Managing cash receipts efficiently plays a vital role in maintaining accurate financial records and healthy cash flow. When businesses clearly track incoming payments, they gain better visibility into daily operations.

A study by BusinessMirror highlights that 60% of small businesses in the Philippines face record-keeping errors due to manual accounting practices. This underscores the critical need for modern solutions to reduce operational inefficiencies.

However, many companies still rely on manual processes that increase the risk of errors. Issues like incorrect amounts or missing records are common and can lead to discrepancies in financial statements and operational confusion.

Table of Contents

Key Takeaways

|

What is the Cash Receipts Journal?

A cash receipts journal is a specialized accounting journal that records all cash inflows into a business during an accounting period. It tracks various transactions, such as cash sales, customer payments, and other cash inflows.

The cash receipts journal plays an important role in managing accounts receivable by ensuring every cash transaction is recorded accurately. It supports accurate general ledger records and ensures all cash-related entries are complete.

For example, a simple cash receipts journal will include details such as dates, client names, and references to paid invoices. This journal ensures businesses can quickly reconcile their cash transactions with other records.

Types of Cash Receipts

Cash receipts can be categorized into distinct types, each reflecting the source of cash inflows within a business. By understanding these categories, companies can ensure accurate record-keeping and effective cash management.

Below are the key types of cash receipts and their explanations.

1. Receipt of cash from cash sales

The cash receipts journal records all cash received from customers who purchase goods or services directly without credit terms. For accurate tracking, each transaction is documented with details like the amount, date, and customer name.

This type of receipt is critical for businesses that rely heavily on immediate cash inflows. Companies can maintain clear and accurate financial records by properly recording these transactions in the cash receipt journal for easier reconciliation.

2. Receipt of cash from credit customers

This category includes payments from customers who were extended credit terms during the initial sale. Once the credit period ends, the money collected is recorded in the cash receipts book, ensuring proper documentation of accounts receivable.

This entry reduces outstanding credit balances and helps businesses monitor aged receivables effectively. These transactions are cross-referenced with the cash payments journal for accurate financial management to ensure all balances align.

3. Receipt of cash from other sources

Cash received from sources other than sales, such as interest on bank deposits, dividends, or the sale of fixed assets, falls under this category. These transactions are logged in the cash receipts journal to record all cash inflows comprehensively.

Proper documentation of cash receipts ensures transparency and makes reporting easier. Organized records also help businesses manage additional cash inflows efficiently and comply with regulatory standards such as BIR requirements.

Additionally, maintaining a sales journal alongside the cash receipts journal ensures that both sales transactions and other cash inflows are accurately tracked, supporting efficient financial reporting and robust decision-making

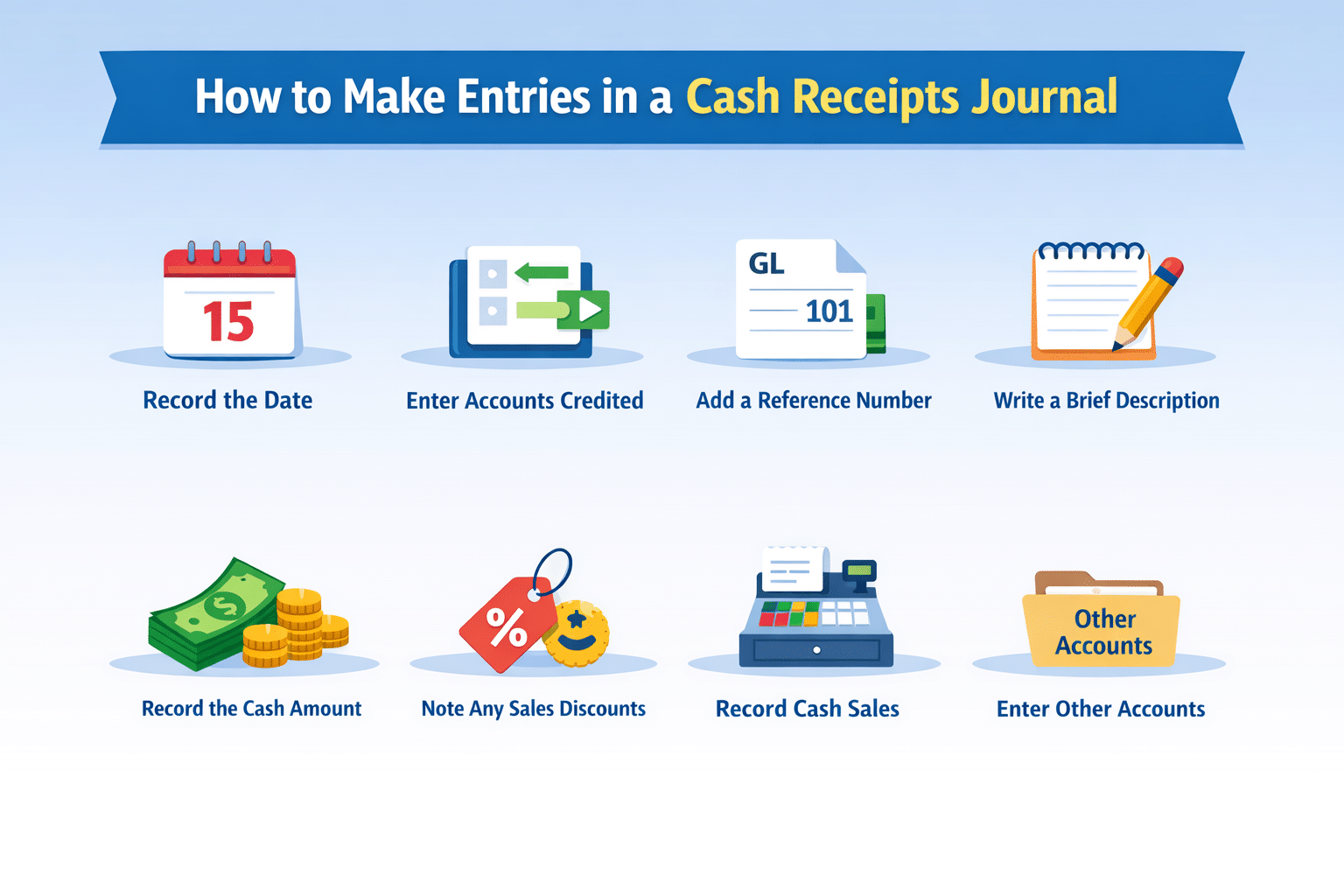

How do You Make Entries in a Cash Receipts Journal?

An accurate and organized cash receipts journal is essential for any business to track its cash inflows effectively. By systematically recording cash and non-cash transaction, companies can ensure financial transparency.

- Record the date: The first step is to log the date the cash was received, ensuring that every transaction is time-stamped accurately. This column in the cash receipts journal is crucial for tracking cash inflows and organizing records efficiently.

- Enter accounts credited: Identify the account that will be credited due to the cash received, such as sales or accounts receivable. This entry helps maintain proper alignment between the cash receipts journal and the general ledger.

- Add a reference number: Include the general ledger account number in the reference column to provide an explicit cross-reference for tracking. This ensures the cash receipts book is organized and easily reconciled during audits.

- Write a brief description: Add a short explanation of the transaction, such as “Payment for Invoice #123” or “Cash sale of goods.” These descriptions make the cash receipts journal example easier to understand and review.

- Record the cash amount: Document the amount received to reflect accurate inflows in the cash receipt journal. This entry is critical for updating the company’s cash account and maintaining accurate financial records.

- Notes any sales discounts: If a discount was offered, record the amount in the respective column of the cash receipts journal. This ensures that the total cash received aligns with the terms offered to the customer.

- Record cash sales: Log the amount received from cash sales, which contributes directly to the company’s revenue. This entry supports accurate revenue tracking in the cash payments journal and other financial records.

- Enter other accounts: Use the “Other Accounts” column for transactions that don’t fall under cash sales or accounts receivable. This ensures that the simple cash receipts journal captures all cash-related entries comprehensively.

Example of a Cash Receipt Journal

A Cash Receipt Journal is a vital tool for businesses to record all cash transactions, ensuring accuracy and transparency in financial management. The primary requirement for this journal is that the total debit column must equal the total credit column.

Below are examples of how a Cash Receipt Journal is implemented based on real-world scenarios, tailored for Filipino businesses:

Case 1: BrightMart Cash Receipt Journal (August 2022)

Transaction Details:

- August 1: BrightMart paid employee salaries amounting to ₱5,000,000.

- August 3: Earned ₱7,000,000 in cash sales.

- August 7: Received a loan of ₱15,000,000 from the bank.

- August 25: Received ₱9,000,000 on credit from a reseller, with a ₱300,000 sales discount.

Cash Receipt Journal Example:

| Date | Description | Reference | Debit | Credit | Notes |

| August 1 | Employee Salaries | ₱5,000,000 | ₱5,000,000 | Payment of salaries | |

| August 3 | Cash Sales | ₱7,000,000 | ₱7,000,000 | Sales income | |

| August 7 | Bank Loan | ₱15,000,000 | Loan received | ||

| August 25 | Reseller Payment | ₱9,000,000 | ₱9,300,000 | Sales discount ₱300K | |

| Total | ₱36,000,000 | ₱21,300,000 |

Case 2: Unity Traders Cash Receipt Journal (July 2022)

Transaction Details:

- July 4: Sold merchandise for ₱2,300,000 (Cash Receipt No. 031).

- July 8: Received ₱300,000 in interest income (Cash Receipt No. 032).

- July 11: Made cash sales totaling ₱3,700,000 (Cash Receipt No. 033).

- July 15: Received a check from “Loyal Partners” for ₱3,200,000, less a 4% discount (Cash Receipt No. 034).

- July 18: Weekly cash sales totaled ₱3,800,000 (Cash Receipt No. 035).

- July 20: Received a ₱10,000,000 loan from MetroBank (Cash Receipt No. 036).

- July 25: Cash sales for the week amounted to ₱3,200,000 (Cash Receipt No. 037).

- July 28: Received a check from “Family Essentials” for ₱1,344,000, less a 4% discount (Cash Receipt No. 038).

- July 31: Final week’s cash sales totaled ₱2,800,000 (Cash Receipt No. 039).

Cash Receipt Journal Example:

| Date | No. Receipt | Description | Debit | Credit | Notes |

| July 4 | 031 | Merchandise Sales | ₱2,300,000 | ₱2,300,000 | Sales income |

| July 8 | 032 | Interest Income | ₱300,000 | ₱300,000 | Interest earnings |

| July 11 | 033 | Weekly Cash Sales | ₱3,700,000 | ₱3,700,000 | Sales income |

| July 15 | 034 | Check from Loyal Partners | ₱3,200,000 | ₱3,072,000 | 4% sales discount |

| July 18 | 035 | Weekly Cash Sales | ₱3,800,000 | ₱3,800,000 | Sales income |

| July 20 | 036 | Bank Loan | ₱10,000,000 | ₱10,000,000 | Loan received |

| July 25 | 037 | Weekly Cash Sales | ₱3,200,000 | ₱3,200,000 | Sales income |

| July 28 | 038 | Check from Family Essentials | ₱1,344,000 | ₱1,344,000 | 4% sales discount |

| July 31 | 039 | Weekly Cash Sales | ₱2,800,000 | ₱2,800,000 | Sales income |

| Total | ₱30,516,000 | ₱30,516,000 |

These examples provide a structured guide for recording cash receipts while showcasing the importance of accurate tracking for Filipino businesses.

What are the Stages of Posting Cash Receipt Journal to Ledger?

Posting a cash receipts journal to the ledger involves several structured steps to ensure accurate financial reporting. This process summarizes transaction data and integrates it into the general ledger, the foundation for preparing financial statements.

- Posting cash column to the cash account: The total amount recorded in the cash receipts journal’s cash column is posted as a debit to the cash account in the general ledger. This step reflects the increase in cash assets resulting from all cash inflows during the accounting period.

- Posting sales column to the sales account: The total amount in the sales column is credited to the sales account in the general ledger. By recording this entry, businesses accurately track sales income generated from cash sales in their financial records.

- Posting accounts receivable to customer accounts: The amounts in the accounts receivable column represent cash collected from credit customers. These entries are posted individually to each customer’s account in the subsidiary ledger.

- Posting trade receivables column: The trade receivables column is posted as a credit to the accounts receivable account in the general ledger. This ensures that all reductions in receivables due to cash collections are accurately reflected.

- Posting other accounts to relevant ledger accounts: Amounts in the “Other Accounts” column are credited to their respective accounts in the general ledger. . However, the total of the “Other Accounts” column is not posted to any specific ledger to avoid duplication.

- Exclusions from subsidiary ledger posting: It is important to note that the total amounts from the cash and sales columns are not posted to the subsidiary ledger. This prevents discrepancies and ensures that only individual receivable entries are recorded.

To streamline this process, businesses can leverage accounting platforms, which offer features such as cash flow reports and automated ledger updates. Tools like these simplify the posting process and enhance the accuracy of financial records.

Essential Things You Need to Remember When Keeping a Cash Receipt Journal

Maintaining a cash receipts journal is essential for tracking cash inflows and ensuring the company’s financial records are up-to-date. This specialized journal records all transactions that increase the company’s cash balance, providing a clear view of cash management.

- Record cash sales accurately: When a company makes a cash sale, debit the cash account to show the inflow of money and credit the sales account to record the revenue, ensuring the transaction is properly reflected in the financial records.

- Update receivables for payments collected: For payments received on accounts receivable, debit the cash account to record the cash inflow and credit the receivable account to reduce the customer’s outstanding balance.

- Account for sales discounts: When offering sales discounts, debit the cash account for the amount received and record the discount in the sales discount account, ensuring both the reduction in revenue and the actual cash inflow are correctly reflected.

- Log returns and adjustments: If a customer returns goods, debit the cash account for any refund and credit the appropriate column, like “Other Accounts” or “Miscellaneous,” to record the return accurately.

Conclusion

A cash receipts journal plays an important role in tracking all incoming cash and keeping financial records accurate and well organized. With clear documentation, businesses can monitor cash flow more effectively and reduce the risk of recording errors.

Using digital systems to manage cash receipts helps simplify the process, improve visibility, and support better financial control. Automation also allows managers to focus more on analysis instead of manual tracking.

If you want to improve cash receipt management and financial reporting, consider a solution with automation and regulatory compliance. Start with a free consultation to see how modern accounting tools can simplify and improve your financial processes.

FAQ About Cash Receipt Journals

-

What is the journal entry of a cash receipt?

A cash receipts journal is a specialized accounting record, often considered a primary entry book, used to track sales and transactions involving cash receipts. It records sales by debiting cash and crediting sales accounts, ensuring accurate documentation of all cash-related transactions.

-

How to record a cash receipt?

Receipts can be manual or electronic and must include the amount received, payer’s name, payment purpose, and payment method (cash, check, or credit card). It’s recommended to issue pre-numbered, two-part receipts for better record-keeping.

-

What is the difference between sales journal and cash receipts journal?

The sales journal is specifically used to record all company credit sales, primarily involving inventory or merchandise. It’s important to note that only credit sales of inventory and merchandise are logged in this journal, while cash sales of inventory are documented in the cash receipts journal.