company’s success.

Frequently Asked Questions About Business Budgeting Software

-

What is business budgeting?

Business budgeting is a process of creating a financial plan that outlines expected revenues, expenses, and profits over a specific period. It guides spending decisions and ensures that financial resources are allocated effectively to meet business goals.

-

What is the main purpose of budgeting in business?

Budgeting’s main purpose is to provide a structured plan for managing financial resources, ensuring that expenditures align with strategic objectives, and predicting future financial performance. Additionally, it helps set financial targets, control costs, and make informed decisions to drive growth and stability.

-

Which budgeting method is best for business?

The best budgeting method for a business depends on its specific needs and goals. Common methods include zero-based budgeting, where every expense must be justified; incremental budgeting, which adjusts previous budgets based on changes; and rolling budgets, which continuously update as new information becomes available. Therefore, the choice should align with the business’s size, industry, and financial complexity.

-

How do businesses manage budgets?

Businesses manage budgets by setting financial goals, tracking actual performance against budgeted figures, and adjusting plans as needed. This process involves creating detailed budget plans, monitoring spending, analyzing variances, and making necessary adjustments to stay within financial targets and ensure efficient use of resources.