Imagine losing millions over time, hindi mo lang alam, kasi your assets are undervalued or unmanaged. Many businesses in the Philippines silently bleed profits because they fail to revalue and mag-track ng kanilang mga fixed assets properly.

Outdated valuation practices cause local governments to lose about ₱30.5 billion in potential annual revenue, highlighting financial risks companies face when asset values aren’t regularly updated. This may result in poor financial planning, inaccurate insurance, and misaligned tax liabilities.

The good news? Structured practices and modern tools are now available to help you perform accurate asset revaluation, ensuring your financial statements truly reflect today’s values. This not only improves transparency and compliance but also empowers smarter investment decisions and strengthens your company’s credibility.

Many forward-thinking firms across the Philippines have already improved their asset strategies through updated valuation practices. Curious if this approach could work for your business too? Let’s explore it together.

Key Takeaways

|

Table of Contents

What Is Asset Revaluation?

Asset revaluation involves adjusting the book value of a fixed asset so that it reflects its current market value. This change can either increase or decrease the recorded value, depending on market fluctuations or business circumstances.

Businesses in the Philippines may choose to conduct asset revaluation for multiple reasons, including corporate mergers, acquisitions, asset disposal, or simply to maintain accurate financial reporting. It’s also a valuable practice when evaluating whether assets are meeting return expectations or if restructuring is necessary.

- Asset revaluation updates the book value of a fixed asset to its fair market value, either increasing or decreasing it, based on whether the asset has appreciated or depreciated. This is often essential during mergers, disposals, or corporate realignments.

- Common asset revaluation methods include indexation, market-based pricing, and third-party appraisals.

- Revaluation gives businesses a clearer understanding of the real value of their holdings, and an upward adjustment allows more depreciation, which can result in tax advantages.

These points make it clear that asset revaluation is a vital financial practice that supports growth, transparency, and smarter asset management.

Asset Revaluation Method

There’s no universal formula when it comes to asset revaluation. Businesses in the Philippines usually select a method based on asset type, purpose of valuation, and the availability of reliable market data.

|

Method |

Description |

Common Use |

|

Indexation |

Adjusts cost using official inflation indices | Long-held fixed assets |

|

Market Price |

Uses current selling price in open market | Land, buildings, machinery |

|

Appraisal |

Valuer estimates based on asset condition | Insurance or audits |

Each of these methods has its own application and relevance depending on the type of asset:

- The Indexation Method is ideal for companies with assets that have been held for several years. It uses official inflation data (often published by government agencies) to estimate present-day values.

- The Current Market Price Method is typically used for assets like land, buildings, and machinery. Local real estate agents and equipment suppliers are commonly consulted to determine an accurate asset valuation.

- The Appraisal Method involves hiring a certified technical valuer. This method is especially useful when applying for insurance coverage or complying with audit requirements. The assessment takes into account factors like the asset’s purchase date, hours of usage, type, maintenance history, and future parts availability.

Choosing the right method for your asset revaluation ensures compliance and gives stakeholders a transparent view of your company’s asset strength.

Examples of Asset Revaluation

To better understand how asset revaluation works in practice, the following examples illustrate how both upward and downward adjustments are reflected in accounting records, as well as how revaluation affects depreciation.

Example 1: Increase in asset value

Scenario:

ABC Ltd. owns a building listed in their books at ₱9.6 million. After revaluation, its market value is determined to be ₱11.3 million.

What happens:

The ₱1.7 million increase is credited to the asset revaluation reserve. This change appears on the balance sheet, not in the profit and loss statement, since it’s not considered earned income.

Example 2: Drop in asset value

Scenario:

ABC Ltd. revalues one of its warehouses and finds its market value has decreased from ₱10 million to ₱8 million.

What happens:

The ₱2 million reduction is deducted from the revaluation reserve. If the reserve isn’t sufficient, the difference is recorded as a loss in the profit and loss statement.

Example 3: Asset Purchase and Revaluation

Scenario:

XYZ Corp. starts the year with fixed assets worth ₱2.8 million. They buy new equipment worth ₱1.1 million. By the end of the year, after revaluation, the total asset value stands at ₱3.5 million.

Calculation:

₱2.8M + ₱1.1M = ₱3.9M (Total before revaluation)

₱3.9M – ₱3.5M = ₱400,000 depreciation

What happens:

The company calculates the difference between the total asset value before and after revaluation. The ₱400,000 difference becomes part of depreciation or revaluation adjustment, depending on the accounting method used.

Example 4: Revaluation after asset sale

Scenario:

XYZ & Co. begins with ₱2.8 million in fixed assets and sells assets worth ₱1.1 million. The remaining assets are revalued at ₱1.4 million.

Calculation:

₱2.8M – ₱1.1M = ₱1.7M (Adjusted asset base)

₱1.7M – ₱1.4M = ₱300,000 depreciation

What happens:

The ₱300,000 decrease is treated as depreciation under the revaluation model, and depending on the balance in the asset revaluation reserve, it may also impact tax reporting and the asset’s book value.

Benefits of Asset Revaluation

Conducting an asset revaluation offers several practical benefits of asset audit for businesses aiming to keep their financial records accurate and strategic decisions well-informed.

- Increases cash profit

A higher asset value leads to increased depreciation, which can boost cash profit when added back to net income. - Improves negotiation position

During a merger or takeover, a clear and updated asset valuation helps justify a better deal. - Enables fixed asset replacement

Funds in the asset revaluation reserve can support asset renewal at the end of useful life. - Lowers leverage ratio

Revaluation raises asset totals, helping reduce the debt-to-capital ratio. - Offers tax benefits

More depreciation can mean lower taxable income and greater savings. - Supports accurate business valuation

Ensures your books reflect market changes and expansion, aiding investor trust and financing.

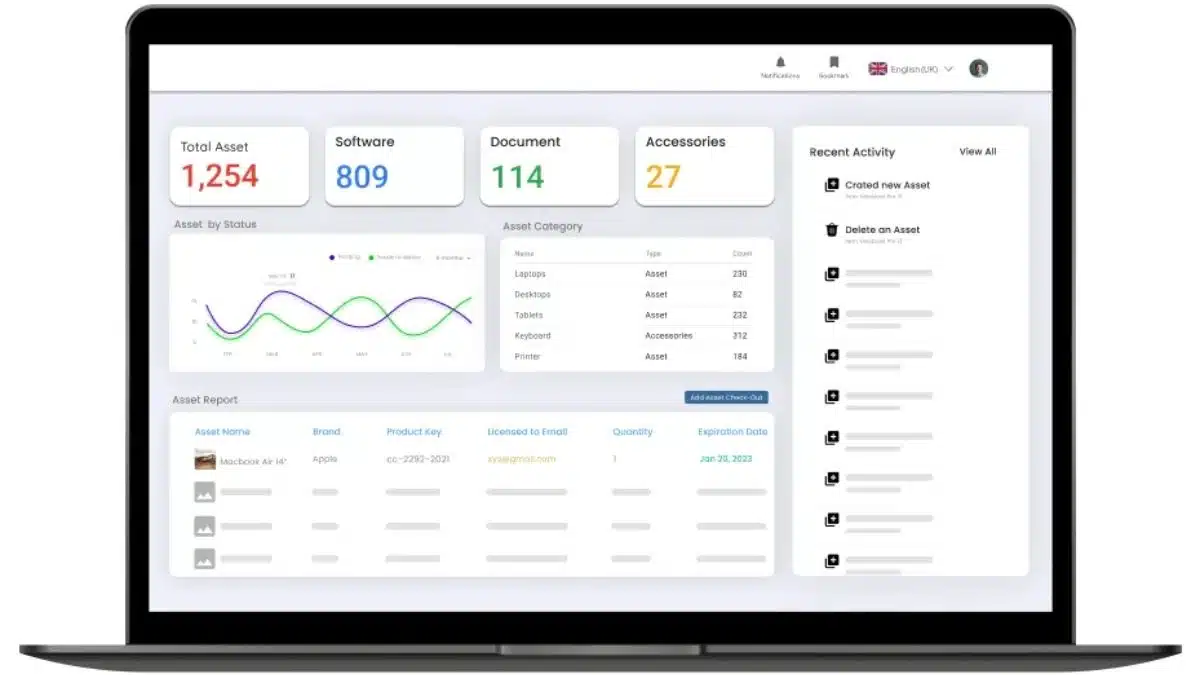

By using asset management software, companies can manage revaluations with greater accuracy and fewer manual steps, saving time, resources, and compliance risks.

For businesses interested in adopting a smarter asset tracking and valuation system, here’s a quick look at the available pricing options from HashMicro to help you plan your next move.

Disadvantages of Asset Revaluation

While asset revaluation provides financial transparency and potential tax benefits, it also comes with certain drawbacks that businesses in the Philippines must carefully consider:

- Irregular depreciation patterns

When revaluation is not done annually, depreciation becomes inconsistent, making year-on-year comparisons less reliable.

- High revaluation costs

Engaging technical experts for accurate valuations can be costly, reducing net profit due to added professional fees.

- Subjective estimations

The process often involves assumptions and analyst judgment, which may lead to overvaluation or undervaluation of assets.

- Operational complexity

Revaluation requires significant time, detailed data collection, and skilled valuation professionals, increasing operational workload.

- Impact on tax liabilities

If revaluation results in higher asset values, it may lead to increased profits—and thus, higher tax obligations.

- Effects of market fluctuation

Asset values can change frequently due to market shifts, requiring continual adjustments that complicate accounting.

- Downward revaluation accounting

If the asset’s value drops and no sufficient balance exists in the asset revaluation reserve, the reduction must be recorded as a loss in the profit and loss account.

Streamline Asset Valuation Using HashMicro’s Asset Management Software

Manually tracking and valuing fixed assets can be time-consuming, prone to error, and often lack real-time visibility. HashMicro’s Asset Management Software is designed to eliminate these challenges by streamlining the entire asset revaluation process through automation and integration.

Here are some of the key features that make this solution indispensable:

- Comprehensive cost reporting

Gain a clear view of the costs tied to each asset, improving transparency and making it easier to evaluate asset performance and ROI.

- Real-time GPS asset tracking

Monitor asset locations with GPS technology to ensure records remain accurate and up-to-date, especially for mobile or distributed assets.

- Parent-child asset management

Manage interconnected assets, like machinery with individual components, by tracking them under one centralized structure.

- Integrated accounting and depreciation tracking

Automatically calculate and record depreciation by syncing with your accounting system, ensuring your books reflect the real-time value of every asset.

Cloud-based asset management software like HashMicro’s helps businesses in the Philippines stay compliant and improve decision-making through enhanced financial planning and asset insights. With these tools, companies can conduct valuations more accurately, reduce manual work, and enhance operational efficiency.

Conclusion

Accurate asset revaluation is essential for financial transparency, better tax planning, and strategic decisions. It ensures that the true value of your fixed assets is reflected in your records, especially during mergers, funding, or business expansion.

HashMicro’s Asset Management Software simplifies this process through automation. With real-time tracking, cost reporting, depreciation integration, and parent-child asset management, it enhances accuracy while saving time and resources.

Ready to make smarter, faster asset decisions? Book a free demo with HashMicro and experience how our solution supports better valuation, reporting, and long-term business growth.

FAQ About Asset Revaluation

-

How to treat asset revaluation in consolidated financial statements?

In consolidated accounts, revaluation of assets is reflected in the parent company’s balance sheet. Adjustments made at the subsidiary level are also consolidated and impact the group’s equity via the revaluation reserve.

-

When should an asset be revalued?

Assets should be revalued when there’s a material difference between the book value and market value. This could be triggered by inflation, business restructuring, or prior to external audits and reporting.

-

Can revaluation affect dividend distribution?

Yes. While asset revaluation can increase equity, it does not increase distributable profits. Dividends are paid from retained earnings, not from revaluation reserves, unless local laws allow otherwise.

-

What are the risks of not revaluing assets regularly?

Failure to revalue assets can result in undervaluation or overvaluation, leading to incorrect financial reporting, poor decision-making, and challenges during audits or asset-based lending.

-

Is asset revaluation mandatory for all businesses?

Not always. It depends on the accounting standards you follow (e.g., IFRS or local GAAP) and whether revaluation is required for specific compliance, audit, or strategic reasons.