Why is ledger management considered the foundational pillar of a company’s financial integrity, and how can weak or inefficient processes lead to inaccurate financial statements, poor strategic decisions, and serious compliance risks?

Ledger management is the system that records, organizes, and summarizes every financial transaction in a business. It serves as the definitive source for financial data and ensures that all reports are built on accurate, consistent information.

This guide explores the core principles of effective ledger management, including its key components, step by step processes, common challenges, and the role of modern technology in improving accuracy and efficiency.

Key Takeaways

|

Table of Contents

What Is Ledger Management and Why Is It Crucial for Your Business?

At its core, ledger management is the process of recording, classifying, and summarizing a company’s financial transactions within a general ledger. This system acts as the central repository from which all financial statements are generated, providing a complete and balanced record of a company’s financial health. It is the single source of truth that captures every economic event, from a simple sale to a complex asset acquisition, ensuring that nothing is overlooked. This comprehensive record-keeping is what allows for a transparent and auditable financial history.

For business leaders, mastering ledger management is not merely an accounting task; it is a strategic imperative that underpins financial transparency, operational efficiency, and informed decision-making across the entire organization. A well-managed ledger provides the clarity needed to assess performance, allocate resources effectively, and navigate the complexities of the modern business landscape. To fully appreciate its role, let’s explore the key reasons why robust ledger management is non-negotiable for any successful enterprise. Each of these functions directly contributes to the stability and growth potential of your business, making it a critical area of focus for management.

1. Foundation for accurate financial reporting

The primary purpose of the general ledger is to provide the data needed to create accurate and timely financial statements, including the balance sheet, income statement, and cash flow statement. Without a meticulously managed ledger, these reports would be unreliable, offering a distorted view of the company’s performance and financial position. This accuracy is essential not only for internal analysis but also for external stakeholders such as investors, lenders, and regulatory bodies who rely on these documents to assess the company’s viability and compliance. A clean ledger ensures that every figure presented in these reports can be traced back to a specific transaction, building trust and confidence among all parties involved.

2. Enables strategic decision-making

Executive leaders and managers depend on precise financial data to make critical business decisions, from budgeting and resource allocation to investment strategies and expansion plans. A well-maintained ledger provides real-time insights into revenue streams, cost structures, and overall profitability, allowing leadership to identify trends, spot opportunities, and address potential issues before they escalate. For instance, detailed expense tracking can reveal areas of overspending, while revenue analysis can highlight the most profitable products or services. This data-driven approach empowers the organization to navigate market changes with confidence and allocate capital where it will generate the highest return.

3. Ensures regulatory compliance

Businesses are subject to a wide array of financial regulations and tax laws that mandate accurate and transparent record-keeping. Effective ledger management creates a clear and comprehensive audit trail of all financial activities, making it easier to demonstrate financial compliance with standards like GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards). This systematic approach minimizes the risk of penalties, legal disputes, and reputational damage associated with non-compliance. It ensures the company maintains its good standing with government authorities and operates within the legal framework of its jurisdiction.

4. Simplifies the audit process

Whether for internal review or external audit, a well-organized and reconciled ledger significantly streamlines the entire process. Auditors require easy access to detailed transaction histories and supporting documentation to verify the accuracy of financial statements. Proper ledger management ensures that all information is readily available and systematically categorized, reducing the time and resources required for audit preparation. This efficiency not only lowers audit costs but also fosters a smoother, more collaborative relationship with auditors, as they can quickly validate the integrity of the financial records without extensive back-and-forth communication.

The Core Components of a General Ledger System

The general ledger system is not a single entity but a collection of interconnected components that work together to create a complete financial picture. Understanding these core elements is essential for anyone involved in managing a company’s finances, as each plays a distinct and vital role in the accounting cycle. From the foundational structure of accounts to the final reports, these components ensure that every transaction is captured, categorized, and summarized correctly. Each piece builds upon the last, creating a logical flow of information that maintains balance and accuracy throughout.

A robust ledger system provides the framework needed to translate raw transactional data into meaningful financial insights, offering a clear and auditable trail for every financial event. Its structure is designed to be both comprehensive and logical, allowing for detailed analysis while maintaining a high-level overview of the company’s financial standing. Let’s break down the fundamental components that constitute a comprehensive and effective general ledger system, exploring how each contributes to the overall integrity of the financial records.

1. Chart of Accounts (COA)

The Chart of Accounts is the backbone of the general ledger, providing a complete and structured listing of every account in the system. It is organized by type: assets, liabilities, equity, revenue, and expenses, which form the five major categories of accounts. Each account is assigned a unique number and name, creating a hierarchical framework that allows for consistent and standardized classification of all financial transactions. A well-designed COA is crucial for generating accurate financial reports and can be customized to fit the specific operational needs and reporting requirements of the business, no matter its size or industry.

2. Journal entries

Journal entries are the initial records of financial transactions before they are posted to the general ledger, detailing the date, the accounts affected, and the debit and credit amounts. Following the principles of double-entry bookkeeping, every journal entry must have equal debits and credits, ensuring that the accounting equation (Assets = Liabilities + Equity) remains in balance. These entries serve as the primary data source for the ledger and provide a chronological log of all business activities, complete with descriptions and supporting references. This detailed record is essential for creating a transparent and verifiable audit trail.

3. Trial balance

A trial balance is an internal report that lists all the general ledger accounts and their respective balances at a specific point in time. Its primary purpose is to verify the mathematical equality of debits and credits after posting all journal entries, acting as a crucial checkpoint before the preparation of financial statements. If the total debits do not equal the total credits, it indicates an error in the recording or posting process that must be identified and corrected. The trial balance is a key internal control tool that helps ensure the integrity of the financial data before it is presented to external stakeholders.

4. Financial statements

Financial statements are the final output of the accounting cycle, summarizing a company’s financial performance and position over a specific period. The primary statements generated from the general ledger are the income statement, which shows revenues and expenses; the balance sheet, which presents assets, liabilities, and equity; and the statement of cash flows, which details the movement of cash from operating, investing, and financing activities. These reports are used by both internal and external stakeholders to evaluate the company’s health, profitability, and liquidity, enabling them to make informed economic decisions.

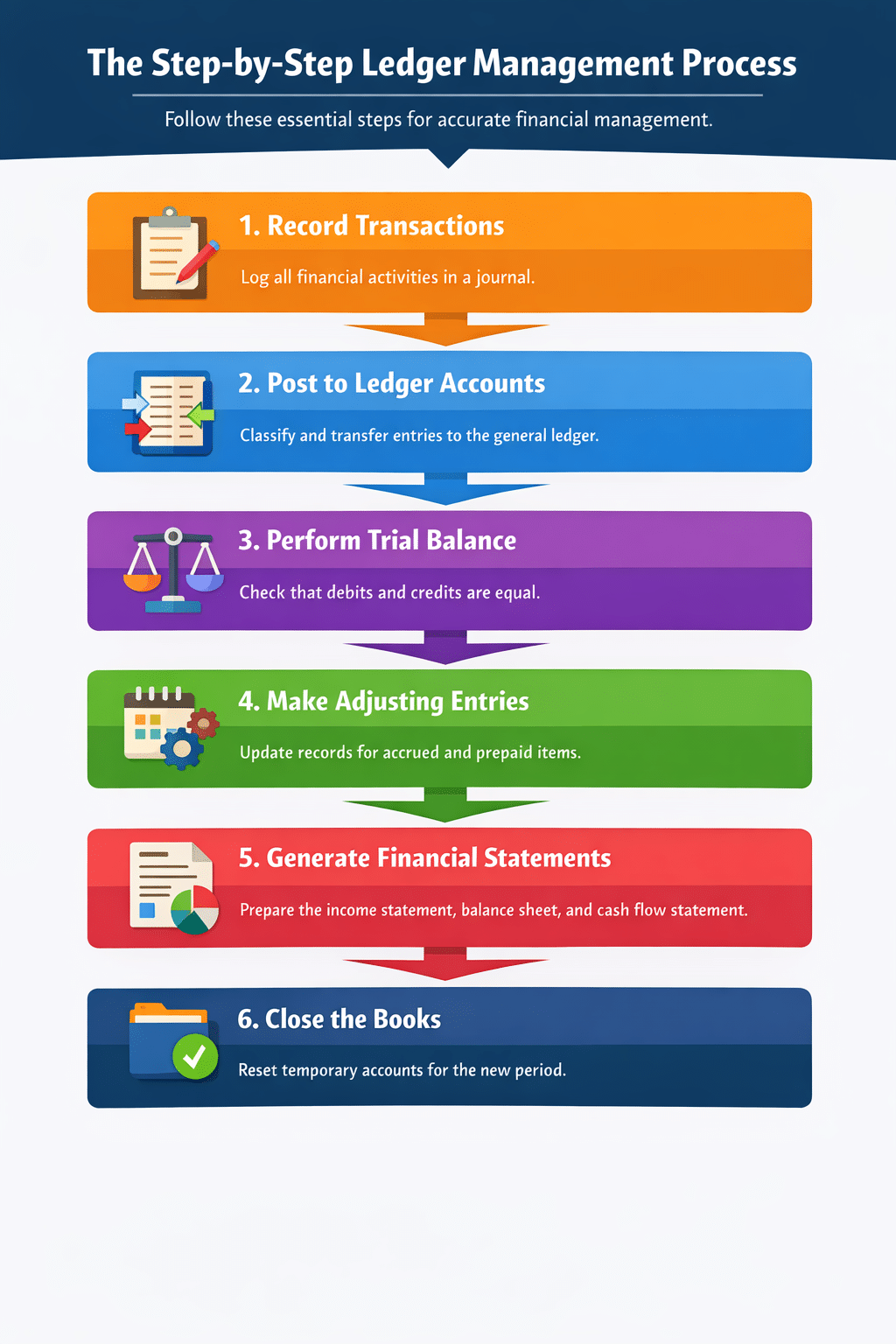

The Step-by-Step Ledger Management Process

Effective ledger management follows a systematic, cyclical process known as the accounting cycle, which ensures that all financial transactions are accurately recorded and reported. This structured workflow transforms raw data from daily business operations into reliable financial statements, providing a clear and consistent view of the company’s financial health. Understanding this process is fundamental for maintaining financial integrity and supporting the entire record to report process. This cycle is repeated for each accounting period, whether it is monthly, quarterly, or annually.

Following these steps diligently is crucial for producing financial information that is both accurate and compliant with accounting standards. Here is a detailed breakdown of the essential steps involved in a typical ledger management cycle, from the initial transaction to the final closing of the books.

1. Recording financial transactions

The process begins with identifying and recording every financial transaction as it occurs, supported by source documents like invoices, receipts, or bank statements. These transactions are first entered into a journal in chronological order, capturing the essential details of each event, including the date, amount, and accounts involved. This initial recording is the foundation of the entire accounting cycle, and its accuracy is paramount to ensure the integrity of the financial data that follows. Modern systems often automate this capture from various business operations like sales or procurement.

2. Classifying and posting to ledger accounts

After being recorded in the journal, each transaction is classified and posted to the appropriate accounts in the general ledger. This step involves transferring the debit and credit amounts from the journal entry to the specific ledger accounts listed in the Chart of Accounts. For example, a cash sale would increase the ‘Cash’ account and the ‘Sales Revenue’ account. This process aggregates all transactions affecting a single account, providing a consolidated view of its activity and ending balance for the period.

3. Performing trial balance

At the end of an accounting period, an unadjusted trial balance is prepared to ensure that the total debits in the general ledger equal the total credits. This is a critical verification step to confirm the mathematical accuracy of the posting process before proceeding further. It serves as an internal control to catch errors early. Any discrepancies found in the trial balance must be investigated and corrected, as they indicate an error in the preceding journalizing or posting steps that could distort the final financial statements.

4. Making adjusting entries

Adjusting entries are journal entries made at the end of the accounting period to record revenues and expenses that have not yet been recorded but belong to the current period. These adjustments are necessary to adhere to the accrual basis of accounting, which recognizes revenues when earned and expenses when incurred, regardless of when cash is exchanged. Common adjustments include accrued expenses (like unpaid salaries), prepaid expenses (like insurance), accrued revenues (like services performed but not yet billed), and depreciation. This ensures that the financial statements accurately reflect the company’s performance and position for that specific period.

5. Generating financial statements

Once all adjusting entries are posted and an adjusted trial balance is confirmed to be in balance, the formal financial statements can be prepared. The income statement is typically created first to determine the net income or loss, followed by the statement of retained earnings, which uses the net income figure. Finally, the balance sheet is prepared, incorporating the updated retained earnings balance. These reports summarize the company’s financial activities and position, providing crucial insights for management, investors, and other stakeholders for decision-making.

6. Closing the books

The final step in the cycle is the closing of the books, where temporary accounts, such as revenue, expense, and dividend accounts, are closed out. Their balances are transferred to a permanent equity account, typically retained earnings, which resets their balances to zero for the start of the next accounting period. This process formally concludes the current period and prepares the accounting system for the new one, ensuring a clean slate for future transactions. Permanent accounts, like those on the balance sheet, are not closed and their ending balances carry forward as the beginning balances for the next period.

Common Challenges in Ledger Management (and How to Overcome Them)

1. Manual data entry and human error

One of the most significant and persistent challenges is the reliance on manual data entry, which is inherently slow, labor-intensive, and highly susceptible to human error. A single misplaced decimal, transposed number, or incorrect account classification can cascade through the financial statements, leading to inaccurate reporting and requiring hours of painstaking work to trace and correct. These errors not only undermine the reliability of financial data but also divert valuable accounting resources from more strategic, analytical tasks. The solution lies in automation, where accounting software can directly pull transaction data from other systems, minimizing manual touchpoints and drastically reducing the risk of error.

2. Lack of real-time visibility

In many organizations, the ledger is only updated periodically, such as at the end of the day, week, or even month. This results in a significant lag between when a transaction occurs and when it is reflected in the financial system, a problem known as data latency. This lack of real-time visibility prevents managers from making timely, data-driven decisions and can obscure the true financial position of the company at any given moment. To overcome this, businesses should adopt cloud-based accounting systems that integrate with other operational platforms (like POS or e-commerce) to update the ledger instantly as transactions happen, providing an up-to-the-minute view of financial health.

3. Difficulty in scaling with business growth

Manual or semi-automated ledger management systems that work for a small business can quickly become overwhelmed as the company scales. A growing volume of transactions, an expanding Chart of Accounts, the complexity of multi-entity or multi-currency operations, and new reporting requirements can strain legacy systems to their breaking point. This lack of scalability leads to bottlenecks in the financial closing process, increases the likelihood of errors, and makes it difficult to maintain consistent financial controls across the organization. Implementing a scalable ERP system with a robust accounting module is the most effective solution, as it is designed to handle increasing complexity and transaction volumes without sacrificing performance.

4. Ensuring data security and compliance

The general ledger contains highly sensitive financial data, making its security a top priority. Inadequate controls, such as shared passwords, lack of role-based access, or a missing audit trail, can expose the company to internal fraud and unauthorized data manipulation. Furthermore, ensuring that all transactions are recorded in compliance with ever-changing tax laws and accounting standards like IFRS 17 is a constant challenge. Modern accounting software addresses this by providing robust security features, including user-level permissions, encrypted data storage, and a comprehensive, unalterable audit trail that logs every change. These systems are also regularly updated to reflect the latest compliance requirements, reducing the burden on the finance team.

The Role of Technology in Modernizing Ledger Management

The traditional, manual approach to ledger management is no longer sustainable in today’s fast-paced and data-driven business environment. The persistent challenges of human error, data lags, and scalability issues have driven a fundamental shift toward technology-driven solutions. Modern accounting software and integrated Enterprise Resource Planning (ERP) systems have revolutionized ledger management by automating repetitive tasks, centralizing financial data, and providing unprecedented real-time visibility. This technological transformation is not just about improving efficiency; it is about empowering businesses to turn their financial data into a powerful strategic asset. By leveraging automation, companies can ensure a higher degree of accuracy, strengthen internal controls, and free up their finance teams to focus on value-added analysis rather than tedious data entry.

Integrated ERP systems with advanced accounting modules represent the pinnacle of this evolution, offering a holistic solution that addresses the core challenges of ledger management head-on. These platforms create a single source of truth for all financial data by unifying accounting with other critical business functions like sales, procurement, and inventory. This deep integration eliminates data silos and automates the flow of information, ensuring that every transaction is captured accurately and posted to the general ledger in real time. Features such as automated bank reconciliation, customizable financial dashboards, and built-in compliance checks empower business leaders with the timely, reliable insights needed for agile decision-making. Ultimately, adopting this technology is a critical step in building a scalable, secure, and strategically-focused finance function prepared for future growth and complexity.

Conclusion

Effective ledger management is far more than a procedural necessity; it is the bedrock of financial transparency, strategic agility, and long-term business resilience. From providing the data for accurate financial reporting to enabling compliance and simplifying audits, a well-maintained ledger empowers leaders to steer their organizations with confidence and precision. A reliable ledger system ensures that every financial decision is based on a solid foundation of truth, fostering trust with investors, regulators, and other key stakeholders.

Traditional manual methods lead to errors, inefficiency, and delayed insights that can limit business growth. By adopting modern, automated systems, you gain real time visibility and turn your ledger into a powerful tool for smarter decisions and stronger performance. Ready to upgrade your financial operations? Get a free consultation today and see how better ledger management can drive sustainable success.

Frequently Asked Question

The main purpose of a ledger is to act as the central repository for all of a company's financial transactions, organized by account. It provides the complete and balanced data necessary to create accurate financial statements like the balance sheet and income statement.

A journal is the first place a transaction is recorded chronologically (the book of original entry), detailing debits and credits. A ledger is the book of final entry, where transactions from the journal are grouped together by account to show the balance of each account.

Double-entry bookkeeping is crucial because it ensures the accounting equation (Assets = Liabilities + Equity) remains in balance. Every transaction affects at least two accounts with equal debit and credit entries, which provides a self-checking mechanism that enhances accuracy and prevents errors.