Imagine managing farm worker salaries without the right payroll system. Late payments, compliance issues, and error-prone manual calculations can hinder productivity and undermine trust.

In Malaysia, the agriculture sector still lags in the adoption of digital technology. According to the World Bank, despite a 7.2% increase in productivity by the second quarter of 2024, the sector has been slow to modernise. The use of manual methods in payroll management, which takes up to 5 days per cycle, increases errors and worker turnover, costing companies money.

The solution to this problem is an automated payroll system, which speeds up payments, reduces errors, and ensures regulatory compliance. However, with so many options, how do you choose the right system?

This article will discuss the 12 best payroll solutions for the agriculture sector in Malaysia that can manage payroll, seasonal workers, and compliance more efficiently.

Key Takeaways

|

What is Agriculture Payroll Software?

Agriculture payroll software is a digital solution designed to help agribusinesses manage wage payments, attendance tracking, and employee records. It automates salary calculations, generates payslips, and ensures compliance with labor and tax regulations relevant to the agriculture sector.

This software supports day-to-day HR operations in farms, plantations, and agro-industrial companies, especially those dealing with large seasonal or field-based labor forces. By integrating payroll processes with HR software, agricultural businesses can reduce errors, save time, and improve workforce transparency.

Agriculture payroll systems often feature automation for statutory contributions, leave tracking, and shift-based payroll. This ensures smoother payroll cycles while improving employee satisfaction through timely and accurate payslips.

Why Do Agricultural Businesses Need Payroll Software?

For agricultural operations, payroll software helps streamline complex wage calculations, improve compliance, and manage large or shifting workforces more efficiently. With tailored HR software functions, it supports daily labor administration and ensures accountability across diverse field operations. Below are the key reasons why this software is vital:

1. Accurate and automated payroll management

Agriculture payroll software automates pay calculations based on attendance, working hours, piece rates, or seasonal contracts. This helps reduce manual errors and ensures employees are compensated fairly and consistently, whether working on plantations, in barns, or at processing facilities.

2. Seamless payslip generation and distribution

The system allows automatic generation and digital distribution of payslips to workers, even in remote field locations. This builds trust and transparency while reducing the administrative workload for HR staff handling large numbers of labourers.

3. Integrated HR software capabilities

Most payroll platforms include built-in HR tools such as leave management, worker databases, and time-tracking features. This centralizes employee information, making it easier to manage and audit labor records across multiple farms or regions.

4. Labor law and tax compliance

Agricultural payroll software ensures compliance with Malaysia’s labor laws, including EPF, SOCSO, and EIS contributions. It automates tax deductions, minimum wage calculations, and generates reports for audits and filings with LHDN. This helps businesses stay compliant and avoid penalties with minimal effort.

5. Better workforce insights for seasonal planning

With access to payroll data and worker trends, agribusiness managers can make informed decisions about staffing needs, labor costs, and contract durations. This supports budgeting and planning, especially for businesses reliant on seasonal labor cycles.

Also read: ERP software for streamlining payroll management in the agriculture industry.

12 Best Agricultural Payroll Software for Your Business

Here are 12 top-rated agricultural payroll software options for farms, plantations, and agribusinesses in Malaysia, at a glance of what they’re best for:

- HashMicro Agricultural Payroll Software: Cloud-based solution with payroll automation, attendance tracking, and employee management for agricultural businesses.

- Talenox Payroll System: Simple payroll software for small agricultural companies with basic payroll and tax calculations.

- Sure Payroll: Payroll system for small businesses with automatic payroll calculation and tax filing.

- Zoho Agriculture Payroll: Automates payroll and integrates with the Zoho ecosystem, suitable for small agricultural businesses.

- PayrollPanda System: Payroll software with EPF/SOCSO/PCB calculation and pay slip generation, suitable for small agricultural businesses.

- Swingvy: Cloud-based payroll platform that automates payroll and employee data management.

- Paylocity: A comprehensive payroll system for medium to large agricultural businesses.

- Kakitangan: Local payroll solution with basic payroll processing and leave management.

- Employment Hero: HR and payroll platform that automates payroll and employee data management.

- HR2eazy: Simple payroll software for small agricultural businesses with basic attendance features.

- QuickBooks Agriculture Payroll: Integrated with QuickBooks for small to medium-sized agricultural businesses.

- BrioHR Agriculture Payroll: Cloud-based payroll software for agriculture businesses with attendance and payroll features.

Selecting the right agricultural payroll software ensures accurate salary processing, tax compliance, and efficient workforce management across the farm or plantation. This guide highlights 12 trusted platforms to help you streamline payroll operations and maintain smooth business practices.

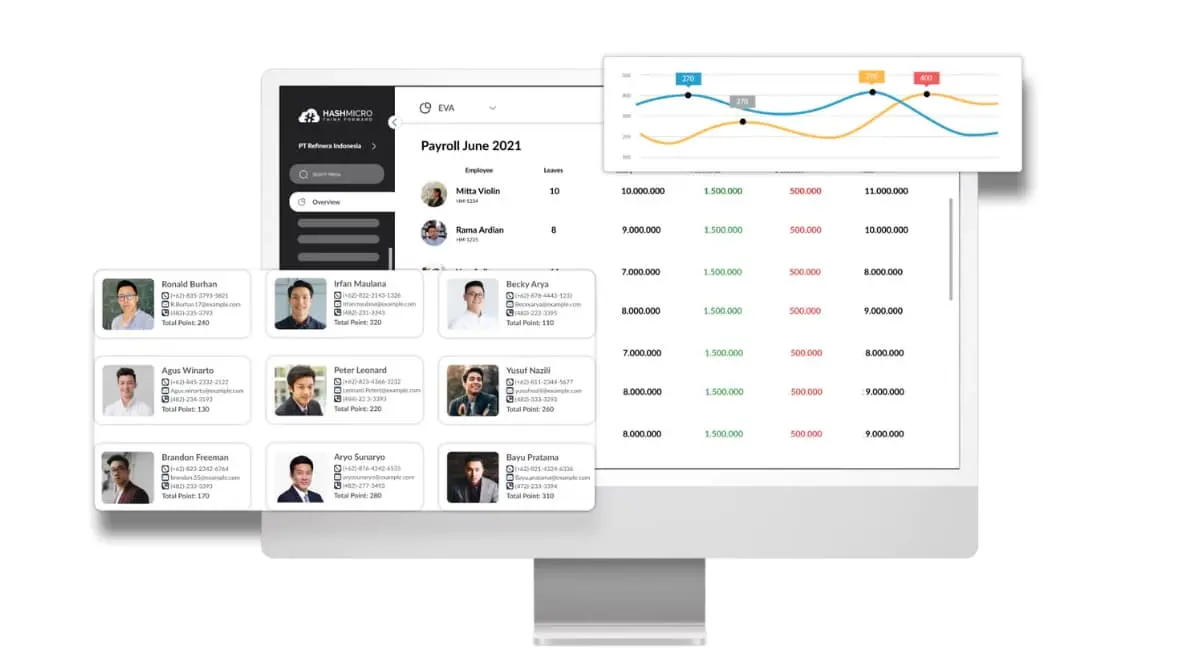

1. HashMicro Payroll Software

HashMicro Payroll Software is a leading HR software solution tailored for various industries, including the agriculture sector. Designed to support the unique challenges of managing a large and diverse workforce, this cloud-based agriculture payroll system helps streamline complex salary processes, especially for seasonal and full-time farm employees.

With its customizable architecture, HashMicro offers an agricultural employee payroll system that integrates seamlessly with attendance, taxation, and government compliance systems, including EPF, SOCSO, EIS, and LHDN requirements. Ideal for farms, plantations, and agribusinesses, HashMicro also provides a localized support team in Malaysia, ensuring expert guidance on payroll processes and local regulations.

The software simplifies end-to-end payroll software for agriculture, enabling accurate salary disbursement, automatic payslip generation, and efficient HR management even in rural or remote settings.

Key features that make HashMicro a top choice for agricultural payroll software include:

- Farm payroll management software: Automates salary calculations based on crop cycles, working hours, field attendance, and overtime, optimizing payroll processes for farming businesses.

- Centralized employee database: Keeps all seasonal, contract, and permanent worker data organized and secure in one system, minimizing manual HR administration.

- Automated payslip generation: Instantly generates digital payslips that include tax, bonus, and deduction breakdowns, which are accessible via the cloud for both HR and workers.

- Flexible leave and attendance tracking: Tracks employee availability and integrates seamlessly with payroll calculations, accommodating varying work schedules common in agriculture.

- Expense tracking & subsidies: Easily record and reimburse field-related expenses such as travel, tools, or equipment.

- Recruitment to retirement lifecycle: Manages the complete employee journey in agribusiness—from hiring laborers during planting seasons to offboarding at harvest end.

| Pros | Cons |

|

|

If you’re interested in learning more about how HashMicro Agricultural Payroll Software can simplify payroll management and streamline HR processes for your farming business, click the banner below to view the pricing scheme.

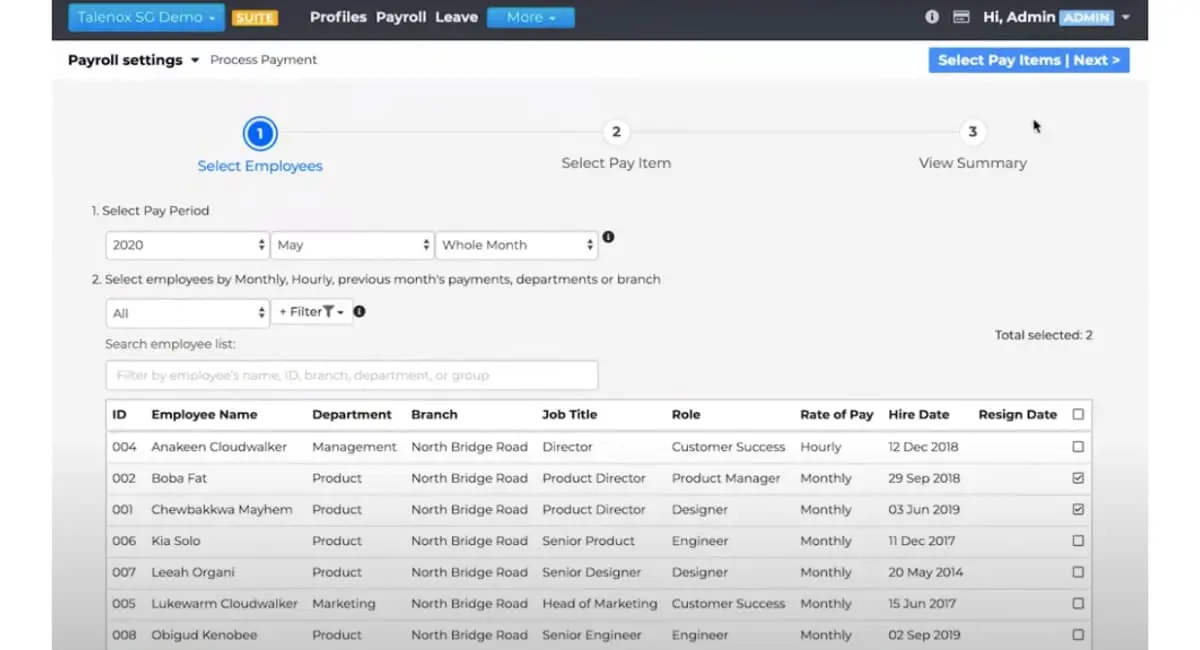

2. Talenox Agriculture Payroll

Talenox is a cloud-based payroll and HR software that helps businesses manage employee information and process salaries. It offers basic functionality for payroll tasks, such as salary calculations, tax contributions, and payslip generation.

The platform is commonly used by small to medium-sized businesses, including those in agriculture, that need a simple and accessible solution to handle payroll and basic HR needs. Talenox is mainly suitable for businesses with straightforward HR structures and limited customisation requirements.

Key Features:

- Payroll processing and tax computation

- Digital payslip generation

- Basic leave and employee data management

| Pros | Cons |

|

|

3. Sure Payroll

Sure Payroll is an online payroll software that offers basic payroll processing services for small businesses. It is used to help companies calculate wages, handle tax filings, and distribute payslips to employees.

The platform is commonly used by small business owners in various sectors, including agriculture, who are looking for a simple tool to manage recurring payroll tasks. It provides essential functions but may not support advanced HR or labor management features.

Key Features:

- Automatic payroll runs

- Tax calculation and filing

- Employee payslip delivery

| Pros | Cons |

|

|

4. Zoho Agriculture Payroll

Zoho Payroll is part of the Zoho suite that offers basic payroll processing features for businesses. It helps automate salary disbursement, tax deductions, and payslip generation through an online system.

The software is generally used by small to medium-sized businesses, including those in agriculture, that require standard payroll functionalities without complex configurations. It is suitable for companies looking to integrate payroll with other Zoho products.

Key Features:

- Salary and tax calculation

- Online payslip distribution

- Integration with the Zoho ecosystem

| Pros | Cons |

|

|

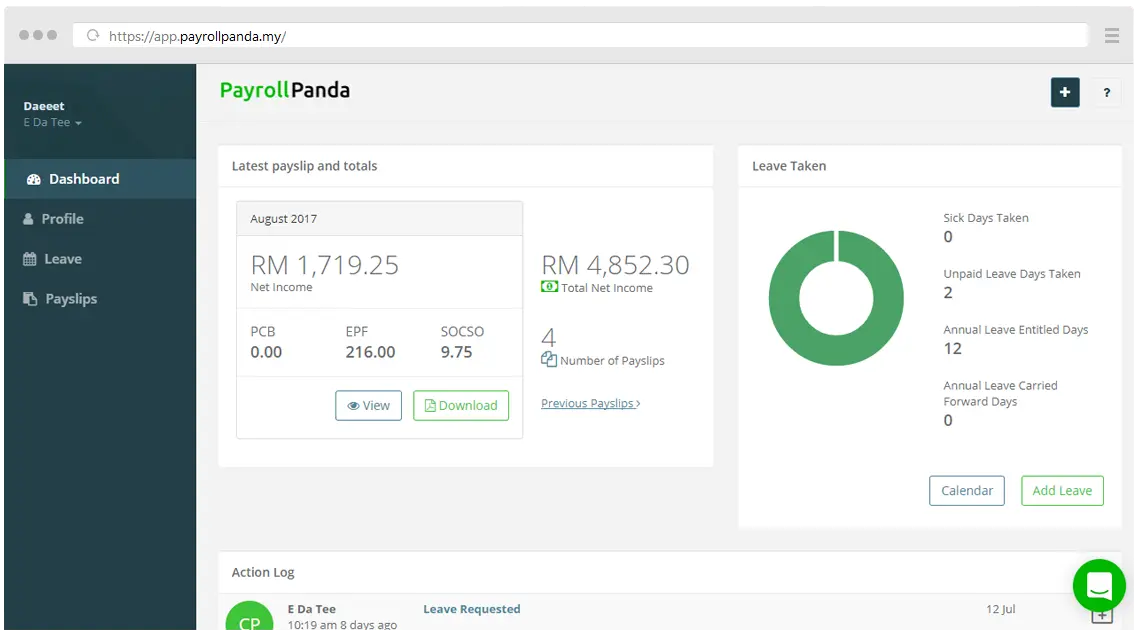

5. PayrollPanda System

PayrollPanda is an online payroll software designed to assist small to medium-sized businesses with salary processing, statutory deductions, and payslip generation. It is mostly used in industries that need a straightforward system for managing payroll tasks.

This farm accounting software is also adopted by agricultural businesses that want a basic platform to ensure employees are paid correctly and on time. PayrollPanda focuses on local compliance and offers simple tools for managing employee records.

Key Features:

- Payroll automation and EPF/SOCSO/PCB calculations

- Payslip generation and distribution

- Employee database management

| Pros | Cons |

|

|

6. Swingvy

Swingvy is a cloud-based payroll and HR software used by small to mid-sized businesses for managing employee compensation, records, and compliance. The system is built to simplify payroll processing and reduce manual administrative tasks.

Agricultural businesses that operate with small teams often use Swingvy for its basic payroll functions, including automated salary calculations and payslip generation. It is a general solution suitable for companies looking to centralize simple HR and payroll activities.

Key Features:

- Automated payroll processing

- Online payslip issuance

- Employee information management

| Pros | Cons |

|

|

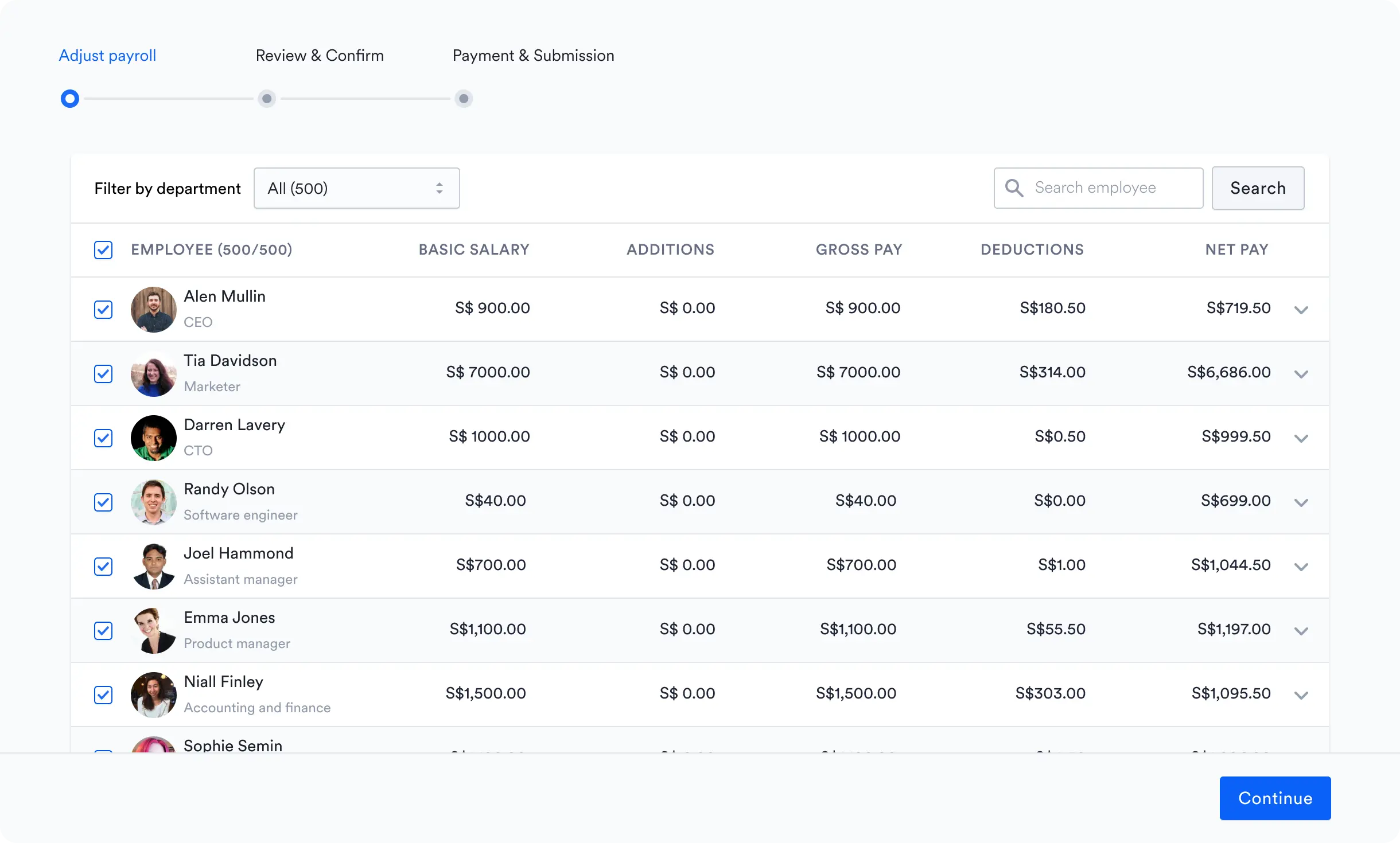

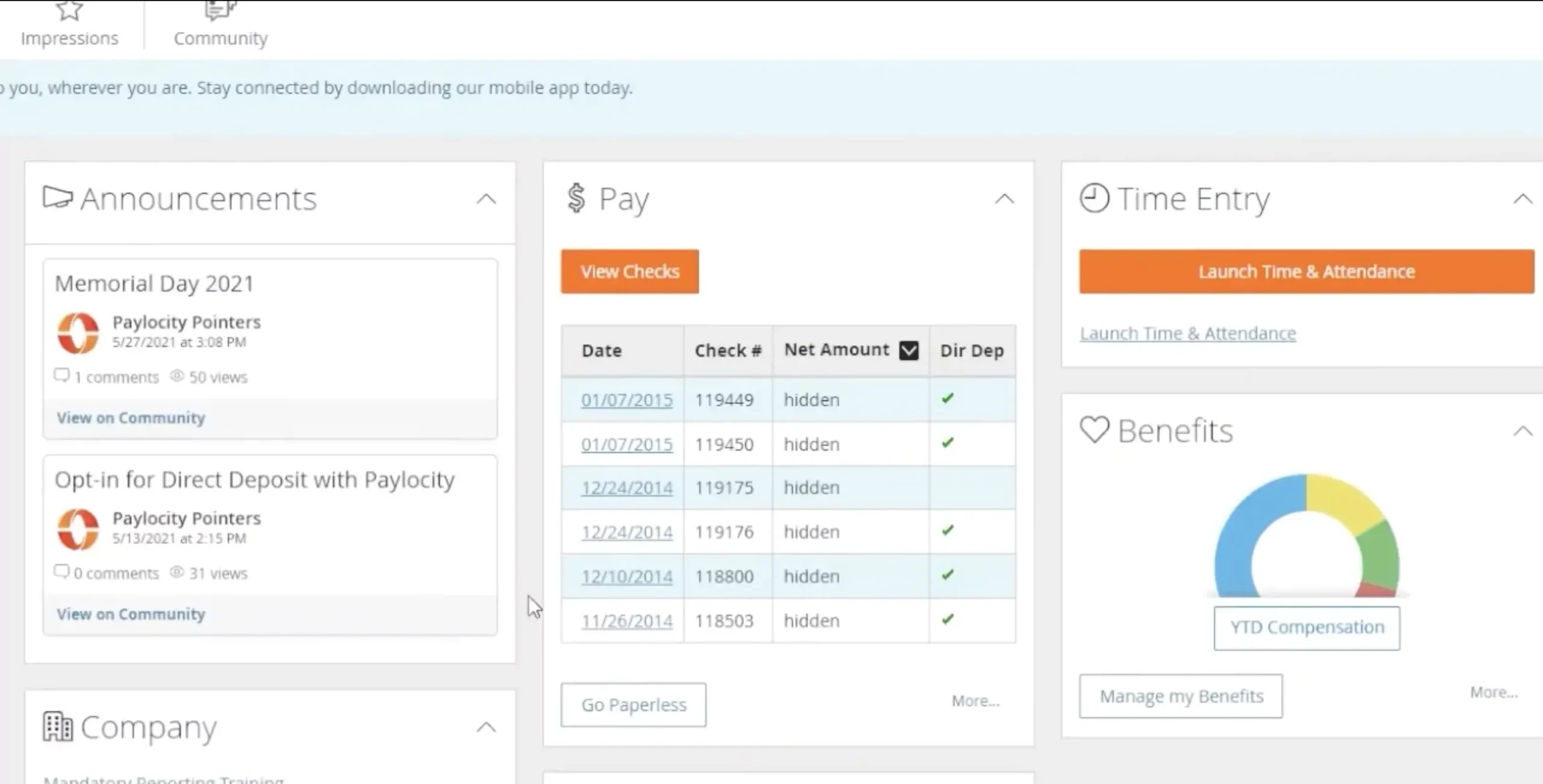

7. Paylocity

Paylocity is an all-in-one payroll and human capital management (HCM) software that offers a variety of tools to help businesses handle HR and employee payment processes. It is used across multiple industries, including agriculture, especially for companies that need a centralized payroll and HR solution.

Agricultural businesses may consider Paylocity when looking for software that supports automated payroll, employee data management, and compliance reporting. The system is more suitable for medium to large teams that require more administrative structure.

Key Features:

- Payroll processing and tax filing

- Employee records and document storage

- Self-service portal for employees

| Pros | Cons |

|

|

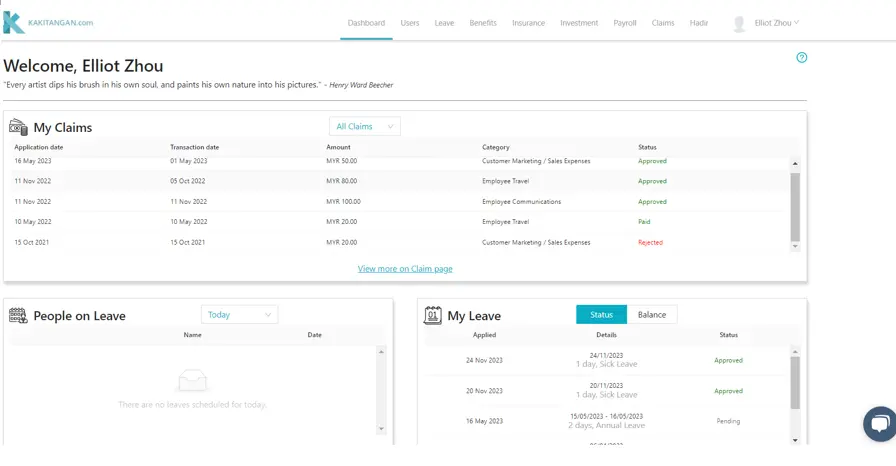

8. Kakitangan

Kakitangan is an online payroll and HR software platform that is commonly used by small and medium-sized businesses in Malaysia. It provides basic payroll services, employee database management, and leave tracking features. For agricultural businesses that require a simple digital tool to handle payroll, Kakitangan can serve as a straightforward option.

The platform is mostly suitable for companies that do not have complex payroll structures or large headcounts, making it usable for small farm businesses or agribusiness startups.

Key Features:

- Monthly payroll processing

- Online payslip distribution

- Leave management tools

| Pros | Cons |

|

|

9. Employment Hero

Employment Hero is an HR and payroll platform designed for businesses that want to digitise their workforce processes, including payroll. For agriculture businesses, it can be used to manage employee records, automate payroll runs, and maintain basic compliance with labor requirements.

The system is cloud-based and mainly used by small to medium-sized companies that prefer combining HR and payroll tasks in one place. It offers some automation features that may help reduce manual work for farm or agri-based companies.

Key Features:

- Payroll automation and reporting

- Employee onboarding and document storage

- Leave and attendance tracking

| Pros | Cons |

|

|

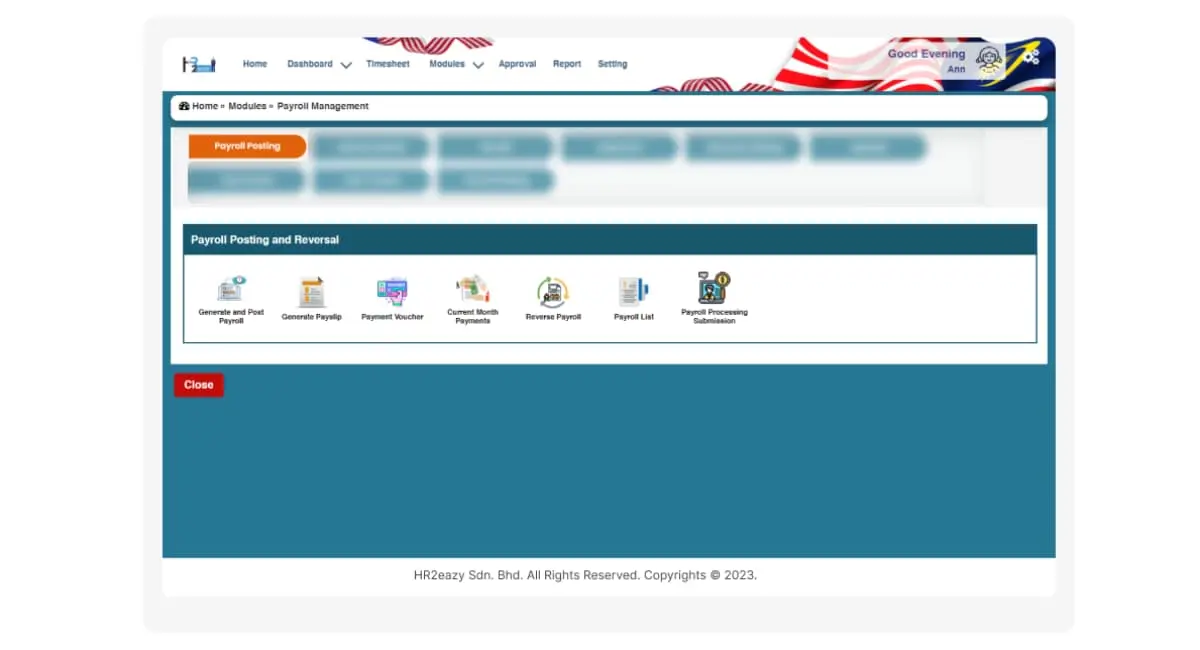

10. HR2eazy

HR2eazy is a payroll and HR software that supports basic employee and salary management. For agriculture businesses, this platform can be used to process monthly wages, record employee attendance, and store personal data in one system.

It is typically used by small to medium-sized companies that need a simple and functional payroll solution. While it offers a range of features, most are designed for general use and may require adjustments for farm-specific workflows.

Key Features:

- Attendance and leave tracking

- Employee database management

- Basic reporting tools

| Pros | Cons |

|

|

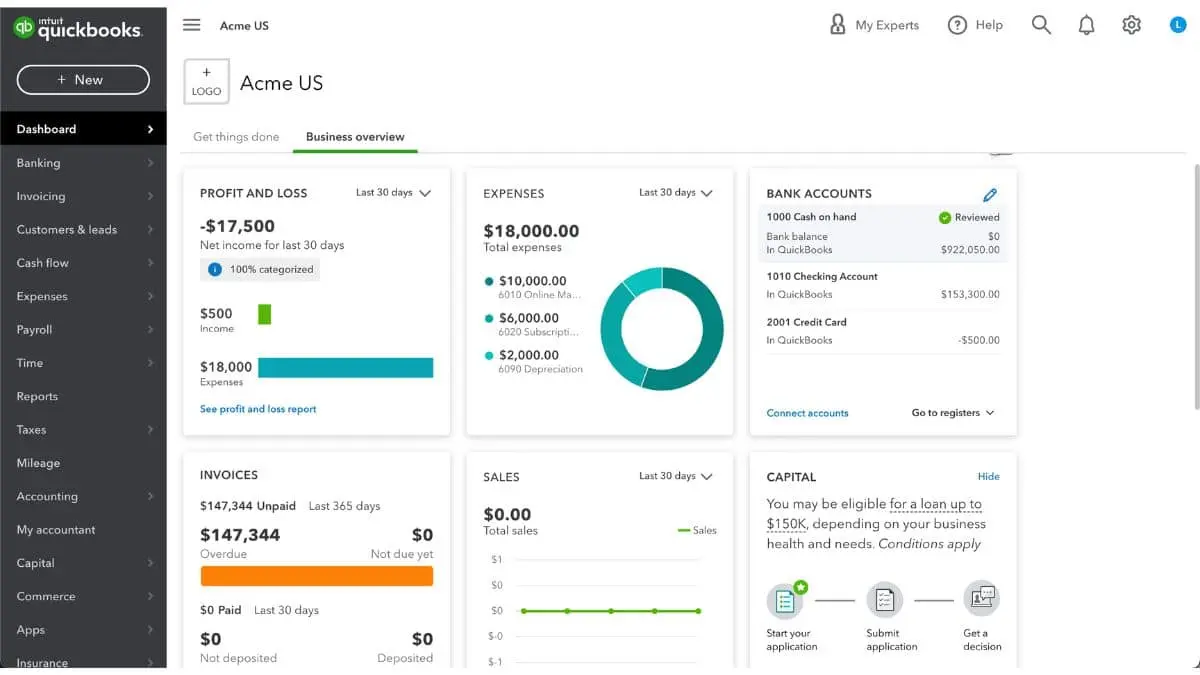

11. QuickBooks Agriculture Payroll

QuickBooks Payroll is a widely used payroll solution that offers basic payroll features for businesses, including those in the agriculture sector. It helps process wages, calculate deductions, and manage payroll taxes in a centralized system.

The platform is often used by small to medium-sized agricultural businesses looking for a payroll solution that can integrate with accounting features. It works best for those already familiar with the QuickBooks ecosystem.

Key Features:

- Automated payroll calculation

- Tax form generation

- Integration with QuickBooks accounting

| Pros | Cons |

|

|

12. BrioHR Agriculture Payroll

BrioHR is a cloud-based HR and payroll system that can be used by agricultural businesses to manage employee compensation, attendance, and statutory contributions. It is generally designed to simplify administrative HR tasks.

The system is commonly adopted by small to mid-sized agricultural organizations that want an all-in-one HR solution with payroll features. It covers basic needs but may require configuration to suit industry-specific workflows.

Key Features:

- Payroll calculation and payslip generation

- Attendance and leave tracking

- Basic employee database management

| Pros | Cons |

|

|

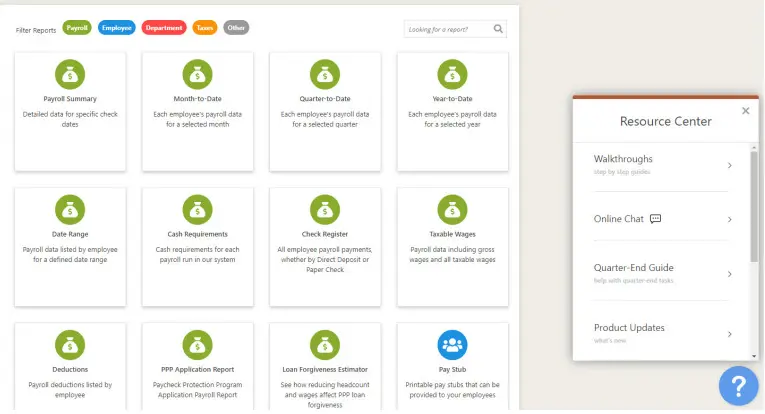

How to Choose the Right Agricultural Payroll Software

Choosing the right payroll software is essential for ensuring efficient payroll processing, accurate tax compliance, and smooth operations in your agricultural business. Whether you operate a small farm or a large agribusiness, here are the key factors to consider when selecting the right payroll software:

1. Identify your payroll needs

Assess the specific payroll needs of your agricultural business, such as handling seasonal workers, calculating wages based on yields or work hours, and managing overtime. Understanding these unique requirements will help you choose software tailored to your farm’s operational model.

2. Tax and regulatory compliance

Ensure the software can accurately handle complex tax calculations and comply with agricultural regulations, such as SOCSO, EPF, EIS, and other local requirements in Malaysia. Look for features that automate tax filings and generate necessary reports to simplify audits and ensure timely compliance with government regulations.

3. Automation and accuracy

Opt for software that automates payroll processes, such as automatic deductions, tax filings, and wage calculations. Automation reduces manual errors, ensures timely payments, and increases operational efficiency, helping you avoid costly mistakes that could affect your workforce’s trust and retention.

4. Integration with other systems

Choose payroll software that integrates seamlessly with your farm’s accounting, HR, and management systems. This integration ensures smooth data flow across departments, minimizes errors, and simplifies financial reporting for better decision-making.

5. Ease of use and customer support

Ensure the software has an intuitive interface that’s easy for both management and staff to use. Look for software that provides accessible customer support and clear onboarding resources, so your team can adapt quickly and fully leverage the system’s features.

Conclusion

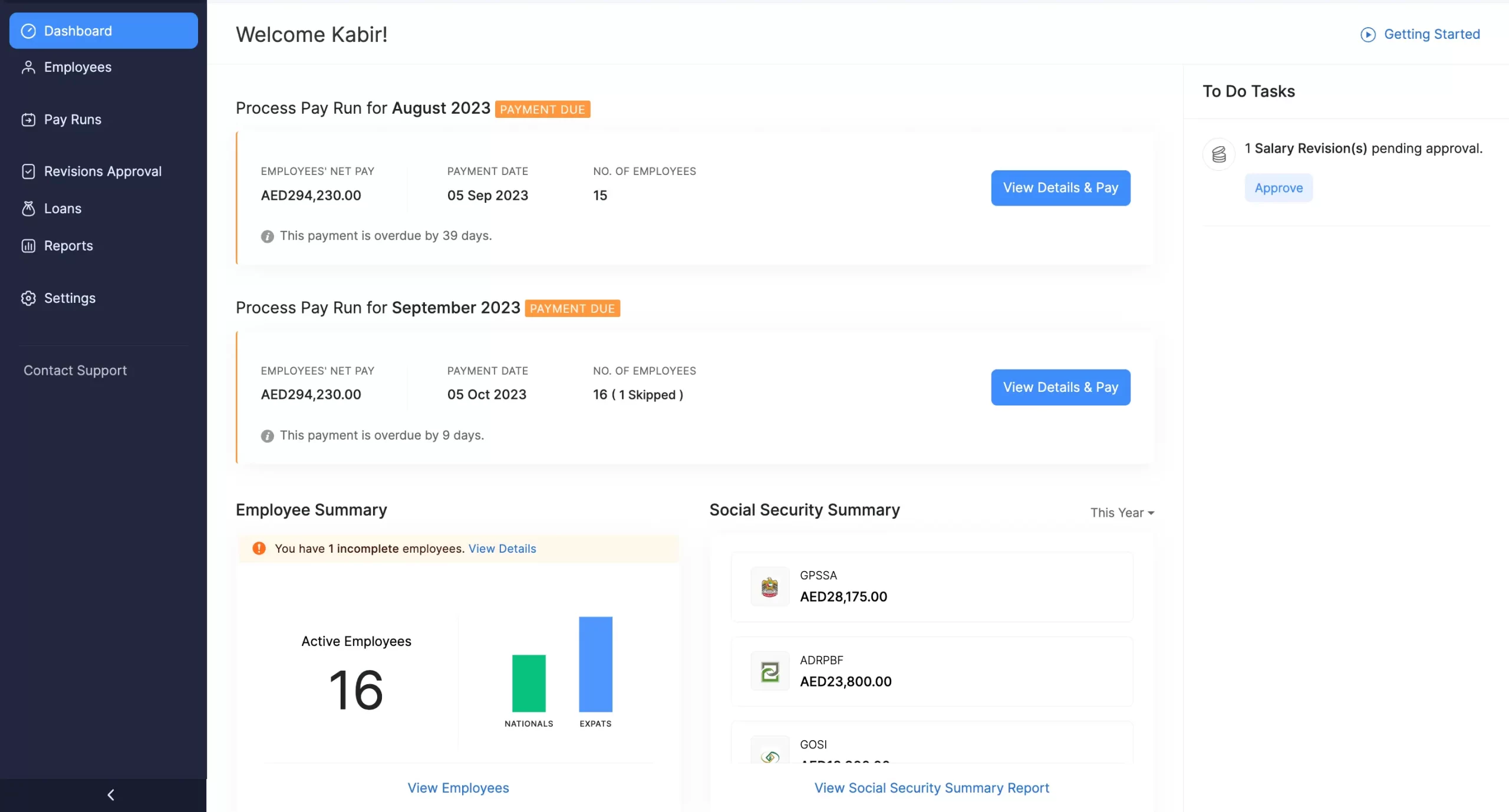

Choosing the right agriculture payroll software is essential for managing seasonal workers, ensuring timely payments, and maintaining compliance in farm operations. With various options available, it’s important to assess your workforce structure and select a solution that simplifies payroll while supporting agricultural workflows.

For agribusinesses seeking a comprehensive solution, HashMicro’s agriculture payroll software offers automated wage calculations, attendance tracking, tax reporting, and full HR integration. Its cloud-based system ensures accuracy, transparency, and efficiency across all payroll processes.

Ready to streamline your farm’s payroll operations? Schedule a free demo today and discover how HashMicro can help you manage agricultural labor with precision, ease, and compliance.

Question About Agriculture Payroll Software

-

What is the best software for agriculture?

HashMicro is the best software for agriculture. HashMicro provides a complete solution for farm management that helps automate operational processes, improve efficiency, and maximize crop yields with cloud-based technology and Business Intelligence features.

-

Which software is mostly used for payroll?

HashMicro also provides payroll software that is widely used by various companies. HashMicro’s payroll system makes it easy to manage salaries, taxes, and benefits with full automation and easy integration with other modules.

-

What is precision agriculture software?

Precision agriculture software is software that helps farmers manage land with precision by leveraging real-time data from sensors, drones, and other technologies to optimize the use of resources such as water, fertilizer, and pesticides. HashMicro provides precision agriculture solutions that enable data-driven decision-making to improve agricultural productivity and efficiency.

-

Which accounting software is best for payroll?

HashMicro Accounting Software is the best choice for accounting needs, integrated with payroll. With complete features ranging from bookkeeping, financial reporting, to payroll management, HashMicro provides a comprehensive solution on one platform.