Managing project finances can be challenging with multiple factors to consider like fluctuating costs, timelines, and resources. Project accounting helps you track and manage project expenses and revenues, ensuring financial control and profitability throughout the lifecycle.

Without it, projects can face budget overruns and delays. By understanding the core principles of project accounting, you can avoid these pitfalls and drive better financial outcomes.

Discover how HashMicro’s software solutions can simplify project accounting and enhance financial management. Magpatuloy sa pagbasa upang matuto pa.

Key Takeaways

|

Table of Contents

What is Project Accounting?

Project accounting is a method of tracking the financial performance of individual projects, rather than just looking at a company’s overall financials.

It focuses on managing budgets, costs, revenues, and resources specific to each project, allowing businesses to monitor profitability, stay on schedule, and make informed decisions throughout the project lifecycle. Understanding project accounting is essential for identifying and managing potential issues like cost overruns early in the project lifecycle.

Project Accounting Principles

To ensure accurate financial tracking and decision-making at the project level, project accounting relies on several key principles:

- Cost tracking by project: All labor, materials, or overhead costs should be assigned directly to specific projects. This ensures clear visibility into where resources are being used and helps prevent cost overruns.

- Revenue recognition: Revenue should be recognized based on project progress, typically through methods like percentage-of-completion or completed-contract. This aligns revenue with actual work delivered and avoids misleading financial reporting.

- Budget vs Actual Comparison: Regularly comparing actual costs and revenues against the project budget helps identify variances early. This allows teams to take corrective action before issues escalate.

- Time and resource allocation: Tracking employee time and resource usage by project ensures accurate billing and supports better workforce planning. It also highlights how efficiently resources are being utilized.

- Project-based financial reporting: Financial reports should be available at the project level, not just the company level. This enables managers to assess the profitability and performance of each individual project in real time.

Project Accounting Benefits

Adopting project accounting provides many benefits that directly impact your organization’s financial health and operational efficiency.

By isolating financial activities at the project level, businesses can gain better control, improve decision-making, and enhance profitability. Here are the key benefits:

- Monitor and manage budgets, expenses, and revenues for each project separately, ensuring better financial oversight.

- Identify cost overruns or inefficiencies early, allowing corrective actions to improve profit margins.

- Track project progress and adjust forecasts based on actual data, leading to more accurate predictions for future financial needs.

- Assign financial responsibility at the project level, enhancing team transparency and accountability.

How Does Project Accounting Work?

Project accounting tracks all financial transactions related to a specific project, separating them from the company’s general accounting. It records each project’s income, expenses, resource usage, and budgets, giving managers clear visibility into financial performance at every stage.

This helps projects stay within budget, meet financial goals, and avoid unexpected cost overruns. The process involves setting a budget, continuously monitoring actual costs, and recognizing revenue based on project progress or milestones.

With the right system, like HashMicro’s integrated software, project accounting becomes more efficient, allowing real-time reporting, accurate billing, and better financial control throughout the project lifecycle.

What is the Difference Between Financial Accounting, Management Accounting, and Project Accounting?

Understanding the key differences between financial accounting, management accounting, and project accounting helps you determine which approach best supports your specific operational needs, and which types of accountants are best suited to handle each aspect of your business.

| Aspect | Financial Accounting | Management Accounting | Project Accounting |

|

Purpose |

External reporting and compliance | Internal decision-making | Tracking the financials of individual projects |

|

Audience |

External stakeholder | Internal management | Project managers, finance teams |

|

Focus |

Company-wide financial performance | Business unit or overall company strategy | Project-specific budgets, costs, and revenues |

|

Reporting Frequency |

Periodic (monthly, quarterly, annually) | As needed for internal analysis | Ongoing throughout the project lifecycle |

|

Detail Level |

Summarized company-wide data | Detailed performance data for departments or functions | Highly detailed and specific to each project |

Project Accounting Revenue Recognition Methods

Regarding project accounting, one of the most critical elements is how revenue is recognized. Different revenue recognition methods help businesses ensure that income is recorded to reflect a project’s actual progress and financial performance.

The proper method depends on the type of project, its timeline, and how revenue is earned. Below are four commonly used revenue recognition methods:

1. Sales basis

This method recognizes revenue when a sale is made, usually upon delivery of goods or completion of services. It is a simple approach often used in shorter-term projects where the transfer of ownership is clear and immediate.

2. Installment

The installment method recognizes revenue as payments are received over time, typically used for projects with longer durations or when payments are spread out. This approach allows businesses to align revenue with the actual cash flow, making it easier to manage income and expenses throughout the project.

3. Percentage of completion

With the percentage of completion method, revenue is recognized based on the project’s progress. As the project advances, a proportion of the total revenue is recognized, often using a cost-to-cost or effort-expended measure.

4. Completed contract

The completed contract method defers revenue recognition until the project is fully completed. This method is typically used for projects with uncertain timelines or those where significant changes in scope could affect the outcome.

Simplify Project Accounting Calculations with HashMicro Software

Efficient project accounting is crucial for keeping projects on track and within budget. With the right tools, businesses can automate calculations, track real-time financials, and ensure accuracy throughout the project lifecycle.

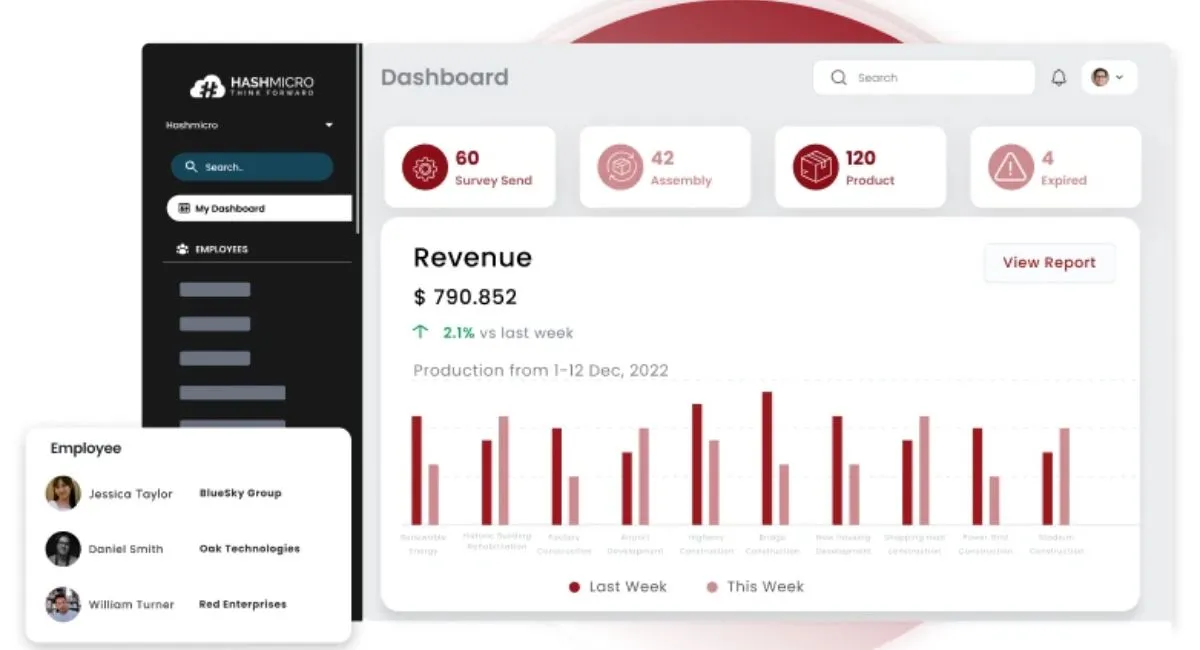

HashMicro software, powered by Hashy AI, is designed to simplify these tasks, offering smart, automated features that streamline the entire project accounting process. From tracking costs to generating insightful reports, here’s how HashMicro can help:

- Real-Time Financial Tracking: Monitor project expenses, revenues, and budgets as they happen, providing up-to-date financial insights.

- Accurate Revenue Recognition: Automatically apply the most suitable revenue recognition method, such as percentage-of-completion or installment, ensuring accurate financial reporting.

- Seamless Integration: Integrates smoothly with your existing systems, allowing for a more unified and efficient workflow across departments.

- Customizable Dashboards: Get a clear overview of project financials with easy-to-read, customizable dashboards that highlight key metrics and performance indicators.

With HashMicro, you can reduce manual errors and improve overall efficiency, allowing your team to focus on delivering successful projects.

Conclusion

Understanding project accounting and its core principles is essential for businesses aiming to manage their projects’ finances effectively.

Companies can ensure better control over their projects, reduce financial risks, and improve profitability by applying proper tracking methods, monitoring budgets, and using the right revenue recognition techniques.

To streamline your processes and improve your financial management, consider exploring HashMicro’s solutions. HashMicro can help optimize your project accounting efforts with features that simplify financial tracking and reporting.

Don’t hesitate to try a free demo to experience firsthand how the accounting system can transform your project management and accounting practices.

FAQ Project Accounting

-

What do project accountants do?

A project accountant monitors the progress of projects, investigates variances, approves expenses, and ensures that project billings are issued to customers and payments collected, where relevant.

-

What is the role of a project account?

Manages and analyzes the collection, recording, and allocation of project costs and revenue. Ensures accurate project profit and loss calculations. Analyzes budgets and actual costs.

-

What are the different types of accounting?

The five main types of accounting include cost accounting, financial accounting, forensic accounting, management accounting and tax accounting.