What can happen financially if revenue recognition is not handled properly? Mismanagement can lead to inaccurate financial statements, cash flow problems, regulatory issues, loss of investor trust, and budgeting challenges.

Ang software sa pagkilala ng kita ay tumitiyak sa pagsunod at katumpakan sa kumplikadong landscape ng accounting.

Revenue recognition software helps businesses accurately record revenue earned, not just when payment is received. This ensures compliance with accounting standards, minimizing the risk of errors and potential legal issues.

In the Philippines, many businesses are transitioning to automated revenue recognition platform. These systems streamline the accounting process, enhance transparency, and improve financial reporting.

Ang artikulong ito ay galugarin at magrerekomenda ng mga nangungunang solusyon na iniakma sa mga lokal na pangangailangan.

Table of Contents

Key Takeaways

|

Understanding Revenue Recognition Software

Revenue recognition system are designed to track and report revenue according to accounting standards like IFRS and GAAP. They enable companies to manage complex transactions efficiently and accurately account for all income.

One significant advantage of revenue recognition tools is their ability to automate calculations and reporting. These solutions, including invoicing software, integrate with existing financial systems to reduce manual effort and minimize errors.

The implementation of revenue accounting software not only increases compliance but also supports strategic decision-making. Businesses can gain insights into revenue trends and performance metrics, enhancing overall financial management.

Why Do Businesses Need Revenue Recognition Software?

Why should businesses invest in revenue recognition software in today’s competitive landscape? Accurate revenue reporting is critical for financial health and stakeholder confidence. Without effective solutions, companies risk misreporting their earnings, which can lead to severe repercussions.

Revenue recognition platform are vital for meeting regulatory requirements. They help businesses adhere to evolving standards, reducing the likelihood of audits and penalties.

Moreover, robust revenue recognition solutions, including accounting software Philippines, can enhance operational efficiency. Automating processes allows teams to focus on strategic initiatives rather than manual data entry, ultimately driving growth.

How Software for Revenue Recognition Works?

To understand how revenue recognition software functions, consider the following key points:

1. Integration with financial systems

Revenue recognition software is designed to work seamlessly with existing accounting and accounting system. This integration ensures that data flows smoothly between platforms, eliminating silos and reducing the risk of discrepancies.

2. Automated revenue recognition

These software solutions automate complex revenue recognition processes. Businesses often face challenges with intricate revenue streams, especially when dealing with different pricing models, contracts, and customer agreements.

3. Compliance management

Adhering to accounting standards, such as GAAP (Generally Accepted Accounting Principles) or IFRS Philippines (International Financial Reporting Standards), is crucial for businesses to maintain transparency and avoid legal issues.

4. Real-time reporting

One of the significant advantages of using revenue recognition software is the ability to generate real-time reports. Users can access up-to-date insights into their revenue trends, customer performance, and overall financial health at any moment.

5. Scalability

As businesses expand, their revenue recognition needs become more complex. Revenue recognition software is designed to scale alongside the organization, accommodating increasing transaction volumes and diverse revenue models.

Sa pamamagitan ng paggamit ng mga tool na ito, mapapahusay ng mga negosyo ang kanilang mga pampinansyal na operasyon, na tinitiyak ang tumpak na pag-uulat at pagsunod.

12 Best Revenue Recognition Software in the Philippines

Ang pagpili ng tamang software sa pagkilala ng kita ay mahalaga para sa tumpak na pag-uulat at pagsunod.

Below, we list the top 12 revenue recognition automation software solutions that excel in functionality, user-friendliness, and scalability, helping businesses streamline their revenue management processes.

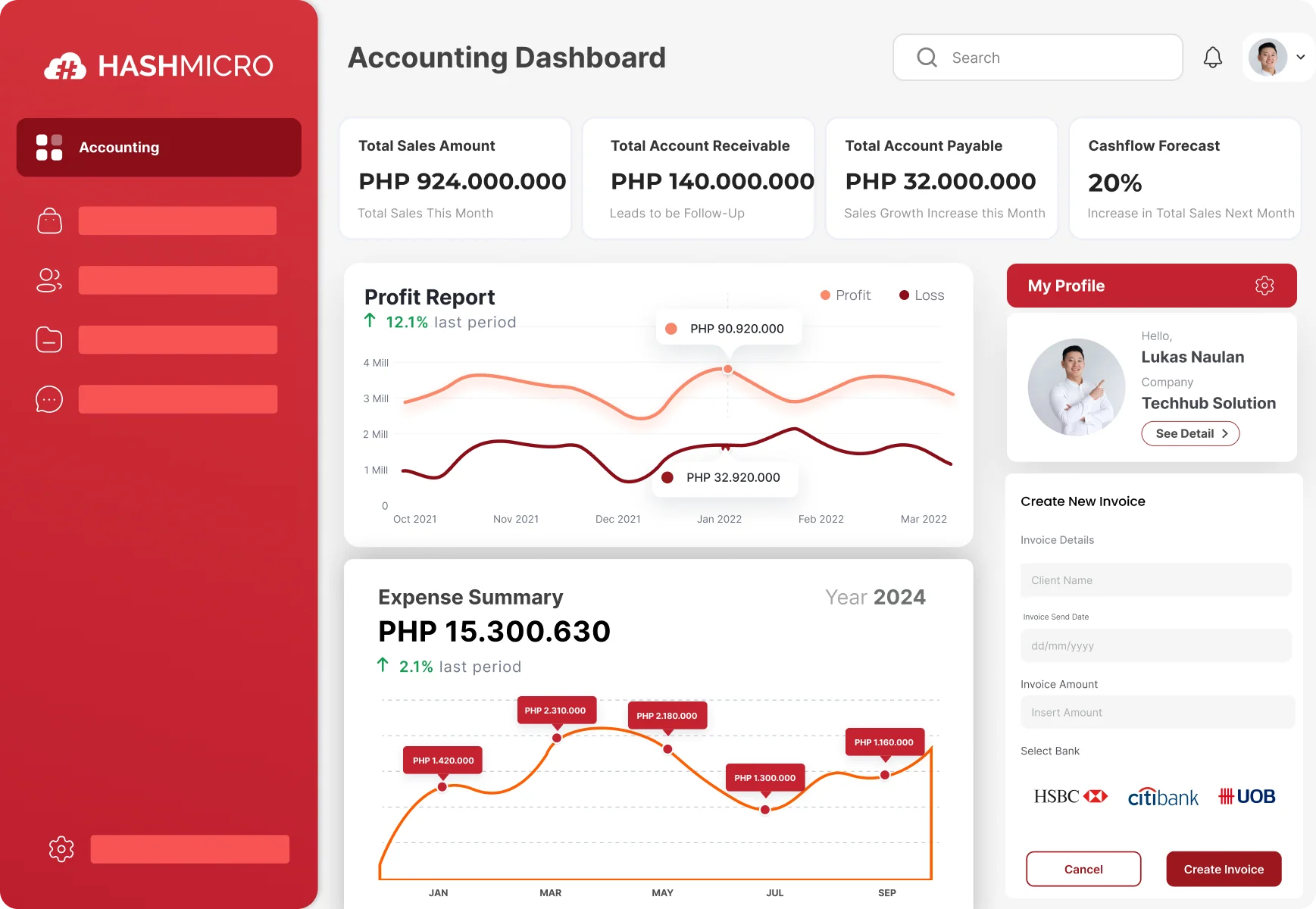

1. HashMicro Accounting Software

HashMicro is a leading provider of cloud-based ERP solutions, specializing in revenue management and accounting. Their Revenue Recognition Software is designed to help businesses automate and streamline their revenue recognition processes, ensuring compliance with accounting standards like ASC 606 and IFRS 15.

The platform offers a user-friendly interface that simplifies the tracking of contracts, performance obligations, and revenue recognition schedules. With real-time reporting and analytics, businesses can gain valuable insights into their financial performance, allowing for informed decision-making.

HashMicro’s solution is particularly beneficial for companies with subscription-based models or those with multiple performance obligations. It automates the allocation of transaction prices and ensures accurate revenue recognition.

Key Features:

- Multi-Level Analysis: Enables revenue analysis based on projects or branches.

- Profit & Loss vs. Budget & Forecast: Compares actual revenue with the budget and projections.

- Cash Flow Reports: Aids in monitoring cash flow related to revenue recognition.

- Financial Statement with Budget Comparison: Assists in tracking revenue against the budget.

- Budget vs. Actual: Compares expected revenue with its realization.

- Equity Movement Report: Monitors changes in equity that may relate to recognized revenue.

Pros:

- Comprehensive Automation

- User-Friendly Interface

- Robust Reporting Tools

- Scalable Solution

Cons:

- Implementation Complexity

- Learning Curve

By choosing HashMicro’s Revenue Recognition Software, businesses can ensure compliance, enhance accuracy, and optimize their financial operations, paving the way for sustained growth and success.

Kaya ano pang hinihintay mo? Huwag mag-atubiling makipag-ugnayan sa amin!

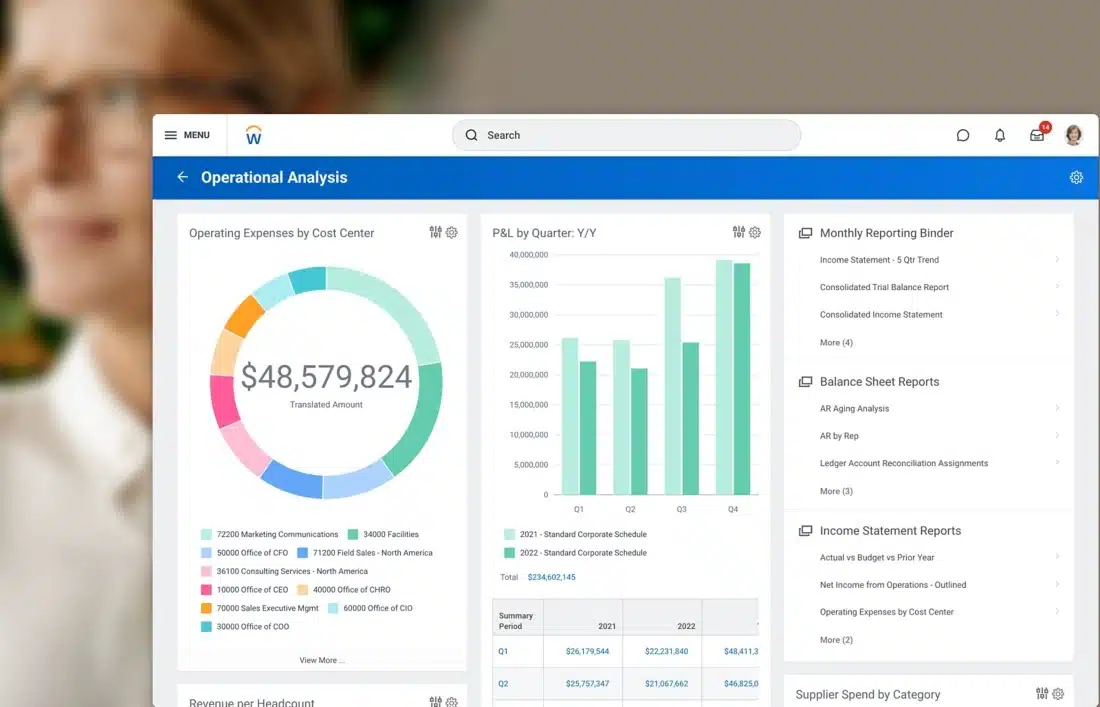

2. Workday Financial Management

Workday Financial Management is a cloud-based ERP solution that provides organizations with comprehensive financial management capabilities. It supports various functions, including accounting, revenue management, financial reporting, and expense management, all within a single platform.

The platform’s robust features include automated revenue recognition that is compliant with ASC 606 and IFRS 15, multidimensional reporting for better insights, and streamlined financial consolidation processes.

Workday Financial Management also offers tools for project management and expense tracking, ensuring that organizations can manage their financial operations seamlessly across multiple departments and locations.

Key Features:

- Multidimensional financial consolidation

- Expense management tools

- Project management integration

- Audit and internal controls

Pros:

- Comprehensive automation of financial processes

- Strong compliance capabilities with accounting standards

- Real-time insights for better decision-making

- User-friendly interface that requires minimal training

Cons:

- Potentially high costs for smaller organizations or startups

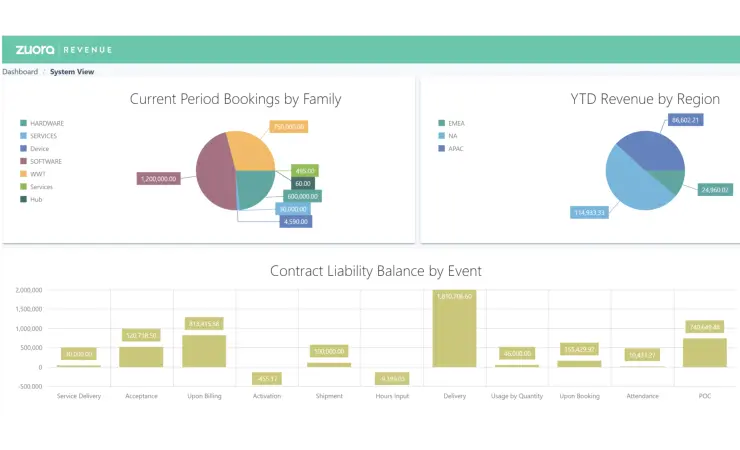

3. Zuora Revenue

Zuora Revenue is a leading revenue recognition and automation software designed to help businesses manage complex revenue streams efficiently.

Recently recognized as the top product in MGI Research’s Automated Revenue Management Buyer’s Guide, Zuora Revenue excels in automating revenue operations for various business models, including subscriptions, usage-based services, and hybrid offerings.

The platform provides customizable performance obligation templates, real-time reporting, and seamless integration with existing ERP systems. This flexibility enables organizations to adapt quickly to changing market demands and optimize their monetization strategies.

Key Features:

- Customizable performance obligation templates

- Real-time financial reporting

- Integration with ERP systems

- Dunning management tools

- Support for multiple revenue models

Pros:

- Highly automated processes reduce manual workload

- Substantial compliance with accounting standards

- Flexible and customizable to suit various business needs

- Excellent customer support and resources

Cons:

- It may require training for users to leverage all features fully

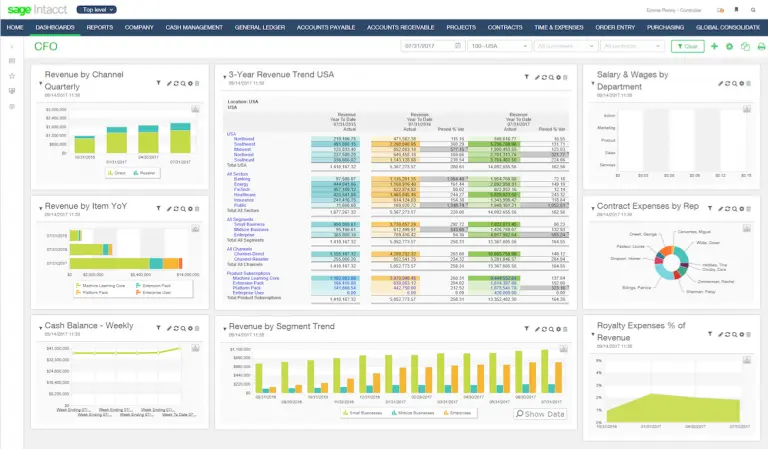

4. Sage Intacct

Sage Intacct is a cloud-based ERP solution designed to streamline financial management and accounting processes for businesses of various sizes.

It is recognized as the only AICPA-preferred financial management software and provides advanced functionalities such as automated revenue recognition, multi entity in accounting, and real-time reporting.

The platform’s modular structure allows businesses to customize their financial systems according to specific needs, integrating seamlessly with other applications like Salesforce.

Key Features:

- Real-time dashboards and reporting

- Multi-entity and multi-currency support

- Integration with third-party applications

- Advanced project accounting capabilities

- Customizable workflows and approval processes

Pros:

- Comprehensive automation reduces manual errors

- Strong compliance with accounting standards

- Scalable solution for growing businesses

- User-friendly interface with customizable options

Cons:

- Initial setup can be complex

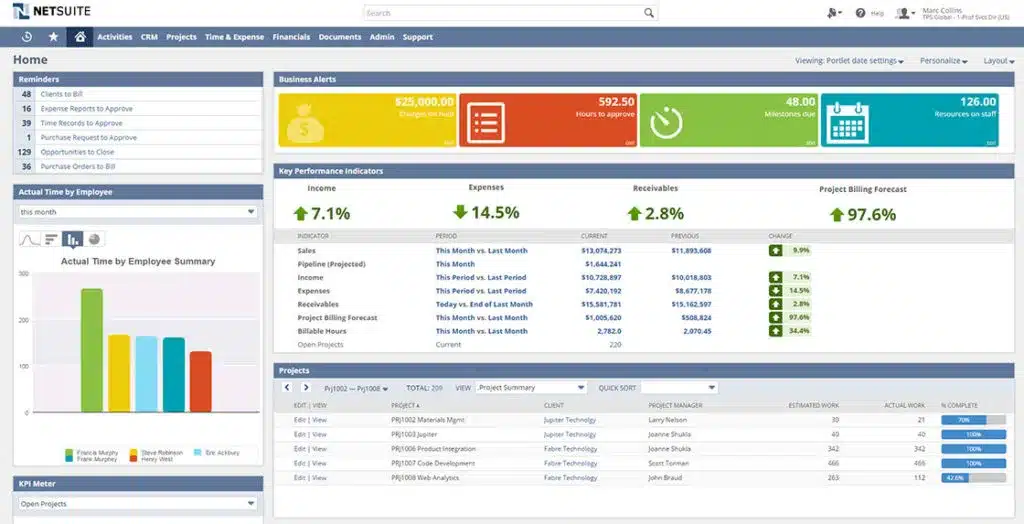

5. NetSuite

NetSuite is a comprehensive cloud-based ERP platform that offers robust financial management capabilities, including advanced revenue recognition features.

Its Revenue Recognition module automates the process of recognizing revenue in compliance with accounting standards such as ASC 606 and IFRS 15.

The NetSuite Revenue Recognition feature allows users to define specific recognition rules for various products and services and link them to customer contracts.

Key Features:

- Automated revenue scheduling and allocation

- Configurable revenue recognition rules

- Multi-performance obligation support

- Integration with other NetSuite modules

- Deferred revenue management

Pros:

- Comprehensive automation reduces manual workload

- Ensures compliance with complex accounting standards

- Real-time visibility into revenue performance

- Scalable solution for growing businesses

Cons:

- Implementation can be complex for new users

- It may require additional training for effective use

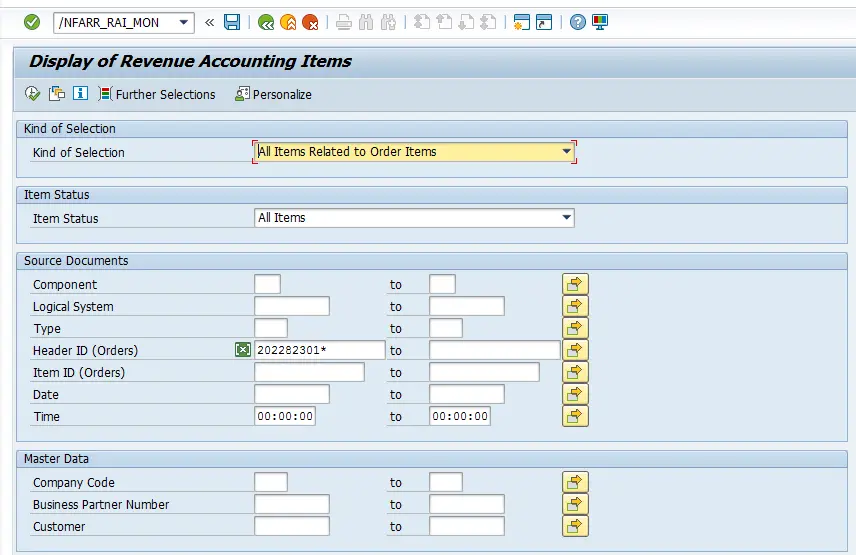

6. SAP Revenue Accounting and Reporting (RAR)

SAP Revenue Accounting and Reporting (RAR) is a specialized solution designed to help organizations comply with complex revenue recognition standards, specifically IFRS 15 and ASC 606.

It automates the revenue recognition process, ensuring accuracy and compliance while enabling businesses to manage their revenue streams effectively.

SAP accounting software supports a comprehensive five-step revenue recognition model that includes identifying contracts, determining transaction prices, allocating prices to performance obligations, and recognizing revenue upon fulfillment.

Key Features:

- Contract management capabilities

- Integration with SAP ERP/S/4HANA

- Allocation of transaction prices

- Compliance with IFRS 15 and ASC 606

Pros:

- Streamlines compliance with complex accounting standards

- Enhances accuracy through automation of revenue processes

- Provides real-time insights into financial performance

- Strong integration capabilities with existing SAP systems

Cons:

- Implementation can be complex and time-consuming

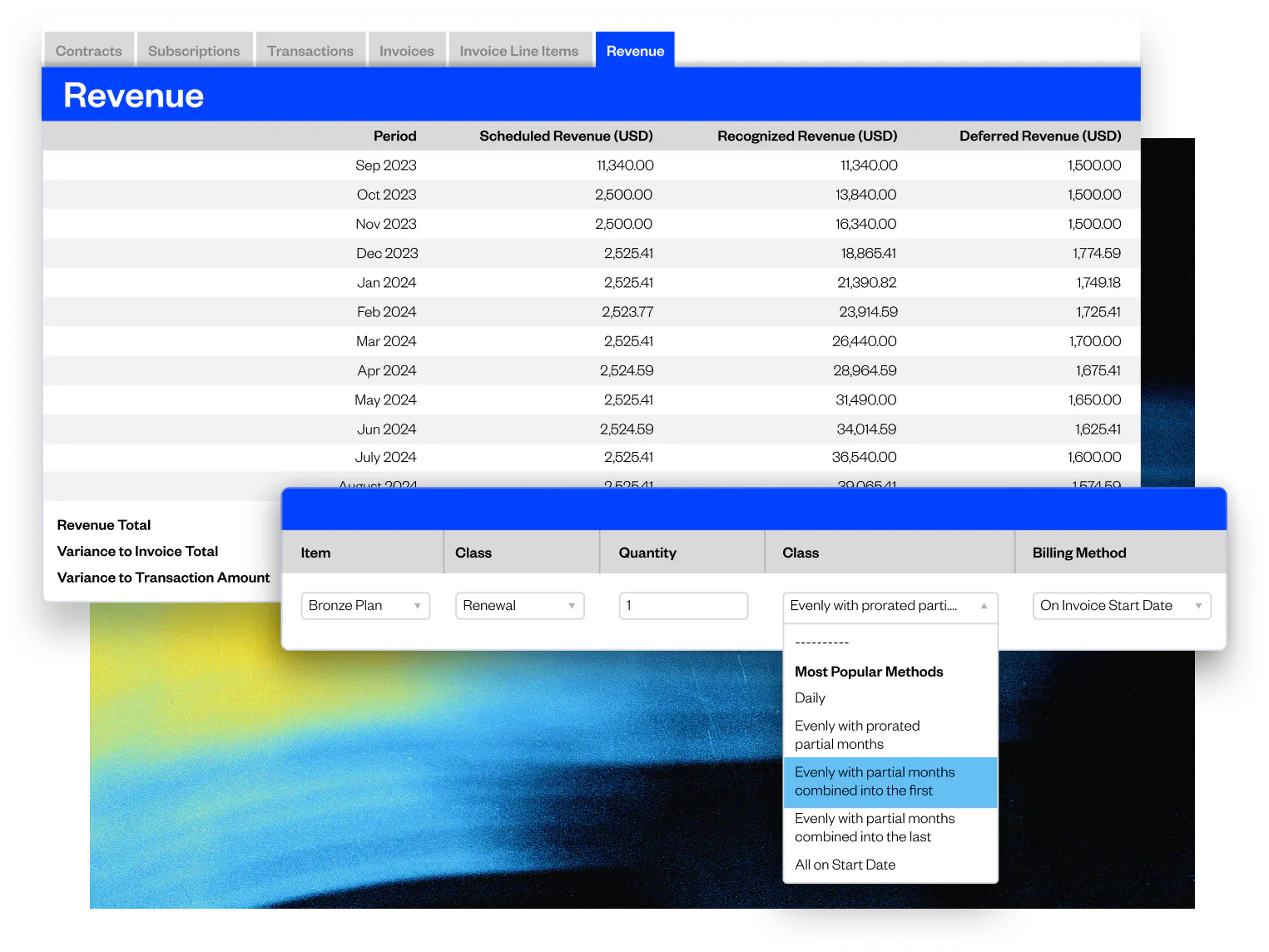

7. Maxio

Maxio is a comprehensive billing and revenue management platform for B2B SaaS companies. It automates complex subscription billing processes and provides essential revenue recognition and forecasting tools, ensuring compliance with accounting standards like ASC 606 and IFRS 15.

The platform supports various subscription models, including usage-based pricing and multi-plan offerings, making it flexible for diverse business needs. Maxio aims to streamline the entire order-to-cash process.

Key Features:

- Automated Revenue Recognition

- Billing Automation

- Financial Reporting

- Integration Capabilities

- Dunning Management

Pros:

- Handles complex billing agreements efficiently

- Strong revenue recognition features for compliance

- Customizable billing workflows

- Provides detailed analytics and reporting

Cons:

- Limited customization options

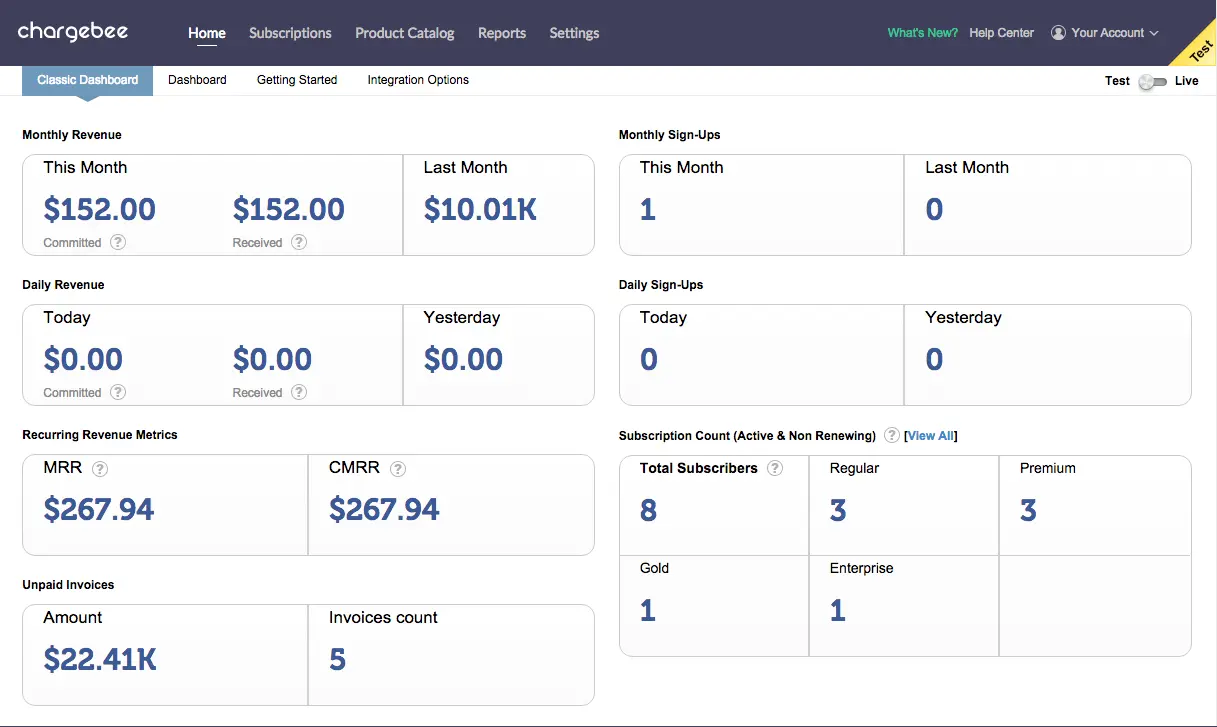

8. Chargebee

Chargebee is a powerful subscription management and recurring billing platform designed to help businesses automate their billing processes and optimize revenue growth.

It supports various pricing models, including flat-fee, usage-based, and hybrid subscriptions, allowing companies to manage customer subscriptions seamlessly.

The platform also features robust analytics and reporting tools that provide insights into subscriber behavior and financial performance.

With integrations across multiple payment gateways and e-commerce platforms, Chargebee enables organizations to scale their operations efficiently while adapting to evolving market demands.

Key Features:

- Flexible pricing model support

- Comprehensive reporting and analytics

- Self-service customer portal

- Integration with various payment gateways

Pros:

- Highly customizable billing options for diverse business needs

- Strong automation capabilities reduce manual workload

- Excellent customer support and resources available

- User-friendly interface enhances customer experience

Cons:

- Some advanced features may have a learning curve for new users

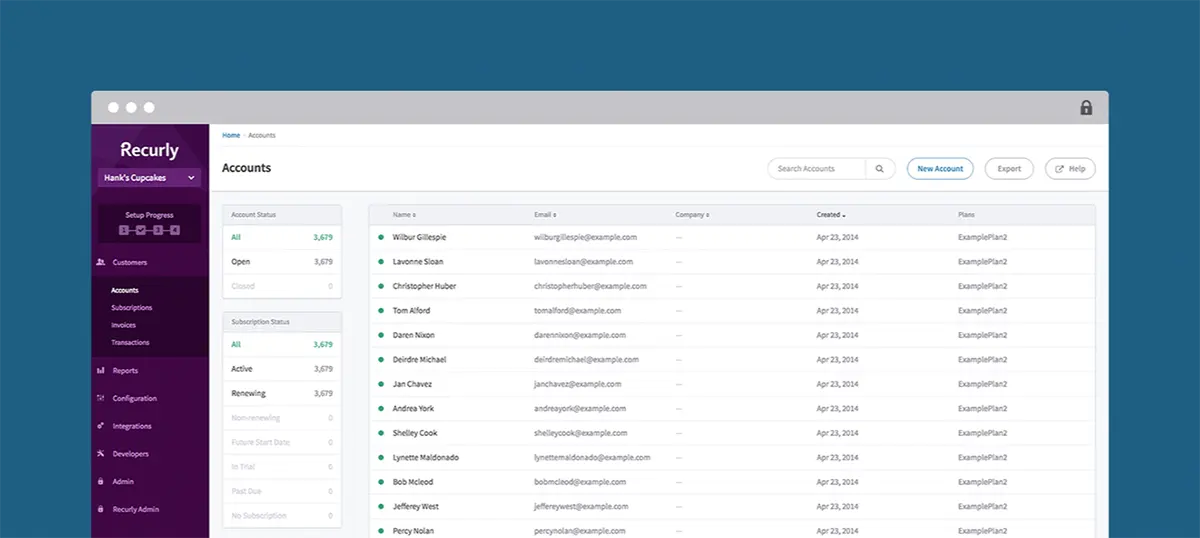

9. Recurly

Recurly is a robust subscription management and recurring billing platform designed to help businesses automate their revenue workflows.

It offers subscription lifecycle management, flexible pricing models, and comprehensive revenue recognition tools that ensure compliance with accounting standards like ASC 606 and IFRS 15.

The platform is mainly known for its user-friendly interface and strong integration capabilities with various payment gateways and business tools.

Key Features:

- Subscription lifecycle management

- Flexible pricing models

- Automated revenue recognition

- Churn management tools

- Integration with multiple payment gateways

Pros:

- Easy to use with a straightforward setup process

- Strong analytics capabilities for tracking performance

- High flexibility in managing subscription offerings

- Robust security and compliance measures

Cons:

- Some users report occasional issues with customer support

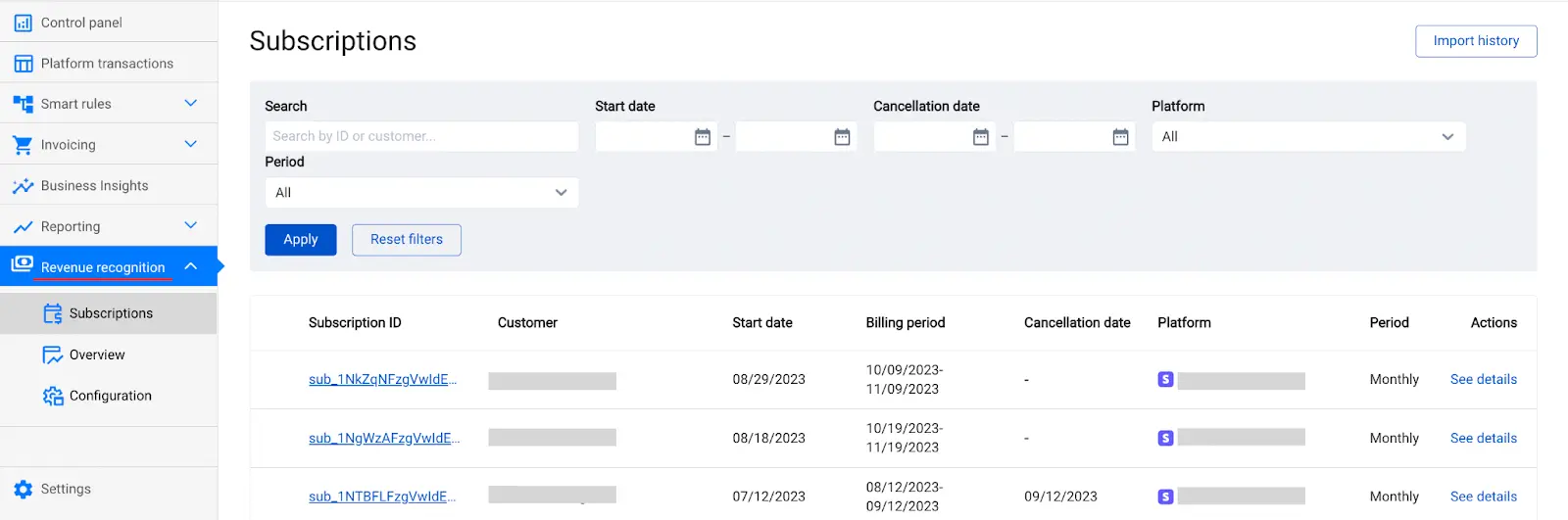

10. Synder RevRec

Synder RevRec is an automated revenue recognition software designed primarily for businesses using Stripe. It simplifies the revenue recognition process by ensuring compliance with accounting standards like ASC 606 and IFRS 15.

The platform automatically detects subscription changes and integrates seamlessly with QuickBooks Online, allowing for accurate and timely revenue reporting.

Synder RevRec’s key advantage is its user-friendly setup, which helps businesses quickly implement the software without extensive training.

However, it may not be suitable for organizations that utilize multiple billing sources or require comprehensive, integrated financial reporting across various platforms.

Key Features:

- Automated revenue recognition for Stripe transactions

- Integration with QuickBooks Online

- Compliance with GAAP, ASC 606, and IFRS 15

- Detection of subscription changes

Pros:

- Streamlines revenue recognition processes

- Reduces manual errors in financial reporting

- Offers real-time insights into revenue trends

- Ensures compliance with accounting standards

Cons:

- Limited to Stripe transactions

- May lack comprehensive reporting for diverse billing sources

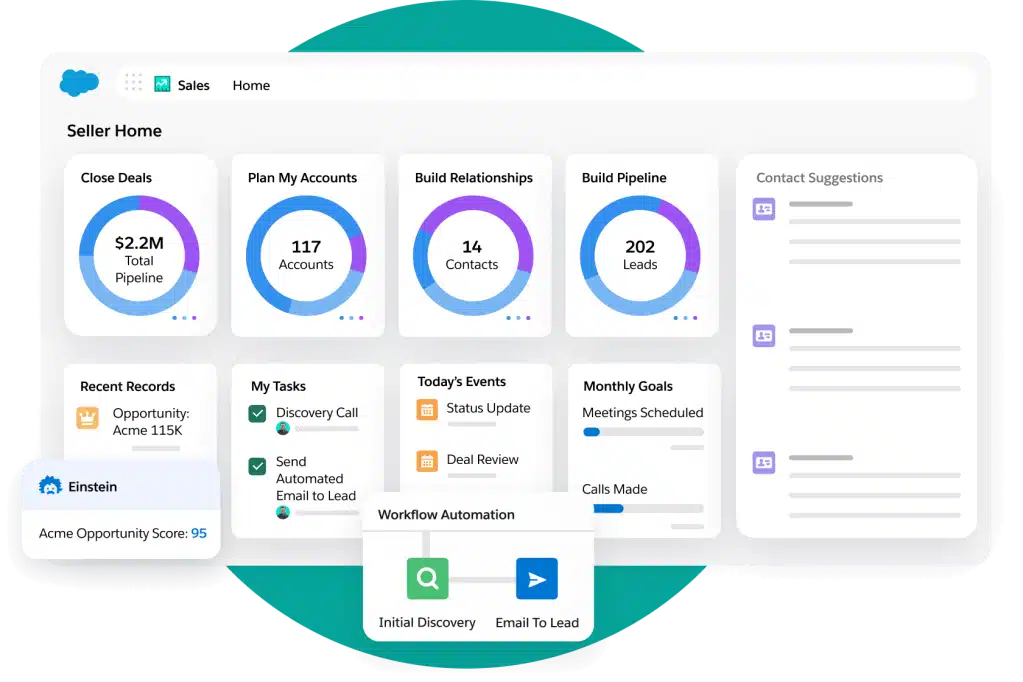

11. Salesforce Sales Cloud

Salesforce is a leading customer relationship management (CRM) platform that integrates various business processes to enhance efficiency and collaboration.

Its Revenue Cloud specifically focuses on automating revenue recognition, ensuring compliance with accounting standards, and providing real-time insights into financial performance.

The Revenue Recognition software within Salesforce helps organizations accurately recognize revenue from complex contracts and subscription models.

Automating this process reduces the risk of human error and enhances accuracy in financial reporting, which is crucial for maintaining compliance with regulations such as ASC 606 and IFRS 15.

Key Features:

- Automated revenue recognition

- Integration with Salesforce CRM

- Customizable revenue rules

- Real-time reporting and analytics

- Compliance with accounting standards

Pros:

- Seamless integration with existing Salesforce tools

- User-friendly interface with a short learning curve

- Robust automation capabilities for revenue processes

- Enhanced accuracy in revenue reporting

Cons:

- Complexity in implementing intricate pricing structures

- Potentially high costs for medium-sized enterprises

12. ChargeOver

ChargeOver is a cloud-based subscription management and recurring billing platform designed to streamline business financial processes.

It automates billing workflows, enabling companies to manage subscriptions efficiently while ensuring timely payments through features like dunning management and automated reminders.

The platform supports various payment methods, including credit cards and ACH, and offers customizable invoicing options. With its robust reporting tools, ChargeOver helps businesses analyze their financial performance and optimize revenue streams.

Key Features:

- Automated invoicing

- Subscription management

- Dunning management

- Customizable billing options

- Multi-currency support

Pros:

- User-friendly interface simplifies billing processes

- Strong automation capabilities reduce manual errors

- Flexible payment options cater to diverse customer needs

- Excellent customer support is available

Cons:

- Limited features in the mobile app compared to the desktop version

- API integration can be complex for some users

Tips for Choosing the Right Software for Revenue Recognition

Choosing the proper revenue recognition software is crucial for efficient financial management. Here are detailed tips to guide your selection process:

1. Understand your needs

Start by assessing your specific revenue recognition requirements. Consider the complexity of your revenue streams, such as subscription models, contracts, or multiple performance obligations.

2. Compliance features

Ensure the software aligns with relevant accounting standards like ASC 606 and IFRS 15. Look for features that automate compliance checks and generate reports that meet regulatory requirements. This will help mitigate risks associated with non-compliance.

3. Integration capabilities

Choose software that seamlessly integrates with your existing systems, such as ERP, CRM, or accounting tools. This integration is crucial for real-time data synchronization, reducing manual entry errors and providing a comprehensive view of your financial landscape.

4. User-friendly interface

Prioritize software with an intuitive interface that your team can easily navigate. A user-friendly platform reduces the learning curve and enhances productivity, allowing staff to focus on strategic tasks rather than grappling with complex software.

5. Scalability and customization options

Consider the growth potential of your business by opting for software revenue recognition that can scale alongside your operations, accommodating increasing transaction volumes and additional features as needed.

Conclusion

Mismanaged revenue recognition can lead to serious financial repercussions, making it essential for businesses to implement effective revenue recognition software.

For businesses in the Philippines, Hashmicro accounting software is a top recommendation. It seamlessly integrates with existing financial systems, automates revenue recognition, and provides real-time reporting, allowing companies to scale efficiently while maintaining compliance and accuracy in their financial management.

Subukan ang isang libreng demo ngayon upang makita kung paano nito mababago ang iyong mga proseso ng kita!

FAQ

-

What is revenue recognition software?

Revenue recognition software is a tool that helps businesses track and manage how and when they recognize revenue in their financial statements, ensuring compliance with accounting standards.

-

What is IFRS 15 in terms of revenue recognition?

IFRS 15 is an international financial reporting standard that provides a framework for recognizing revenue from contracts with customers, focusing on the transfer of control rather than the transfer of risks and rewards.

-

Is revenue recognition governed by GAAP?

Yes, revenue recognition is governed by Generally Accepted Accounting Principles (GAAP) in the U.S., which outlines specific guidelines for when and how revenue should be recognized in financial reporting.