Deferred income is one of those accounting concepts that sounds technical, but it shows up in very normal situations: subscriptions, retainers, maintenance contracts, or project deposits. You’ve been paid, but you haven’t fully delivered yet, so the cash is real, but the revenue isn’t earned yet.

When deferred income is handled incorrectly, financial reporting can quietly drift. Revenue can look “better” simply because payments arrived early, and month-to-month performance becomes harder to trust. That’s not a small issue either. In SEC accounting and auditing enforcement actions that referred to restatements in FY2022, 69% alleged improper revenue recognition.

The practical goal is simple. Keep revenue aligned with delivery. With a solid accounting setup, deferred income can be tracked automatically, recognized as obligations are fulfilled, and reflected clearly in reports, so leaders can make decisions based on what the business has actually earned, not just what it has collected.

Key Takeaways

|

Deferred Income (Unearned Revenue) Meaning and Why It Matters

Deferred income, often referred to as unearned revenue, is a fundamental accounting principle that represents advance payments a company receives for products or services that have not yet been delivered or rendered.

Without the proper treatment of deferred income, a business could appear significantly more profitable than it actually is in a given period, which could mislead stakeholders such as investors, lenders, and management in their strategic decision-making.

By recording it as a liability, the company acknowledges its future commitment, ensuring that revenue is recognized only when it has been genuinely earned through the fulfillment of its contractual obligations. This disciplined approach to revenue recognition is a cornerstone of sound financial management and transparent reporting.

Why Is Managing Deferred Income Crucial for Business Financial Health?

Managing deferred income is far more than a simple accounting task; it is a strategic pillar for maintaining a business’s stability and fostering sustainable growth. Therefore, mastering deferred income management is an essential discipline for any organization aiming to build a robust, resilient financial foundation for the future.

Managing deferred income is far more than a simple accounting task; it is a strategic pillar for maintaining a business’s stability and fostering sustainable growth. Therefore, mastering deferred income management is an essential discipline for any organization aiming to build a robust, resilient financial foundation for the future.

1. Reflects accurate financial health

Properly managing deferred income ensures that a company’s income statement reflects only revenue genuinely earned within a specific period. This practice prevents the artificial inflation of revenue figures, which can create a misleading picture of profitability and lead to flawed performance assessments. By adhering to the revenue recognition principle, management can make critical business decisions based on valid and reliable data.

2. Helps in better cash flow forecasting

Although deferred income is not yet recognized as revenue, the cash from these advance payments is already in the company’s possession, significantly boosting liquidity. By meticulously tracking this liability, the finance team can create more precise cash flow projections, enabling better planning for investments, operational expenses, and working capital management.

3. Maintains compliance with accounting principles

The revenue recognition principle, under both local accounting standards and International Financial Reporting Standards (IFRS), mandates that revenue be recognized only when earned, not when cash is received.

4. Enhances investor and creditor confidence

Accurate financial statements that comply with established standards are the bedrock of trust for external stakeholders, including investors and lending institutions. When a company demonstrates a firm grasp of concepts such as deferred income, it signals robust internal financial controls and disciplined management.

The Fundamental Difference: Deferred Income vs. Accrued Revenue

In accounting, the terms deferred income and accrued revenue often confuse, yet they represent opposite sides of the revenue recognition coin. While both are critical components of accrual accounting, they describe fundamentally different scenarios regarding the timing of cash collection versus service delivery.

| Aspect | Deferred Income (Unearned Revenue) | Accrued Revenue |

|---|---|---|

| Definition & timing | Cash is received before goods/services are delivered. Revenue is recognized later when obligations are fulfilled. | Goods/services are delivered before cash is received. Revenue is recognized now, cash comes later. |

| Balance sheet position | Recorded as a liability (often “Unearned Revenue”) because the company still owes delivery to the customer. | Recorded as an asset (often “Accounts Receivable” or “Accrued Revenue”) because the customer owes payment. |

| Cash flow impact (at initial recording) | Creates an immediate cash inflow because payment is received upfront. | No immediate cash inflow. Cash arrives only when the customer settles the invoice. |

The following comparison will highlight their definitions, placement in financial statements, and impact on cash flow to provide a complete picture.

1. Definition and timing of recognition

The most fundamental distinction lies in the sequence of events between the cash receipt and the recognition of revenue. Deferred income is recorded when a company receives a cash payment from a customer before the goods or services are delivered, meaning cash comes first.

2. Position in financial statements

Because they represent opposite concepts, their placement on the balance sheet is also fundamentally different. Deferred income is recorded as a liability, often under “Unearned Revenue,” because the company still owes a product or service to its customer. It is a debt of performance.

3. Impact on cash flow

The effect of these two transactions on the statement of cash flows at the time of initial recording is also starkly different. The recognition of deferred income always involves an immediate cash inflow, as the company receives money up front from its customers. On the other hand, the initial recording of accrued revenue has no immediate impact on cash flow; cash inflow will occur only when the customer settles the invoice. This distinction is vital for accurate accrual accounting and cash flow analysis.

Practical Examples of Deferred Income Across Various Industries

The concept of deferred income is not confined to a single type of business; it is a prevalent and important accounting practice across a wide range of industries.

These examples will illustrate the common scenarios where deferred income arises and how it is managed over the lifecycle of a customer contract, providing a clearer picture of this crucial accounting concept in action.

1. Software as a Service (SaaS) industry

This is one of the most common examples in the digital economy. SaaS companies often offer discounts for annual subscriptions paid upfront. For instance, if a business pays $12,000 in January for a one-year software license, the SaaS provider records the full amount as deferred income. Each month, as the service is provided, the company will then recognize $1,000 of that amount as earned revenue, systematically reducing the liability on its balance sheet over the 12 months.

2. Media and publishing industry

Publishing houses and media companies that offer annual subscriptions to magazines, newspapers, or online content also rely heavily on this concept. When a customer pays $120 for a one-year magazine subscription, the publisher initially records the entire $120 as a deferred income liability. As each monthly issue is delivered to the subscriber, the company recognizes $10 ($120 / 12 months) as earned revenue, reflecting the fulfillment of its obligation for that period.

3. Professional and consulting services

Law firms, marketing agencies, and IT consultants frequently require a retainer or an upfront payment before commencing a project or providing ongoing services. For example, a marketing agency might receive a $5,000 monthly retainer at the beginning of the month. This amount is recorded as deferred income and is recognized as earned revenue only at the end of the month, after the marketing services for that period have been fully delivered under the agreement.

4. Construction and real estate industry

In long-term construction projects, developers often receive substantial down payments or installment payments from clients long before a project is completed. According to a leading financial education site, these payments are recorded as deferred income, and revenue is recognized progressively using the percentage-of-completion method. This ensures revenue is matched to construction progress, providing a more accurate reflection of the project’s financial performance over time rather than booking all revenue at the end.

A Step-by-Step Guide: Journal Entries for Deferred Income

Accurately recording deferred income involves a straightforward, two-stage journal entry process that is fundamental for any accounting team. This process ensures that financial statements remain compliant with the revenue recognition principle. The process prevents the premature recognition of revenue and aligns financial records with the actual delivery of value to the customer, a core tenet of accrual accounting.

1. Stage 1: Receiving the advance payment (before delivery)

At this stage, the company has received cash in Malaysia (RM), but the product or service has not yet been delivered. Since the revenue is not earned yet, it must be recorded as a liability (Deferred Income / Unearned Revenue), not as income.

Journal entry:

- Dr Cash (increase assets)

- Cr Deferred Income / Unearned Revenue (increase liabilities)

Example (1 Jan, RM12,000 for a 12-month service contract):

- Dr Cash RM12,000

- Cr Deferred Income RM12,000

2. Stage 2: Recognizing the earned revenue

Managing deferred income manually using spreadsheets, especially for a growing business with hundreds or thousands of customers, is not only inefficient but also highly prone to errors. The complexity of tracking multiple contracts with different start dates and recognition schedules can quickly become an administrative nightmare.

Fortunately, modern financial tools and accounting software offer robust solutions to simplify and automate this process, transforming it from a high-risk task into a streamlined, accurate operation. This automation is a key component of effective financial management in today’s business environment.

Implementing finance automation for deferred income provides significant advantages, including enhanced accuracy, improved efficiency, and real-time financial visibility. By leveraging technology, companies can ensure compliance with accounting standards while freeing up valuable time for their finance teams to focus on more strategic analysis.

1. Reduces human error in recording

An integrated accounting system can automatically generate the initial journal entry the moment an invoice for an advance payment is created and paid. The software will instantly debit the cash account and credit the deferred income liability account without requiring any manual data entry.

2. Ensures timely revenue recognition

One of the most significant benefits of accounting software is its ability to create and manage automated revenue recognition schedules. Once a contract’s terms, such as its start date and duration, are entered into the system, it can be configured to automatically post the necessary adjusting journal entries at the end of each period.

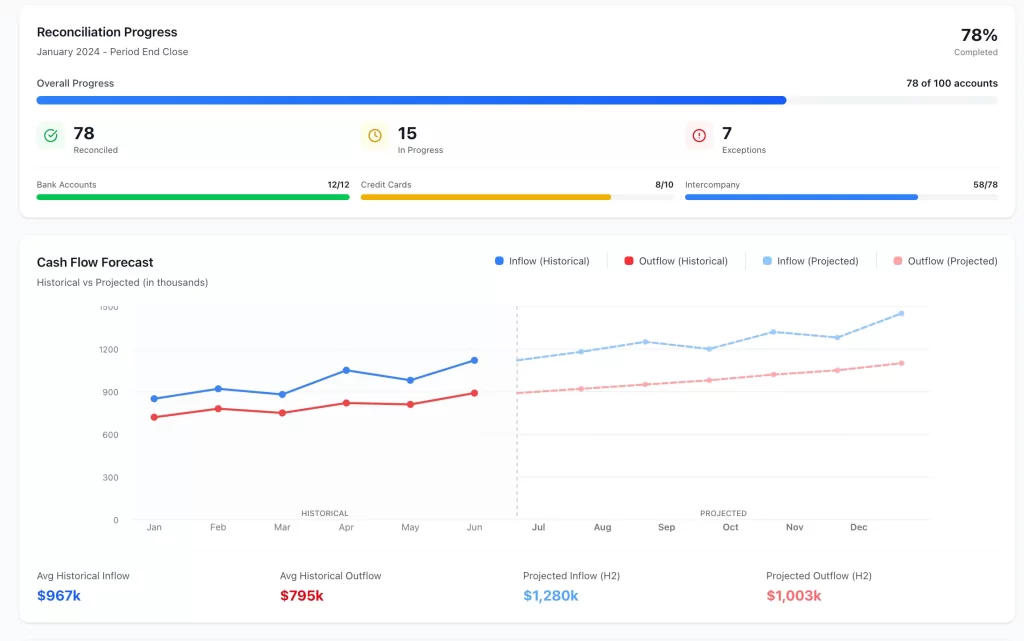

3. Generates accurate financial reports automatically

With both the initial recording and periodic adjustments fully automated, an accounting ERP system can produce accurate, real-time financial statements such as the balance sheet and income statement on demand. Management can access up-to-the-minute balances for the deferred income account and track actual revenue performance without waiting for a lengthy, laborious manual reconciliation at the end of the month.

Optimize Your Financial Management with the Right Accounting Solution

Managing finances manually gets harder as your business grows. The right accounting software takes the heavy lifting off your team by automating repetitive tasks and keeping your financial data accurate and accessible.

Key Features to Look for in Accounting Software:

- Automated Journal Entries: Records transactions automatically, including deferred income and revenue recognition, reducing manual bookkeeping and the risk of errors.

- Real-Time Financial Reporting: Pulls up balance sheets, income statements, and cash flow reports whenever you need them, not just at month end.

- Cash Flow Forecasting: Projects future cash positions based on historical data and current transactions to support smarter budgeting and investment decisions.

- Multi-Level Approval Workflow: Routes transactions through customizable approval steps so every entry follows company policy before it gets posted.

- Seamless Module Integration: Connects with sales, purchasing, and inventory to keep financial data consistent across the entire organization.

If manual processes and disconnected tools are slowing your finance team down, trying a free demo of an integrated accounting system is a good first step to see how things can run more smoothly.

Conclusion

In conclusion, deferred income is far more than a simple accounting entry; it is a critical indicator of a company’s future obligations and a key component of accurate financial reporting. Properly managing this liability ensures compliance with accounting standards, provides a true reflection of profitability, and enhances the confidence of investors and creditors.

While manual tracking is feasible for tiny businesses, the risk of error and inefficiency grows exponentially with scale. The adoption of modern technologies is no longer a luxury but a necessity for achieving accuracy and efficiency.

Try our free demo now to see how automating the creation of journal entries and revenue recognition schedules can free up valuable resources, minimize human error, and gain real-time insights into their’ financial health, ultimately paving the way for smarter, data-driven growth.

FAQ About Deferred Income

-

Is deferred income the same as unearned revenue?

Yes, deferred income and unearned revenue are interchangeable terms for the same accounting concept. They both represent payments received for services or goods not yet delivered and are recorded as a liability.

-

Where does deferred income appear in financial statements?

Deferred income appears on the balance sheet under current liabilities if the revenue is expected to be earned within one year. If the recognition period exceeds 1 year, it is classified as a long-term liability.

-

What happens if deferred income is incorrectly recorded as revenue?

Recording deferred income immediately as revenue overstates a company’s income and net profit for that period. This violates the revenue recognition principle and leads to inaccurate financial statements that can mislead stakeholders.