Many businesses wonder why some companies make confident financial decisions while others constantly struggle. The difference often lies in how well they understand and apply accounting principles and assumptions to ensure financial data is accurate and reliable.

In Malaysia, staying compliant with evolving Malaysian Financial Reporting Standards (MFRS) is a significant challenge, and mistakes can lead to costly errors or credibility issues. Navigating these regulations affects financial transparency and overall business stability.

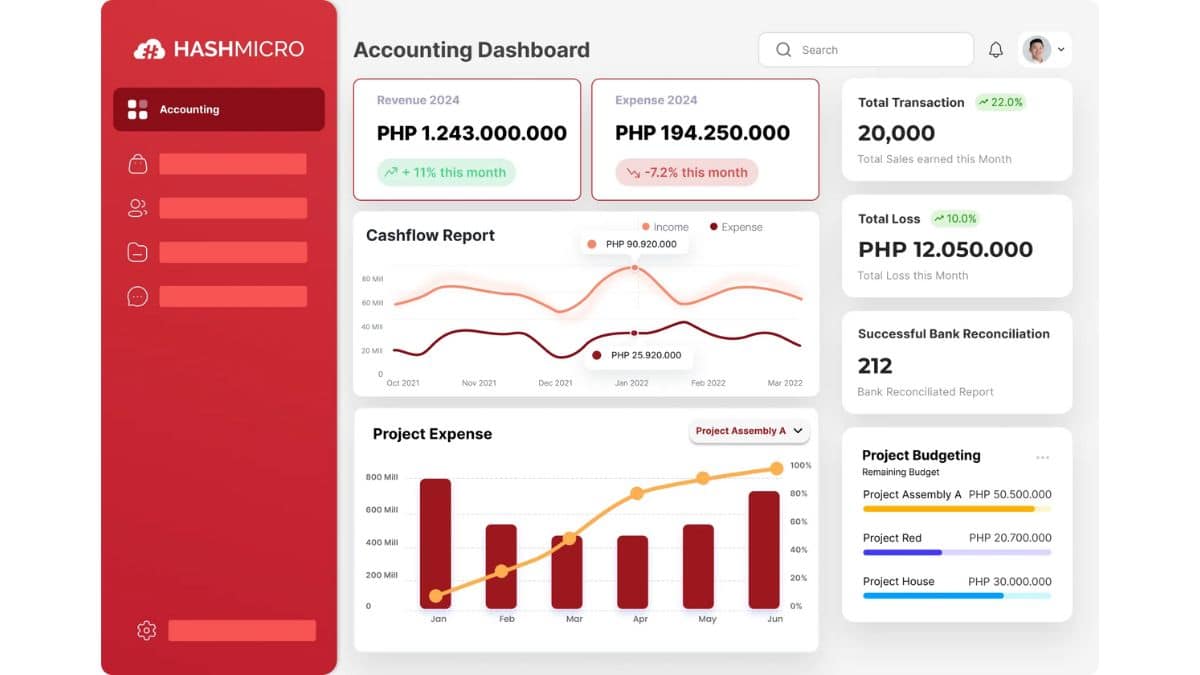

This is why mastering accounting principles and using the right tools can transform the way your business operates. HashMicro’s Accounting Software helps automate complex tasks, ensure MFRS compliance, and deliver real-time financial insights so you can make smarter decisions with confidence.

Key Takeaways

|

What are Accounting Principles?

Accounting principles are essential guidelines that govern the recording and reporting of financial transactions. These basic accounting principles ensure businesses maintain clear, consistent, and accurate financial records, fostering trust and reliability in their financial statements.

Under the General Accepted Accounting Principles (GAAP), these rules are the foundation for bookkeeping practices. By adhering to these fundamental accounting principles, accountants ensure that financial statements are accurate and comparable over time, helping stakeholders make informed decisions.

These accounting rules and regulations are crucial for understanding complex financial transactions. They help businesses consistently record their financial matters, building credibility with investors, regulators, and customers by ensuring transparency and honesty in their financial practices.

Importance of Accounting Principles

Accounting principles are essential for businesses in Malaysia to maintain consistent and accurate financial reporting. These principles improve financial data quality and help stakeholders make informed decisions based on reliable information.

Adhering to regulations like the Malaysian Financial Reporting Standards (MFRS) ensures compliance and promotes transparency in business operations.

1. Enhancing financial information quality: Accounting principles ensure clarity and dependability in financial data, making it easier for stakeholders in Malaysia to make informed decisions. By adhering to these principles, businesses can present financial data that accurately reflects their actual performance, thereby fostering transparency and trust.

2. Facilitating understanding: These principles standardise financial statements, making it more straightforward for Malaysian users to comprehend the information. With uniform formats and definitions, stakeholders can easily interpret the financial health of a business without confusion.

3. Simplifying comparisons: With uniform accounting standards, comparing financial statements across different periods and companies in Malaysia becomes straightforward. This consistency enables analysts, investors, and managers to evaluate performance over time or against industry benchmarks.

4. Foundation for tax calculations: Accounting principles are the backbone of tax calculations, ensuring that businesses in Malaysia comply with tax regulations. These principles help companies avoid tax discrepancies and legal issues by determining taxable income based on established rules.

5. Regulatory compliance and alignment: In Malaysia, businesses must follow the Malaysian Financial Reporting Standards (MFRS), which align with international standards. This compliance satisfies legal obligations and provides stakeholders with valuable insights for better resource allocation.

6. Supporting stakeholder decision-making: Accounting principles guide how financial statements are prepared, offering investors, lenders, and creditors in Malaysia the information they need for well-informed decision-making. With standardized reporting, businesses help stakeholders evaluate risk, profitability, and growth potential more confidently.

7. Preventing accounting problems: By providing a structured framework, accounting principles help prevent common financial issues like discrepancies and errors. The consistent application of these principles ensures that businesses maintain accurate and reliable financial records, thereby reducing the risk of misreporting.

8. Promoting transparency: Accounting principles promote transparency in financial reporting, fostering greater accountability. When businesses in Malaysia adhere to established rules and principles, stakeholders can have confidence that the financial data presented is accurate and reliable.

Using accounting software, companies can efficiently apply these principles to ensure consistency, accuracy, and transparency in financial reporting, fostering trust and informed decision-making.

12 Types of Accounting Principles

The fundamental accounting principles or concepts are essential for guiding the preparation of financial reports. In Malaysia, these principles are derived from the Malaysian Financial Reporting Standards (MFRS) and are influenced by long-established practices widely accepted within the accounting profession.

Below are the most commonly recognized accounting principles for businesses:

1. Separate entity concept

This principle treats a business as an independent entity distinct from its owners. Only transactions directly related to the business are recorded in the books, while the owner’s personal transactions are excluded.

2. Historical cost principle

Assets are initially recorded at their purchase cost, reflecting their value at the time of acquisition. This principle ensures that assets are reported based on their original cost, rather than their current market value.

3. Going concern assumption

Businesses are assumed to continue operating indefinitely unless there is evidence to the contrary. This assumption allows assets to be recorded at historical cost, provided the business is expected to remain operational.

4. Matching principle

This principle dictates that costs should be recorded as assets and only recognized as expenses when the related revenue is earned. It ensures that income and related expenses are matched in the same period for accurate profit measurement.

5. Accrual basis of accounting

Economic events must be recorded when they occur, not when cash is received or paid. Income is recognized when earned, and expenses are recognized when incurred, regardless of the actual cash flow timing.

6. Prudence (Conservatism)

Prudence requires caution when making estimates in uncertain situations. For example, businesses should choose the more conservative option when facing unfavourable or favourable outcomes to avoid overstating assets or income.

7. Period concept

The life of a business is divided into reporting periods, typically lasting 12 months but sometimes shorter or longer. This allows businesses to provide regular and consistent financial information over specific periods, such as fiscal years or interim periods.

8. Stable monetary unit principle

This principle assumes that financial transactions are recorded using a stable currency, such as the Malaysian Ringgit. It provides consistency and reliability in measuring assets, liabilities, and other financial figures.

9. Materiality principle

Items significant enough to impact economic decisions should be treated as material. This principle emphasizes the need to disclose items whose omission or misstatement could influence decision-making.

10. Cost-benefit principle

The cost of gathering and communicating financial information should not exceed the benefits derived from its use. This principle ensures that businesses strike a balance between the effort required to collect data and the usefulness of the information.

11. Full disclosure principle

This principle mandates that all relevant financial information must be disclosed to users of financial statements. It emphasizes the need for sufficient detail while ensuring the information remains concise.

12. Consistency concept

Businesses must apply the same accounting policies consistently across periods. Any changes to accounting policies must be justified and clearly explained, ensuring that financial statements remain comparable over time.

Generally Accepted Accounting Principles (GAAP)

Generally Accepted Accounting Principles (GAAP) were developed in the United States to establish financial reporting standards, particularly for private companies and nonprofit organisations. While GAAP is predominantly used in the U.S., it can also serve as a reference for Malaysian businesses, particularly those engaging in cross-border transactions with U.S. entities.

GAAP encompasses fundamental principles, including revenue recognition, matching expenses to corresponding revenues, and full disclosure. These principles ensure financial statements are transparent and reliable, fostering trust and helping businesses maintain a clear view of their financial performance.

In Malaysia, businesses generally follow the Malaysian Financial Reporting Standards (MFRS), which are aligned with the International Financial Reporting Standards (IFRS). While GAAP may not be the primary standard used in Malaysia, understanding it is crucial for companies dealing with U.S. counterparts or operating in multinational environments.

MFRS, developed by the Malaysian Accounting Standards Board (MASB), replaced the older local accounting standards. These standards ensure that Malaysian businesses align with global financial practices, promoting consistency and transparency in financial reporting.

International Financial Reporting Standards (IFRS)

International Financial Reporting Standards (IFRS) provide a global framework for preparing financial statements, ensuring consistency and comparability. Adopting IFRS principles simplifies financial reporting for businesses in Malaysia, especially for companies operating internationally or with foreign investors.

The Malaysian Financial Reporting Standards (MFRS) are closely aligned with IFRS, enabling businesses to maintain transparency and ensure their financial statements are comparable to those of global companies. By adopting these standards, Malaysian businesses can enhance their credibility and attract more foreign investments.

By applying IFRS principles, including fair presentation and accrual accounting, Malaysian businesses can present their financial data in accordance with international standards. This ensures that financial statements are accurate and reliable, improving business relations and facilitating smoother international transactions.

Differences Between GAAP and IFRS

The key difference between GAAP and IFRS lies in their approach to financial reporting. While GAAP is a rules-based system, offering strict guidelines predominantly used in the U.S., IFRS is a principle-based system that provides more flexibility and adaptability, making it more suitable for international businesses.

In Malaysia, businesses adhere to the Malaysian Financial Reporting Standards (MFRS), closely aligned with IFRS. This alignment ensures that Malaysian companies follow global accounting standards, essential for businesses looking to attract foreign investments and expand into international markets.

Understanding the distinction between GAAP and IFRS is crucial for Malaysian businesses, particularly those engaging with U.S. investors or operating globally. Although MFRS aligns with IFRS, knowing GAAP can still be beneficial for smooth financial dealings with U.S. companies and other international stakeholders.

Characteristics and Features of Accounting Principles

Comparability is crucial when applying accounting principles. It allows businesses in Malaysia to maintain consistent financial reporting, making it easier to compare financial performance over time and across different companies, which is essential for decision-making by investors, regulators, and managers.

Reliability ensures that financial information is accurate and trustworthy. By following standard accounting principles, businesses can present dependable financial statements, fostering trust and transparency, which is essential when managing business growth or adapting to changes in the market.

Relevance is crucial in ensuring that financial information enables businesses to make informed decisions. Accounting principles ensure that financial data accurately reflects the company’s true financial position, enabling businesses in Malaysia to respond promptly to market shifts and comply with evolving regulations.

Limitations and Critiques of Accounting Principles

While accounting principles provide a structured framework for financial reporting, they do have certain limitations that businesses in Malaysia must consider. These limitations can sometimes obscure a complete and accurate view of a company’s financial health, highlighting the need for additional analysis beyond what accounting standards alone can offer.

Let’s look at some key critiques and limitations of accounting principles that may affect your business operations.

- Exclusion of non-monetary events: Accounting principles only capture monetary transactions, excluding significant non-monetary events that may still impact a business. This limitation means businesses could overlook essential factors affecting their performance and prospects.

- Historical cost basis: Assets are recorded based on their historical cost, disregarding changes in value caused by inflation or shifts in market conditions. As a result, the true value of assets may not be accurately reflected, affecting decision-making for businesses in Malaysia.

- Focus on past transactions: Accounting primarily focuses on past financial transactions without accounting for future events that may affect the business. This narrow scope can limit the ability to predict and plan for changes that could impact a company’s financial health.

Read Also: Revenue Recognition Software – Explore the best software solutions available this year to ensure accurate and compliant revenue recognition for your business.

How HashMicro Accounting Software Can Address Accounting Principle Challenges

HashMicro’s Accounting Software, integrated with ERP software, optimizes financial reporting and ensures businesses comply with essential accounting principles. By automating revenue recognition and matching expenses, the software enables Malaysian companies to maintain accurate records in accordance with GAAP and IFRS standards.

With the integration of account receivable software in Malaysia, businesses can efficiently manage outstanding invoices, track payments, and improve cash flow. The software consistently applies accounting rules like accruals and cost principles, reducing the risk of errors and promoting transparency in financial reporting.

With its precise approach, businesses can rely on the software to improve financial accuracy and enhance overall business operations. You can experience these benefits firsthand by trying the free demo.

For businesses struggling with traditional accounting principles, HashMicro offers a solution that simplifies complex financial tasks while adhering to global standards. This ultimately leads to improved economic management, greater stakeholder trust, and a more accurate representation of a company’s financial health.

Key features of HashMicro Accounting Software:

- Bank Integrations – Auto Reconciliation: This feature automatically reconciles bank transactions with the company’s records, reducing manual effort. It ensures accuracy and saves time by matching transactions directly from bank statements to your accounting system.

- Multi-Level Analytical (Compare FS per project, branch, etc): The multi-level analytical feature allows businesses to compare financial statements across different projects or branches. This enables a more transparent performance analysis, helping management make more informed decisions based on detailed data.

- Profit & Loss vs Budget & Forecast: This feature helps businesses compare actual profit and loss forecast against budgeted figures and forecasts. By analysing these variances, companies can adjust strategies and make more accurate financial predictions.

- Cashflow Reports: Cashflow reports track the inflows and outflows of cash within a business, providing insights into its liquidity. This feature helps companies to forecast cash needs and avoid financial shortfalls.

- Complete FS with period comparison: This feature provides complete financial statements with the ability to compare data over different periods. It enables businesses to track performance and financial trends across multiple time frames.

- Chart of Accounts Hierarchy: The chart of accounts hierarchy organizes financial data into a clear structure, allowing businesses to categorize transactions efficiently. It provides a detailed overview of financial information, aiding in more effective reporting and decision-making.

With its advanced features and automation, HashMicro’s software simplifies financial processes, helping businesses easily navigate today’s dynamic environments. Additionally, its ability to integrate with other business systems and customize features according to specific business needs ensures that even complex requirements are efficiently met.

Conclusion

Understanding and applying GAAP, IFRS, and MFRS is essential for ensuring transparent and accurate financial reporting in Malaysia. These standards enable businesses to maintain compliance while streamlining their financial processes for improved efficiency.

HashMicro’s Accounting Software automates compliance with GAAP, IFRS, and MFRS principles, simplifying financial reporting. It provides real-time insights, customizable reports, and seamless integration with other systems to enhance financial management.

Try our free demo to experience how it can streamline financial processes and improve reporting accuracy, making your accounting tasks easier and more efficient.

FAQ About Accounting Principles

-

What are the five rules of accounting?

The five rules of accounting (also known as the golden rules) are:

1. Personal Account: Debit the receiver, credit the giver.

2. Real Account: Debit what comes in, credit what goes out.

3. Nominal Account: Debit all expenses and losses, credit all incomes and gains.

4. Revenue Account: Credit increases in revenue, debit decreases.

5. Expense Account: Debit increases in expenses, credit decreases. -

What are the 5 key elements of accounting?

The five key elements of accounting are:

1. Assets

2. Liabilities

3. Equity

4. Revenue

5. ExpensesThese elements form the foundation of financial statements and accounting assumption frameworks.

-

What is the 3 type of account?

The three main types of accounts in accounting are:

1. Real Accounts – related to assets (e.g., equipment, buildings, cash).

2. Personal Accounts – related to individuals, firms, and organizations.

3. Nominal Accounts – related to income, expenses, gains, and losses. -

How to write a statement of assumption?

To write a statement of assumption, follow these steps:

1. State the assumption clearly (e.g., expected economic conditions, accounting assumption used, or operational conditions).

2. Explain the basis or reasoning behind the assumption.

3. Ensure it is relevant and measurable to the financial statement or business context.

4. Keep it simple and direct, such as:

“This financial projection assumes stable market demand, consistent operating costs, and no major regulatory changes during the period.”