Choosing the right accounting software in the Philippines can be challenging because businesses vary widely in size, industry, and financial complexity. With so many options available, it’s easy to feel overwhelmed by features, pricing, and technical requirements.

The ideal accounting system should simplify financial management rather than complicate it. It needs to handle tasks like bookkeeping, tax compliance, payroll, and reporting while remaining intuitive and adaptable to the way your business operates.

Focusing on the features that matter most, such as BIR compliance, real-time reporting, and scalability, can make it easier to identify a solution that meets your needs. The right software ensures accuracy, saves time, and helps maintain smooth financial operations.

Table of Contents

Key Takeaways

|

A Quick Review of the Top Accounting Software in the Philippines

Choosing the best accounting software for Philippine businesses is key to managing finances efficiently. To help you decide, we’ve listed the top accounting system Philippines options suited for various business needs.

Best Because

The best end-to-end solution for all types of business needs

Best Because

Intuitive and easy to use, but not ideal for extensive collaboration.

Best Because

Best for small to midsize firms across many sectors.

Best Because

Best for organizations needing strong financial automation and compliance

Best Because

Best for small business finance tracking.

Table of Contents

Understanding Accounting Software and Its Practical Uses

Accounting software is used by accountants and finance teams to manage a company’s financial activities in a more organized and efficient way. It helps with things like recording transactions, managing cash flow, preparing tax reports, and monitoring expenses.

When it comes to choosing accounting software for business decision-making, you want something that saves time and cuts down on repetitive manual work. Tasks like typing in data by hand not only take longer but also make people more prone to mistakes.

By automating calculations and reports, accounting management tools that helps improve accuracy and give finance teams more time to focus on analysis and strategic planning instead of routine admin work.

The Function of Accounting Software

Accounting software serves as the backbone of financial management by automating routine tasks and organizing key data. Understanding its functions helps you see how it improves accuracy, efficiency, and overall control of business finances.

- General ledger management: Maintains a structured, accurate record of all financial activities using double-entry bookkeeping as its foundation.

- Bank reconciliation: Syncs bank transactions with internal records to identify inconsistencies and maintain accurate balances.

- Tax preparation: Helps streamline tax filing by tracking deductible expenses and computing applicable taxes.

- Transaction recording: Automatically logs daily financial activities, such as payments, sales, and purchases, often by linking directly to bank or card accounts.

- Financial reporting: Delivers real-time statements like balance sheets and profit-and-loss reports to reflect overall economic performance.

- Accounts receivable and payable: Oversees customer billing and supplier payments, from issuing invoices to monitoring outstanding balances.

What are the Benefits of Accounting Software?

Accounting software offers various benefits to those who use it, including ensuring that the company’s accounting system is implemented well. Here are some key benefits of accounting software:

- Efficiency and Accuracy: Automates calculations, reduces human error, and ensures accurate financial reporting and tax compliance.

- Real-Time Financial Insights: Provides up-to-date reports on cash flow, expenses, profits, cash ratio, and return on equity (ROE), so the company can track where its funds are used and make adjustments immediately.

- Time Savings: Speeds up processes such as invoicing, sales orders, rebate accounting, adjusting entries, journal entries, payroll, reconciliation, accounts receivable, purchase journal, and Year-End Accounting.

- Cost Management and Structure: Tracks expenses, budgets, marginal costs, and manufacturing overhead costs, enabling upper management to identify cost-saving and revenue-cost opportunities.

- Accessibility: Cloud-based software provides access to financial data anytime and anywhere, making it easier for teams to use the sales and inventory accounting, and allowing anyone who needs it to access the data.

- Forecasting Tools: Help predict future financial performance by analyzing historical data, enabling the company to implement more effective budgeting and strategic planning.

Need to know!

AI-driven accounting software automates transactions, reconciliations, and reporting. With Hashy from HashMicro, businesses cut errors, improve cash flow, and gain real-time financial insights.

Get a Free Demo Now!

Top 12 Accounting Software in the Philippines

Choosing the best software for your business can be a challenging task, given the numerous available options. However, do not worry, as we have compiled a comprehensive list of the Top 12 accounting software and tools in the Philippines for 2025, along with their features and functionalities.

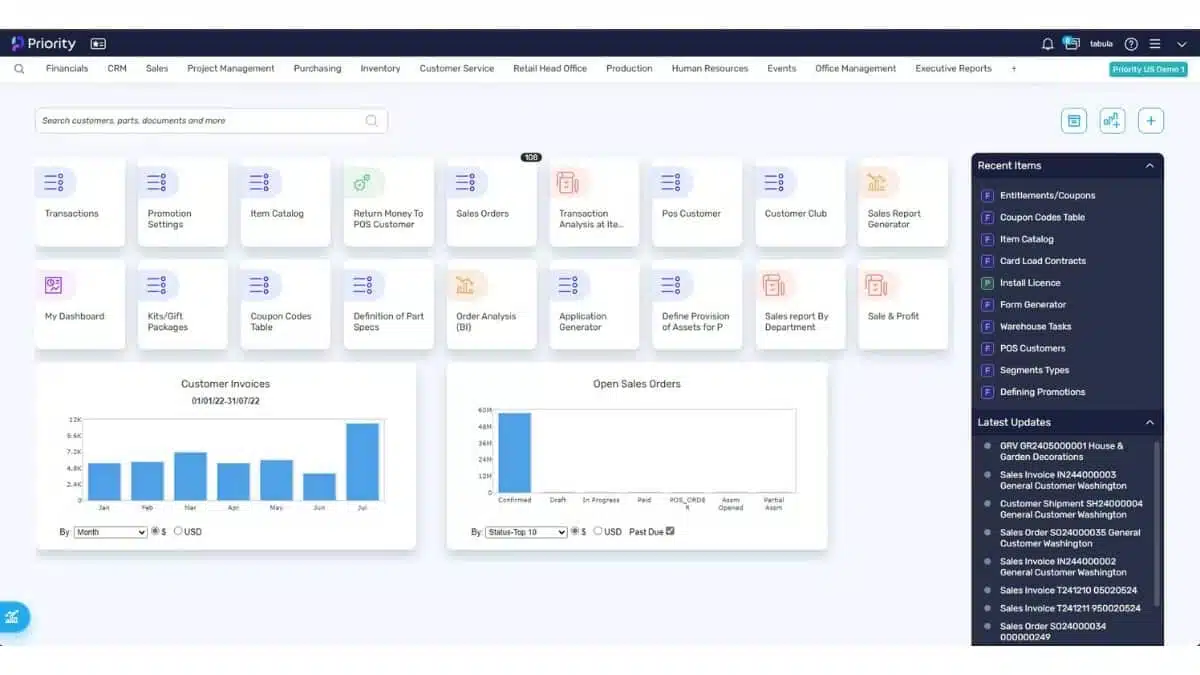

1. HashMicro Accounting Software

HashMicro, an accredited BIR AI accounting software, helps businesses track transactions, assets, liabilities, and expenses with ease. With detailed tracking, fast reporting, and easy analysis, financial operations become more efficient while adhering to accounting principles.

HashMicro Accounting Software offers a scalable accounting system Philippines companies can use for real-time reporting and BIR-compliant features. This automated BIR accounting solution is ideal for small to enterprise-level business owners, accountants, and finance managers.

HashMicro key features:

- Cash Flow Statements: This feature helps you make informed financial decisions, prevents cash shortages, and improves long-term sustainability.

- Asset Database and Depreciation: With this feature, you can ensure accurate financial planning, optimize asset utilization, and avoid unexpected losses.

- Client Monitoring Dashboard: This will allow you to personalize promotions, enhance customer retention, and improve overall dining experiences.

- PFRS-compliant financial reporting: This feature allows you to generate reliable reports effortlessly and maintain financial transparency.

- Financial budgeting and realization: This feature allows you to forecast expenses, track spending, and maximize profitability.

- Automated Tax Calculation: This feature eliminates manual tax errors, ensuring compliance while saving time and effort.

- Profit and loss with templates and budget forecast: With this, you can analyze your restaurant’s financial health and make strategic growth decisions.

- Financial statement with comparison: This can help you identify trends, optimize operations, and boost restaurant profitability.

- Bank Reconciliation: Matches internal records with bank statements to identify discrepancies and ensure accuracy. Integration with bank reconciliation software enables automatic data import, real-time matching, and faster error detection.

| Pros | Cons |

|

|

To see how HashMicro’s BIR-accredited accounting system can transform your financial processes, explore our flexible pricing plans. Click the banner below to learn how our accounting and bookkeeping software delivers substantial value.

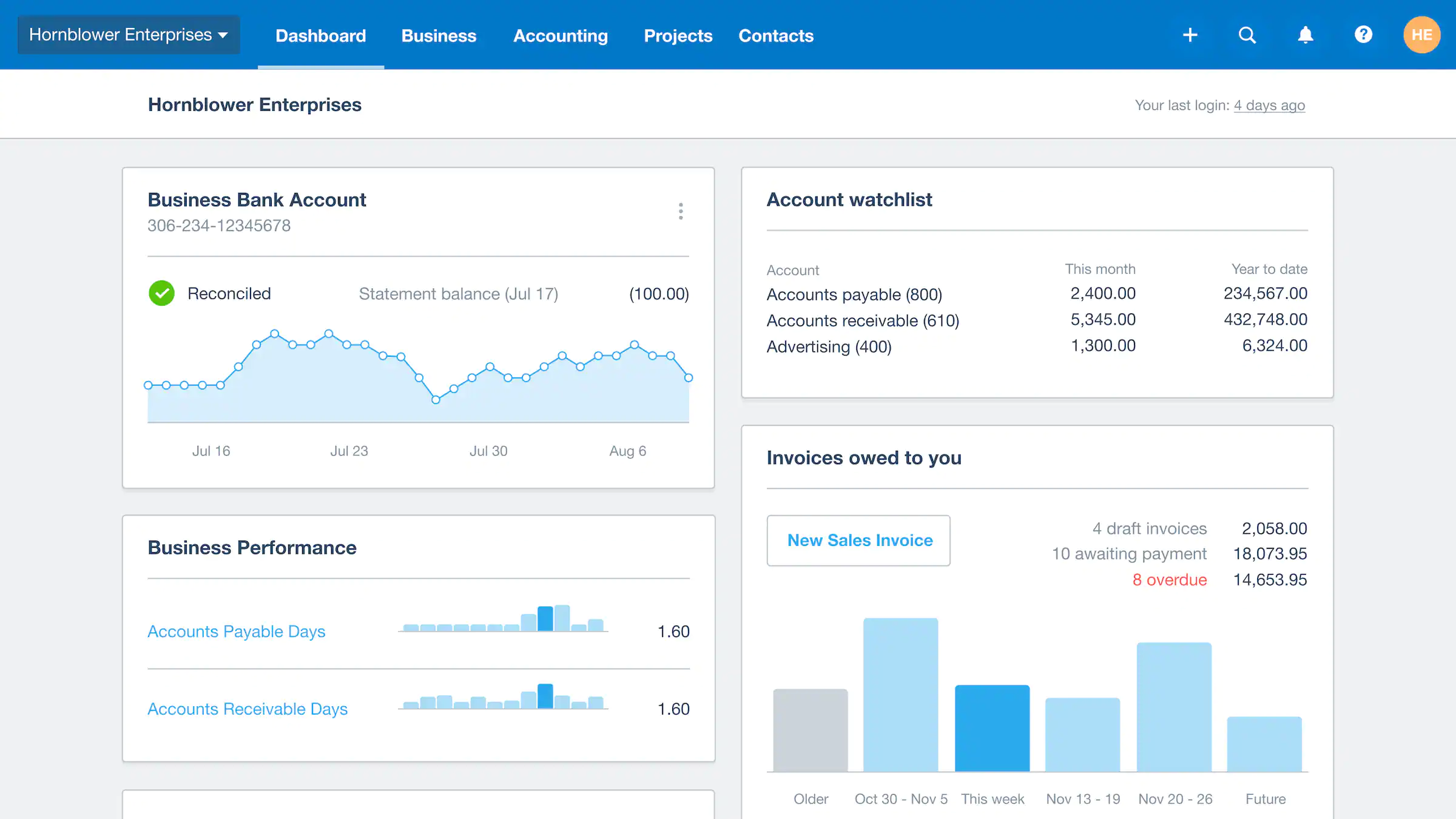

2. Xero

Xero is a cloud-based accounting software Philippines SMEs prefer for its user-friendly tools, automation, and live bank feeds. While it covers bookkeeping needs like invoicing and payroll, it lacks direct BIR integration.

Furthermore, the system allows both cash-based and accrual-based bookkeeping software, which is very suitable for companies in the Philippines that comply with IFRS.

Xero key features:

- Bills tracking

- Bank connections

- Online payment

- Financial reporting

- Inventory tracking

- Multi-currency accounting

| Pros | Cons |

|

|

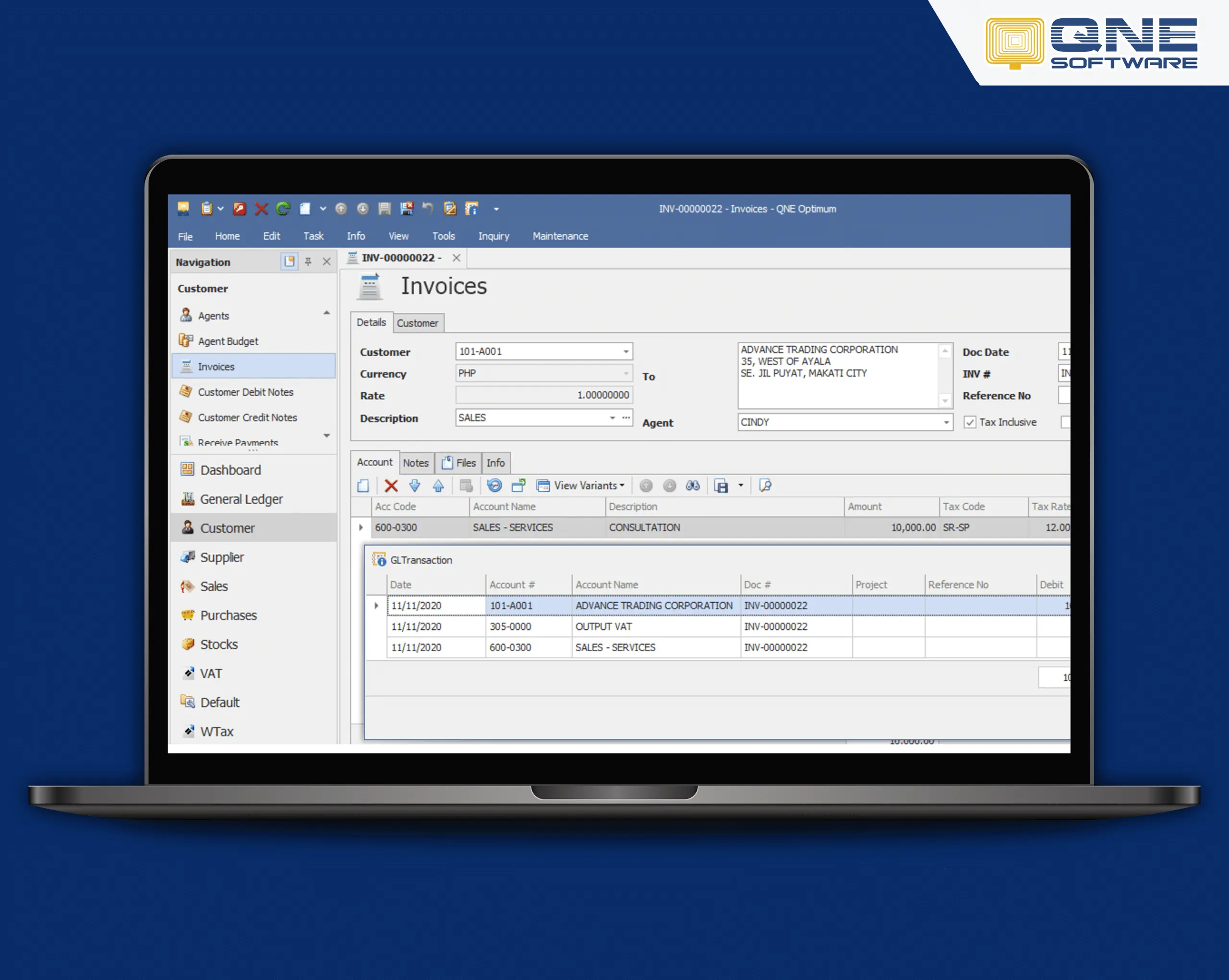

3. QNE Accounting Software

QNE Software is a localized accounting system Philippines option known for its user-friendly interface and customizable reporting tools. It assists with financial accounting, progress billing, and sales distribution modules.

It is tailored to meet local business requirements and challenging environments in the region. The software offers real-time processing, data handling, database recovery, and scheduled backup, enabling users to manage their accounting operations efficiently.

QNE key features:

- Cloud-based deployment

- Online order portal

- Online customer portal

- BIR CAS-ready

| Pros | Cons |

|

|

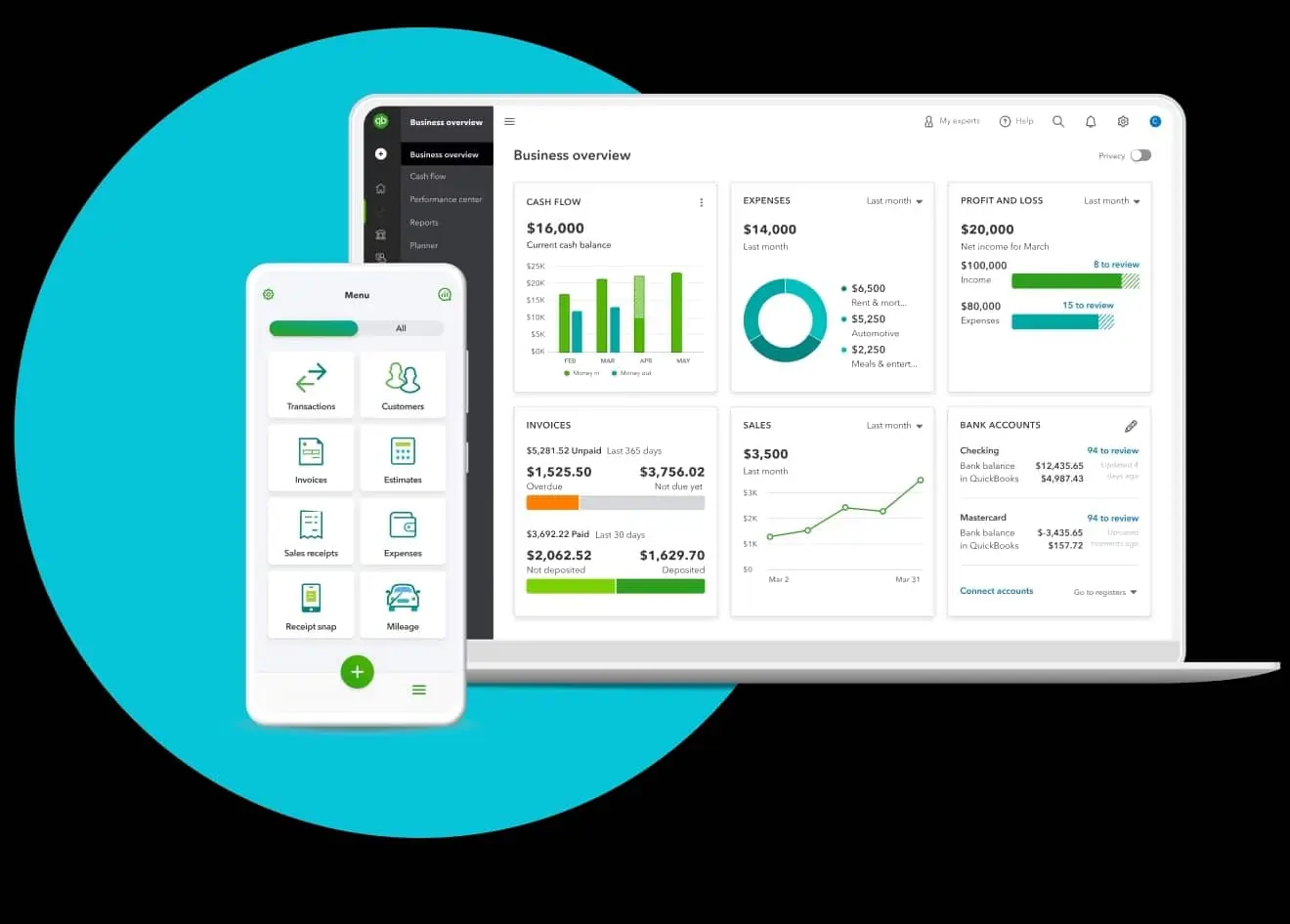

4. QuickBooks Accounting Software

QuickBooks accounting system is one of the best accounting software suites businesses use to manage their financial transactions. It enables users to create invoices, process payments, generate reports, and print documents needed for tax preparation.

QuickBooks key features:

- Purchasing and vendor management

- Reporting and analytics

- Time and expense management

- Invoicing and billing

- General ledger

| Pros | Cons |

|

|

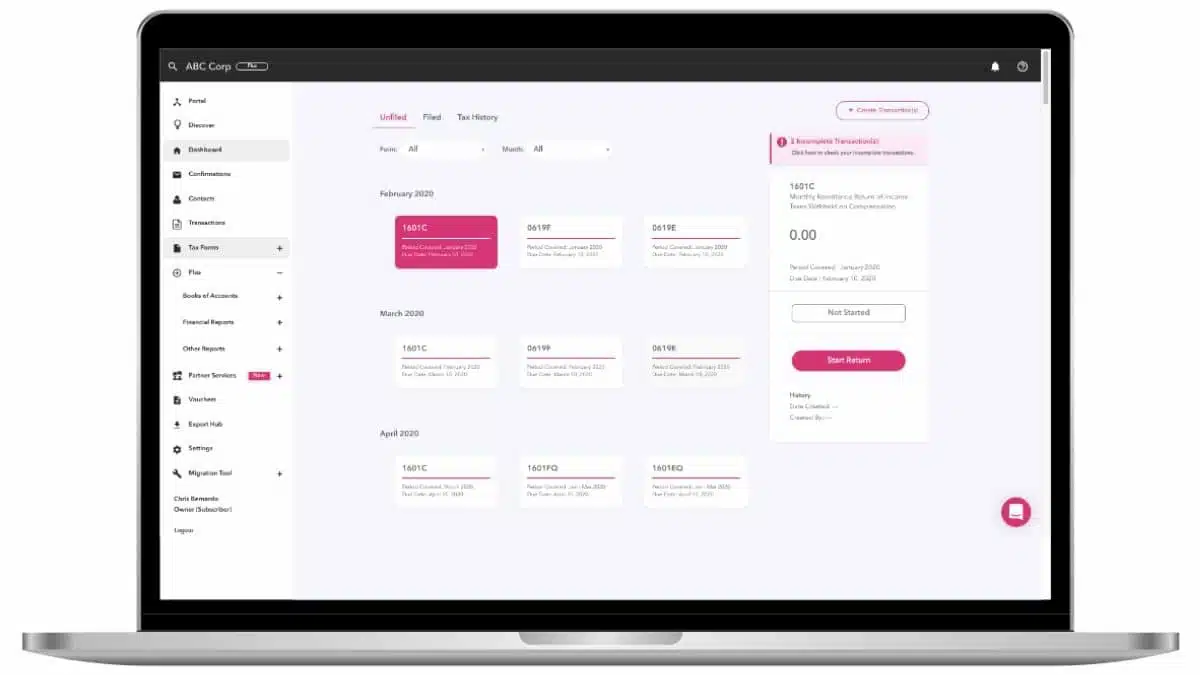

5. JuanTax

JuanTax is a modern tax and accounting system tailored for businesses in the Philippines. Designed to simplify tax compliance, it automates tax calculations, tracks expenses, and generates required reports for both small and large enterprises.

JuanTax key features:

- Tax Compliance Automation

- Real-Time Reporting

- Expense and Invoice Tracking

- Cloud-Based Access

| Pros | Cons |

|

|

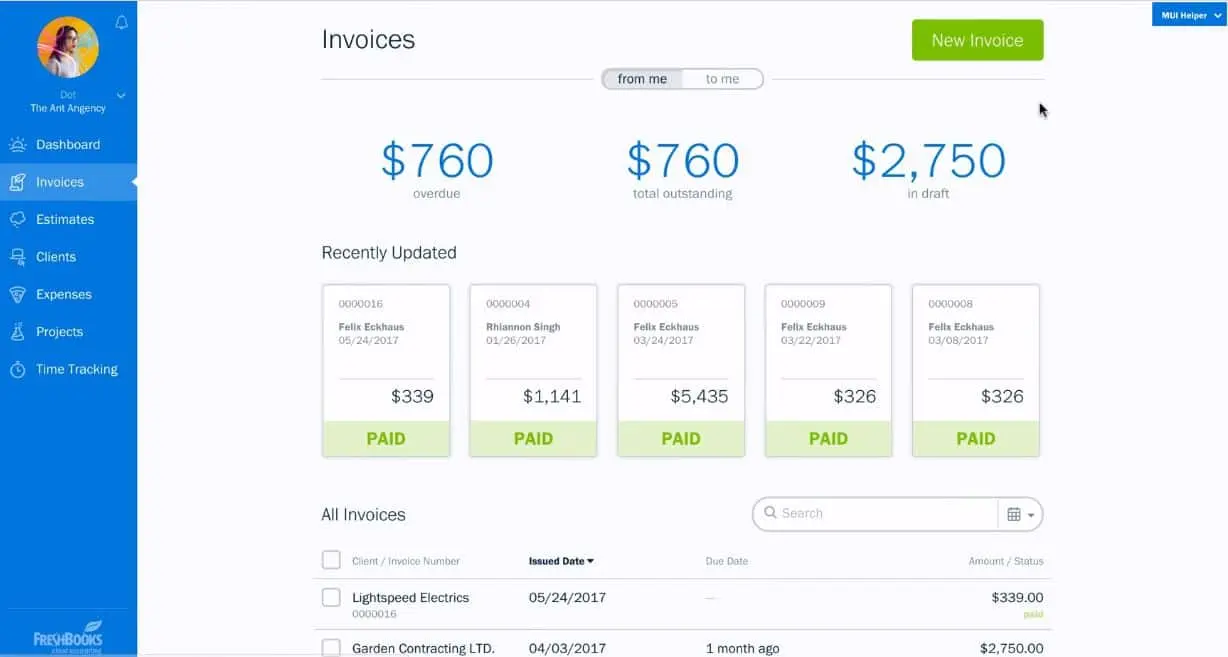

6. FreshBooks Online Accounting Software

FreshBooks is one of the best small business accounting software for business owners, freelancers, and sole proprietors. It simplifies financial management for Filipino businesses by tracking payments and expenses, managing invoices, and facilitating payments.

FreshBooks key features:

- Budget and cost management

- Reporting

- Chart of Accounts

- Time tracking

- Project management

| Pros | Cons |

|

|

7. AccountEdge

AccountEdge is a robust accounting solution designed for businesses looking for a desktop-based solution. With features ranging from payroll to inventory management, it caters to small and medium-sized companies that need comprehensive accounting tools.

AccountEdge key features:

- Complete Accounting Management

- Payroll Processing

- Inventory Control

- Customizable Reports

| Pros | Cons |

|

|

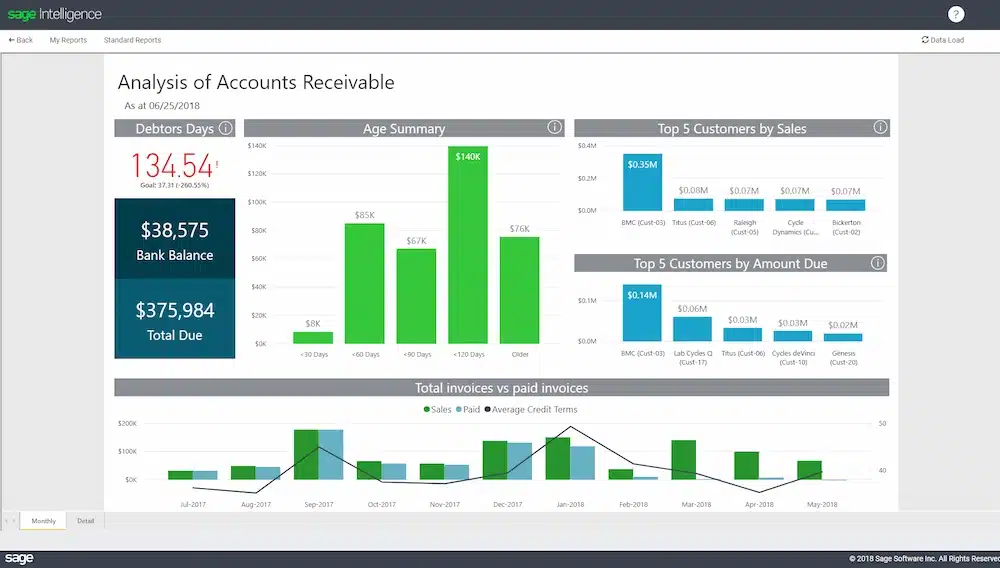

8. Sage 50

Sage 50 is one of the best small-business accounting software options for medium-sized businesses. This accounting tool operates on a desktop platform with cloud-connected capabilities, which can integrate with Microsoft 365.

This software offers three versions: Pro Accounting is ideal for single users, Premium Accounting supports multiple users with advanced features such as serialized inventory tracking, and Quantum Accounting is designed for larger teams with role-based permissions.

Sage 50 key features:

- Invoicing and Billing

- Expense Tracking

- Inventory Management

- Bank Reconciliation

- Financial Reporting

| Pros | Cons |

|

|

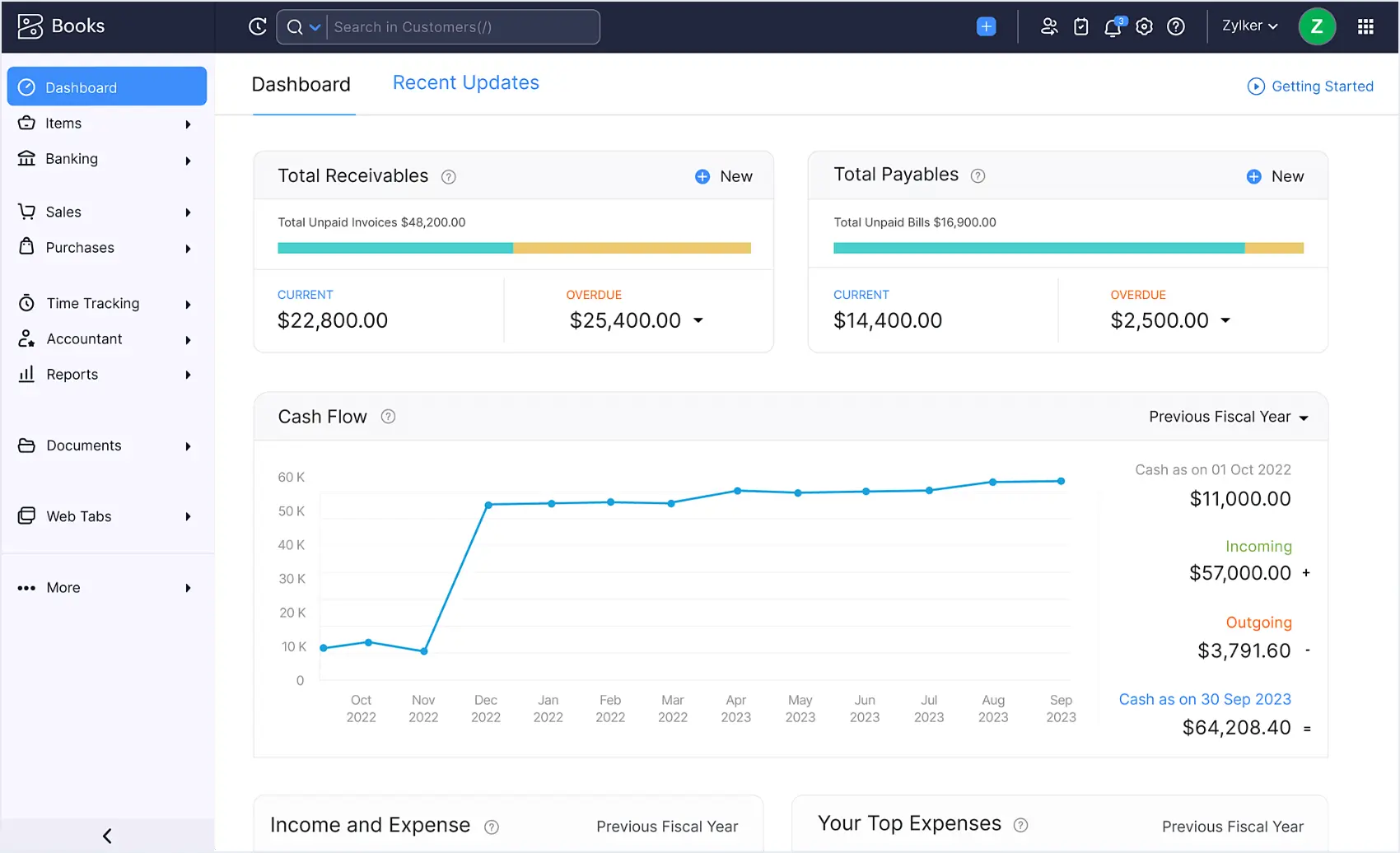

9. Zoho Books

Zoho Books is one of the top cloud accounting software solutions, offering comprehensive capabilities in invoicing, inventory management, and project management. It provides a free plan and a range of features designed to simplify accounting tasks.

Furthermore, Zoho Books stands out as an accounting software example in the Philippines landscape for businesses already using other Zoho applications, as it seamlessly integrates with over 40 other Zoho applications, including Zoho CRM and Zoho Inventory.

Zoho Books key features:

- Inventory management

- Bank integration

- Expense tracking

- Customer portal

| Pros | Cons |

|

|

10. Wave Accounting System Software

Wave is free retail accounting software designed for businesses in the Philippines that aim to minimize their expenses. It provides a range of financial management tools.

Wave accounting software examples help you oversee cash flow by tracking income and expenses, managing accounts receivable and payable, generating reports, automating tasks, and allowing multiple users.

Wave key features:

- Income and expense tracking

- Customizable sales taxes

- Exportable basic accounting reports

- Online payment

| Pros | Cons |

|

|

11. Kashoo

Kashoo is a cloud accounting software for businesses in the Philippines seeking to manage their finances independently. With Kashoo, users can create invoices, track expenses, manage transactions, and handle other accounting tasks from any device.

Kashoo offers three plans: a free plan, which includes invoicing and payment tracking, and a small plan. Accounting for automated income and expenses tracking, and Kashoo, for full features unlocked.

Kashoo key features:

- Inventory tracking

- Customizable layout

- Invoicing and bill management

- Reporting

- AR/AP functionality

- Tax Management

| Pros | Cons |

|

|

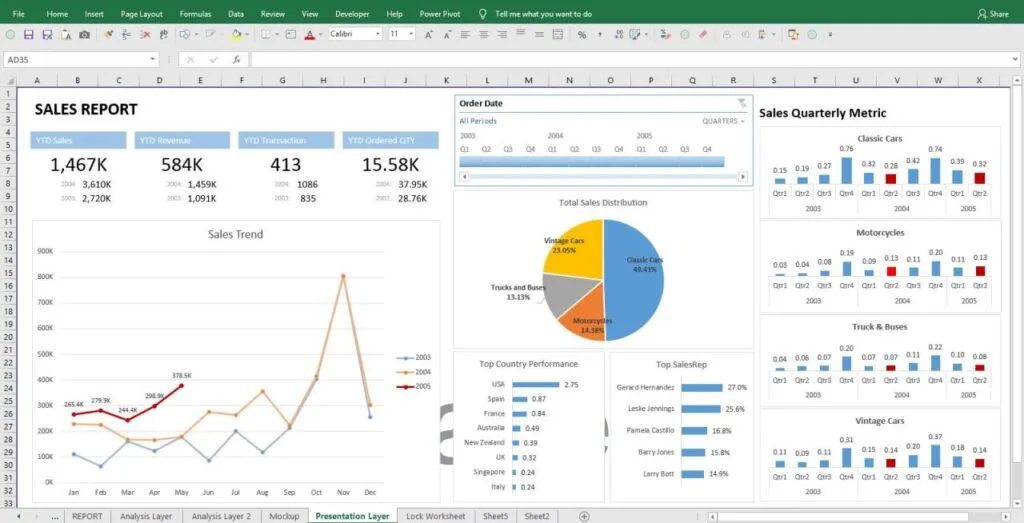

12. Microsoft Excel

Microsoft Excel remains a widely relied-upon tool for accounting tasks across businesses in the Philippines. Its familiarity, flexibility, and accessibility make it a practical choice for companies looking to manage their financial data with precision and control.

Microsoft Excel key features:

- Built-in formulas for quick calculations and data analysis

- Charting tools to visualize trends and patterns

| Pros | Cons |

|

|

Full Comparison of Accounting Software

Best Accounting Software Recommendation for Various Business Needs

- An all-in-one accounting solution with strong reporting, scalability, and local tax readiness for growing businesses → HashMicro

- Real-time cloud accounting tools suited for small businesses that prioritize simplicity and quick setup → Xero, FreshBooks, Kashoo

- Accounting software focused on ease of use and solid financial reporting for small to mid-sized companies → QuickBooks, Sage 50

- Tax-focused and compliance-driven solutions designed for fast and simple local tax filing → JuanTax

- Flexible accounting platforms with invoicing, inventory, and basic project management in one ecosystem → Zoho

- Budget-friendly or free tools suitable for micro-businesses with basic accounting needs → Wave

- Spreadsheet-based tools commonly used for manual accounting and basic financial tracking → Microsoft Excel

How to Choose the Right Accounting Software?

Choosing the best accounting software for your business in the Philippines can be a challenging task. When selecting an accounting system for your business, keep these factors in mind to make your search easier.

1. Budget

Consider the monthly investment you’re comfortable with and the potential savings from using accounting software. Review all available pricing plans to ensure you select one that provides the necessary functionality within your budget.

2. Features

Besides the budget, consider whether the accounting tool’s features fit your needs. List essential functions like invoicing, expense tracking, and financial reporting. Also, look for software that integrates smoothly with other tools you use.

Pro tip: Choose a scalable system to future-proof your business. For example, FMCG companies may initially start with accounting software, but later require ERP solutions that seamlessly integrate new tools as they expand.

3. Scalability

Implementing the best accounting system software is a long-term investment. Select a scalable bookkeeping software that can be easily customized to add features and accommodate increasing transaction volumes without requiring a system switch.

4. Integration

Integration is crucial as it impacts efficiency, accuracy, and overall workflow. Seamless integration allows different software systems and applications to communicate and share data.

For example, integrating an accounting tool with inventory management ensures that inventory levels are accurately reflected in financial reports. Linking it with CRM software streamlines invoicing and enables more effective tracking of customer payments.

5. Security

Security is crucial in the best accounting software in the Philippines, and implementing two-way matching strengthens protection against data breaches and fraud.

HashMicro, an accounting and bookkeeping software, holds ISO certification, ensuring the security of your financial data against breaches. This certification underscores HashMicro’s commitment to maintaining the highest standards of data security for its users.

FAQ about Accounting Software

-

What is accounting software?

Accounting software helps businesses in the Philippines manage their daily financial activities, such as expenses, revenues, assets, and payments. It also simplifies the handling of receivables and payables.

-

What is the most commonly used accounting software?

The Philippines’ most commonly used accounting software is the HashMicro accounting system, which is integrated with the BIR-CAS. HashMicro is the best option due to its flexibility, automation features, and integration with other business processes.

-

What are the three types of accounting software?

The three main types of accounting systems are:

ERP System: This system integrates accounting with other business processes like inventory, sales, and HR, making it ideal for larger companies.

Billing and Invoicing System: This system focuses on creating and managing customer invoices, making it useful for small businesses needing straightforward billing solutions.

Payroll Management System: This system automates employee payment processes, including salary calculations and benefits, making it essential for companies managing payroll.

-

How does accounting system software work?

It automates financial management processes. It records transactions, tracks expenses and revenues, and generates various financial reports. Users input data, such as sales or purchases, and the software processes this into usable reports.

-

Why do we need accounting software?

It’s important because it makes handling money easier and more accurate. Instead of doing everything manually, automation reduces mistakes and saves time. Additionally, real-time updates enable businesses to make informed decisions.