The ability to understand and handle Net Working Capital (NWC) can make the difference between surviving and thriving. Knowing how much working capital you have and how to manage it effectively is essential, whether you’re planning for expansion or navigating seasonal cash flow management.

Despite its importance, NWC remains an overlooked metric in many local businesses. Without careful monitoring, a negative working capital can lead to late payments, missed opportunities, and strained vendor relationships.

This article explores what net working capital is, how to calculate it in the Philippines, and how strategic management of NWC can be a big help for sustainable business. Basahin ang aming artikulo tungkol sa NWC at tuklasin kung paano ito makakatulong sa pagpapalago ng iyong negosyo!

Key Takeaways

|

Table of Contents

What is Net Working Capital?

Net Working Capital (NWC) is a key financial metric that measures a company’s short-term financial health. It is calculated by deducting current assets, such as cash, accounts receivable, and inventory, from current liabilities, including accounts payable, short-term loans, and accrued expenses.

The formula is:

Net Working Capital = Current Assets – Current Liabilities

In the Philippine business context, NWC plays a critical role in daily operations. It shows how much capital is available to run the business after settling short-term debts.

While a negative NWC could indicate possible financial issues or operational inefficiencies, a positive NWC suggests the company has enough resources to meet its short-term obligations.

Read more: Top 20 Accounts Receivable Software Solutions in 2025

How to Calculate Net Working Capital

NWC calculation, as previously mentioned, is simple yet crucial to understanding the liquidity of your company.

Here’s an example of NWC in the Philippines’ businesses:

Current Assets

- Cash in bank: ₱250,000

- Accounts receivable: ₱400,000

- Inventory: ₱350,000

Total Current Assets: ₱1,000,000

Current Liabilities

- Accounts payable: ₱250,000

- Short-term loan: ₱400,000

- Taxes payable: ₱350,000

Total Current Liabilities: ₱1,000,000

Net Working Capital = ₱1,000,000 – ₱500,000 = ₱500,000

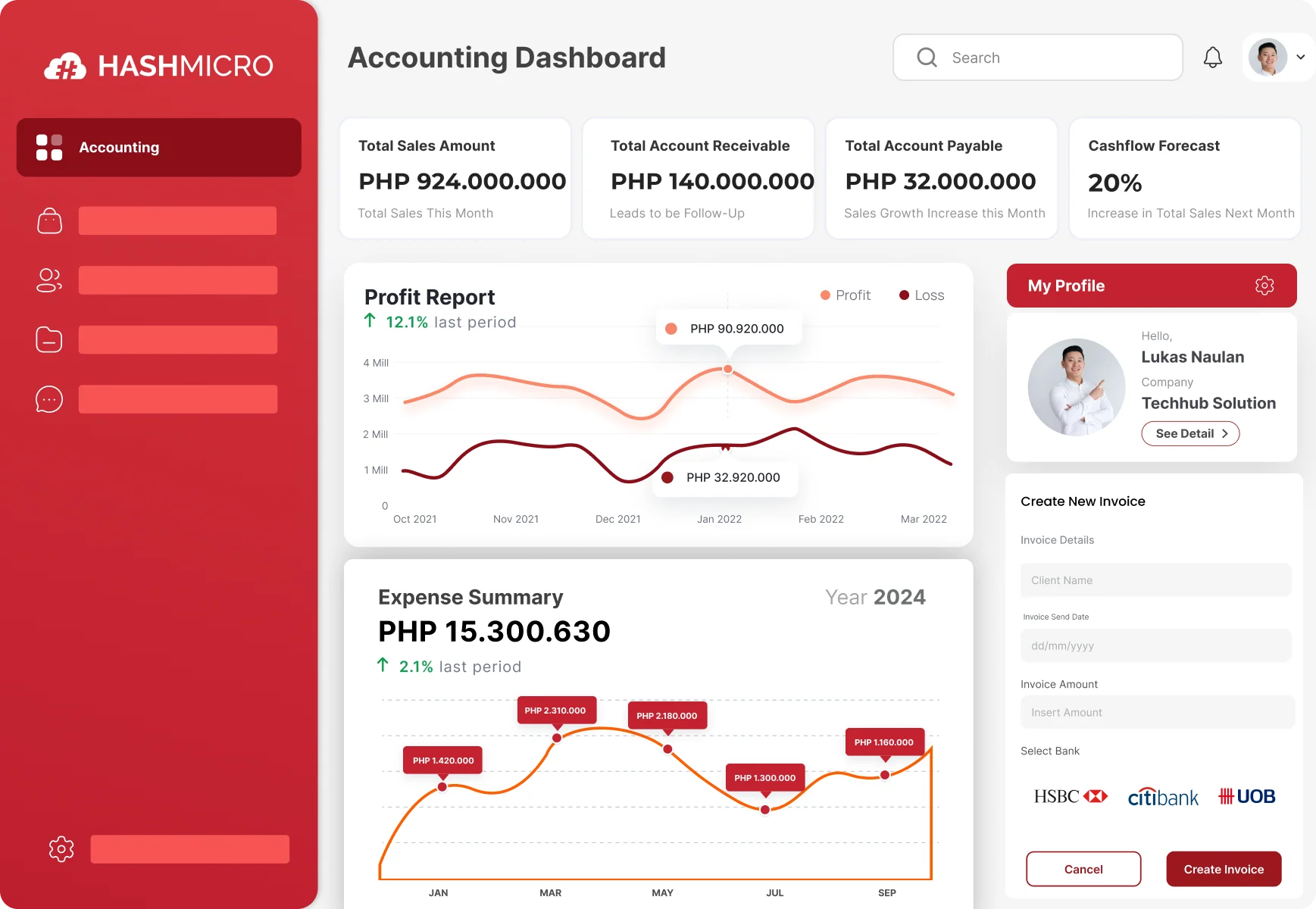

Click our banner below to see how HashMicro Accounting Software helps you take control of your NWC through an integrated ERP system that streamlines cash flow, automates invoicing, and optimises inventory levels.

Working Capital vs Net Working Capital (NWC)

In the Philippines, business owners can enhance their cash flow management, request financing, and make more informed financial decisions by understanding the distinctions between working capital as a concept and NWC as an indicator.

Here are the differences between Working Capital and Net Working Capital:

| Working Capital | Net Working Capital |

|---|---|

|

|

Calculate Net Working Capital with HashMicro Accounting Software

Monitoring NWC is crucial for local SMEs, wholesalers, retailers, and manufacturers, particularly those facing supply chain delays, various consumer payment methods, or seasonal demand fluctuations. It helps ensure that the company can pay staff, purchase products, cover utilities, and maintain efficient operations.

HashMicro Accounting Software empowers your team to make data-driven decisions that free up working capital and strengthen your financial foundation. With real-time financial insights, smart procurement tools, and automated payment tracking, you can reduce operational bottlenecks and improve liquidity.

Here are the key features of HashMicro Accounting Software:

- Hashy AI: Hashy AI reduces cash flow gaps, shortens your operating cycle, and identifies hidden working capital by continuously evaluating your payables, receivables, and inventory levels.

- Direct & indirect cash flow reports: Tracks real-time cash inflows and outflows, categorising transactions into operational, investing, and financing activities, helping improve accounts receivable and overall NWC.

- Bank loan & working capital loan tracking: These tools not only provide short-term funding to cover operational needs but also help businesses avoid liquidity crises through better financial planning and debt management.

- Online payment/e-invoice: By digitising your invoicing and payment processes, you can shorten the cash conversion cycle, optimise working capital, and support sustainable growth.

- Simple & comprehensive budgeting: Enables companies to implement purchase control settings, handle carryover balances, and create and track monthly budgets.

Conclusion

Having a healthy NWC ensures that you can meet short-term obligations, capitalise on new opportunities, and remain competitive, regardless of whether you’re a major organisation looking to expand or a small business struggling with cash flow issues.

With the right strategies and technology, such as those offered by HashMicro Accounting Software, businesses can gain better control over their liquidity and make smarter financial decisions. With HashMicro managing your NWC becomes simpler, smarter, and more impactful.

Subukan ang free demo ng HashMicro ngayon at simulang pamahalaan ang iyong negosyo nang mas madali!

FAQ About Net Working Capital

-

Is a higher or lower NWC better?

Tracking net working capital helps measure your company’s liquidity and influences cash flow, day-to-day operations, and your overall financial health. A higher NWC usually indicates greater liquidity, allowing you to cover short-term obligations. When NWC increases, it typically means that there are more current assets than liabilities.

-

What is a good NWC ratio?

If you have a net working capital ratio between 1.5 to 2, your business is likely in good financial standing. A ratio between 1 and 1.5 isn’t necessarily the end of the world, but anything lower than that indicates a struggle or complete inability to pay off current liabilities.

-

How can you determine a company’s net working capital from a balance sheet?

With access to a company’s balance sheet, net working capital can be calculated simply by subtracting current liabilities from current assets.