A tax invoice is more than a billing document, it’s a compliance record that supports accurate VAT reporting and keeps financial transactions transparent. In Malaysia, getting tax invoicing right matters because errors can trigger reporting issues and potential penalties.

This is becoming even more important as Malaysia moves toward e-invoicing in phases, starting in August 2024, beginning with taxpayers with annual turnover exceeding RM100 million. The rollout then expands to the rest of taxpayers by 2025, with the goal of improving reporting accuracy and reducing tax fraud.

To stay ready, businesses need to understand what a tax invoice is, what information it must include, and which types apply to different transactions in Malaysia. Once the fundamentals are clear, it’s easier to connect tax invoicing with cleaner documentation workflows and stronger control over invoicing data.

Key Takeaways

|

What is a Tax Invoice?

A tax invoice is a legally recognized document that records the sale of taxable goods or services. It is issued by the seller to the buyer and is essential for ensuring proper tax documentation and compliance with Malaysian tax regulations.

For VAT-registered businesses or those under the Sales and Service Tax (SST) regime, a tax invoice serves as proof of transaction and enables the buyer to claim input tax credits. It plays a vital role in accurate reporting, accounting, and financial auditing.

A valid tax invoice typically includes the seller’s and buyer’s details, tax identification numbers, invoice date, a unique invoice number, description of goods or services, quantity, unit price, total value, tax rate, and the VAT amount. Without a proper tax invoice, businesses risk penalties, missed deductions, and non-compliance.

Tax Invoice Requirements and Issuance

A tax invoice is required when a business sells taxable goods or services under Malaysia’s VAT or SST systems. This document must be issued for every taxable transaction, especially if both parties are tax-registered. Issuing a valid tax invoice ensures compliance, supports input tax claims, and helps businesses avoid penalties.

Typically, the seller is responsible for issuing the tax invoice at the time of sale or shortly after. In some cases, especially for imports or reverse charges, the buyer may need to issue a tax invoice themselves to meet regulatory requirements.

Components of a Tax Invoice

A tax invoice issued in Malaysia must include specific mandatory details set by the Inland Revenue Board (IRBM). These components ensure proper documentation, accurate reporting, and compliance with local tax regulations. Below are the key elements that every Malaysian tax invoice must contain.

A valid tax invoice Malaysia format must include the following key details:

- Seller’s name, address, and Tax Identification Number (TIN)

- Buyer’s name and address

- Description and quantity of goods or services

- Unit price and total amount due

- VAT invoice rate and tax amount

- Date of invoice and unique invoice number

- Seller’s VAT registration number

Using invoicing software for tax compliance can simplify the process by automatically generating tax invoices with all required fields, reducing manual errors and ensuring compliance with local regulations.

Types of Tax Invoices

There are several types of tax invoices used in Malaysia, depending on the nature and scale of the transaction. Understanding each type ensures proper documentation and helps businesses stay compliant with local tax laws.

1. Full Tax Invoice

This is the most detailed form of a tax invoice. It includes all required information such as the seller’s and buyer’s details, item descriptions, quantity, unit prices, tax amount, invoice number, and date. It’s typically used for large-scale or business-to-business transactions.

Example: A logistics company issues a full tax invoice after delivering freight services to a corporate client.

2. Simplified Tax Invoice

A simplified invoice contains fewer details but is still acceptable for smaller transactions. It usually includes the seller’s name, the date, a brief item description, and the total amount payable with tax.

Example: A retail store issues a simplified invoice for a walk-in customer buying office supplies.

3. Electronic Tax Invoice

An electronic tax invoice is a digital version sent via email or electronic platforms. It includes all standard invoice details but offers added convenience and traceability. This type is gaining popularity in Malaysia, especially with the shift toward digital tax systems.

Example: An e-commerce business sends an electronic tax invoice to a customer after an online purchase.

Choosing the right type of tax invoice helps maintain consistency with accounting principles, improves reporting accuracy, and ensures full compliance with VAT regulations.

How to Prepare a Tax Invoice

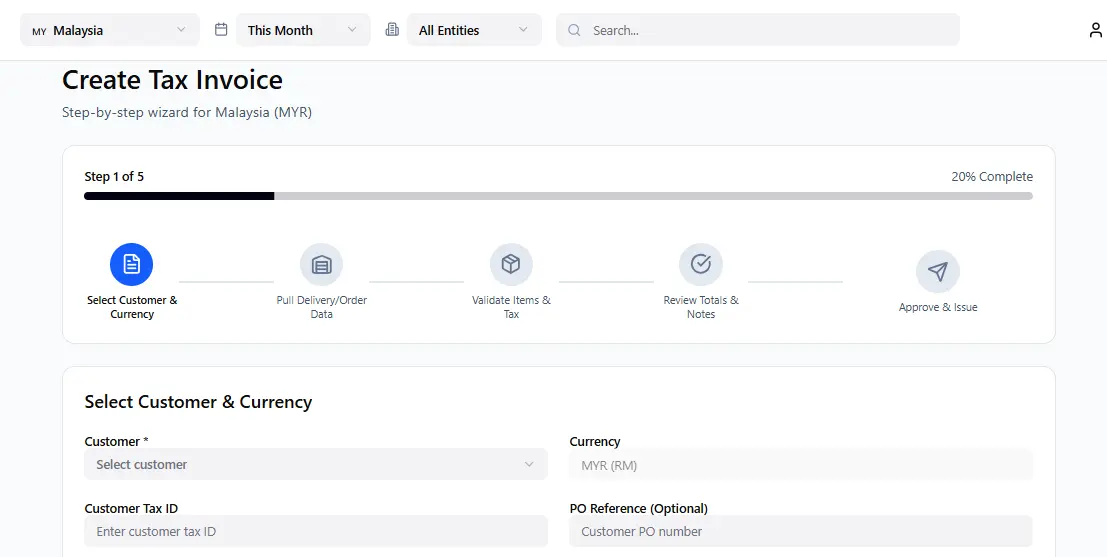

Creating a proper tax invoice is essential for maintaining compliance and documenting business transactions. Here’s a step-by-step guide to help you prepare one accurately:

Step 1: Collect Required Information

Start by gathering all necessary details, including the seller’s and buyer’s names, addresses, and tax identification numbers, as well as the goods or services sold, quantity, unit price, and applicable tax rates.

Step 2: Use a Standard Template

Choose a tax invoice template that includes all mandatory fields. You can design one manually or use financial management software that comes with customizable templates built to meet Malaysia’s tax requirements.

Step 3: Enter Transaction Details

Fill in the invoice with relevant data, including the invoice number, date, product or service descriptions, amounts, and tax breakdowns. Make sure figures are calculated precisely to avoid disputes or audit issues.

Step 4: Calculate VAT

Apply the correct VAT rate, usually 6% under the SST framework in Malaysia, and show both the subtotal and total with tax included.

Step 5: Review for Accuracy

Before sending, double-check the information for completeness and accuracy. Incomplete or incorrect invoices can result in processing delays or non-compliance risks.

Step 6: Send to Buyer

Once finalized, send the invoice to the buyer via your preferred method: email for a digital copy, or print for physical delivery.

Well-prepared tax invoices reduce the risk of miscommunication and help ensure smooth financial operations. Many businesses now rely on financial management software to automate this process, eliminate manual errors, and enhance reporting accuracy.

Automate Compliance and Invoicing for Malaysian Businesses

As transaction volume grows, manual invoicing often leads to slow processing, inconsistent formatting, and avoidable SST calculation errors. A structured invoicing system helps standardise documents, maintain consistent tax fields, and reduce rework during month-end closing or audit checks.

Because this article focuses on Malaysia, the compliance angle should stay Malaysia-specific and align with SST requirements rather than Indonesia-only frameworks. The most relevant local context is SST practices, e-invoicing readiness, and documentation accuracy that support traceable reporting, especially for high-volume B2B invoicing.

In many cases, results improve most when invoices are generated from real operational data (sales, deliveries, inventory) rather than being manually entered each time. For example, a mid-sized distributor in Selangor reduced recurring SST input errors by moving from spreadsheets to automated templates with item-based tax tagging, while also speeding up billing by issuing invoices immediately after delivery.

Instead of choosing a tool based on “billing” alone, prioritise features that strengthen control, accuracy, and traceability:

- Customisable invoice templates: Adjust layouts for different customers and transaction types while keeping mandatory fields consistent.

- Tax and discount automation: Automatically calculate SST and discounts to minimise manual errors.

- Online payment integration: Enable multiple payment methods to speed up collections and make them more convenient.

- Credit limit management: Set and monitor customer credit limits to protect cash flow and reduce risk.

- Invoice approval and validation workflows: Apply multi-level approvals for special pricing, terms, or exceptions.

- Real-time reporting: Track unpaid invoices, tax position, and billing performance from a central dashboard.

With the right setup of an enterprise system, businesses can improve invoicing accuracy, reduce compliance risk, and maintain healthier cash flow as operations scale.

Conclusion

Tax invoicing is essential for maintaining accurate financial records and meeting Malaysia’s tax requirements. The right invoicing software can simplify this process by automating routine tasks, reducing manual errors, and improving payment follow-ups, enabling finance teams to work faster with greater control.

A well-designed invoicing system typically supports automated invoice creation, flexible templates, real-time receivables tracking, and smooth integration with accounting workflows. With stronger visibility and cleaner documentation, businesses can shorten billing cycles and reduce the risk of inconsistencies in tax-related records.

If you want to improve how your invoicing process runs day to day, consider booking a free consultation to review your current workflow. This helps identify quick wins and the most practical automation setup before you make any system changes.

FAQ about Tax Invoice

-

What is a tax invoice in Malaysia?

A tax invoice in Malaysia is a document issued by a seller to record the sale of taxable goods or services, required for SST compliance and input tax claims.

-

Is a tax invoice a receipt?

No. A tax invoice details the transaction before or during the sale, while a receipt confirms that payment has been made.

-

Why is it called a tax invoice?

It’s called a tax invoice because it includes tax details—such as SST or VAT—showing the amount charged and enabling tax reporting or claims.