Accounting automation is the use of software to automate repetitive financial tasks such as data entry, invoicing, and reporting. It helps businesses reduce manual errors, save time, improve accuracy, and streamline financial management for better decision-making.

Without proper automation, businesses often struggle with data entry mistakes, delayed reports, and compliance issues. These accounting problems can lead to financial discrepancies and penalties, slowing down overall growth and decision-making.

HashMicro Accounting Software helps streamline accounting processes in the Philippines. With features like bank integration and cash flow reporting, it enhances accuracy and keeps businesses competitive. In this article, learn how accounting automation can benefit your business.

Table of Contents

Key Takeaways

|

Accounting Automation Definition

Accounting automation is a system for automating repetitive and routine accounting tasks. It integrates specialized software that automatically handles tasks like data collection, transaction recording, and financial report generation. By using accounting automation, accountants can streamline tasks and reduce hands-on work.

From old bookkeeping to today’s automated accounting systems, significant changes have occurred. Early on, accountants used paper and performed calculations manually. Then, computers made tasks more accessible, although much work was done manually.

Now, with cloud computing, AI, and machine learning, advanced automation is available, performing complex calculations quickly and providing real-time insights.

The primary goal of accounting automation is to improve the accuracy, efficiency, and speed of financial management within a company. Businesses can focus more on data analysis and strategic decision-making by automating time-consuming and error-prone processes.

Key features of accounting automation include:

- Automatic data processing: Enables the automated collection and processing of data from various sources.

- Automated reconciliation: Automates account reconciliation processes to ensure accurate balances.

- Financial report generation: Automatically generates timely and accurate financial reports.

- Compliance monitoring: Ensures all transactions comply with relevant regulations and accounting standards.

- System integration: Integrates various financial systems and applications for seamless data flow and consistency.

Using automation in accounting is changing how businesses manage money. It brings strong features that make things more efficient and accurate.

Benefits of Accounting Automation

Now, let’s explore the benefits of accounting automation and how they can transform financial management:

- Enhanced data accuracy: One of the main advantages of accounting automation is enhanced data accuracy. By minimizing manual input, these systems reduce the risk of human errors, ensuring that financial data is precise and reliable. This leads to more accurate reports, better decision-making, and greater overall trust in financial information.

- Quicker completion time: Automated accounting systems significantly reduce the time required to complete financial tasks. By streamlining processes such as transaction recording and report generation, these systems enable faster data processing, allowing businesses to close financial periods and make decisions more quickly.

- Comprehensive analysis: Accounting Automation provide comprehensive analysis by consolidating financial data into detailed reports and insights. This allows businesses to gain a deeper understanding of their financial performance, identify trends, and make informed decisions based on accurate, real-time information.

- Cost reduction: Accounting Automation contribute to cost reduction by minimizing the need for manual labor and reducing the likelihood of errors that can lead to costly mistakes. By streamlining financial processes, businesses can cut down on administrative expenses, improve efficiency, and allocate resources more effectively.

- Better security: Accounting information systems offer better security by protecting sensitive financial data through encryption and access controls. With fewer manual interventions, the risk of data breaches or unauthorized access is significantly reduced, ensuring that financial information remains safe and compliant with regulatory standards.

- Swift data retrieval: Automated accounting systems enable swift data retrieval by organizing financial information in a centralized and easily accessible format. This allows businesses to quickly locate and access important data, saving time and improving efficiency when making financial decisions or generating reports.

6 Steps to Automate your Accounting Processes

Here are the steps to automate your accounting process:

- Evaluate your current accounting processes and identify areas that could be improved.

- Select accounting automation software that meets your business requirements and fits within your budget.

- Choose software that offers customizable invoice templates and integrates smoothly with your ERPs, banks, and other systems.

- Appoint a project leader to oversee and manage workflows, ensuring a smooth data migration process.

- Ensure your team receives adequate training and time to familiarize themselves with the new software.

- Plan a transition period and inform all relevant staff, particularly the CFO, accountants, and finance team, about the upcoming changes.

Why Should We Shift From Manual to Accounting Automation Systems?

Despite being traditional and familiar, manual accounting system poses several significant challenges in today’s fast-paced business environment. These challenges can hinder a company’s efficiency, accuracy, and financial health.

Understanding these issues is crucial to appreciating the benefits of accounting software. Below are the challenges of using manual accounting:

1. Manual accounting processes are highly time-consuming

Manual accounting processes require significant time for data entry, reconciliation, and report generation tasks. These tasks are labor-intensive and often involve repetitive actions, which can lead to inefficiencies.

As a result, accountants may spend more time on administrative work than on strategic financial planning and analysis. Traditional accounting’s time-consuming nature can hinder the finance department’s overall productivity.

2. Manual accounting is a risk for potentially costly errors

Manual data entry increases the likelihood of human errors, which can result in inaccurate financial records. Even small mistakes can have significant consequences, such as incorrect financial statements or missed compliance deadlines.

These errors often require additional time and resources to identify and correct, leading to further inefficiencies. The potential for mistakes in traditional accounting can undermine the reliability of financial data and decision-making.

3. Manual accounting methods lack proper security

Manual accounting systems often involve handling physical documents and unprotected digital files, which unauthorized individuals can easily misplace or access. Without appropriate security measures, sensitive financial information is at risk of theft, fraud, or loss.

This lack of security can compromise the integrity of financial data and expose the company to legal and financial repercussions. Ensuring financial information safety is crucial, yet traditional methods may fail to provide adequate protection.

Will Accounting Automation Replace CPA (Certified Public Accountant)?

Automation is changing the game, making us rethink the future of CPAs. While some wonder if AI will make CPAs unnecessary, it’s clear that CPAs offer deep insights, strategic advice, and personalized help that AI cannot provide. Accounting automation modernizes the traditional role of CPAs, allowing them to focus on high-level tasks and make more strategic decisions.

AI can handle tasks like data entry and report generation, reducing errors and freeing up CPA time. This enables CPAs to create strategies, provide financial advice, and work on budgets to help increase business profits. Finally, this automation allows CPAs to focus on essential roles.

Viewing automation as a threat is a misconception. Instead, it’s an opportunity for CPAs to enhance their roles and contribute more strategically. Accounting automation software improves CPAs’ efficiency by enabling faster and more accurate data analysis, leading to better decision-making and improved company performance.

The table below shows how CPAs and automation work together:

| Traditional CPA Tasks | Automated Processes | Enhanced CPA Roles |

| Manual Data Entry | Automated Data Capture | Financial Analysis |

| Transaction Reconciliation | Automated Reconciliations | Advisory Services |

| Report Generation | Autogenerated Reports | Strategic Planning |

AI in accounting means CPAs will change, not disappear. By using these tools, CPAs can do more for their clients. The real value of automation is in making CPAs better at what they do.

How to Get Started with Accounting Automation?

Accounting automation is revolutionizing the way businesses manage their finances, offering greater accuracy and efficiency. If you’re considering making the shift, it’s essential to understand the key steps involved in getting started.

Here’s a simple guide to help you transition smoothly to automated accounting.

1. Automating the accounts payable process

Start by implementing accounting automation software that can automatically capture and process invoices. This system should match invoices with purchase orders, approve payments, and schedule them, reducing manual entry and errors.

By automating accounts payable, businesses can improve cash flow management, ensure timely payments, and enhance overall efficiency.

With accounting automation offered by HashMicro, invoices can be processed swiftly and efficiently through the accounts payable department. Any issues that arise are quickly identified, allowing accountants to address them promptly.

2. Audit documentation

Conventional audit documentation has several problems, such as difficulty accessing specific invoices and protecting sensitive information. Business owners often need to provide a year’s worth of records, which can be cumbersome and risky.

Companies prefer to track who accesses these records and when. Therefore, using intuitive software for audit documentation should be a priority, as poor record-keeping is not an option in business.

3. Procurement integration

Procurement involves translating business needs into necessary supplies and services orders and managing supplier relationships. Digitizing the extensive documentation involved can help companies become more organized and efficient.

By integrating with procurement software, companies can automate order approvals, track delivery statuses, and manage vendor relationships. Thus, you can achieve better control over their purchasing activities, reduce costs, and improve accuracy in inventory management.

With accounting automation, many tasks become much more manageable, such as:

- Requesting and managing documents: Simplifies the process of handling quotation files, inspection sheets, and approval documents.

- Preparing various business records: Streamlines the preparation of shipment receipts, freight bills, manufacturing records, invoices, and supplier data.

- Forecasting and research: Helps accurately forecast regulatory sheets, product research documents, and supplier details.

- Documenting inspections and workflows: Ensures efficient documentation of inspection reports, defect resolution workflows, and testing reports.

- Managing orders and contracts: Facilitates creating and managing purchase orders, contracts, and estimates.

These processes involve a lot of paperwork and various systems to ensure accuracy. By automating these tasks, companies can reduce the documentation burden and allow their accountants to focus on more critical business activities.

What to Look for in Accounting Automation Software?

Choosing the right accounting automation tools is key for your business. The software should integrate smoothly with other business systems like ERP or CRM platforms. It is essential to pick software that complies with Philippine financial laws to protect your business from legal issues.

Below are some things to consider when choosing the right accounting software for your business:

1. Core accounting modules

Essential accounting systems should include core modules such as general ledger, accounts payable, accounts receivable, and payroll. These modules ensure comprehensive financial management and accurate record-keeping.

Integration between these modules is essential for smooth data flow and financial operations that will facilitate robust reporting and analysis. The ability of these modules to be customised to specific business needs can enhance their usability.

In addition, ensure that the software supports compliance with relevant accounting standards and regulations. If you want to learn more before choosing the best accounting software Philippines for your company in the Philippines, you can read this article.

Below are some of the most practical features that business owners should look for in an accounting system:

- Invoicing capabilities

- Time tracking

- Expense tracking

- Automated financial reports

- Daily dashboard

- Customer support service

- Mobile application

An excellent accounting software company often offers a free trial of its program. Accounting Automation Software like HashMicro allow users to schedule a demo, demonstrating how their system can help automate payables processes.

2. Automation

Accounting automation software should handle repetitive tasks like data entry, invoicing, and reconciliations. Smart automation reduces errors, saves time, and supports compliance. Look for tools that can automate workflows, approvals, and generate real-time financial reports.

3. Business Intelligence

Choose accounting automation with strong BI features to analyze data, track trends, and forecast performance. Real-time dashboards and predictive analytics help businesses make smarter decisions and stay competitive, especially when integrated with core accounting modules.

4. Cloud Access and Capabilities

Cloud-based accounting automation gives users access to real-time data from any location. It ensures security with encryption, offers automatic backups, and keeps software up-to-date. Seamless integration with other cloud tools enhances flexibility and efficiency for growing teams.

5. Multi-User Access

Multi-user access lets teams collaborate in real-time with shared access to financial data. Choose software with customizable roles, permission controls, and audit trails to ensure data privacy, security, and accountability across departments or business units.

6. Ability to Scale

Scalable accounting automation grows with your business. It should support more users, higher transaction volumes, and new features without slowing down. Look for flexible pricing, module add-ons, and system integrations that support long-term expansion and complexity.

7. Proven Track Record

Select accounting automation software from vendors with a solid track record. Check reviews, case studies, and client success stories. Reliable vendors offer regular updates, strong customer support, and industry experience, ensuring your business stays on a stable platform.

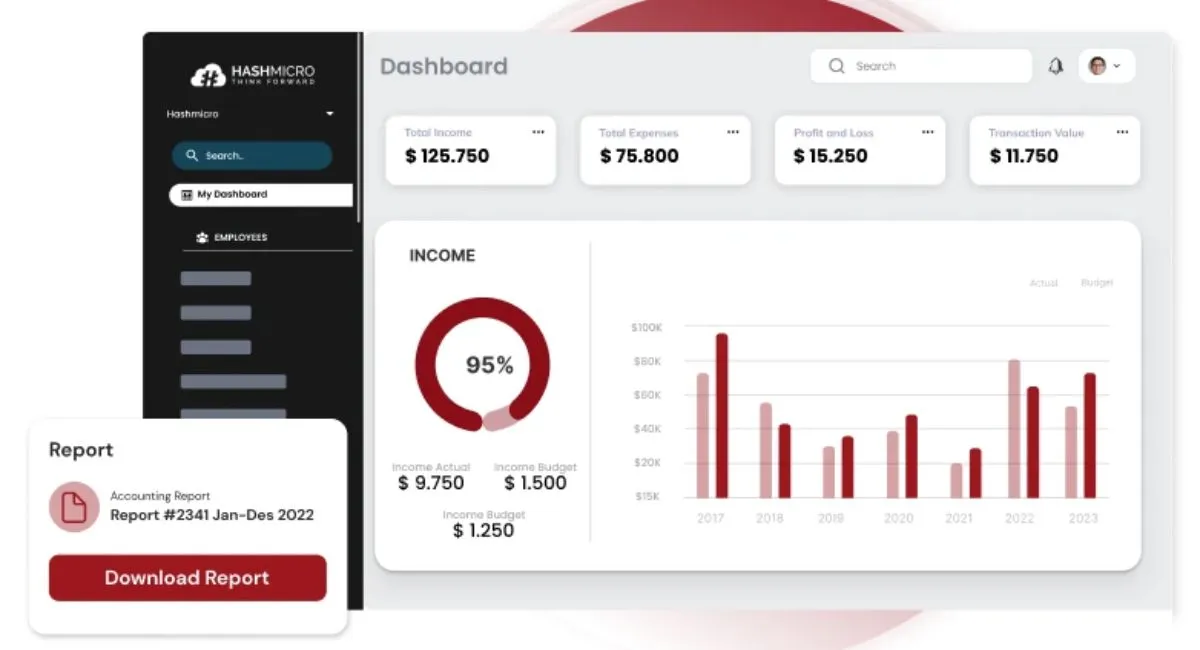

HashMicro’s Accounting Software Provides an All-in-One Solution to Automate Company Finances

HashMicro is recognized as one of the best ERP software providers in the Philippines. This vendor has successfully helped businesses of all sizes achieve accounting automation, enhance their financial management processes, and improve overall efficiency.

If you want to automate your financial management, try HashMicro’s AI accounting software for free. This trusted vendor offers a free trial to experience the benefits of accounting automation firsthand.

HashMicro’s Accounting Solution comes with a variety of features, such as:

- Bank Integration – Auto Reconciliation: This bank reconciliation feature ensures that internal bookkeeping balances match the bank’s recorded balances, enhancing accuracy and consistency.

- Multi-level Analytical: This feature allows businesses to gain real-time insights and trends from all financial transactions, filtering by categories such as projects or branches.

- Profit & Loss vs Budget & Forecast: This feature delivers reports highlighting deviations between estimated and actual profit and loss based on set budget values.

- Cash Flow Reports: This feature allows companies to monitor cash inflows and outflows to ensure sufficient liquidity, enabling precise financial planning and early identification of potential financial issues.

- Forecast Budget: This feature allows businesses to predict future budgets based on historical data, aiding in efficient resource allocation and better strategic decision-making.

- Budget S Curve: This feature visually tracks and understands expenditure distribution within projects, enabling faster and more accurate budget management decisions.

- Financial Ratio Analysis: This feature helps quickly and accurately analyze the company’s financial health and performance, supporting informed strategic decisions.

- Financial Statement with Budget Comparison: This feature allows businesses to clearly see how actual financial performance aligns with planned targets, helping them identify deviations and make necessary adjustments to achieve financial goals.

- Custom Printout for Invoices: This feature simplifies invoice printing for various needs with customizable formats, enhancing business branding and leaving a positive impression on customers.

In addition to offering a wide range of features, HashMicro also supports businesses by integrating various modules for comprehensive business process automation. It can seamlessly connect with third-party systems and customize features to meet specific business needs, making HashMicro a versatile and powerful solution for automating company finances.

Conclusion

Transitioning from manual to accounting automation systems offers numerous benefits, including increased efficiency, reduced errors, and better compliance. Embracing these technologies can transform your financial operations, making them more streamlined and effective.

One of the best accounting automation software solutions in the Philippines is HashMicro. HashMicro’s Accounting Software offers comprehensive features to simplify and enhance your accounting processes. Its user-friendly interface ensures that even those with limited technical skills can use it effectively.

With real-time data access, advanced reporting capabilities, and seamless integration with other business systems, HashMicro stands out as a reliable and robust solution. Additionally, it ensures full compliance with local regulations, making it an ideal choice for businesses in the Philippines.

If you want to explore how HashMicro can benefit your business, try the trial system and consultation with the professional team. This trial will allow you to experience firsthand how the software can streamline your accounting processes and determine if it fits your needs.

FAQ

-

What is automation of accounting?

Automation of accounting refers to using software to perform repetitive financial tasks such as data entry, invoicing, and reporting without manual intervention. It improves efficiency, reduces errors, and ensures timely financial management, enabling businesses to focus on strategic growth.

-

What is an automatic accounting system?

An automatic accounting system uses software to automate financial tasks such as transaction recording, invoicing, reconciliation, and reporting. It reduces the need for manual intervention, improves accuracy, and enables real-time financial insights, saving businesses time and resources.

-

What is AI and automation in accounting?

AI and automation in accounting combine intelligent software and automated processes to optimize financial workflows. They handle tasks like bookkeeping, reporting, and auditing, reducing human error, improving speed, and providing businesses with more accurate financial data for better decision-making.