Financial management software is a critical tool for businesses to streamline their financial operations. The software automates and enhances financial operations and processes, offering robust budgeting, forecasting, reporting, compliance, and more tools.

Malaysian companies face many challenges in financial management, from navigating complex regulatory requirements to managing cash flow effectively. Inefficient financial processes strain resources and limit a company’s potential for growth and profitability.

However, with numerous financial management software options, businesses often struggle to choose which software aligns with their unique needs. Each solution offers different features and functionality, making the selection process even more challenging.

Therefore, this article will provide a list of Malaysia’s 20 best financial management software solutions. We will also discuss what is financial management software and its essential features to help you make an informed decision that best fits your business requirements.

Key Takeaways

|

Table of Content

Content Lists

Why do Businesses Need Financial Management Software?

Financial management software is a specialized tool that integrates with Enterprise Resource Planning or ERP software to streamline financial operations. It assists businesses in managing financial tasks, such as accounting, budget management, payroll, billing, and reporting.

The adoption of financial management software brings numerous benefits to businesses, which include:

- Adequate cash flow from effective tracking and managing payables, receivables, and inventory, enhancing both financial and management accounting insights.

- Automating routine tasks reduces the risk of human errors, labor costs, and financial losses.

- Simplified complex financial processes, from payroll to tax filing, make them more manageable and less time-consuming.

- Improved data security from robust security features to protect against unauthorized access and data breaches.

- Enhanced decision-making from real-time financial data and analytics.

Hashy AI Fact

Need to know!

Hashy AI monitors overdue invoices and automatically engages customers for follow-up, enhancing financial management by ensuring timely payments.

Request a free demo today!

20 Best Financial Management Software for Businesses in Malaysia

Choosing the right financial management software is crucial for optimal financial management. Below are the top 20 financial management software in Malaysia to help you make an informed choice that will drive your business forward.

- HashMicro is a comprehensive ERP solution automating finance, ensuring compliance, and integrating seamlessly.

- Sage Intacct cloud-based software with automation, real-time insights, and multi-currency support.

- SAP Business One is an integrated ERP for accounting, sales, and inventory with industry-specific customization.

- Oracle NetSuite cloud-based finance dashboard combining CRM, e-commerce, and real-time analytics.

- QuickBooks is an user-friendly finance software with automation and cloud accessibility for small businesses.

- FreshBooks is a simple invoicing and expense tracking for freelancers and small businesses.

- Zoho Finance Plus an integrated finance system automating invoicing, accounting, and payroll.

- Infor ERP industry-specific financial software linking finance, supply chain, and CRM.

- Acumatica scalable finance software with real-time insights and cost-effective access.

- Xero cloud-based accounting with mobile access and real-time financial tracking.

- Workday integrates finance and HR for large multinational enterprises.

- Kissflow automates financial workflows, approvals, and expense tracking.

- Cube enhances budgeting, forecasting, and financial data analysis.

- Multiview ERP offers financial tools for healthcare, hospitality, and service industries.

- Prophix automates budgeting, planning, forecasting, and scenario analysis.

- Anaplan provides cloud-based financial planning, forecasting, and decision-making.

- MYOB Accounting simplifies invoicing, payroll, tax tracking, and compliance.

- Clockwork uses AI for financial forecasting, automation, and insights.

- SmartFusion manages public sector finance, compliance, and reporting.

- Vena Solutions combines spreadsheets with enterprise budgeting and forecasting.

1. HashMicro Financial Management Software

HashMicro Financial Management Software is an accounting ERP solution to streamline financial processes. The software automates and simplifies financial tasks such as ledger management, payroll, invoicing, and tax management.

Best overall: HashMicro is the best overall option for Malaysian businesses looking to streamline their financial management.

Why we pick it: HashMicro adheres to a high standard of compliance and functionality in its software design. The system is standardized to ensure consistency and reliability, while also being fully compliant with local regulations, including Peppol standards for e-invoicing.

To experience the full range of benefits of HashMicro Financial Management Software, HashMicro offers a free product tour. These opportunities allow potential users to explore the software’s capabilities and see firsthand how it can optimize their financial processes.

HashMicro’s credibility is proven by being trusted by notable names such as Forbes, Bank of China, and Hino. These collaborations highlight HashMicro’s capability to support complex, large-scale financial operations, proving its reliability and effectiveness.

Below is the comprehensive suite of features that HashMicro Financial Management Software offers:

- Bank Integrations & Auto Reconciliation: This feature seamlessly connects with banking institutions to automatically align and reconcile transactions, thereby eliminating the need for manual entry and minimizing the chance of errors.

- Budget S-Curve: This feature displays cumulative budgeted expenses or revenues over a period, enhancing the visualization of budget progress. This tool is essential to monitor budget trends and effectively manage resources to maintain financial discipline.

- Profit & Loss vs Budget & Forecast: HashMicro enables businesses to compare profit and loss against budgeted and forecasted figures. This provides a dynamic view of financial status, facilitating more precise expense tracking and budget adjustments.

- Financial Ratio Analysis: HashMicro calculates essential financial ratios, such as liquidity, profitability, and solvency. These ratios furnish a detailed assessment of a company’s financial stability, supporting strategic planning and risk management.

- Custom Printout for Invoices: This feature allows companies to design invoices that reflect their branding. Businesses can tailor aspects such as logos, contact information, and payment terms, ensuring a professional and consistent image to their clients.

- Automated Currency Update: The software automatically updates exchange rates, facilitating precise financial calculations for transactions involving multiple currencies. This function simplifies accounting tasks and ensures financial accuracy.

- Cashflow Reports: This feature offers an analysis of cash inflows and outflows. With customizable reports, companies can gain insights into spending behaviors and make informed projections, aiding in more effective cash flow management.

| Pros | Cons |

|---|---|

|

|

The all-encompassing nature of HashMicro’s accounting software makes it an ideal choice for businesses seeking to optimize their financial operations. Click the banner below to view the pricing scheme!

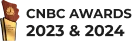

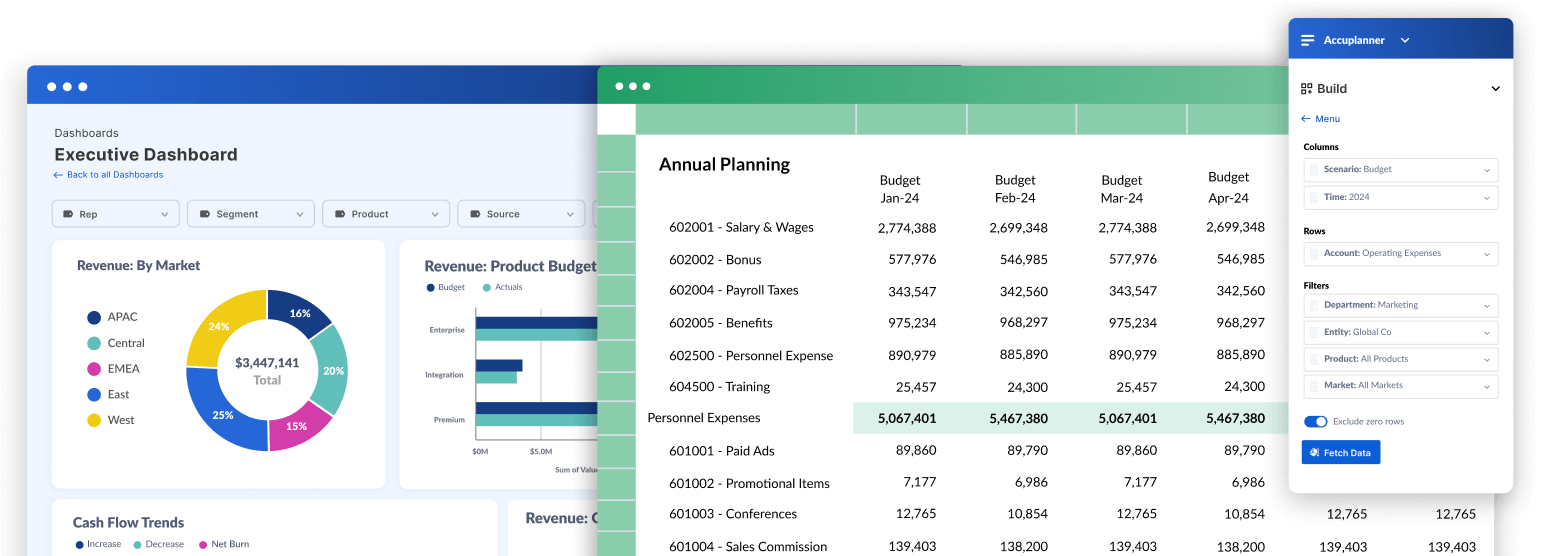

2. Sage Intacct

Sage Intacct is a cloud financial management software that provides comprehensive accounting software. It stands out for its robust automation capabilities that reduce manual tasks and its real-time operational and financial visibility that aids strategic decision-making.

The software supports various financial processes, including accounts payable, accounts receivable, cash management, and financial reporting. It also handles multi-currency operations, making it ideal for businesses looking to scale and expand internationally.

| Pros | Cons |

|---|---|

|

|

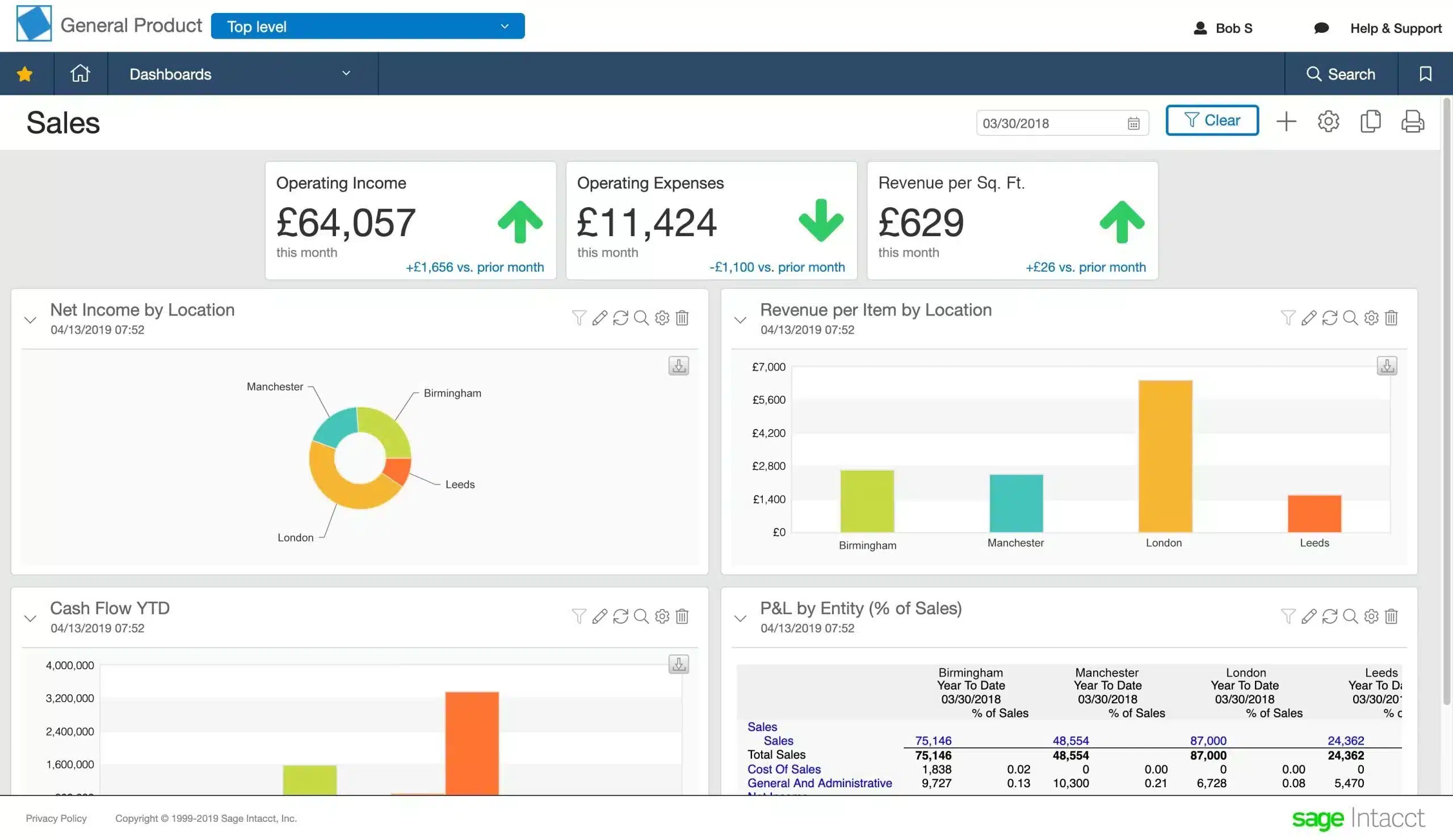

3. SAP Business One

SAP Business One provides an integrated ERP solution that covers everything from accounting and sales to customer relationships and inventory management. It simplifies business processes by providing a unified system that increases visibility across the company.

The software helps businesses manage detailed financial records, complete with analytics and reporting features. Its customization and scalability options make it suitable for growing businesses seeking to manage their operations more efficiently.

| Pros | Cons |

|---|---|

|

|

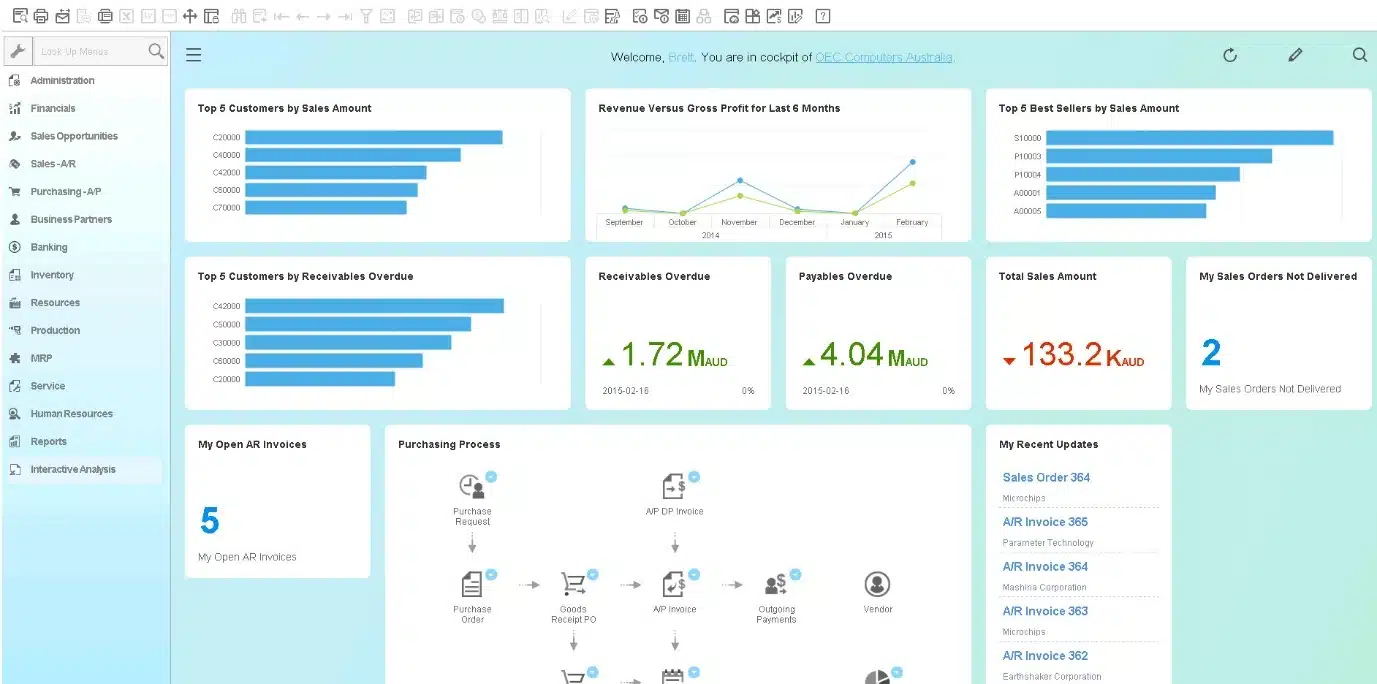

4. Oracle NetSuite

Oracle NetSuite is a cloud financial management software designed to consolidate financial management with other key business processes. Its flexibility makes it a popular choice for various industries, including retail, manufacturing, and technology.

The software allows businesses to manage their operations on a single platform, from financials and CRM to e-commerce and inventory management. It features real-time analytics that provides actionable insights and helps companies optimize their performance and scale globally.

| Pros | Cons |

|---|---|

|

|

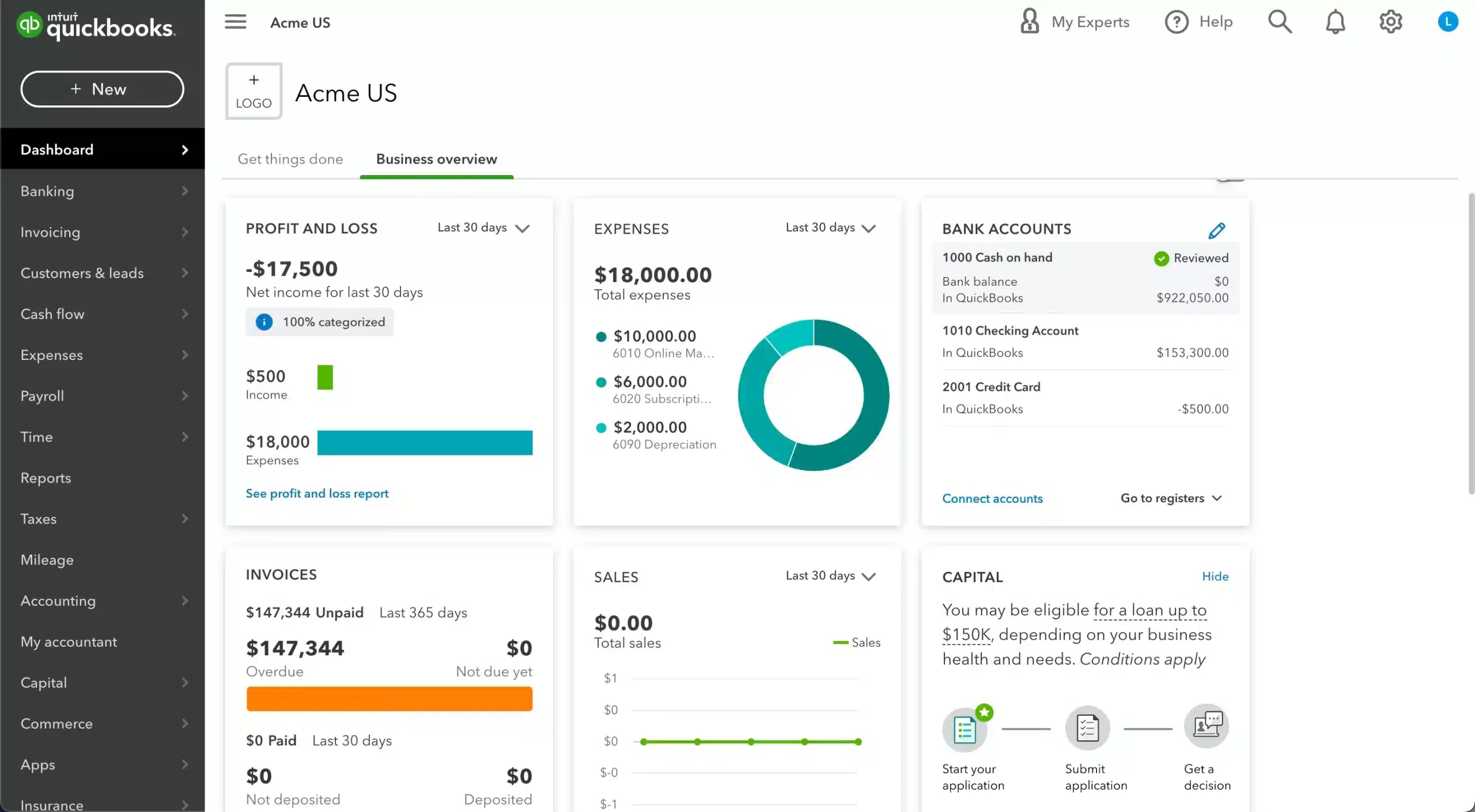

5. QuickBooks Financial Management Software

QuickBooks Financial Management Software is widely recognized for its powerful accounting features, making it ideal for small businesses and freelancers. It offers functionalities such as invoicing, payroll processing, profit and loss reporting, and tax preparation.

The software allows for automated transactions and reconciliation features, which help maintain accurate financial records. It also supports cloud-based capabilities, which enable users to access financial information remotely and collaborate with accountants in real-time.

| Pros | Cons |

|---|---|

|

|

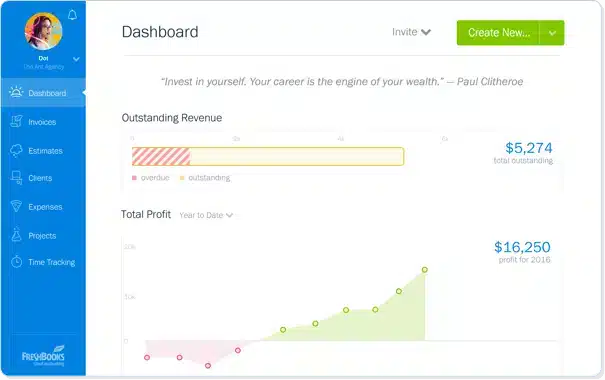

6. FreshBooks

FreshBooks is cloud-based financial software primarily for business owners and self-employed professionals. It focuses on streamlining client invoicing and time tracking, expense management, and project financial management.

FreshBooks helps users send professional invoices in minutes and get paid faster with integrated, automated online payments. Its features also include financial reporting tools that are easy to understand, making accounting tasks less intimidating for non-accountants.

| Pros | Cons |

|---|---|

|

|

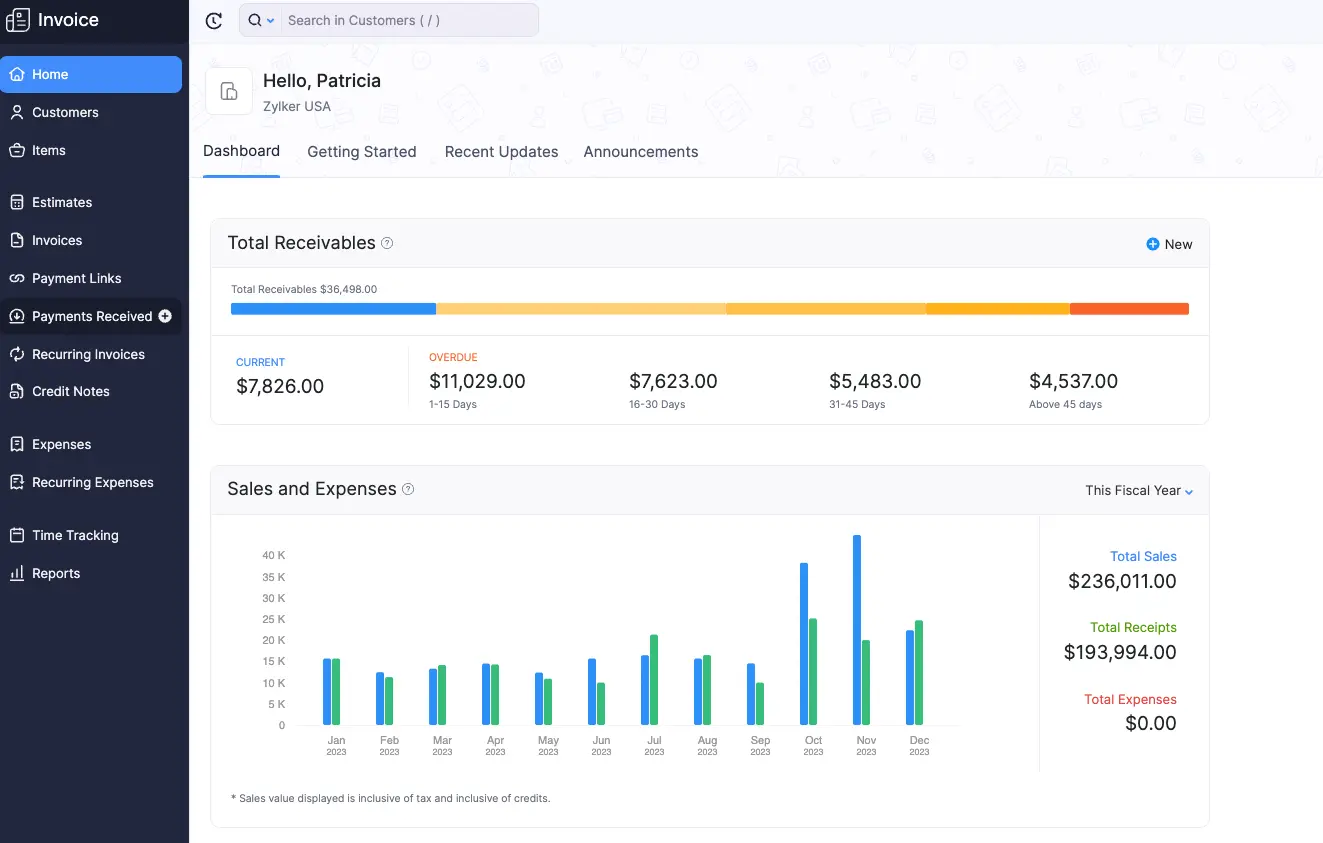

7. Zoho Finance Plus

Zoho Finance Plus offers a comprehensive suite of integrated finance software designed for businesses of all sizes. It covers various financial management processes, from invoicing and expense management to accounting and payroll.

The software integrates seamlessly with other Zoho products, providing a unified business environment. Additionally, its automation capabilities help reduce manual data entry and its real-time insights into business finances, improving overall financial control and compliance.

| Pros | Cons |

|---|---|

|

|

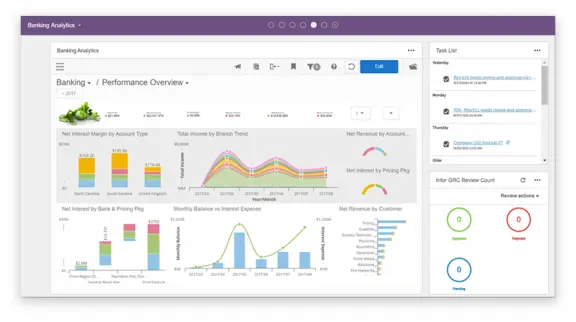

8. Infor ERP

Infor ERP offers industry-specific ERP financial management software designed to meet the complex demands of specific industries. The software uses advanced analytics to provide insights that help businesses optimize operations and enhance financial performance.

With a strong focus on manufacturing, distribution, and service industries, Infor ERP integrates core financial management with supply chain, production management, and customer relationship management.

| Pros | Cons |

|---|---|

|

|

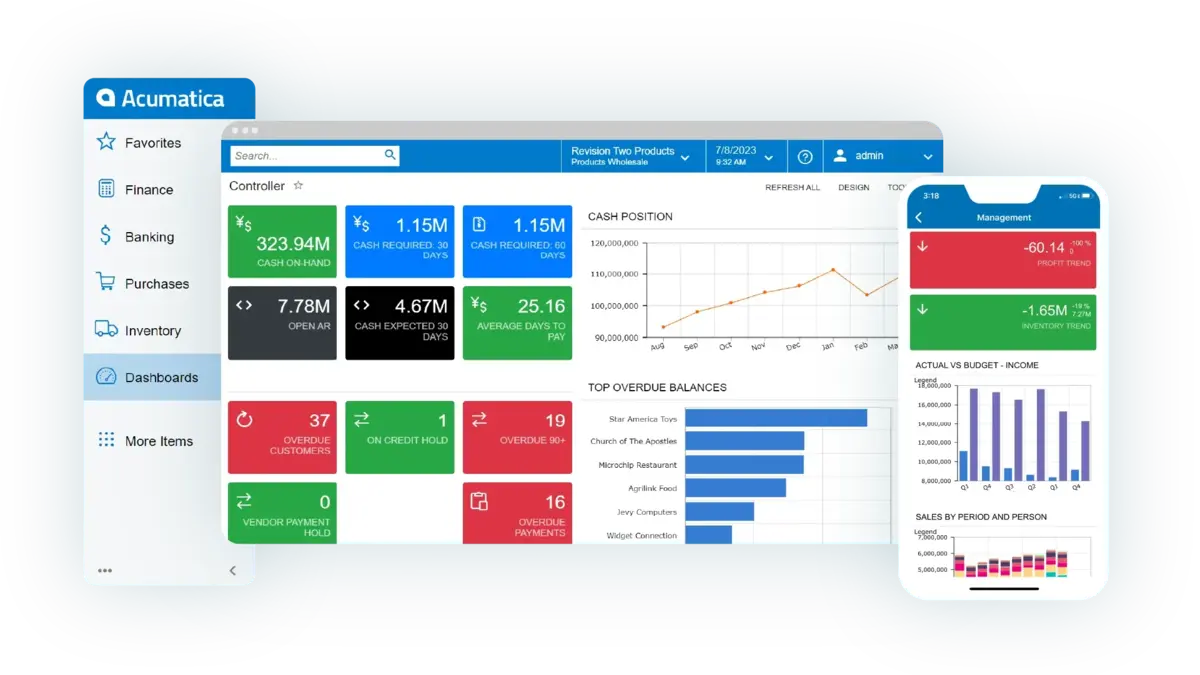

9. Acumatica

Acumatica provides financial management tools known for their adaptability and comprehensive functionality. It supports various business functions, including financial management, project accounting, and CRM.

Acumatica allows businesses to involve more of their team without additional cost per user. Its real-time insights and scalability make it a strong candidate for rapidly growing companies and enterprises with complex needs.

| Pros | Cons |

|---|---|

|

|

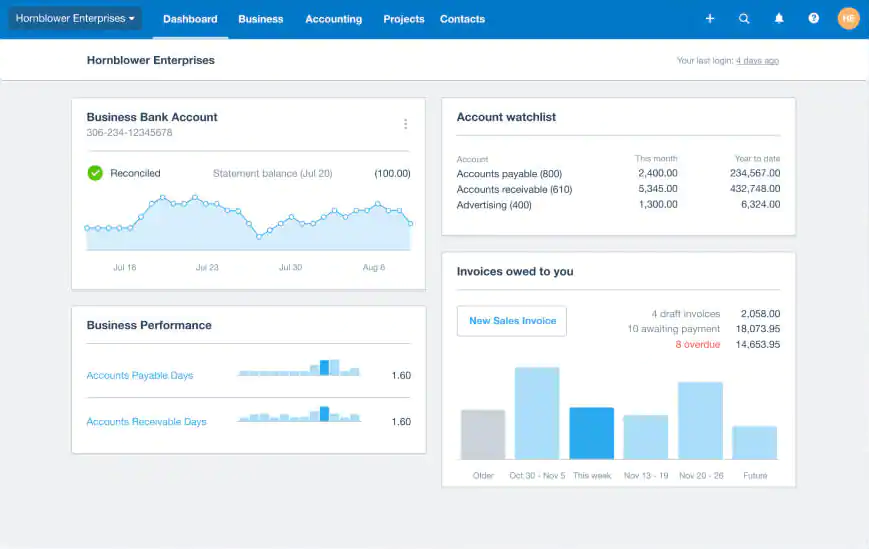

10. Xero Financial Risk Management Software

Xero Financial Risk Management Software is a cloud-based accounting software known for its simplicity and strong mobile capabilities. It provides essential financial management features such as invoicing, expense tracking, and payroll.

Xero’s real-time financial dashboard gives businesses a clear overview of their financial status at any time. It integrates with various third-party apps, enhancing its functionality and making it highly adaptable to the needs of a variety of business types.

| Pros | Cons |

|---|---|

|

|

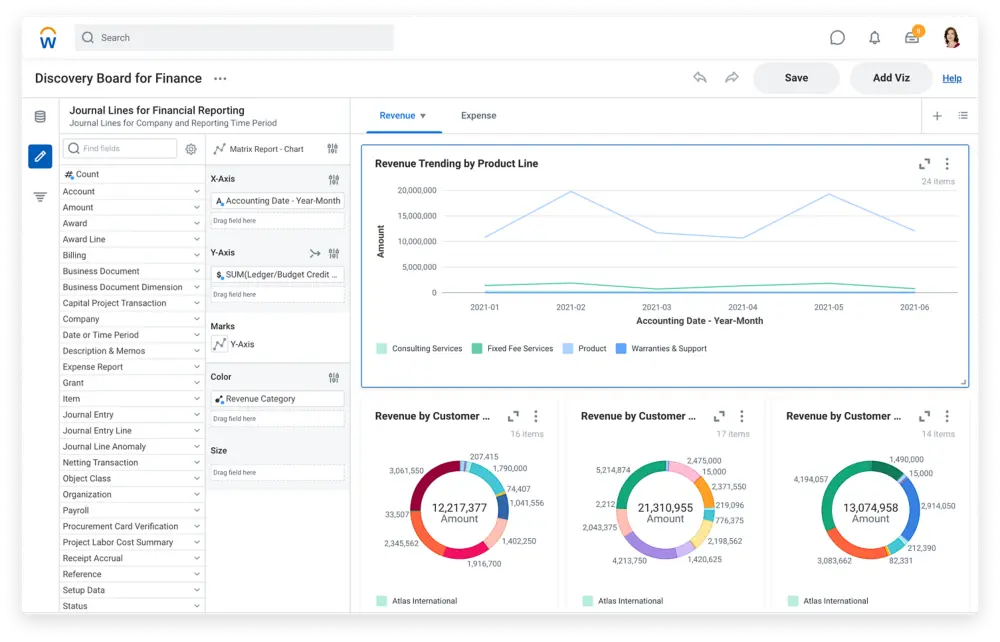

11. Workday

Workday offers a finance management app and human capital management software for large and multinational enterprises. It combines finance and HR in a single system, making it easier for businesses to view their performance comprehensively.

Workday’s features include financial planning, analysis, and execution and sophisticated reporting capabilities that support strategic business decisions. The software suits businesses seeking to automate and streamline their complex operations.

| Pros | Cons |

|---|---|

|

|

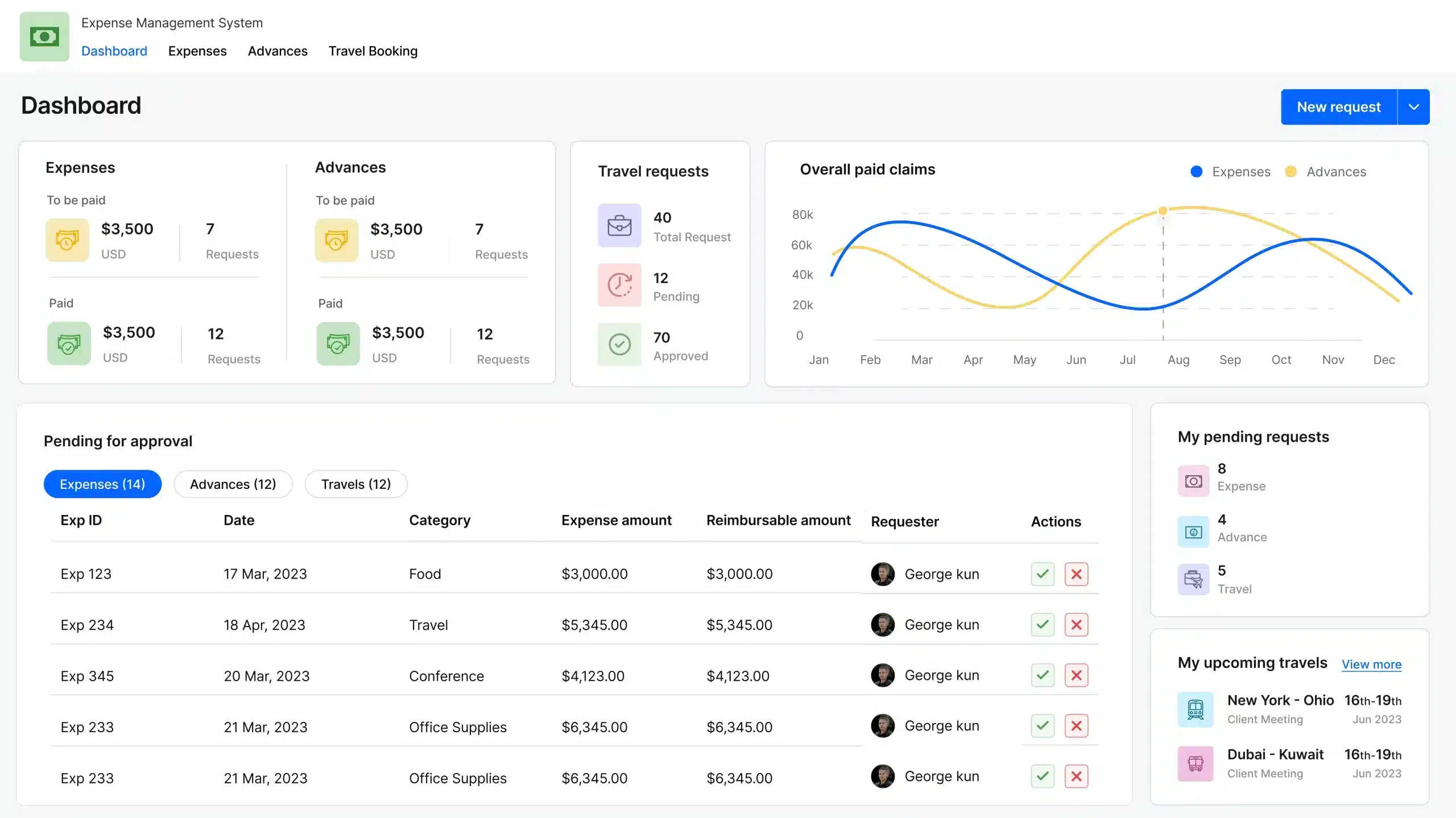

12. Kissflow

Kissflow offers financial management tools to automate and streamline business processes. Its financial management module integrates seamlessly with its workflow management system, facilitating an automated process for budget approvals, expense tracking, and reporting.

The software is particularly beneficial for businesses looking for a solution to manage cross-functional business processes within a single interface, enhancing collaboration and operational visibility.

| Pros | Cons |

|---|---|

|

|

13. Cube

Cube is a financial management software that specializes in enabling real-time financial insights and data-driven decision-making. It is designed to help finance teams accelerate their planning processes, manage budgets more effectively, and generate detailed financial forecasts.

The software also integrates directly with spreadsheets and other business systems, maintaining the flexibility of managing financial tasks while providing the control and collaboration of a robust software solution.

| Pros | Cons |

|---|---|

|

|

14. Multiview ERP

Multiview ERP offers a robust money management solution for complex businesses, particularly those in healthcare, hospitality, and service industries. The software provides a suite of financial applications, including a general ledger, accounts payable, and financial reporting.

The solution enables businesses to gain a deeper understanding of their financial data through powerful visualization tools and custom reporting capabilities, enhancing strategic planning and operational efficiency.

| Pros | Cons |

|---|---|

|

|

15. Prophix Financial Management Software

Prophix is a corporate financial management software that helps companies plan, budget, forecast, and report on their financial health. The software automates repetitive tasks and integrates financial data to provide a holistic view of business performance.

Prophix is particularly valuable for businesses looking to advance beyond spreadsheets to more dynamic financial management practices. It supports detailed scenario planning and what-if analyses, helping companies to navigate uncertainties and plan for the future effectively.

| Pros | Cons |

|---|---|

|

|

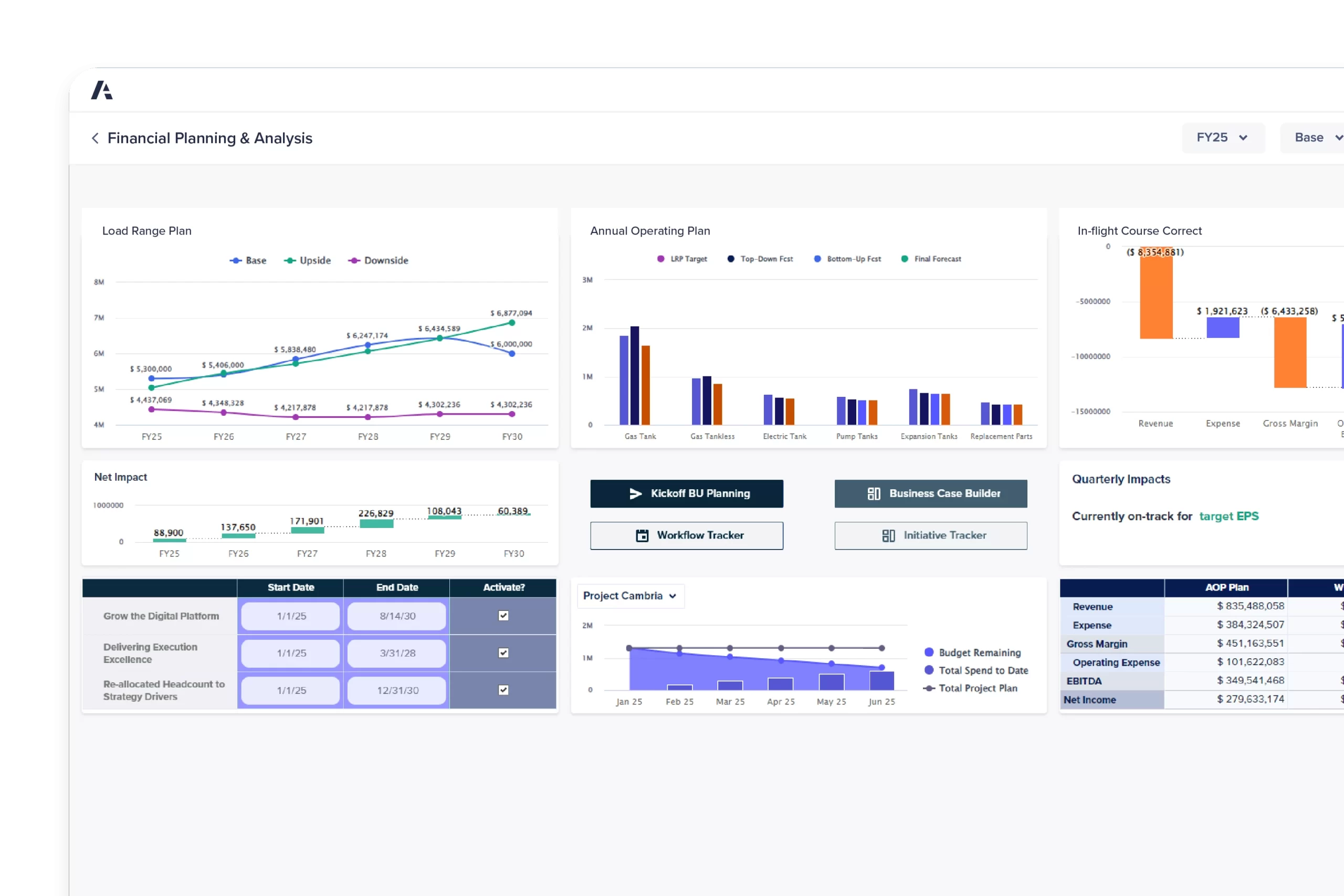

16. Anaplan

Anaplan is a cloud-based financial risk management software that offers extensive tools for budgeting, forecasting, and decision-making. It connects data, people, and plans across the business, providing a deep insight into financial and operational performance.

Additionally, Anaplan’s real-time analytics and scenario planning capabilities make it a powerful tool for businesses that require flexibility and scale in their financial planning processes, aiding companies in strategic decision-making.

| Pros | Cons |

|---|---|

|

|

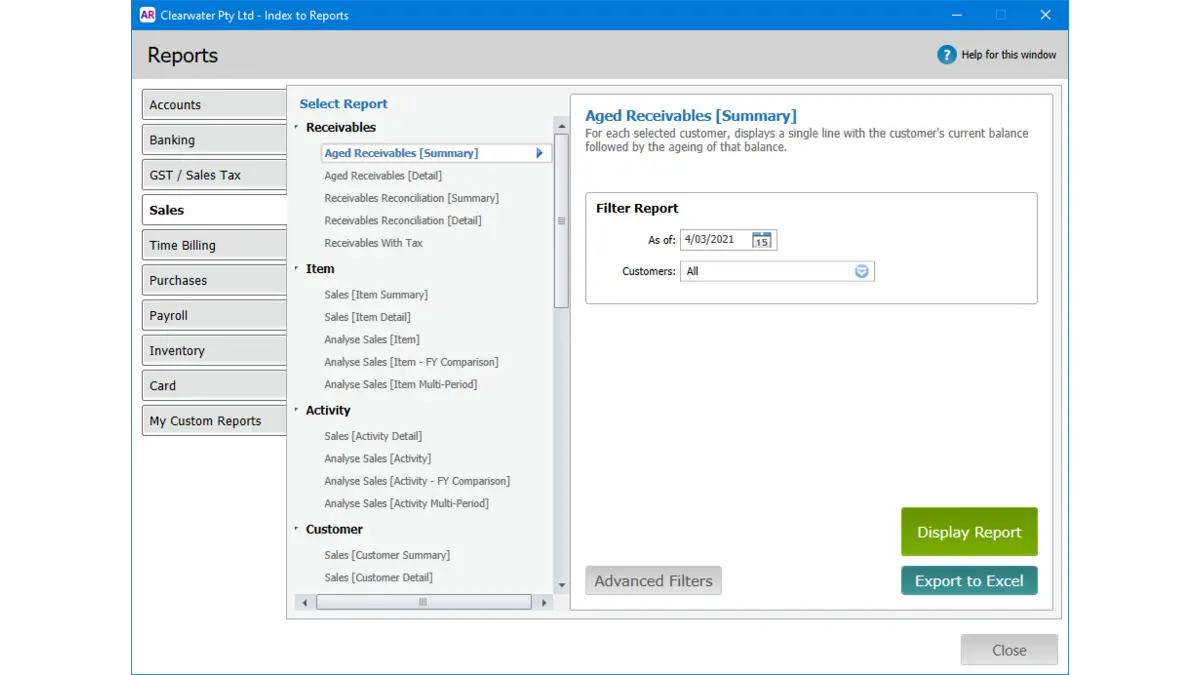

17. MYOB Accounting

MYOB Accounting is a financial management software that provides essential accounting features including invoicing, expenses, GST tracking, and payroll. The software also offers cloud-based capabilities, allowing business owners and accountants to collaborate remotely.

Moreover, the software stands out with its user-friendly interface and comprehensive support resources, making it easy for businesses to manage their finances and comply with local tax regulations.

| Pros | Cons |

|---|---|

|

|

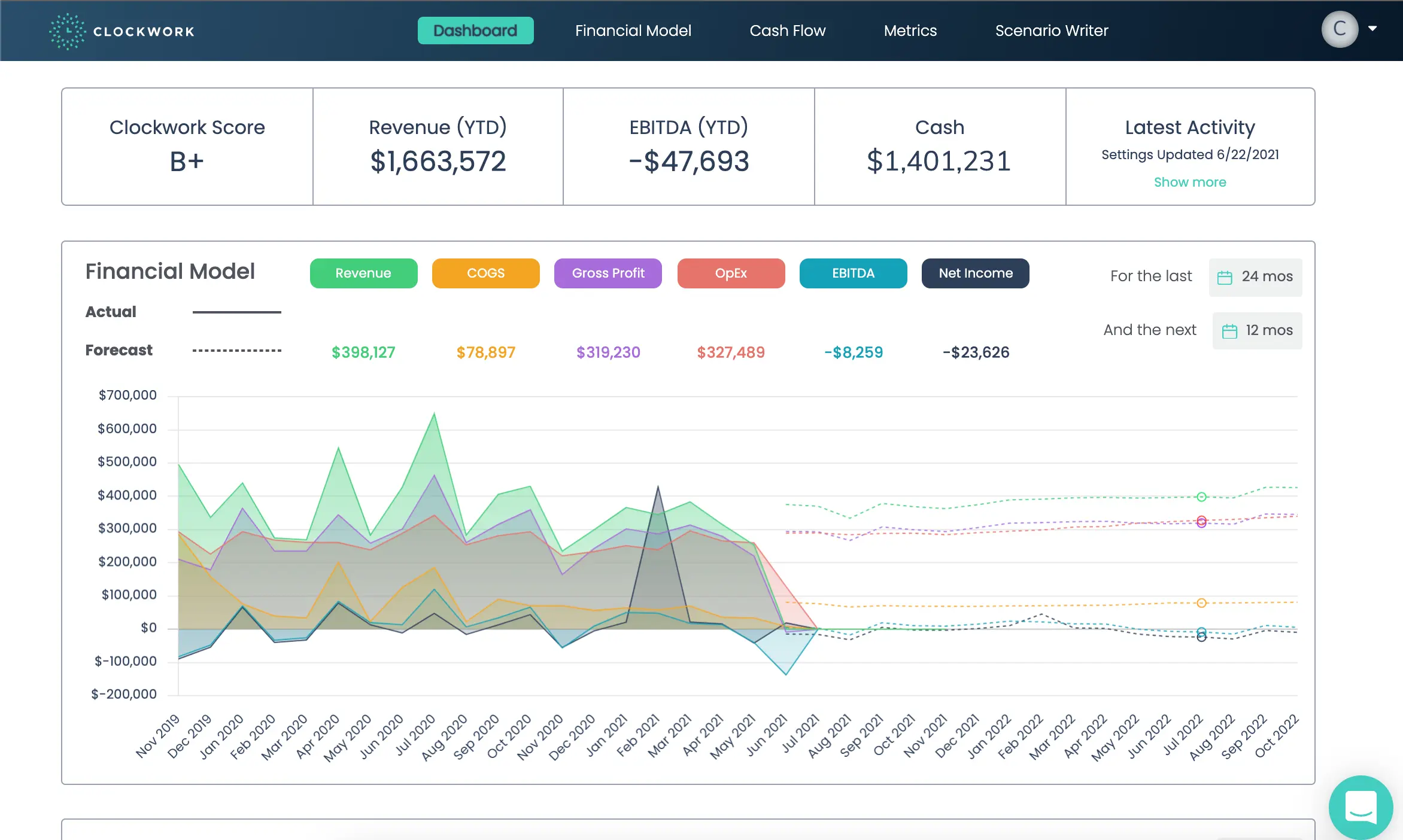

18. Clockwork

Clockwork is a financial management system that leverages artificial intelligence (AI) to provide businesses with accurate forecasts and actionable financial insights. It helps companies automate their financial analysis, reducing manual input and increasing the precision of financial projections.

The system is designed to integrate seamlessly with existing accounting software, enhancing its forecasting capabilities and providing businesses with a forward-looking approach to financial management.

| Pros | Cons |

|---|---|

|

|

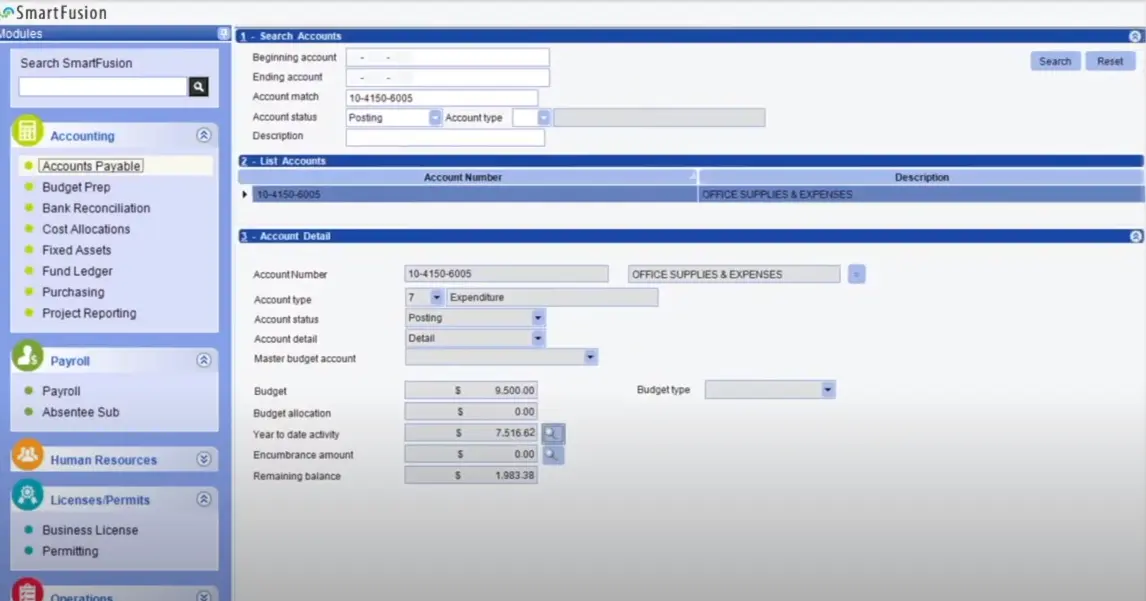

19. SmartFusion

SmartFusion is financial management software tailored for public sector entities. It provides a comprehensive suite of financial management tools designed to meet the unique needs of government agencies, schools, and non-profit organizations.

It includes fund accounting, human resources, payroll, and utility billing functionality. SmartFusion emphasizes compliance and reporting features that cater to the stringent regulations typical of the public sector, ensuring that financial management is efficient and transparent.

| Pros | Cons |

|---|---|

|

|

20. Vena Solutions Financial Management System

Vena Solutions Financial Management System combines spreadsheet familiarity with the reliability and security of an enterprise-class solution. It offers planning, budgeting, and revenue forecasting tools that are integrated into a centralized database.

The system is particularly suited for businesses that require robust financial planning capabilities without departing from the familiar Google Excel environment. It enhances financial data integrity and provides comprehensive audit trails.

| Pros | Cons |

|---|---|

|

|

Key Features to Look For in Financial Management Software

When choosing financial management software, focusing on features that enhance accuracy, efficiency, and strategic decision-making is crucial. Each functionality plays a significant role in transforming raw data into actionable insights. Here are some key features to look for:

1. Bank reconciliation

One of the fundamental features to seek in financial management software is bank reconciliation. This feature automates the matching of bank transactions with corresponding entries in the accounting ledger.

Automated bank reconciliation is vital as it ensures accuracy, saves time, and reduces the potential for human error by eliminating the need to manually reconcile account entries. Thus, it streamlines financial workflows and maintains up-to-date and accurate financial records.

2. Financial forecasting

Effective financial management is not just about understanding where your business stands today but also predicting future financial conditions. This tool helps predict future revenues, expenses, and cash flow based on historical data, current trends, and economic conditions.

Additionally, the software’s forecasting capabilities support strategic planning, risk assessment, and decision-making processes by providing businesses with foresight into potential financial outcomes.

3. Compliance management

Compliance management is a critical feature in the face of ever-changing financial regulations. Financial management software should help businesses adhere to local and international accounting standards and regulations, ensuring that all financial operations comply.

This financial management software capability can include automatic updates to meet new regulatory requirements, thus safeguarding the business against potential legal or financial penalties.

4. Multi-currency support

Multi-currency support is indispensable for businesses operating globally. This financial management system feature allows transactions in different currencies to be accurately recorded, processed and converted.

Good accounting software should also be able to handle currency conversions, fluctuations, and revaluations automatically, ensuring that financial statements are accurate and compliant with global financial reporting standards.

5. Analytical reporting

Comprehensive analytical reporting capabilities are essential for deep insights into business performance. This feature should offer customizable reports that can analyze various financial aspects, such as profitability, cost centers, and departmental performance.

Good financial management software will allow users to quickly generate reports that can aid in making informed business decisions and presenting financial data to stakeholders in a digestible format.

If you manage multiple companies, read our article about accounting software for multiple businesses to learn which software is best for enhancing your business’s operations.

How to Choose the Right Financial Management Software for Your Business

Choosing the right financial management software for your business is a crucial decision that can significantly impact your operational efficiency and financial insight. Here is a guide on how to navigate through the selection process:

- Assess your business needs: Begin by evaluating your business’s specific financial processes and requirements. Determine whether you require a simple accounting solution or a comprehensive ERP system that integrates other business functions.

- Evaluate features: Once you have a clear understanding of your needs, match these with the features offered by various software solutions, Ensure the software you choose can handle your current needs and can scale as your business grows.

- Ease of use and support: Look for a user-friendly interface and intuitive navigation. Additionally, consider the vendor’s customer support services. Reliable support can significantly ease the implementation process and ongoing maintenance.

- Integration capabilities: Check how well the software integrates with other tools and systems you currently use, such as CRM systems, HR software, and e-commerce platforms.

- Compliance and security: Ensure the software complies with the financial regulations and standards relevant to your industry and location. Look for features that safeguard your data, such as secure data storage, user access controls, and regular backups.

By thoroughly considering these factors, you can select financial management tools that not only meet your financial management needs but also enhance your decision-making and business growth potential.

Conclusion

Choosing the right financial management software is a crucial step in ensuring your business’s efficiency and growth. The right software can streamline financial operations, provide insightful analytics, ensure compliance with regulations, and support your business as it scales.

HashMicro Accounting Software stands out as a comprehensive ERP solution. With its features like automated bank reconciliation, and real-time financial forecasting and reporting, HashMicro ensures that your financial management processes are efficient and accurate.

Discover how HashMicro Accounting Software can transform your financial management and help you achieve greater financial control. Sign up for a free demo today!

FAQ about Financial Management Software

-

What software is used for financial management?

Accounting software is commonly used for financial management. This software helps track financial transactions and manage various operational aspects of a business’s finances.

-

What is a CRM system in finance?

CRM (Customer Relationship Management) software is designed to assist businesses in monitoring and managing their interactions with clients. It facilitates the organization and analysis of customer data, enhancing communication and improving customer relationships.

-

How do I monitor my finances?

Below are the stops to monitor finances:

1. Review your account statements regularly.

2. Categorize your expenses.

3. Create a budget tailored to your financial needs.

4. Use budgeting or expense-tracking apps.

5. Explore different methods for tracking expenses.

6. Implement accounting software for a comprehensive financial overview.