For many business owners in Malaysia, the hardest part of accounting isn’t recording transactions, it’s knowing where they belong. It’s common to confuse tax categories with accounting accounts, especially when you’re trying to keep records clean for LHDN.

This is where the Chart of Accounts (COA) helps. Think of it as the master list of financial categories your business uses to record every transaction in the general ledger, consistently and traceably.

When a COA is poorly structured, expenses can be misclassified, reports become unreliable, and tax-season reconciliations turn into rework. This guide explains what a COA is, why it matters, and how to set it up so your financial reporting stays clear and audit-ready.

Key Takeaways

|

What is a Chart of Accounts?

A Chart of Accounts (CoA) is a structured list of account codes and names used to organize financial transactions. It helps classify different types of accounts and ensures consistent and accurate bookkeeping. The codes are usually numeric and identify each account category.

In accounting, a CoA is used to prepare financial reports such as the balance sheet and income statement. It is divided into five main types of accounts:

- Assets: records what the business owns

- Liabilities: records what the business owes

- Equity: records owner contributions and withdrawals

- Revenue: records income earned by the business

- Expenses: records money spent by the business

These five categories are standard, but the accounts within each can be customized to meet the business’s needs. A well-designed Chart of Accounts reflects the general accounting principle of classifying transactions into structured account types.

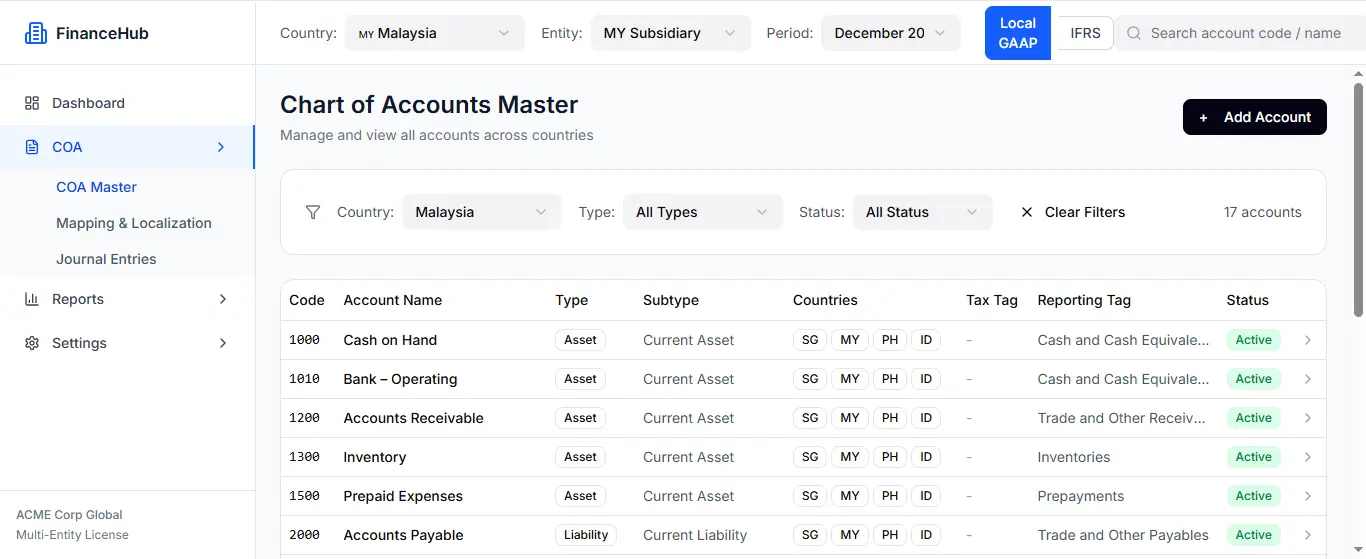

How the Chart of Accounts Works

A Chart of Accounts (CoA) is a tool that helps businesses structure their financial transactions clearly and systematically. When using a CoA system or software, users log in to access a list of categorized accounts. These categories typically include assets, liabilities, equity, revenue, and expenses.

Each account within these categories has a specific code to simplify identification. For instance, asset accounts may begin with 1000, while revenue accounts might start with 4000. When a transaction occurs, such as purchasing supplies or receiving income, it is recorded in the appropriate account in the system.

The accounting system then automatically logs and organizes the transaction, ensuring that financial records remain accurate. This setup helps businesses manage their finances efficiently and simplifies the creation of reports like balance sheets and income statements.

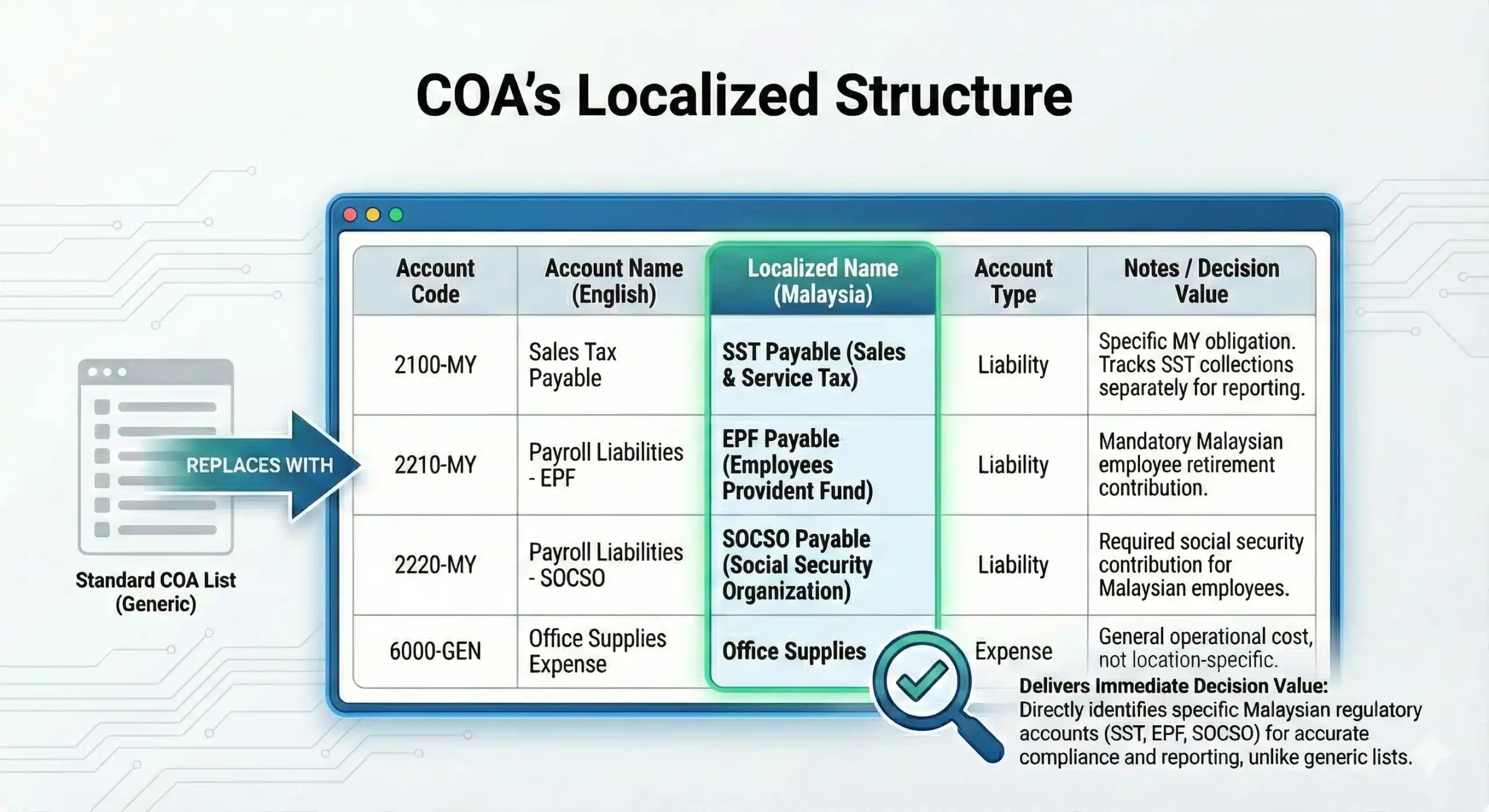

How to Structure Your COA: A Localized Example

Before jumping into the structure, treat your Chart of Accounts (COA) as a reporting framework, not just a list of account codes. A well-structured, Malaysia-ready COA makes monthly closing smoother, reduces misposting, and gives management cleaner insights across entities, outlets, or projects.

Below is a localized example of how to structure it in a way that stays tidy today and still scales when the business grows:

1. Start from Malaysian reporting and tax needs

A practical COA structure in Malaysia should be built around the end reports your team actually uses, P&L, Balance Sheet, Cash Flow, plus common tax and compliance tracking. When the chart is aligned to reporting outcomes, every account created has a purpose, not just a number added “because it came up.”

2. Use a consistent account code logic (and keep it scalable)

Set a numbering scheme that’s easy to read and can grow with the business, such as a 4–6 digit hierarchy (e.g., 1xxx Assets, 2xxx Liabilities, 3xxx Equity, 4xxx Revenue, 5xxx COGS, 6xxx Operating Expenses). A consistent logic reduces posting errors, keeps audits cleaner, and makes analysis faster across periods.

3. Build a clear hierarchy: header → group → posting accounts

Separate summary headers from posting-level accounts so reports can be viewed at a high level or drilled down without mess. For example, a header like “1100 Cash & Bank” can sit above detailed accounts such as “1110 Petty Cash,” “1120 Maybank,” and “1130 CIMB,” keeping daily entries tidy while still enabling granular cash visibility.

4. Localise key statutory and tax-related accounts

Include dedicated accounts that help track Malaysian obligations, especially SST (where applicable), withholding tax categories if relevant to your transactions, and statutory contributions such as EPF, SOCSO, and EIS for payroll-related postings. Having these mapped properly upfront prevents misclassification and makes month-end reconciliation smoother.

5. Separate revenue and direct costs by business line

If you sell multiple product categories, services, or channels, split revenue and direct costs accordingly (e.g., “Revenue—Retail,” “Revenue—Wholesale,” “Direct Costs—Services,” “Direct Costs—Materials”). This structure makes gross margin performance clearer and helps management spot which lines are driving profit, or quietly draining it.

6. Group operating expenses by function for better control

Instead of listing expenses randomly, structure them by function (Sales & Marketing, General & Admin, Logistics/Warehouse, IT, Finance). This makes it easier to set budgets, track variances, and identify where cost creep is happening without digging through dozens of misc expense accounts.

7. Add adjustment and control accounts for clean month-end closes

Reserve accounts for accruals, prepayments, depreciation/amortisation, FX gains/losses, and provisions where relevant. These accounts help your finance team close faster, maintain consistency across periods, and clearly separate operational spend from accounting adjustments.

Types of Chart of Accounts

There is no universal format for a chart of accounts. Generally, they follow a common basic structure, but the final layout and format vary based on the type and size of the business.

COA Structure

A chart of accounts is usually arranged to reflect the order of financial statements. This means accounts on the balance sheet appear first, followed by those on the income statement.

The main account categories (assets, liabilities, shareholders’ equity, revenue, and expenses) can be divided into sub-categories such as operating revenues, operating expenses, non-operating revenues, and non-operating losses.

Operating revenue and expense accounts can also be grouped by business function or by different company divisions. For example, a company using distribution accounting software may customize its Chart of Accounts to reflect inventory, logistics, and warehouse-specific cost centers.

And then, for further explanation, let’s imagine a small business chart of accounts might include the following sub-accounts under the main categories:

Assets

- Checking account

- Cash on hand

- Accounts receivable

- Inventory

- Prepaid rent

- Office equipment

- Computers

Liabilities

- Accounts payable

- Accrued expenses

- Credit line payable

- Tax payable

- Customer deposits

Shareholders’ Equity

- Owner’s capital

- Owner’s draw

- Retained profits

Account Identifiers

To help users find specific accounts quickly or understand their purpose, each account typically includes a code, a name, and a short description.

This coding system is essential because each primary account can contain many individual transaction lines.

Many businesses organize their chart of accounts so that expense accounts are grouped by department. This means departments like sales, engineering, and accounting each use the same list of expense accounts.

Benefits of the Chart of Accounts

Here are some key benefits of using a Chart of Accounts (CoA) within an accounting system, especially when paired with an integrated financial accounting solution for Malaysia:

- Defines a consistent financial structure: The Chart of Accounts organizes accounts by type, making financial data easier to read, track, and manage.

- Prevents entry errors: Unique codes for each account reduce the risk of entering transactions into the wrong category.

- Keeps reports accurate and consistent: The system assigns every transaction to the correct account, helping maintain the integrity of your financial reports.

- Speeds up financial reporting: With accounts already organized, the system can generate reports like balance sheets and income statements without manual input.

- Reveals operational insights: Managers can review financial results by department, location, or project to identify cost drivers or growth opportunities.

- Simplifies audits and tax reviews: Auditors can trace every transaction back to its source, reducing review time and supporting compliance.

- Scales with the business: Companies can add or restructure accounts without disrupting past records or reporting workflows.

Building a Scalable Chart of Accounts for High-Volume Businesses

Managing a growing Chart of Accounts (CoA) can quickly become an operational bottleneck as businesses scale. As transaction volume expands across entities, branches, and cost centres, manual categorisation and disconnected tools often lead to inconsistent postings, slower month-end close, and limited visibility for decision-making.

This is a common challenge in high-volume environments where accuracy and speed are non-negotiable. One of our clients, Brinks, uses HashMicro Accounting to centralise finance workflows and strengthen control over complex account structures, helping the team maintain consistency, improve traceability, and stay audit-ready without adding unnecessary manual work.

With the right accounting system, the CoA becomes more than a list of codes, it becomes a structured framework that supports faster closing, cleaner reconciliations, and reliable insights for leadership. Here are practical ways the system supports complex financial operations:

- Automated reconciliation: The system automates matching internal ledgers to bank statements, reducing manual checks and minimizing errors during the close period.

- Multi-dimensional reporting: Finance teams can generate reports by CoA segments, filtered by department, project, or branch, so management can see performance drivers with greater precision.

- Real-time cash visibility: Dashboards provide an up-to-date view of cash inflows and outflows mapped to the relevant accounts, supporting liquidity monitoring and forecasting.

- Localized compliance support: The CoA structure can be aligned with Malaysian reporting requirements (MPERS/MFRS), with clear tracking for tax-related entries to support SST reporting where applicable.

You don’t need to be a global enterprise to apply enterprise-grade financial control. A well-structured CoA, supported by a system that enforces consistency, helps finance leaders close faster, report with confidence, and make decisions based on real-time numbers.

Conclusion

A Chart of Accounts helps organise business transactions into clear categories, keeping records consistent and easier to review. With a well-structured CoA, finance teams can produce accurate reports faster, reduce posting errors, and maintain stronger control over financial data.

However, CoA management often breaks down when systems are rigid or disconnected. Limited flexibility, delayed visibility, and messy account mapping can slow down closing, weaken analysis, and make it harder to scale reporting across branches, entities, or cost centres.

If you’re refining your CoA, a free consultation can help map your needs and recommend the right setup for your reporting.

FAQ on Chart of Accounts

-

What is the difference between a Chart of Accounts and a general ledger?

A Chart of Accounts is a master list of account names and codes, while the general ledger records the actual transaction entries under those accounts

-

How do you set up a Chart of Accounts?

Start by assigning account names, add unique identification codes, and organize accounts into the standard five categories, then customize sub‑accounts as needed for your business

-

Can your Chart of Accounts include more than the five main categories?

Yes. Some businesses add separate categories for gains, losses, or project-specific segments to better track financial activities beyond the standard categories.

-

Should you delete unused accounts from your Chart of Accounts?

Best practice suggests keeping all accounts, even unused ones, for historical accuracy, and only deleting obsolete accounts at year-end to preserve data integrity.