Efficiently managing operating expenses is critical for business success, yet it’s often a major challenge for managers balancing daily needs and budget constraints. With rising costs, the need for precise expense management has never been greater.

Many businesses face challenges like overlooked expenses, inconsistent budgeting, and insufficient tracking, which can lead to budget overruns and missed financial goals. These common pitfalls highlight the importance of structured expense management.

A study by the Philippine Institute for Development Studies (PIDS) found that approximately 30% of businesses in the Philippines face challenges in managing operational costs effectively. This highlights the need for improved expense management strategies to enhance business sustainability.

This article delves into operating expenses and explores the best accounting software philippines and solutions that can ease the burden of expense management. Keep reading to learn more about optimizing operating costs and the tools available to help.

Table of Contents

Key Takeaways

|

What is Operating Expense?

An operating expense, or OpEx, is a cost a business incurs during regular activities that is essential for sustaining daily operations. Common examples include rent, payroll, marketing, insurance, and research funds, all of which keep the business running smoothly.

Understanding operating expenses helps businesses better manage their resources, as each expense contributes to the overall operational efficiency. To calculate these costs accurately, companies often use the operating expense formula, which assists in tracking spending and controlling financial resources effectively.

When businesses know how to compute operating expenses, they can monitor their operating expense ratio, a critical indicator of financial health. Keeping a balanced ratio ensures that costs remain manageable, allocating more funds towards growth rather than just covering general and administrative expenses.

Different Types of Operating Expenses

Understanding the various types of operating expenses is essential for effective financial management. Each expense category impacts a business’s profitability, and identifying them allows companies to allocate resources wisely and maintain a balanced operating expense ratio.

- Rent: The cost of leasing business space, such as an office or warehouse, is a significant component of OpEx. Efficient rent management helps maintain a favourable operating expense ratio.

- Salaries and Wages: This is often one of the largest general expenses, covering employee compensation. Calculating it accurately with an operating expense formula ensures proper budgeting.

- Accounting and Legal Fees: Costs for professional services that support compliance and business integrity fall under administrative expenses. These fees are essential for minimizing risks and ensuring regulatory compliance.

- Bank Charges: These include transaction fees, account maintenance, and other banking services, which affect cash flow. Controlling them helps improve the operating expense ratio.

- Sales and Marketing Fees: Expenses in promoting the business and reaching customers are critical for growth. Balancing these costs wisely is crucial for effectively managing OpEx.

- Office Supplies: These are everyday items like paper and computer accessories needed for operations. Tracking these general expenses prevents minor costs from accumulating unchecked.

- Repairs: Repair costs for equipment and facilities ensure smooth, uninterrupted operations. Timely maintenance can prevent more significant and unexpected expenses down the line.

- Utilities Expenses: Essential utilities like electricity, water, and internet are necessary for daily business functions. Monitoring these costs within OpEx aids in efficient resource management.

- Cost of Goods Sold: COGS includes direct production expenses like raw materials and labour, which are fundamental to profitability. Tracking COGS along with operating expenses provides a complete financial picture.

By recognizing and controlling these operating expenses, businesses can optimize their overall OpEx and enhance financial stability. Effective expense management supports operational efficiency and empowers companies to focus on growth and long-term success.

How to Calculate Operating Expenses

Calculating operating expenses is straightforward and provides essential insights into a business’s financial health. Companies can use the operating expense formula to sum up various costs, such as payroll, rent, utilities, and marketing, to understand their overall spending.

Here’s the most common formula used to calculate operating expenses:

Operating Expenses = Payroll/Wages + Sales Commissions + Marketing/Advertising Costs + Rent + Utilities + Insurance + Taxes

To get a clear picture of operating expenses, it’s essential to include direct and general expenses supporting daily operations. Items like insurance, taxes, and administrative expenses determine the total OpEx.

Understanding how to compute operating expenses helps businesses evaluate their operating expense ratio, a key efficiency indicator. Companies can track and manage their expenses by regularly calculating this ratio, ensuring they allocate resources wisely for sustainable growth.

Examples of Operating Expenses

Operating expenses cover a business’s essential costs to keep daily operations running smoothly. These expenses are diverse, encompassing everything from employee wages to marketing and office supplies, and they play a crucial role in financial planning.

Let’s look at some key examples of operating expenses to understand how each impacts business efficiency and profitability.

1. Personnel costs

Personnel costs include salaries, benefits, and other employee-related expenses, making them a significant component of operating expenses. This general expense is essential for businesses to keep the team productive and motivated.

Personnel costs range from regular salaries and bonuses to health benefits and retirement plan contributions. By managing these costs effectively, such as by optimizing staff levels and reward systems, companies can enhance their overall operating expense ratio while maintaining a skilled workforce.

2. Occupancy expenses

Occupancy expenses cover costs associated with maintaining a business’s physical space, such as rent, utilities, and property taxes. These are crucial operating expenses directly impacting a company’s daily operations.

For example, reducing unnecessary occupancy costs, like excess storage space, can improve the operating expense ratio. Companies often evaluate options like remote work or shared office spaces to minimize these costs while meeting their space needs.

3. Administrative expenses

Administrative expenses encompass all behind-the-scenes costs that keep the business running, such as software subscriptions, legal fees, and communication costs. As part of general expenses, administrative costs ensure smooth operations but can be optimized with the right tools.

Switching to digital tracking systems or negotiating supplier contracts can lower these operating expenses. By efficiently managing administrative costs, businesses can improve their opex without sacrificing essential functions.

4. Marketing and advertising costs

Marketing and advertising costs include expenses for campaigns, ad placements, and brand promotions, which are crucial for business growth. While it may seem tempting to cut these costs, an optimized marketing strategy ensures a better operating expense ratio by targeting effective channels.

For instance, digital marketing can often reach a broader audience at a lower cost than traditional methods like TV ads. Striking the right balance between different media can maximize reach without overspending.

5. Research and Development (R&D) expenses

R&D expenses represent the costs of developing new products, improving existing ones, or exploring new technologies. Though part of operating expenses, this investment demonstrates the company’s commitment to innovation and market leadership.

Maintaining an R&D budget is essential for long-term growth in highly competitive fields. Companies like Nvidia spend billions on R&D to enter new markets, showing that a well-calculated R&D budget can set a business apart.

6. Interest and finance charges

Interest and finance charges arise when a company borrows money to support its operations or fund growth, making them a crucial part of operating expenses. For businesses, it’s essential to manage these costs by negotiating favourable loan terms and controlling debt levels.

Inventory financing, for instance, allows companies to use their inventory as collateral to secure loans with better terms. Understanding how to compute operating expenses like interest can help businesses better plan their financial strategy.

7. Depreciation and amortization

Depreciation and amortization reflect how the value of physical and intangible assets decreases over time, impacting the company’s reported expenses. While they don’t involve cash outflow, these non-cash expenses are essential for accurately presenting a business’s finances.

Depreciation applies to physical assets, while amortization relates to intangible assets like patents, lowering taxable income. Factoring in these expenses helps businesses comply with tax regulations and improves the accuracy of the operating expense formula.

Accurately tracking depreciation and amortization is simple with the right accounting system. These tools help ensure clear, compliant financial records. Try our software pricing calculator to see how an accounting system can optimize your expense tracking.

Operating vs. Non-Operating Expenses

Operating expenses are essential to a business’s daily activities, directly supporting revenue generation. These expenses include payroll, rent, utilities, and administrative expenses, which are necessary to keep the business running smoothly and are often calculated using the operating expense formula.

On the other hand, non-operating expenses refer to costs unrelated to a company’s core operations, such as interest charges on loans or losses from asset disposals. Businesses and accountants often separate these from OpEx to better understand operational performance, as they don’t reflect regular business activities.

Understanding the distinction between operating and non-operating expenses is crucial for financial accuracy, especially when assessing profitability or calculating the operating expense ratio. By focusing on core costs and knowing how to compute operating expenses, businesses can make informed financial decisions and maximize efficiency in their day-to-day operations.

OpEx vs. CapEx

OpEx, or operating expenses, are a business’s day-to-day costs to maintain smooth operations, such as payroll, rent, and utilities. These expenses are typically written off in the year they occur, helping companies calculate their operating expense ratio and manage cash flow effectively.

In contrast, CapEx, or capital expenditures, are investments in long-term assets that benefit the business over multiple years, like property, machinery, or patents. Rather than expensing them immediately, companies must capitalize on these costs, spreading the deduction over the asset’s useful life according to IRS guidelines.

The distinction between OpEx and CapEx is crucial for financial planning, as it impacts tax treatment and cash flow management. Understanding how to compute operating expenses versus capital expenditures allows businesses to assess their financial health better, accurately apply the operating expense formula, and make informed budgeting decisions.

Fixed Costs and Variable Costs

When analyzing operating expenses, managers often classify costs as either fixed or variable to understand spending patterns. Fixed costs, such as rent and insurance, remain constant regardless of production levels, offering stability for financial planning.

Variable costs, on the other hand, fluctuate with production output, including expenses like raw materials, labour, and sales commissions. By knowing how to compute operating expenses based on these variations, businesses can adapt spending to match demand.

Certain expenses can fall under fixed and variable categories depending on the role or situation. For example, a full-time employee’s salary is a fixed cost, while the wage of a production worker may vary with output, impacting the operating expense ratio accordingly.

Optimizing Your Operating Expenses with HashMicro’s Accounting Software

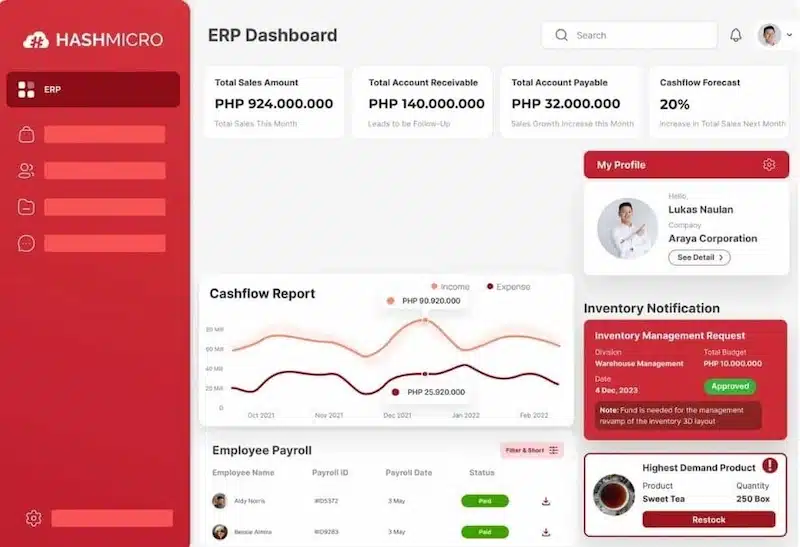

Why We Picked It: HashMicro Accounting Software is an exceptional choice for Philippine businesses looking to manage their operating expenses effectively. Not only does it offer advanced accounting tools, but it is also BIR CAS-ready, ensuring compliance with local tax regulations and streamlining reporting requirements.

HashMicro’s Accounting Software addresses common challenges in managing operating expenses, providing a comprehensive solution to improve accuracy and efficiency. With robust features tailored for accounting needs, it simplifies expense tracking, budgeting, and forecasting, helping businesses optimize their OpEx effectively.

If you want to explore this solution, HashMicro offers a free demo, allowing you to experience its capabilities firsthand. Through this demo, you’ll discover tools designed to enhance cost control, automate routine tasks, and provide businesses with a clearer view of their financial health.

Below are some key features HashMicro provides to help businesses manage their operating expenses seamlessly:

- Bank Integrations – Auto Reconciliation: This feature automatically matches bank transactions with internal records, reducing manual errors and ensuring up-to-date financial data. It streamlines monthly reconciliations, helping businesses maintain accurate and consistent expense tracking.

- Profit & Loss vs Budget & Forecast: With this tool, businesses can quickly compare actual spending against their budget, identifying variances. This insight enables proactive adjustments to keep operating expenses within planned limits.

- Cashflow Reports: Cashflow reports clearly show cash inflows and outflows, which are crucial for managing daily operational expenses. By monitoring cash positions, businesses can ensure they meet financial obligations without disrupting operations.

- Forecast Budget: This feature allows companies to predict future expenses based on historical data, enhancing budget accuracy. Businesses can use these insights to allocate resources effectively and avoid unexpected cost overruns.

- Financial Statement with Budget Comparison: This tool highlights differences between actual financial performance and budgeted figures, offering more profound insights. Companies can refine their budget strategies by tracking deviations for better cost management.

- Budget & Realization: Budget & Realization helps track expenditures in real-time, comparing them to budgeted amounts for better control. It ensures that spending aligns with financial plans, reducing the risk of overspending.

- Automated Currency Update: Automatically updating currency rates ensures accurate conversion for international transactions, minimizing financial discrepancies. This feature is essential for businesses with multi-currency expenses and supports reliable financial reporting.

- Treasury & Forecast Cash Management: This tool forecasts cash availability, enabling businesses to plan for regular expenses and maintain sufficient liquidity. It helps companies to manage their cash flow strategically, supporting operational stability and growth.

In addition to these features, HashMicro offers customization options to adapt to any business’s unique needs and complexity. The software also integrates easily with various third-party systems, providing a flexible and comprehensive solution for managing expenses and improving overall efficiency.

Conclusion

Operating expenses are essential for every business to maintain its daily operations, covering everything from payroll to utilities. Managing these expenses effectively is crucial for financial health, so companies must utilize the right software or solution to ensure accuracy, efficiency, and control over spending.

HashMicro’s Accounting Software is an excellent solution for Philippine businesses looking to streamline their operating expense management. With features like automated reconciliation, real-time expense tracking, and budget forecasting, HashMicro empowers businesses to gain better insight into their financials, optimize resources, and keep expenses in check.

To experience the full benefits, we invite you to sign up for HashMicro’s free demo. Discover how this powerful tool can transform your expense management and support your business’s financial stability and growth.

FAQ About Operating Expenses

-

What is included in operating expenses?

Operating expenses, or SG&A (selling, general, and administrative expenses), cover the essential costs of running a business. These include expenses like rent, utilities, marketing, advertising, sales, accounting, and salaries for management and administrative staff.

-

What are examples of pre-operating expenses?

Pre-operating expenses are costs incurred before a business officially opens. Examples include recruitment and training of new staff, market research, site visits, regulatory fees like permits and licenses, administrative costs like office rental, and fees for training programs or seminars.

-

What are non-operating expenses?

Non-operating expenses are costs not directly tied to the company’s core activities. These can include interest payments, one-time costs from asset disposal, or inventory write-downs.