According to Softwarepath, 41% of accounting worksheet reports are inaccurate due to human error. This isn’t surprising because manual errors are a common accounting problem among Filipino businesses.

Manual errors should no longer disrupt your workflow when managing accounting worksheets. These worksheets are crucial in managing daily expenses and ensuring financial accuracy in your business operations.

Managing finance worksheets manually is not the best practice. So, is there a best solution? Of course there is. Kaya, in this article, we’ll explore what an accounting worksheet is and how you can simplify your accounting processes to help you reach your business goals faster.

Table of Contents

Key Takeaways

|

What is an Accounting Worksheet?

Accounting worksheet is a tool used to help businesses prepare their financial statements. It organizes and summarizes all financial data, including account balances, adjustments, and trial balances. This allows accountants to ensure that all accounting entries are accurate before creating final financial reports.

The worksheet is not an official financial document but serves as an internal reference to track transactions and changes, check calculations, and prepare reports like year-end statements. It helps improve the accuracy and efficiency of the financial reporting process.

Hashy AI Fact

Need to know!

Accounting worksheets made easy! With Hashy AI, you can automate calculations, track changes, and prepare reports in less time. Smart, simple, and stress-free!

Get a Free Demo Now!

Types of Accounting Worksheet

Worksheets come in various forms based on the number of debit and credit columns. The company’s name, worksheet title, and the period it covers, typically placed at the top, must be included. Common formats include 6-column, 8-column, 10-column, and 12-column worksheets.

Here’s a look at some commonly used worksheets examples:

1. General Worksheet

This type of worksheet is a spreadsheet accountants use to review balances across different accounts. It typically has four to six columns, although this can vary based on company requirements. Common columns might include:

- Unadjusted Trial Balance

- Adjustment

- Adjusted Trial Balance

- Income Statement

- Balance Sheet

Example: A small business might use a general worksheet to summarize its income and expenses at the end of each month, comparing the adjusted trial balance with the income statement to spot discrepancies.

2. Detailed Worksheet

This worksheet provides a more comprehensive breakdown than the general worksheet and often includes a supplementary page with additional details. Typical entries might cover:

- Accounts Receivable and Payable Lists

- Production Costs

- Insurance Premiums

Example: A manufacturing firm may use a detailed worksheet to track production costs, listing specific material and labor expenses on a separate page for easy reference.

3. Audit Worksheet

Sometimes called an audit spreadsheet, this worksheet helps verify the accuracy of financial information by preparing financial statements. The number of columns in this worksheet can vary based on the company’s audit needs.

Example: During the yearly audit, a company could use this worksheet to cross-reference its internal records with external audit reports, ensuring alignment.

4. 12-Column Worksheet

Also known as an extended trial balance, this worksheet is especially useful for companies with retained earnings or profit-and-loss appropriation accounts, such as joint stock companies, where multiple shareholders own stock.

Example: A publicly traded company might use a 12-column worksheet to document retained earnings. This worksheet provides a detailed breakdown that includes income and equity adjustments across several columns.

Each type of worksheet serves a unique purpose, helping companies maintain clear, organized, and accurate financial records.

Key Components of an Accounting Worksheet

The key components of these worksheets are:

- Account number: Helps organize account numbers from the general ledger in the accounting system.

- Account name: Lists the names of the accounts in the general ledger.

- Trial balance: Reflects data that has been adjusted, showing the values for each account.

- Adjustment: Worksheet paper accounting shows details of the adjustments made.

- Trial balance after adjustment: Provides the final balance for each account after adjustments.

- Profit and loss: Displays income and expenses after adjustments.

- Balance sheet: Contains the final balance for all real accounts after the trial balance is adjusted.

How to Create an Accounting Worksheet

Creating an accounting worksheet requires a clear and organized approach to structuring financial data. With financial management tools, you can streamline the process and ensure accurate, reliable reporting. Follow these steps:

1. Set Up the Worksheet

Start by preparing the foundation of your accounting worksheet.

- Title and Period: Include the company name, worksheet title, and the accounting period.

- Columns: Create headers for essential columns such as Account Name, Unadjusted Trial Balance, Adjustments, Adjusted Trial Balance, Income Statement, and Balance Sheet.

- Organization: Arrange rows for each account listed in your general ledger.

2. Enter Unadjusted Trial Balances

Begin filling in the worksheet with data from your financial records.

- Source Data: Pull balances directly from the general ledger.

- Debit and Credit Columns: Record unadjusted balances under the appropriate columns to ensure they align with the chart of accounts.

- Cross-Check Totals: Verify that the total debits equal total credits to maintain accounting accuracy.

3. Record Adjustments

Document any necessary changes to ensure compliance with accounting principles.

- Identify Adjustments: Include entries for depreciation, accrued expenses, or prepaid revenues.

- Details: Specify the reason for each adjustment in a notes section.

- Calculate Impact: Reflect adjustments in the respective debit and credit columns.

4. Calculate Adjusted Trial Balances

Reassess your data to update balances after adjustments.

- Add/Subtract Adjustments: Apply each adjustment to the corresponding account balance.

- Check Totals: Confirm that adjusted debits equal credits to maintain balance.

5. Prepare Financial Statement Columns

Allocate the adjusted balances to financial statement sections.

- Income Statement Columns: Transfer all revenue and expense accounts for profit calculation.

- Balance Sheet Columns: Include assets, liabilities, and equity accounts for a snapshot of financial health.

- Link Adjustments: Ensure adjustments are applied to the correct accounts.

6. Verify Accuracy

Double-check the entire worksheet for errors or inconsistencies.

- Cross-Referencing: Match totals between trial balances and financial statement columns.

- Adjustments Review: Ensure all adjustments are correctly recorded and reflected.

- Consistency Check: Verify that every account aligns with general ledger data.

7. Finalize the Worksheet

Prepare the worksheet for internal or external use.

- Review: Confirm all entries, calculations, and adjustments are accurate.

- Presentation: Format the worksheet for clarity, including proper alignment and spacing.

- Application: Use the completed worksheet to prepare formal financial statements, such as the income statement and balance sheet.

By following these steps, you can create a detailed and accurate accounting worksheet, simplifying the preparation of financial statements and improving decision-making. For greater efficiency, consider using automated accounting tools to streamline this process.

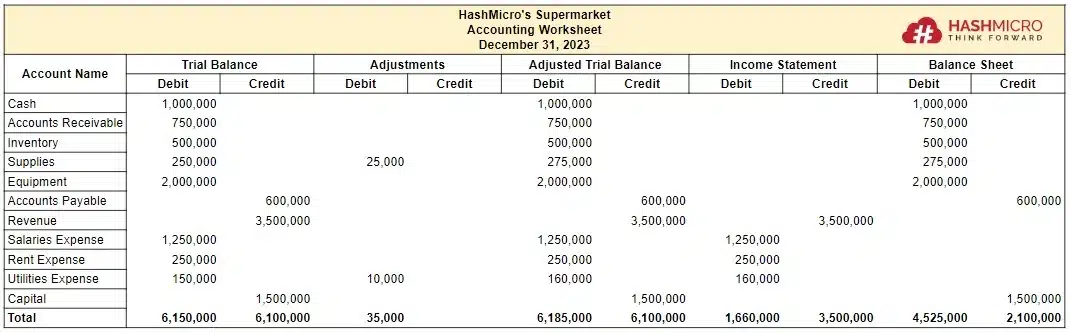

Accounting Worksheet Example that You Should Know

Business people, kahit alam na ninyo ang mga uri ng finance worksheet, maaaring mahirap pa rin isipin ang tamang example ng accounting worksheet, diba?

Therefore, here we present an example of a professional accounting worksheet template. Make sure you carefully review the following worksheet in the accounting examples so there are no mistakes in the process of making it.

- Trial balance: Lists the balances before adjustments.

- Adjustments: Any required corrections or updates, such as supplies used.

- Adjusted trial balance: Reflects the balances after adjustments.

- Income statement: Includes all income and expenses.

- Balance sheet: Displays all assets, liabilities, and equity after adjustments.

Accounting Software: The Advanced Solution for Your Accounting Software

1. Planning ahead

A worksheet helps business managers see what the company’s financial report will look like. It allows them to prepare interim financial statements and make informed decisions. The worksheet also ensures that the company’s reports follow accounting principles, such as Generally Accepted Accounting Principles (GAAP).

2. Verifying calculations

Accountants can verify that accounting entries are correct by checking the formulas and calculations in the worksheet before creating the final financial reports. Since the accounting worksheet is for internal use, its format is flexible and adaptable to the company’s needs.

3. Financial Report Preparation

Creating financial reports is a collaborative task involving accountants and financial managers, and using accounting worksheet paper helps businesses prepare monthly or quarterly reports more efficiently.

When paired with tools like automated bank matching features, the process becomes even smoother by ensuring accurate record-keeping and error-free financial data.

4. Ensuring accuracy

A worksheet for accounting helps address the common issue of data errors, which can lead to costly mistakes for businesses. Identifying these errors early ensures that decisions are based on accurate information, helping the company avoid potential financial losses.

Conclusion

Using a worksheet simplifies the process of preparing financial statements for businesses. However, with accounting software, the process becomes even more streamlined. Financial reports can be generated automatically, eliminating the need to create them manually.

Address your accounting challenges today by choosing an AI-powered accounting system that offers advanced features and a wide range of benefits, including built-in bank reconciliation integration.

These financial management tools also support seamless invoicing workflows, making it easier to manage your finances. Try a free consultation and see how it can transform your business!

FAQ About Accounting Worksheet

-

What are the basics of a worksheet?

In Excel, a worksheet is a structured grid of cells arranged in rows and columns that provides a space for data entry and manipulation. Each worksheet contains 1,048,576 rows and 16,384 columns, functioning as an extensive table for efficiently organizing and analyzing large sets of information. This grid-like format is essential for managing, calculating, and visualizing data.

-

What are the golden rules of accounting?

The golden rules of accounting are debit (what comes in and what goes out), credit (the giver and the receiver), and credit (all income and expenses).

-

What are the basics of accounting?

The basics of accounting are assets, liabilities, equity, revenue, and expenses.