It’s 2025, and yet many businesses still haven’t adopted accounts receivable software. Instead, they drown in invoices, slowing down operations and killing cash flow.

Outdated AR systems force companies to rely on external financing just to stay afloat. Worse, manual AR tasks are repetitive, boring, and drain productivity. Teams waste hours chasing payments instead of focusing on growth. Hay naku!

If you’re tired of the chaos, try HashMicro Accounting Software. It automates invoicing, tracks payments, and sends reminders—freeing your team to strategize.

Of course, every business is different. That’s why this article also highlights 20 top accounts receivable software options to help you choose the right one.

Key Takeaways

|

Table of Contents

Overview of the Best Accounts Receivable Software:

- HashMicro: Best overall AR automation solution.

- NetSuite: Best for enterprise-level AR operations.

- Sage Intacct: Best for diverse billing scenarios and real-time insights.

- SAP S/4HANA: Best for advanced credit management and real-time data processing.

- Xero: Best for small business invoice and payment tracking.

- Zoho Books: Best for affordable and integrated financial automation.

- Square Invoices: Best for POS and payment processing.

- FreshBooks: Best for automated invoicing and expense tracking.

- Invoice2go: Best for efficient and mobile-friendly invoice management.

- Centime: Best for real-time cash flow forecasting and banking integration.

What is Accounts Receivable Software?

Accounts receivable software is a digital tool that helps businesses manage and track payments from customers. It automates invoicing, monitors due dates, and records payments, making the process more accurate and efficient.

This software supports businesses by reducing manual work in tracking outstanding balances. It ensures timely follow-ups and accurate payment records, which are essential for maintaining healthy cash flow and financial operations.

When integrated with notes receivable tracking, accounts receivable software helps businesses avoid late payments and better manage expected income. This improves overall cash flow visibility and reduces financial risks.

Benefits of Accounts Receivable Software

Implementing accounts receivable software provides several valuable advantages for businesses:

- Reduces human errors: Automation minimizes mistakes in invoicing and data entry, ensuring greater accuracy.

- Saves time for finance teams: By eliminating repetitive manual tasks, finance staff can focus on higher-level strategic work.

- Lowers operational costs: Automating accounts receivable reduces the need for manual intervention, cutting labor and processing costs.

- Speeds up invoice processing: Faster invoice generation and follow-ups lead to quicker customer payments and improved cash flow.

- Delivers actionable insights: Built-in analytics and reporting tools offer deeper visibility into outstanding receivables, payment trends, and customer behavior.

- Enhances customer experience: Consistent communication and faster processing contribute to better client relationships and satisfaction.

Hashy AI Fact

Need to know!

AI-powered accounts receivable automation improves cash flow by reducing errors, accelerating invoice processing, and ensuring timely payments. With Hashy AI HashMicro, businesses can manage receivables more efficiently and enhance financial accuracy.

Get a Free Demo Now!

Top 20 Accounts Receivable Software Solutions

Below are the top 20 accounts receivable software solutions for businesses, with a comparison of their features, functionalities, and benefits.

1. HashMicro

HashMicro’s accounting system is a comprehensive accounts receivable software that automates receivables management. It streamlines invoice handling, payment tracking, and customer communications through advanced automation.

HashMicro also provides a free product tour and consultation with its expert team, offering potential users an in-depth look at how the AR software functions and how it can be customized to meet specific business requirements.

Prominent clients like the Bank of China, Forbes, and Hino demonstrate HashMicro’s reliability across various industries, showcasing its ability to manage complex financial tasks. This makes it an ideal option for businesses aiming to improve their accounts receivable processes.

HashMicro’s Accounts Receivable Software has features designed to optimize and simplify financial workflows. Here’s an overview of its key functionalities:

- Bank Integrations & Auto Reconciliation: The software connects with bank accounts to automatically match incoming payments to outstanding invoices, ensuring accurate application to the correct accounts receivable entries.

- Forecast Budget: This tool utilizes historical receivables data to forecast future cash inflows, giving businesses a clearer picture of expected payments and aiding in planning for future expenses and investments.

- Financial Ratio Analysis: Automatically calculates key ratios like the accounts receivable turnover ratio, helping identify customer payment trends and highlighting areas that may need improved collection efforts.

- Custom Invoice Printouts: Allows for tailored invoice designs that meet specific branding or regulatory standards, enhancing invoice clarity and professionalism, which may encourage quicker customer payments.

- 3-Way Matching: Confirms that invoices, received goods, and purchase orders match before releasing payments, preventing overpayments or payments for undelivered goods, and safeguarding against fraud and discrepancies.

- Cash Flow Reports: Monitors cash generated from receivables, aiding in managing the timing of incoming cash and adjusting credit policies or collection practices as needed.

| Pros | Cons |

|

|

2. NetSuite

NetSuite provides accounts receivable software designed to simplify the AR process for businesses. The accounts receivable management software automates key tasks, including invoice creation, payment tracking, and account reconciliation.

NetSuite’s features include an automated billing system for generating and delivering invoices, in-depth financial analytics for valuable insights, and credit management tools to set and monitor credit limits while assessing customer creditworthiness.

| Pros | Cons |

|

|

3. Sage Intacct

Sage Intacct offers a complete solution to improve the efficiency and accuracy of the accounts receivable process. With features that address past-due scenarios, Sage Intacct keeps all financial data synchronized and current.

The software supports diverse billing scenarios, such as time-based and project-based billing. It also delivers real-time insights into payment statuses and customer account activity, along with an automated dunning system to facilitate timely collections.

| Pros | Cons |

|

|

4. SAP S/4HANA

SAP S/4HANA provides accounts receivable software that streamlines financial tasks such as credit management, invoice creation, and payment matching, which often demand significant manual effort.

Its key features include sophisticated credit management tools that assess customer credit risk in real-time and adjust credit limits based on past data and payment patterns. Additionally, its analytics features offer comprehensive insights into accounts receivable activities.

| Pros | Cons |

|

|

5. Xero

Xero Accounts Receivable Software is designed to streamline the management of invoices and incoming payments. It integrates with Xero’s accounting system, ensuring smooth data transfer between invoicing and financial reporting.

Key features include real-time tracking of invoice statuses, automated payment reminders, and support for multiple payment gateways to enable quicker and more convenient customer transactions.

| Pros | Cons |

|

|

6. Zoho Books

Notable features include advanced analytics that offer real-time insights into accounts receivable status, allowing companies to monitor aging summaries and evaluate customer payment patterns.

| Pros | Cons |

|

|

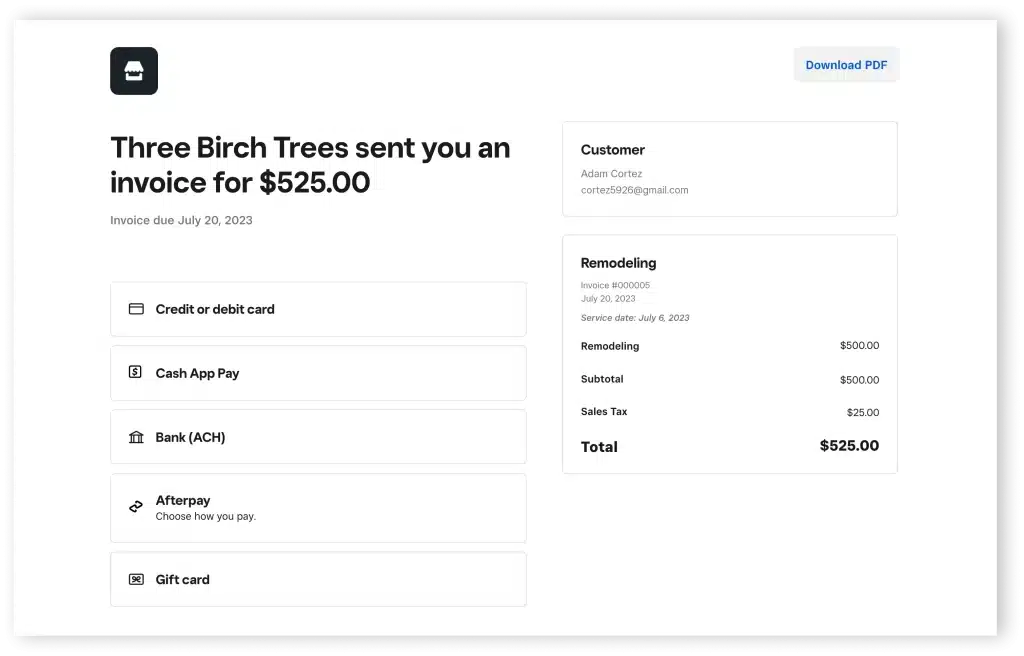

7. Square Invoices

Square Invoices provides accounts receivable software to streamline receivable management for businesses. Users can create, send, and manage invoices directly from their devices or via the Square app. Notable features include customizable invoices, automated payment reminders, real-time invoice tracking, mobile integration for on-the-go invoicing, secure payment processing, and detailed reporting and analytics.

| Pros | Cons |

|

|

8. FreshBooks

This accounts receivable management software offers features such as automated invoicing, payment reminders, online payment integration, expense tracking, time tracking, financial reporting, multi-currency support, and client management tools, all aimed at simplifying and improving financial tasks for businesses of any size.

| Pros | Cons |

|

|

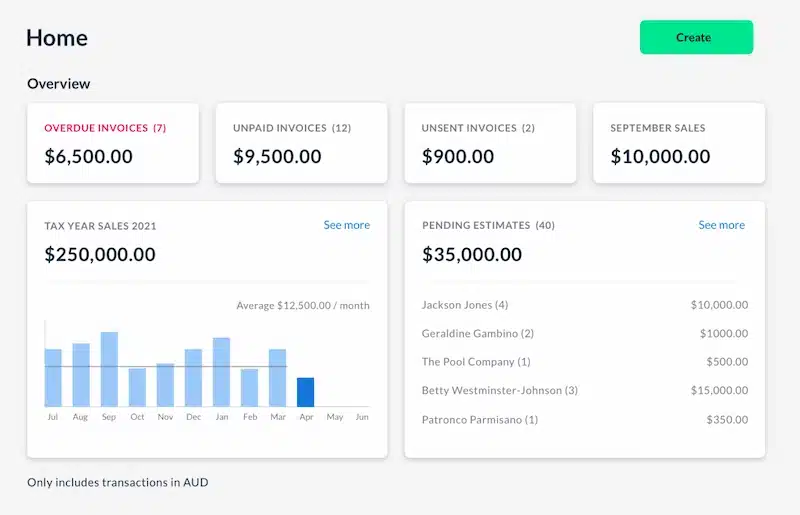

9. Invoice2go

Invoice2go Accounts Receivable Software distinguishes itself in the realm of accounts receivable solutions by transforming how businesses handle their receivables through more efficient processes.

The software automates invoicing, monitors payments, and sends automated reminders to simplify financial operations. It also tracks payments seamlessly, automatically updating accounts receivable records to ensure accuracy and efficiency in financial management.

| Pros | Cons |

|

|

10. Centime

| Pros | Cons |

|

|

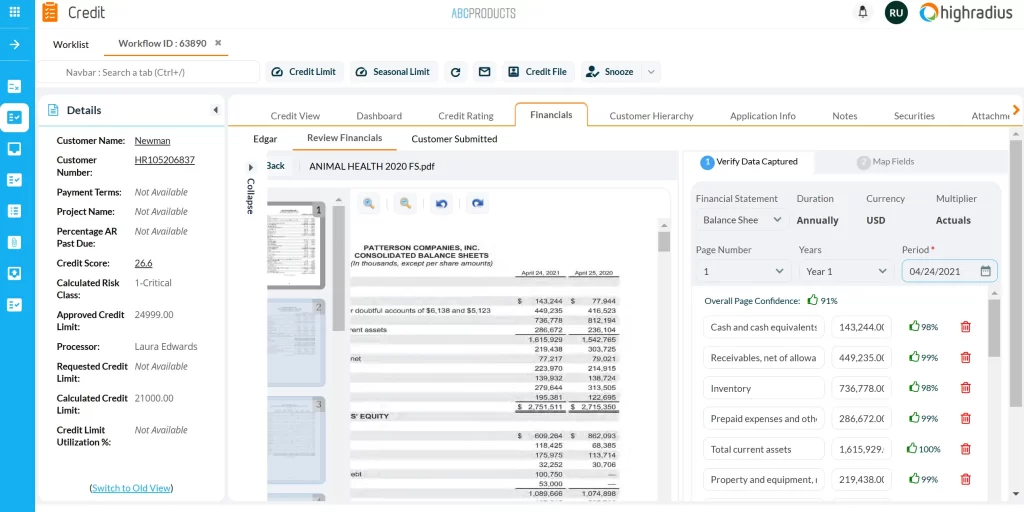

11. HighRadius

HighRadius provides AR automation software to streamline and enhance businesses’ accounts receivable processes. The software focuses on reducing manual effort, minimizing errors, and boosting efficiency in managing receivables.

Key features of this accounts receivable software include automated invoice processing, payment reconciliation, credit management, collections management, cash application, dispute management, along with reporting and analytics, all aimed at optimizing financial operations.

| Pros | Cons |

|

|

12. BlackLine

The accounts receivable software automates invoice handling, real-time payment tracking, dispute management, credit risk assessment, and detailed reporting and analytics. Together, these tools help businesses maintain accuracy and stay up-to-date.

| Pros | Cons |

|

|

13. Billtrust

Key features of this accounts receivable software include automated invoicing, electronic payment processing, customer portals, in-depth analytics and reporting, automated cash application, and credit management tools.

| Pros | Cons |

|

|

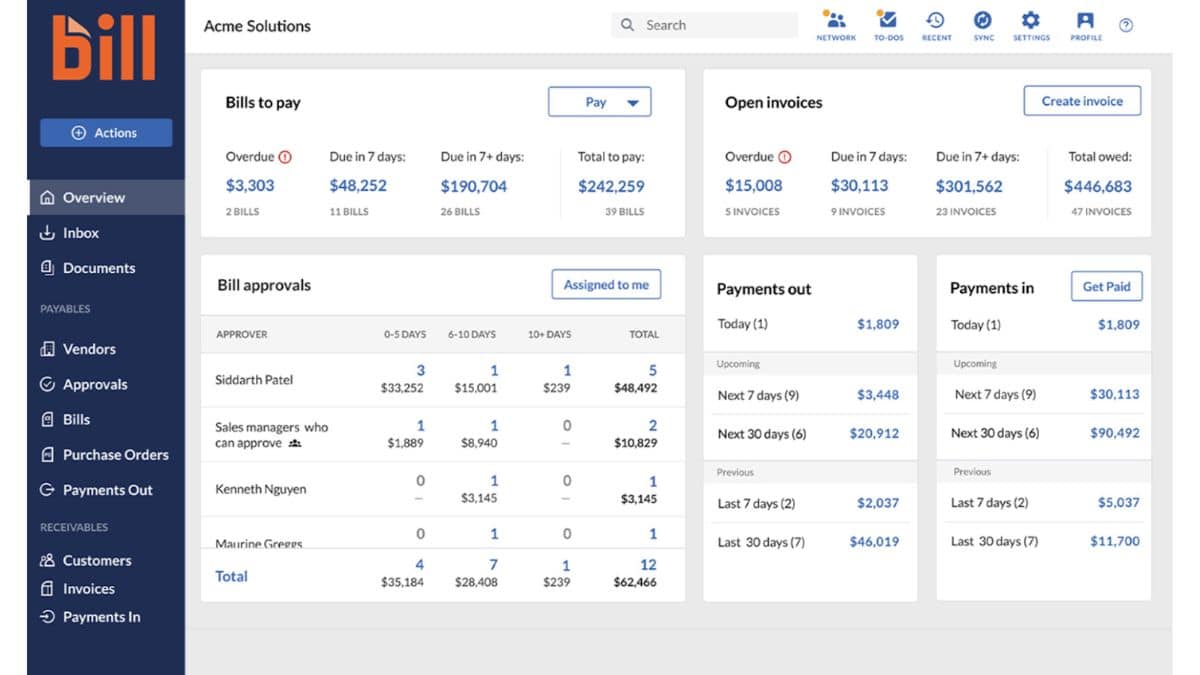

14. BILL AP/AR

BILL AP/AR is built to simplify and streamline business accounts receivable management. It generates invoices from sales data, sends them to customers, and tracks each invoice’s status until payment is received.

Key features include payment reminders, integrated payment processing, real-time tracking and reporting, and customizable invoice templates, all of which aim to improve accuracy and efficiency in managing accounts receivable.

| Pros | Cons |

|

|

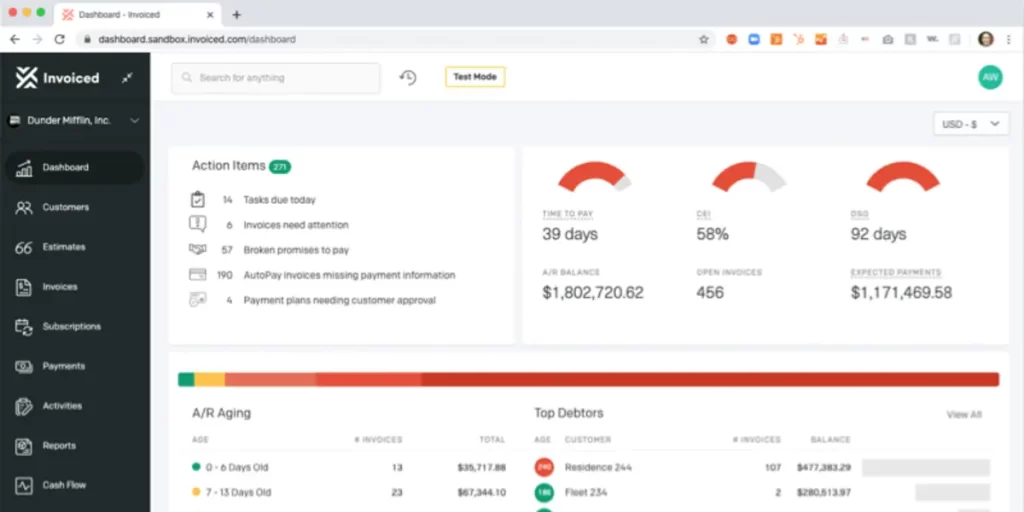

15. Invoiced

Invoiced is a powerful accounts receivable automation software that automates essential tasks like invoice creation, payment tracking, and customer communication. The accounts receivable software synchronizes all data, minimizing errors and enhancing efficiency.

Key features of the Invoiced Accounts Receivable System include automated invoice generation, payment reminders, online payment processing, customer portals, as well as detailed reporting and analytics to streamline financial processes.

| Pros | Cons |

|

|

16. Versapay

Versapay Accounts Receivable Software automates multiple parts of the receivables process, including invoicing, payment handling, and reconciliation. It promotes real-time collaboration, ensuring timely payments and swift dispute resolution.

Notable features of Versapay include invoice distribution, real-time payment monitoring, an integrated customer portal, automated reconciliation, and robust analytics and reporting. These tools are designed to boost efficiency, improve cash flow, and reduce manual tasks.

| Pros | Cons |

|

|

17. Gaviti

For businesses facing challenges with overdue accounts receivable automation, Gaviti offers a complete accounts receivable software to optimize processes and enhance financial performance. It seamlessly integrates with existing ERP and accounting systems, providing real-time updates and synchronization.

Gaviti’s key features include automated invoice distribution, payment reminders, customizable dunning letters, real-time analytics, integration with leading ERP systems, and a dashboard that delivers a detailed view of receivables performance.

| Pros | Cons |

|

|

18. Tesorio

Tesorio is a top-tier accounts receivable software designed to streamline and optimize receivables management. It automates the tracking, collection, and reporting processes, minimizing the need for manual efforts.

Tesorio’s key features include automated invoice reminders, payment monitoring, cash flow forecasting, advanced analytics, smooth integration with current financial systems, and customizable reporting options.

| Pros | Cons |

|

|

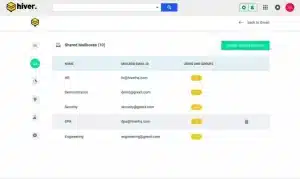

19. Hiver

Hiver Accounts Receivable Automation Software is built to simplify and enhance receivables management. By connecting with your current financial systems, Hiver provides real-time data updates, reducing manual work and minimizing mistakes.

Hiver’s main features include effortless integration with financial systems, automated invoice tracking, payment reminders, real-time data synchronization, comprehensive reporting, and analytics. These tools increase efficiency in managing receivables and assist in making more informed financial decisions.

| Pros | Cons |

|

|

20. BlueSnap

BlueSnap Accounts Receivable Software streamlines key tasks in the receivables process, such as invoicing, payment monitoring, and reconciliation. It ensures accurate, real-time transaction recording, minimizing errors and boosting financial efficiency.

BlueSnap’s main features include global payment processing, advanced invoicing options, real-time payment monitoring, multi-currency support, detailed reporting tools, fraud prevention, and strong security protocols.

| Pros | Cons |

|

|

5 Major Pain Points in Accounts Receivable Operations

Managing accounts receivable (AR) effectively is key to ensuring steady cash flow, but several challenges can impede business operations. Here are five common pain points companies frequently encounter in AR management:

- Delayed payment cycles: Slow payments, often caused by manual invoicing processes and late customer payments, can disrupt cash flow and hinder business activities

- Payment tracking and reconciliation: Manually matching payments to invoices is labor-intensive and prone to errors, which can cause discrepancies and delay collections.

- High Days Sales Outstanding (DSO): A high days sales outstanding (DSO) suggests longer collection times, which can adversely affect cash flow and financial stability.

- Invoice mistakes: Errors like incorrect amounts or missing invoice details can lead to disputes and payment delays.

- Ineffective communication: Poor communication with customers about payment terms and due dates can cause confusion and result in late payments.

Addressing these AR pain points is crucial for improving financial and operational efficiency. By recognizing and resolving these issues, businesses can enhance their accounts receivable processes.

Trends in Accounts Receivable Software

As businesses evolve, staying on top of the latest trends in accounts receivable software is essential to maintaining financial efficiency and a competitive edge. Here are some of the most significant trends in AR software and how businesses can stay prepared:

1. Customer-centric payment experience

A customer-centric payment experience is becoming increasingly vital in accounts receivable software. By offering multiple payment options, including mobile and online payments, businesses can make it easier for customers to pay on time, leading to faster collections and better cash flow management.

2. Predictive analytics

Predictive analytics is revolutionizing the way businesses manage accounts receivable. AI-powered accounts receivable software allows businesses to analyze historical data and predict future payment trends, helping them identify potential risks and take proactive measures.

3. Cloud-based AR solutions

Cloud-based accounts receivable solutions are becoming the standard due to their flexibility, scalability, and ease of access. These solutions allow businesses to access real-time financial data, track payment statuses, and collaborate with teams from anywhere, anytime.

4. Blockchain in receivables management

Blockchain technology is making its way into accounts receivable management, offering increased transparency, security, and efficiency in financial transactions. Blockchain-enabled AR software allows businesses to record and verify transactions without the need for intermediaries, reducing the risk of fraud and streamlining the invoicing and payment process.

By considering these trends, businesses can future-proof their accounts receivable processes and stay ahead of the competition. Implementing advanced accounts receivable software will ensure enterprises remain efficient, customer-focused, and prepared for future challenges in the financial landscape.

How to Choose the Best Accounts Receivable Software Solution

Choosing the best accounts receivable software is a crucial decision that can significantly influence your financial efficiency and overall operational success. Here are several key considerations to help ensure you make the best choice:

- Assess your business requirements: Consider the volume of invoices, the complexity of your payment processes, and any unique needs your business has. This will guide you in identifying the software’s must-have features.

- Review key features: Look for a solution that provides a robust set of features aligned with your business needs, such as automated invoicing, payment processing, customer portals, and detailed reporting tools.

- Ease of use: The software should have an intuitive and easy-to-navigate interface. A user-friendly design minimizes the learning curve, boosts productivity, and helps your team quickly adapt to the new system.

- Customization options: Opt for customized software to suit your specific workflows and processes. Flexibility in customization ensures the solution will meet your unique needs and grow with your business.

- Integration capabilities: Ensure the software integrates seamlessly with your existing ERP, CRM, and financial systems. Integration is essential for maintaining accurate data flow and ensuring real-time updates across your financial operations.

- Scalability: Factor in your business’s future growth. The software should be scalable to handle increasing transaction volumes and more complex accounts receivable tasks as your company expands.

- Security and compliance: Verify that the software complies with industry standards for data security. Strong security measures are vital to protect sensitive financial data and ensure compliance.

- Vendor support and training: Select a vendor that provides strong customer support and comprehensive training. Reliable support ensures prompt issue resolution, while thorough training helps your team fully leverage the software’s features.

By carefully considering these factors, you can choose the best accounts receivable software to streamline financial operations, improve accuracy, and support your business’s growth and success.

Conclusion

Choosing the best accounts receivable software is essential for any business. With the right solution, you can simplify your accounts receivable workflows, increase accuracy, reduce manual effort, and maintain a smooth cash flow.

HashMicro Accounting Software excels with its robust features and seamless integration capabilities. Trusted by businesses across multiple industries, HashMicro offers high-quality solutions and excellent customer support, ensuring easy management of receivables for your business.

Explore how HashMicro can optimize your accounts receivable processes and help your business succeed financially. Sign up for a free demo today and consult with our expert team to address your business needs.

FAQ About Accounts Receivable Software

-

What software is used for accounts receivable?

HashMicro’s Accounts Receivable Software is an all-in-one solution designed to streamline the process of managing incoming payments. It automates invoicing, payment tracking, and financial reporting, giving businesses real-time insights into outstanding invoices and cash flow. The software allows companies to set up automated reminders, track overdue payments, and generate detailed reports to ensure timely collections and minimize administrative burden.

An example of an AR account in HashMicro’s system could be a customer’s open invoice. The software tracks the amount due, payment status, and due date in one centralized dashboard. This enables businesses to efficiently monitor and manage their accounts receivable, improving cash flow management and reducing the risk of delayed payments.

-

What is an example of an AR account?

An example of an AR account is “Accounts Receivable – Customer XYZ”, where payments owed by Customer XYZ are tracked. In this case, the AR account reflects the amount the customer owes for goods or services provided on credit. For example, if a company sells products to a customer on credit, the amount due from the customer is recorded under an AR account, which will be cleared once the customer makes the payment.

-

What software is required for AR?

The software required for accounts receivable (AR) depends on the size and needs of the business, but generally, any accounting software with AR capabilities will suffice. Key features to look for in AR software include:

1. Invoicing and payment tracking

2. Integration with accounting systems

3. Automation for reminders and late fees

4. Reporting and analytics tools for cash flow forecasting

5. Cloud-based functionality for real-time access to data

Examples of software commonly used for AR include QuickBooks, Xero, FreshBooks, and NetSuite. These solutions allow businesses to efficiently track outstanding invoices, manage collections, and improve cash flow management.